Is options trading free on Fidelity? - All you need to know

Is options trading free on Fidelity? When it comes to options trading, many investors want to know if it is free on Fidelity. Options trading can be …

Read Article

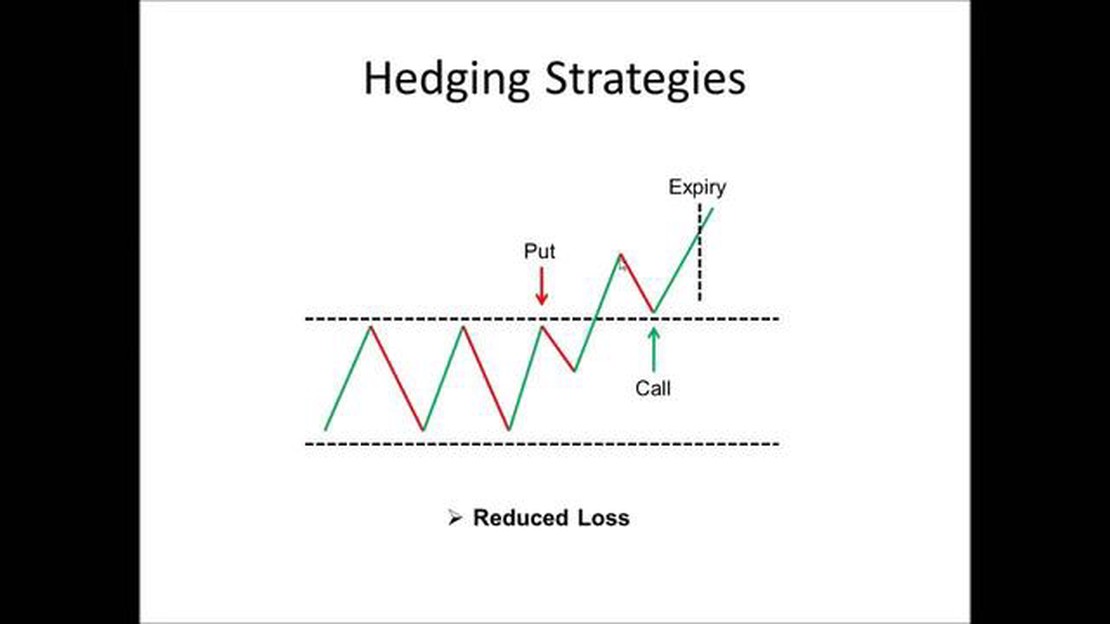

Binary options trading can be an exciting and lucrative way to invest in the financial markets. However, like any investment, it comes with its own set of risks. One way to minimize these risks is through the use of hedging strategies. Hedging involves taking on a second position that is designed to offset potential losses in the original position. In this article, we will explore the concept of hedging in binary options trading and discuss various hedging techniques that traders can use to protect their investments.

Hedging in binary options trading can help reduce the impact of unpredictable market movements and manage potential losses. By using this risk management technique, traders can ensure that they are not exposed to excessive risk and are better equipped to handle market volatility. Hedging involves taking on a second position that will act as a counterbalance to the original position, effectively minimizing any potential losses.

There are several hedging techniques that traders can employ in binary options trading. One popular strategy is called the “straddle.” This involves entering into both a call and a put option on the same underlying asset at the same strike price and expiry time. The idea behind the straddle strategy is that, regardless of which direction the market moves, the trader will be able to profit from one of the options, thereby offsetting any potential losses on the other option.

Another common hedging strategy is known as “hedging with multiple brokers.” This involves opening accounts with multiple binary options brokers and placing opposite trades with each broker. By doing so, traders can hedge their positions by taking opposite positions with different brokers. This allows them to spread their risk and ensure that they are not overly exposed to a single broker or market.

In conclusion, hedging is an essential risk management technique that traders can use to minimize their exposure to losses in binary options trading. By employing various hedging strategies, such as the straddle strategy or hedging with multiple brokers, traders can protect their investments and reduce the impact of unpredictable market movements. It is important for traders to understand the fundamentals of hedging and to carefully consider their risk tolerance and investment goals before implementing any hedging strategies.

Binary options are a type of financial instrument that allow traders to speculate on the price movement of an underlying asset. The term “binary” refers to the fact that there are only two possible outcomes for each trade: a fixed monetary gain if the option expires in-the-money, or a loss if the option expires out-of-the-money.

When trading binary options, traders have the ability to choose from a variety of assets, including stocks, commodities, currencies, and indices. Each option has a predetermined expiration time, which can range from minutes to hours or even days.

