How Much is One Volume in Forex Trading? - Explained

Understanding the Value of 1 Volume in the Forex Market When it comes to understanding the intricacies of forex trading, one of the key concepts that …

Read Article

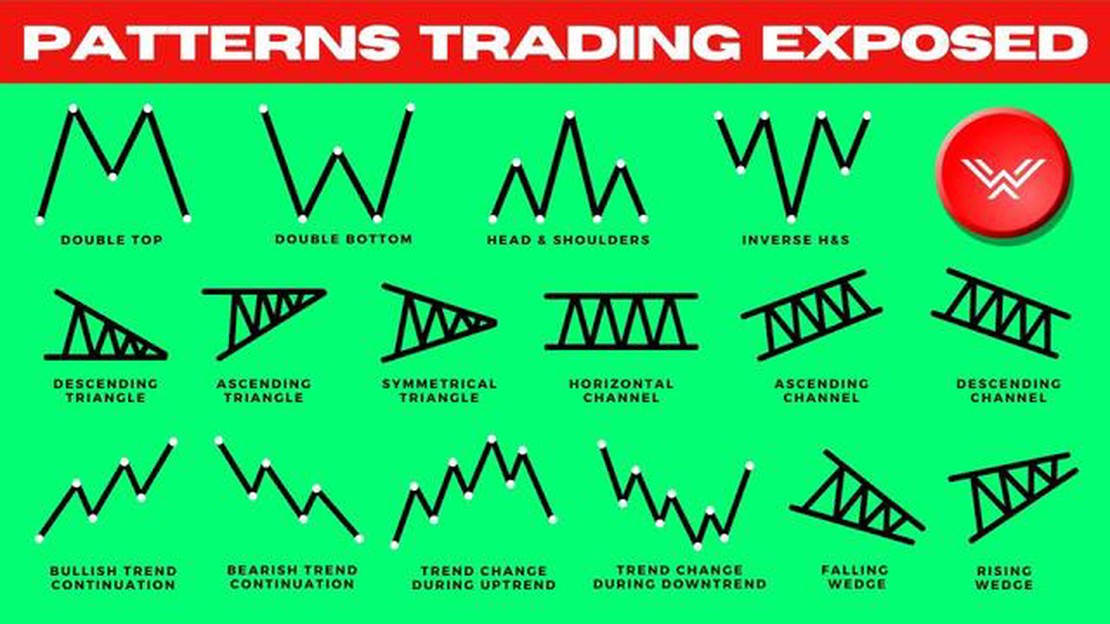

When it comes to forex trading, understanding and analyzing chart patterns is crucial for making informed decisions. Chart patterns provide valuable insights into market trends, price movements, and potential trading opportunities. By learning to identify and interpret these patterns, traders can gain a competitive edge and increase their chances of success in the forex market.

Forex chart patterns are visual representations of price movements over time. They can be categorized into two main types: continuation patterns and reversal patterns. Continuation patterns indicate that the current trend is likely to continue, while reversal patterns suggest that the trend is about to change direction.

Some of the most common chart patterns used in forex trading include the head and shoulders, double top, double bottom, triangle, flag, and pennant patterns. Each pattern has its own unique characteristics and signals, which traders must learn to recognize and interpret correctly. This requires a combination of technical analysis skills, market knowledge, and experience.

By mastering forex chart patterns, traders can enhance their ability to identify potential entry and exit points, set stop-loss and take-profit levels, and manage risks effectively. These patterns can also provide valuable insights into market sentiment and help traders anticipate future price movements. However, it is important to note that chart patterns should not be used in isolation. Traders should always consider other factors such as technical indicators, fundamental analysis, and market news before making trading decisions.

Forex chart patterns are graphical representations of price movements in the foreign exchange market. By learning how to identify and interpret these patterns, traders can gain a significant edge in their trading strategies.

Mastering forex chart patterns involves understanding the different types of patterns, such as triangles, wedges, head and shoulders, and double tops/bottoms. Each pattern has its own characteristics and potential trading opportunities.

One of the secrets to mastering forex chart patterns is to combine them with other technical indicators, such as moving averages or oscillators. This can help confirm the validity of a pattern and increase the probability of a successful trade.

Another secret is to pay attention to the timeframe in which the pattern is formed. A pattern that appears on a longer timeframe, such as a daily or weekly chart, is usually more reliable than a pattern on a shorter timeframe, such as a 5-minute or 15-minute chart.

Additionally, it’s important to consider the overall market trend when analyzing chart patterns. A pattern that occurs in the direction of the trend is more likely to result in a successful trade.

Furthermore, learning to manage risk is crucial when trading forex chart patterns. Traders should always set stop-loss orders to limit potential losses and take-profit orders to secure profits. It’s also essential to have a clear understanding of risk management principles, such as determining the appropriate position size based on account balance and risk tolerance.

Lastly, consistent practice and continuous learning are key to mastering forex chart patterns. Traders should regularly review their trades, analyze the outcome, and seek to improve their pattern recognition skills. By staying disciplined and dedicated, traders can develop a high level of proficiency in identifying and trading forex chart patterns.

In conclusion, mastering forex chart patterns requires a combination of technical analysis skills, risk management strategies, and continuous learning. By discovering the secrets of these patterns and applying them in a systematic manner, traders can achieve success in the forex market.

In the world of forex trading, being able to analyze and interpret charts is essential for making informed trading decisions. One powerful tool in a trader’s arsenal is the ability to understand forex chart patterns.

