Understanding the Settlement Time for IBKR Cash Account Options

How long does it take for Ibkr cash account options to settle? When trading options in your Interactive Brokers (IBKR) cash account, it is important …

Read Article

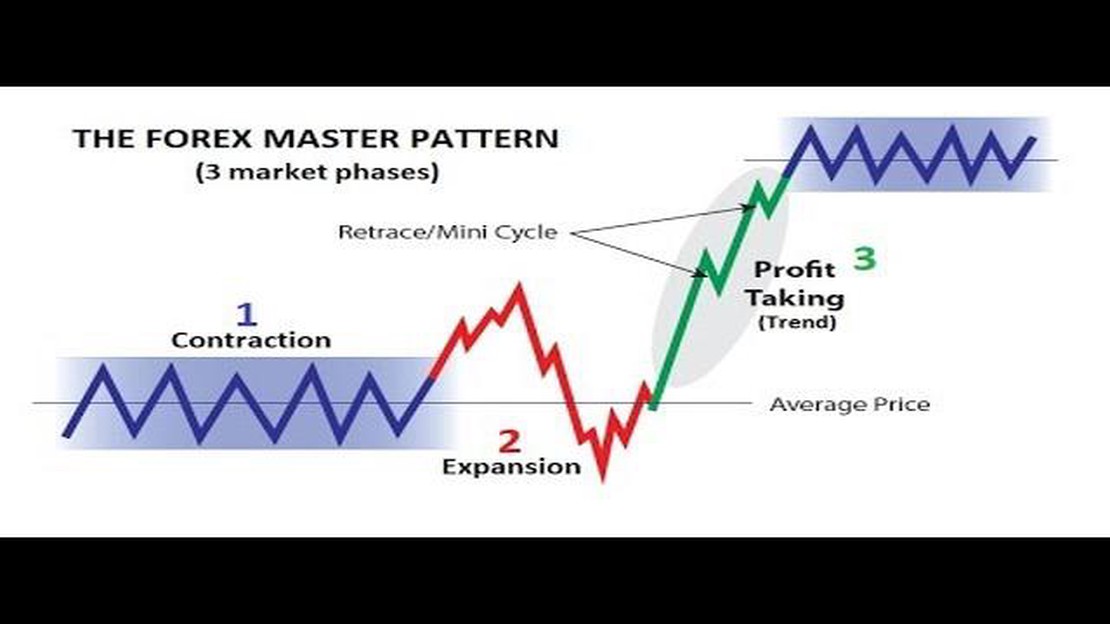

When it comes to forex trading, having a solid strategy is crucial for success. One popular strategy that has gained traction among traders is the Forex Master Pattern. This pattern is a versatile tool that can help traders identify potential trends and make informed trading decisions.

The Forex Master Pattern is a technical analysis tool that utilizes chart patterns to predict future price movements. It is based on the recognition of specific patterns that occur frequently in the forex market. These patterns can indicate potential reversal or continuation of trends, providing traders with valuable insight into market dynamics.

By observing the Forex Master Pattern, traders can identify key support and resistance levels, as well as potential entry and exit points. This allows them to set more accurate take-profit and stop-loss levels, minimizing the risk and maximizing the potential return on investment. Moreover, the pattern can be used in conjunction with other technical indicators to further enhance trading strategies.

Whether you are a novice trader or an experienced professional, understanding and effectively utilizing the Forex Master Pattern can significantly boost your trading strategy. By mastering this tool, you can gain a competitive edge in the forex market and increase your chances of success. So, take the time to learn about the various patterns and how they can be applied to different market conditions. Your trading portfolio will thank you.

The Forex Master Pattern is a chart pattern that traders use in technical analysis to identify potential trading opportunities. It is a powerful tool that can help traders predict market trends and make informed trading decisions.

The Forex Master Pattern is a variation of the traditional candlestick pattern, which is a graphical representation of price movements in a specific period of time. The pattern consists of four key components: a breakout, a pullback, a continuation, and a reversal. These components help traders identify the current market trend and anticipate future price movements.

Traders use the Forex Master Pattern to determine the best entry and exit points for their trades. By analyzing the pattern and its components, traders can identify potential support and resistance levels, trend lines, and price targets. This allows them to set realistic profit targets and manage their risk effectively.

One of the main advantages of the Forex Master Pattern is its versatility. It can be applied to various time frames, from short-term to long-term, and across different currency pairs. Traders can use the pattern to trade in different market conditions, including trending markets, ranging markets, and volatile markets.

In conclusion, the Forex Master Pattern is a valuable tool for traders looking to improve their trading strategy. By understanding and utilizing this pattern, traders can increase their chances of success in the forex market.

