Learn how to effectively trade on a 4-hour chart | Expert tips from professionals

How to Trade on a 4-Hour Chart Trading on a 4-hour chart can be a powerful tool for traders looking to capitalize on short-term market movements. This …

Read Article

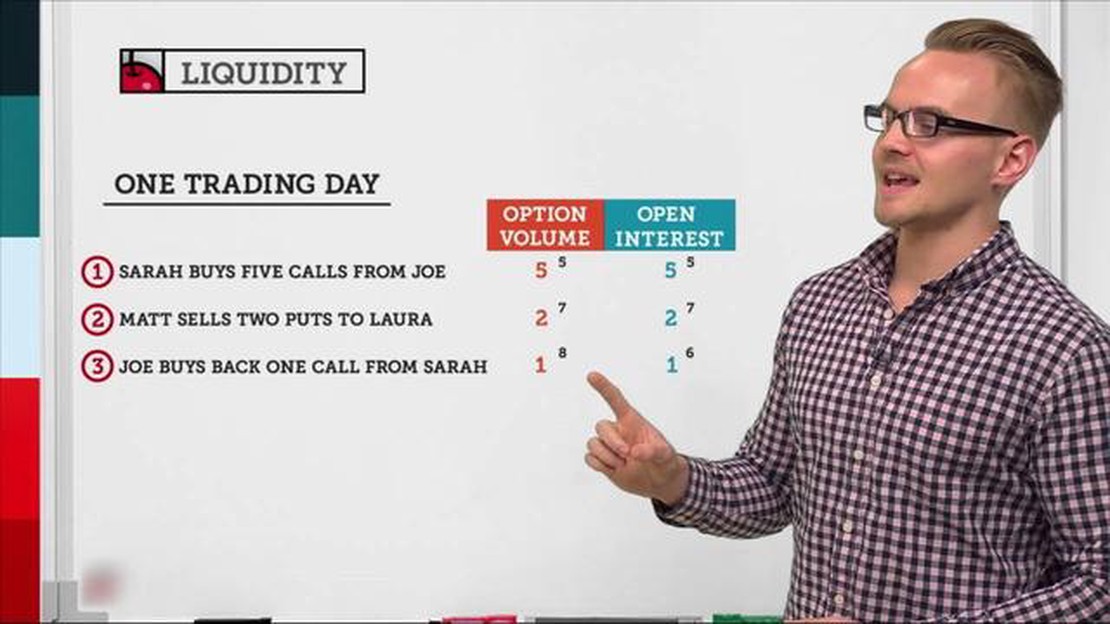

Options trading is a complex financial instrument that involves buying and selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. When analyzing options data, traders often look at two key metrics: volume and open interest. While volume represents the number of contracts traded in a given period, open interest refers to the total number of outstanding contracts at any given time.

One interesting scenario that traders encounter is when the open interest of a particular options contract exceeds its trading volume. This situation, known as higher open interest than volume, is a significant indicator of market sentiment and can provide valuable insights into the future direction of the underlying asset.

When open interest is higher than volume, it suggests that there are a large number of outstanding contracts that have not been closed or offset by an opposing trade. This indicates that market participants are holding onto their positions and are confident in the direction of the underlying asset. Traders view this as a bullish signal, as it indicates a strong consensus among market participants and suggests that the price of the underlying asset is likely to move in a particular direction.

Furthermore, higher open interest than volume can also signal the presence of institutional and professional traders in the market. These market participants typically trade larger volumes and tend to hold their positions for longer periods. Their involvement in the options market can provide additional validation for the strength of the prevailing trend and increase traders’ confidence in their trading decisions.

It is important to note that the significance of higher open interest than volume can vary depending on the overall market conditions and the specific options contract being analyzed. Traders should consider this as one piece of information among many and use it in conjunction with other technical and fundamental analysis tools to make informed trading decisions.

In conclusion, higher open interest than volume in options trading is a valuable indicator of market sentiment and the future direction of the underlying asset. Traders can use this information to identify potential trading opportunities and increase their confidence in their trading decisions. However, it is important to consider this metric in the context of other market factors and analysis techniques to ensure accurate and informed decision-making.

Open interest is a crucial metric that traders and investors should understand when participating in options trading. It refers to the total number of open or outstanding options contracts in a given market at a specific time. Unlike volume, which represents the total number of contracts traded during a particular period, open interest provides insights into the overall interest and activity in a specific options contract.