Forex chart patterns are formations that occur on price charts and provide valuable information about the future direction of a currency pair. By recognizing these patterns and understanding what they mean, traders can gain an edge in the market.

There are various types of chart patterns, such as triangles, head and shoulders, double tops and bottoms, and wedges. Each pattern has its own unique characteristics and gives traders insights into market sentiment and potential price movements.

For example, a symmetrical triangle pattern indicates a period of consolidation, where buyers and sellers are in balance. Once the price breaks out of the triangle, it often signals a strong move in the direction of the breakout.

By being able to identify and interpret these patterns, traders can anticipate potential reversals, breakouts, or trend continuations, allowing them to enter or exit positions at optimal times.

Moreover, understanding forex chart patterns helps traders manage their risk more effectively. By setting proper stop-loss levels based on the pattern, traders can limit their potential losses and protect their capital.

Read Also: Are Pivot Points accurate for trading? Debunking the myth

However, it’s important to note that chart patterns should not be used in isolation. They should be combined with other technical indicators, such as moving averages, support and resistance levels, and oscillators, to confirm trading signals.

In conclusion, understanding forex chart patterns is crucial for successful trading. It allows traders to recognize market patterns, anticipate potential price movements, and manage risk effectively. By incorporating chart pattern analysis into their trading strategy, traders can improve their overall trading performance and increase their chances of success in the forex market.

One essential skill for successful forex trading is the ability to identify and analyze common chart patterns. These patterns can provide valuable insights into market trends and potential price movements, allowing traders to make informed decisions.

Here are some of the most common forex chart patterns and how to identify and analyze them:

Read Also: Scalping: How Many Pips Can Traders Make Per Day?

1. Head and shoulders:

A head and shoulders pattern consists of three peaks, with the middle peak (the head) being the highest. This pattern often indicates a reversal of an uptrend, suggesting that a downtrend may follow. Traders can look for a break below the “neckline” of the pattern as a signal to enter a short position.

2. Double top and double bottom:

A double top pattern occurs when the price reaches a high level twice but fails to break above it. This can indicate a potential reversal of an uptrend. Conversely, a double bottom pattern occurs when the price reaches a low level twice but fails to break below it, suggesting a potential reversal of a downtrend.

3. Triangle:

A triangle pattern forms when the price consolidates between two trendlines, creating a triangular shape. This can indicate a period of indecision in the market, with potential for a breakout in either direction. Traders can wait for a breakout above or below the trendlines to enter a trade.

4. Wedge:

A wedge pattern is similar to a triangle pattern but with a noticeable slant. It is formed by two converging trendlines, with the price consolidating within the wedge. A breakout above or below the trendlines can signal a potential continuation of the trend.

5. Flags and pennants:

A flag pattern consists of a sharp, vertical price movement followed by a consolidation phase, forming a rectangular shape. A pennant pattern is similar but has a triangular shape. These patterns often indicate a continuation of the previous trend. Traders can wait for a breakout above or below the flag or pennant to enter a trade.

When identifying and analyzing these chart patterns, it is important to consider other factors such as the overall market trend, support and resistance levels, and volume indicators. Additionally, using technical indicators and candlestick patterns can further enhance the analysis.

By mastering the skill of identifying and analyzing common forex chart patterns, traders can more effectively anticipate market movements and improve their trading decisions. It is important to practice and continually refine these skills to become a successful forex trader.

Forex chart patterns are formations that appear on currency charts, representing potential price movement in the market. These patterns provide traders with valuable information about trend reversals, continuations, and possible entry and exit points for trades.

Some of the most common forex chart patterns are the head and shoulders, double top, double bottom, triangle, rectangle, and cup and handle patterns. These patterns can be identified by specific price formations on the charts and can indicate possible future price movements.

To use forex chart patterns for successful trading, you need to first learn how to identify them on the charts. Once identified, you can use these patterns to make informed trading decisions, such as entering or exiting trades, setting stop-loss orders, or taking profit. It is important to combine the analysis of chart patterns with other technical indicators and fundamental analysis to increase your chances of success.

Forex chart patterns can be reliable indicators of future price movements, but they are not 100% accurate. It is important to consider other factors such as market conditions, news events, and the overall trend when using chart patterns for trading decisions. Traders should also use proper risk management techniques to mitigate potential losses.

There are many resources available online where you can learn more about forex chart patterns. You can read books, watch educational videos, take online courses, or join trading communities and forums to learn from experienced traders. It is important to practice identifying and analyzing chart patterns on demo accounts before trading with real money.

Understanding the Value of 1 Volume in the Forex Market When it comes to understanding the intricacies of forex trading, one of the key concepts that …

Read ArticleStocks eligible for options trading Stock options offer investors the opportunity to profit from the movement of a specific stock, without actually …

Read ArticleWhere can I find reliable trading signals? Trading signals play a crucial role in the world of financial markets. They offer valuable insights and …

Read ArticleExamples of E-commerce Systems With the rise of the internet, e-commerce has become an integral part of our daily lives. From buying clothes to …

Read ArticleUnderstanding the 30 Day Rule on ETFs Investing in Exchange-Traded Funds (ETFs) has gained popularity among investors due to their flexibility and …

Read ArticleUnderstanding EOD in Inventory Management Effective inventory management is crucial for the success of any business. One of the key aspects of …

Read Article