The Forex Master Pattern is a powerful trading tool that can significantly improve your trading strategy in the foreign exchange market. By understanding the key concepts behind this pattern, you will be able to identify and take advantage of high-probability trading opportunities.

The Forex Master Pattern consists of a series of price movements that form distinct patterns on the price chart. These patterns can provide valuable information about the market’s sentiment and help traders make more informed decisions.

One key concept behind the Forex Master Pattern is trend identification. By analyzing the highs and lows of price movements, traders can determine whether the market is trending upward, downward, or ranging. This information is crucial in determining the appropriate trading strategy and entry and exit points.

Read Also: Top Forex Brokers Using cTrader - Find the Best Brokers

Another important concept is support and resistance levels. These are price levels where the market has historically had difficulty breaking through. Traders often use these levels to identify potential areas of price reversal, which can be an excellent opportunity to enter or exit a trade.

Additionally, understanding chart patterns is essential in utilizing the Forex Master Pattern. Chart patterns, such as triangles, rectangles, and head and shoulders patterns, can indicate potential trend reversals or continuations. By identifying these patterns, traders can anticipate market movements and adjust their strategy accordingly.

Furthermore, risk management and proper position sizing are essential components of trading with the Forex Master Pattern. Traders must set clear stop-loss and take-profit levels to protect their capital and maximize profits. Additionally, understanding the concept of position sizing helps traders manage risk and ensure that no individual trade can significantly impact their overall portfolio.

In conclusion, learning the key concepts behind the Forex Master Pattern can greatly enhance your trading strategy in the forex market. By understanding trend identification, support and resistance levels, chart patterns, and implementing sound risk management techniques, you will be better equipped to take advantage of high-probability trading opportunities and improve your overall trading performance.

The Forex Master Pattern is a powerful trading strategy that can significantly enhance your trading success. To effectively utilize this pattern, it is crucial to understand how to identify it in the market. Here are the key steps to identify the Forex Master Pattern:

Read Also: Understanding the Right Time to Exercise Stock Options - A Comprehensive Guide4. Draw horizontal lines connecting the swing high and swing low points. These lines define the boundaries of the consolidation phase and are referred to as the upper and lower levels of the Master Pattern. 5. Next, look for a breakout from the consolidation phase. A breakout occurs when the price breaches either the upper or lower level of the Master Pattern. This breakout signals that the market is ready to resume its initial trend. 6. Confirm the breakout by checking for other technical indicators or patterns. Look for bullish or bearish candlestick patterns, support or resistance levels, or trendline breaks that align with the breakout direction.

7. Once the breakout is confirmed, enter a trade in the direction of the initial trend. Set a stop loss below the breakout level and a take profit target based on your risk-reward ratio.

7. Once the breakout is confirmed, enter a trade in the direction of the initial trend. Set a stop loss below the breakout level and a take profit target based on your risk-reward ratio.

Remember that mastering the identification of the Forex Master Pattern requires practice and a deep understanding of market dynamics. Continuously analyze historical price data and practice identifying the pattern on various currency pairs to strengthen your trading skills.

The Forex Master Pattern is a specific trading pattern that professional traders use to identify potential trading opportunities in the forex market.

The Forex Master Pattern can boost your trading strategy by providing a clear and simple set of rules to follow in order to identify high-probability trade setups.

Yes, the Forex Master Pattern can be applied to any timeframe, from short-term intraday trades to long-term position trades.

The main components of the Forex Master Pattern are the inside bar and the engulfing pattern. These patterns help traders identify potential reversals or continuations in price.

No, the Forex Master Pattern is a standalone trading strategy that does not require the use of additional indicators or tools. However, traders can choose to combine it with other analysis techniques if they prefer.

The Forex Master Pattern is a trading strategy that helps traders identify high-probability trading setups in the Forex market. It is based on the concept of price action and uses specific chart patterns to determine potential trade entries and exits.

How long does it take for Ibkr cash account options to settle? When trading options in your Interactive Brokers (IBKR) cash account, it is important …

Read ArticleLuLu Exchange’s associated bank If you’re a frequent traveler or someone who needs to send money abroad, you’ve probably heard of LuLu Exchange. But …

Read ArticleTips for Choosing a Forex Card When traveling abroad, one of the most important things to consider is how to handle your finances. With so many …

Read ArticleUnderstanding UCL and LCL in APQR The APQR (Automated Process Quality Reporting) system is widely used in industries to monitor and evaluate the …

Read ArticleWhat are the forex market hours today in the UK? Are you interested in trading on the foreign exchange market? One important factor to consider when …

Read ArticleIs options trading free on Fidelity? When it comes to options trading, many investors want to know if it is free on Fidelity. Options trading can be …

Read Article