Understanding Moving Averages QC: A Complete Guide

Understanding the concept of moving averages QC In the world of trading and investing, understanding moving averages is essential for making informed …

Read Article

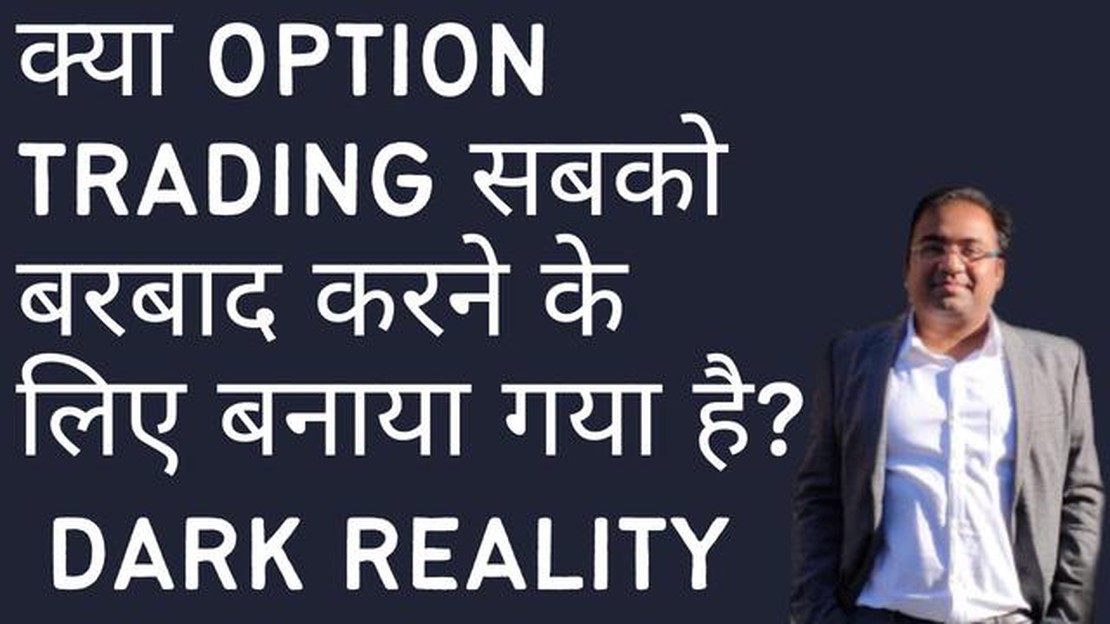

Options trading has become increasingly popular in recent years, with many investors eager to try their hand at this potentially lucrative financial strategy. However, with the allure of high profits comes the risk of significant losses. So, is options trading really profitable? Let’s delve into this question and explore the answers.

Firstly, it’s important to understand that options trading is not a guaranteed path to riches. It requires a deep understanding of the market, careful analysis of trends, and the ability to make informed decisions based on complex financial data. Successful options traders possess a combination of knowledge, skill, and intuition that sets them apart from the average investor.

That being said, options trading does offer the potential for substantial profits. By leveraging options contracts, traders can increase their exposure to the market and potentially amplify their returns. When executed correctly, options strategies can provide significant upside, allowing traders to capitalize on both rising and falling markets.

However, it’s crucial to recognize that options trading also carries an inherent risk. Options contracts can expire worthless, resulting in a complete loss of the initial investment. Moreover, complex options strategies can be difficult to navigate and require careful risk management. This means that for every profitable trade, there may be multiple unsuccessful ones, leading to net losses.

In conclusion, options trading can be profitable for those who possess the necessary knowledge, skills, and discipline. However, it is not a guaranteed path to riches, and the potential for losses should not be overlooked. As with any form of investing, it is important to thoroughly research and understand the risks involved before diving into options trading.

Options trading is often portrayed as a highly profitable investment strategy that can lead to significant wealth accumulation. However, the reality is that options trading can be both profitable and risky, depending on various factors.

Options are derivative financial instruments that give investors the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. This flexibility allows traders to profit from changes in the price of the underlying asset without actually owning it.

One of the main advantages of options trading is the potential for high returns. Options can offer leverage, allowing traders to control a larger position with a smaller initial investment. This means that even a small price movement in the underlying asset can result in a substantial profit. However, it’s essential to note that high returns come with high risks, and options trading can also lead to significant losses.

Profitability in options trading depends on various factors, including market conditions, volatility, and the trader’s skill and knowledge. Volatile markets can create more opportunities for profitable trades, as price movements are more frequent and significant. However, volatility can also increase the risk of losses. Skill and knowledge are also important factors since options trading requires a deep understanding of financial markets, technical analysis, and risk management.