One of the key features of binary options is their simplicity. Traders are only required to predict whether the price of the underlying asset will rise or fall within a specified time frame. If the trader believes the price will go up, they would choose a “call” option. Conversely, if the trader believes the price will go down, they would choose a “put” option.

Binary options also offer a fixed payout structure. This means that regardless of how much the price of the underlying asset moves, the trader will receive a predetermined payout if their prediction is correct. On the other hand, if their prediction is incorrect, they will lose the initial investment amount.

Read Also: What to do with your stock options when leaving a company

It is important for traders to understand the risks involved in trading binary options and to have a clear strategy in place. As with any form of financial trading, there is always the potential for loss. Traders are advised to only invest an amount they are willing to lose and to educate themselves on market trends and analysis techniques.

Overall, binary options can be a profitable form of trading for those who are knowledgeable and disciplined. By understanding how binary options work and implementing effective risk management strategies, traders can minimize their losses and increase their chances of success.

Binary options are a type of financial instrument where traders speculate on the price movement of an underlying asset, such as stocks, indices, currencies, or commodities. Unlike traditional options trading, binary options have a fixed payout and a fixed expiration time.

With binary options, traders make predictions about whether the price of the underlying asset will go up or down within a specified period of time. If their prediction is correct, they will receive a predetermined payout. If their prediction is incorrect, they will lose the amount they invested in the trade.

Binary options are known for their simplicity, as traders only need to predict the direction of price movement, not the magnitude of the movement. This makes binary options a popular choice for beginners and those who prefer a simple way to trade financial markets.

There are two types of binary options: call options and put options. A call option is used when traders believe the price of the underlying asset will go up, while a put option is used when traders believe the price will go down.

Binary options can be traded on various platforms, including online brokers and exchange-traded binary options. They offer traders the opportunity to profit from market movements in a straightforward and transparent manner.

It is important to note that binary options trading carries a high level of risk, and traders should only invest money that they can afford to lose. It is advisable to learn about risk management strategies and use hedging techniques to minimize potential losses.

Read Also: Understanding Momentum Trading: Key Indicators to Watch

Overall, binary options provide a simple and accessible way to trade financial markets, but they require careful consideration and risk management to be successful.

Binary options are a type of financial derivative where the trader speculates on whether an underlying asset’s price will rise or fall within a specified time period. Unlike traditional options, binary options have a fixed payout and risk, making them easier to understand and trade.

One way to hedge binary options is to use a combination of a binary option and a traditional option. By buying a traditional option that goes against your binary option position, you can limit your potential losses in case of an unfavorable outcome. Another way is to use binary options with different expiration times to hedge your trades.

Hedging binary options can help minimize risk and protect against potential losses. It allows traders to have a backup plan in case their initial trade doesn’t go as expected. By hedging, traders can potentially reduce their exposure to market volatility and improve their overall trading strategy.

While hedging can help minimize risk, it is important to note that it also limits potential profits. When you hedge your binary options, you are essentially placing a trade that goes against your initial position. If the market moves in your favor, your hedge trade may result in a loss. Therefore, it’s crucial to carefully consider the risks and rewards of hedging before implementing this strategy.

There are several effective hedging strategies for binary options. One popular strategy is the “straddle” strategy, where a trader simultaneously buys a call option and a put option on the same underlying asset with the same expiration date. This allows the trader to profit from both upward and downward price movements. Another strategy is the “collar” strategy, where a trader buys a call option and sells a put option to offset potential losses.

Binary options are a type of financial instrument that allows traders to predict the price movement of an underlying asset within a specified time frame. Traders can choose between two options: a “call” option if they believe the price will go up, or a “put” option if they believe the price will go down.

Is options trading free on Fidelity? When it comes to options trading, many investors want to know if it is free on Fidelity. Options trading can be …

Read ArticleOpen Interest Rate for Natural Gas Futures Natural gas is a highly sought-after commodity, used in various industries such as energy production, …

Read ArticleProgramming Language Used in Trading Systems The development of trading systems requires a combination of technical knowledge and programming skills. …

Read ArticleTrading US Index Options: A Beginner’s Guide Options trading can be a lucrative investment strategy, and understanding US index options is a key part …

Read ArticleWhich bank offers the most affordable exchange rates? When it comes to exchanging currency, finding the best exchange rate can save you a significant …

Read ArticleIs FX swap an OTC derivative? Introduction: Table Of Contents Is FX Swap an OTC Derivative? Exploring the Characteristics FAQ: What is an FX swap and …

Read Article