One of the main advantages of monitoring open interest is its ability to indicate market sentiment. A high open interest suggests that there is considerable trader interest and that the options market is active. Conversely, a low open interest could indicate a lack of interest or limited trading activity in a specific options contract.

Read Also: Guide on Trading US Stocks in the UK: Everything You Need to Know

In addition to providing insights into market sentiment, open interest can also help traders identify potential support and resistance levels. When there is a significant number of open contracts at a specific strike price, it can act as a support or resistance level, as traders may have a vested interest in that particular price point.

Furthermore, open interest can also assist traders in identifying potential trading opportunities. Significant increases in open interest, especially in out-of-the-money options, could indicate that market participants expect a significant price movement in the underlying asset. This information can help traders gauge market expectations and make informed trading decisions.

It is important to note that while open interest provides valuable insights, it should not be solely relied upon for trading decisions. It is essential to consider other factors such as volume, price, and market trends to make well-informed trading decisions.

In conclusion, open interest is a crucial metric in options trading that can provide valuable insights into market sentiment, support and resistance levels, and potential trading opportunities. By monitoring open interest alongside other key indicators, traders can gain a more comprehensive understanding of the options market and make informed trading decisions.

Open interest is a term used in the options market to indicate the number of outstanding contracts held by market participants at a given point in time. It represents the total number of contracts that have not been closed out, exercised, or expired. When evaluating the options market, one key metric that traders and analysts look at is open interest.

Higher open interest is generally seen as a positive sign in the market. It suggests that there is a high level of investor interest and involvement in a particular option. This can indicate a higher level of market activity and liquidity, as there are more participants trading and holding positions in that option.

Higher open interest can also be an indication of increased hedging activity by market participants. Hedging involves taking positions in options contracts to offset potential losses in a related position. If there is a higher open interest in a specific option, it suggests that market participants are actively hedging their positions, possibly due to anticipated market volatility or risk.

Furthermore, higher open interest can imply that there is a higher level of information and analysis being performed by market participants. Traders and investors may be conducting detailed research and analysis to identify potential opportunities and risks in the market. This can lead to increased trading activity and higher open interest in specific options.

Read Also: Understanding Systematic Strategies: A Comprehensive Guide

It is important to note that open interest should not be solely relied upon when making trading decisions. It should be used in conjunction with other technical and fundamental indicators to get a comprehensive understanding of the market dynamics. Open interest alone does not provide information about the direction or sentiment of the market; it simply indicates the level of participation and interest in a particular option.

In conclusion, higher open interest is a positive sign in the options market, indicating increased investor interest, market activity, and possibly hedging activity. Traders and analysts should consider open interest alongside other indicators to make more informed trading decisions.

If the open interest is higher than the volume in options trading, it means that there are more outstanding contracts that have not been closed or settled. This could indicate that there is significant interest or activity in those options.

It is important to pay attention to open interest in options trading because it can provide insights into the liquidity and potential for movement in a particular options contract. High open interest suggests that there is a large number of traders involved and a greater likelihood of active trading in that contract.

Higher open interest can affect options prices by increasing liquidity and narrowing bid-ask spreads, making it easier for traders to enter and exit positions. Additionally, higher open interest can indicate a greater probability of large price movements, as there is more capital at risk in those contracts.

Open interest refers to the total number of outstanding options contracts that have not been closed or settled, while volume refers to the total number of contracts that have been traded during a particular period. Open interest represents the total amount of contracts that can potentially create trading activity in the future, while volume represents the actual trading activity that has occurred.

How to Trade on a 4-Hour Chart Trading on a 4-hour chart can be a powerful tool for traders looking to capitalize on short-term market movements. This …

Read ArticleTips for Creating a Powerful Deck in the Pokemon Trading Card Game Deck building is a crucial skill for any competitive player in the Pokemon Trading …

Read ArticleCan I hire someone to do trading for me? Trading in financial markets can be a complex and time-consuming endeavor. It requires knowledge, skill, and …

Read ArticleIs paper trading smart? When it comes to learning how to trade stocks, many beginners turn to paper trading as a way to practice without risking real …

Read ArticleCan I get foreign currency from the CBA? If you’re planning a trip abroad or looking to invest in foreign markets, you might be wondering how to …

Read ArticleBest Timeframe for Accurate RSI Signals The Relative Strength Index (RSI) is a popular technical indicator used by traders to identify overbought and …

Read Article