It’s worth mentioning that options trading can be more complex compared to traditional investments such as stocks or bonds. The intricacies of options contracts, including different strike prices and expiration dates, require careful analysis and decision-making. Proper risk management strategies are essential to minimize potential losses and maximize profits.

In conclusion, options trading can be profitable, but it’s not a guaranteed path to wealth and success. The potential for high returns comes with high risks, and success in options trading requires skill, knowledge, and a disciplined approach. It’s important to thoroughly educate yourself on options trading and seek guidance from experienced professionals before engaging in this investment strategy.

| Pros | Cons |

|---|---|

| Potential for high returns | High risk of losses |

| Flexibility and leverage | Complexity and intricacies of options |

| Opportunities in volatile markets | Requires skill, knowledge, and experience |

Options trading is a financial strategy that involves buying and selling options contracts. Options are derivative securities that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame.

There are two types of options: calls and puts. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell the underlying asset. Traders can use options to speculate on the price movements of various assets, including stocks, commodities, and currencies.

Read Also: Learn how to master forex chart patterns for successful trading

Options trading involves understanding concepts such as strike price, expiration date, and the option premium. The strike price is the price at which the underlying asset will be bought or sold if the option is exercised. The expiration date is the last day on which the option can be exercised. The option premium is the price paid for the option contract.

Traders can profit from options trading in several ways. One strategy is to buy call options if they believe the price of the underlying asset will rise. If the price does go up, the trader can exercise the option and buy the asset at a lower price than the market value, making a profit. Another strategy is to sell call options if the trader believes the price of the underlying asset will decline. If the price does go down, the trader can keep the premium received for selling the option.

Read Also: Understanding the European Union (EU) in Forex Trading: Everything You Need to Know

However, options trading can also be risky. Traders can lose the entire premium paid for an option if the price of the underlying asset does not move as expected or if the option expires worthless. It is essential to have a thorough understanding of the market and the specific risks associated with options trading before getting involved.

In conclusion, options trading can be profitable if executed wisely. It offers traders the opportunity to profit from market movements without the need to own the underlying asset. However, it is crucial to have a solid understanding of the options market and employ effective strategies to minimize risks and maximize potential profits.

Options trading can be a lucrative investment strategy, but it also comes with its own set of advantages and disadvantages. Before diving into options trading, it is important to understand these pros and cons which can help you make an informed decision.

Pros of Options Trading:

Cons of Options Trading:

It is important to weigh the pros and cons of options trading before deciding to engage in it. If you are willing to put in the time and effort to learn and keep up with the market, options trading can offer both potential profits and risks.

Options trading is a type of investment strategy where traders buy and sell options contracts, which give them the right to buy or sell an underlying asset at a specific price within a specific time period.

Yes, options trading can be profitable, but it carries a high level of risk. Traders who are successful in options trading often have a deep understanding of the market, a solid trading strategy, and good risk management skills.

Options trading involves risks such as the potential loss of the entire investment, volatility of the market, and the possibility of the options expiring worthless. There is also the risk of making poor investment decisions or being influenced by emotions.

To increase your chances of being profitable in options trading, it is important to educate yourself about the market, develop a robust trading strategy, practice risk management, and continually analyze and adapt your approach based on market conditions.

Yes, there are many successful traders who have made significant profits through options trading. However, it is important to keep in mind that their success is not guaranteed for everyone and that they have likely put in a considerable amount of time and effort to develop their skills and knowledge.

Options trading is a type of investment strategy that involves buying and selling contracts that give the investor the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time period.

Options trading can be profitable if done correctly. It requires a deep understanding of the market, careful analysis of potential trades, and proper risk management strategies. However, it is important to note that options trading also carries significant risks and can result in losses.

Understanding the concept of moving averages QC In the world of trading and investing, understanding moving averages is essential for making informed …

Read ArticleWhat is the full name of forex trading? Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global …

Read ArticleWhat time does the forex market close? Trading in the foreign exchange market, also known as Forex, is a 24-hour a day, five days a week activity. …

Read ArticleIs the euro devaluation? The euro, the official currency of the European Union, has been a topic of great interest and concern in recent years. With …

Read ArticleWhy do executives receive stock-based compensation? Stock compensation has become a common practice for many companies around the world, especially …

Read ArticleUnderstanding the Significance of High Open Interest Compared to Volume on Options Options trading is a complex financial instrument that involves …

Read Article