Where is EU ETS traded: Exploring the Trading Platforms and Exchanges

Where can you trade EU ETS? The European Union Emissions Trading System (EU ETS) is the largest international cap-and-trade system for greenhouse gas …

Read Article

When it comes to trading and investing, one key term that often comes up is “open interest.” Open interest refers to the number of open contracts in a particular market at a given time. It is used as an indicator of market activity and liquidity. In other words, it tells us how many contracts are currently being traded and are yet to be closed.

But is $1,000 a good open interest? The answer to this question depends on various factors such as the specific market, the size of the contracts, and the overall trading volume. However, $1,000 open interest can generally be considered as a decent starting point for many markets.

Having a good open interest indicates that there is enough activity and interest in the market, making it easier for traders and investors to buy or sell positions without significantly affecting the market price. It also suggests that there are enough participants in the market, which can provide more opportunities for profitable trades.

However, it’s important to remember that open interest alone should not be the sole criteria for making trading decisions. It should be used in conjunction with other technical and fundamental analysis tools to get a clearer picture of market trends and potential opportunities.

In conclusion, while $1,000 open interest can be considered as a decent starting point for many markets, it’s important to analyze the market as a whole and use additional tools to make well-informed trading decisions.

In the world of finance and investing, open interest refers to the total number of outstanding or open options or futures contracts held by market participants at any given point in time. It is a measure of the liquidity and popularity of these contracts.

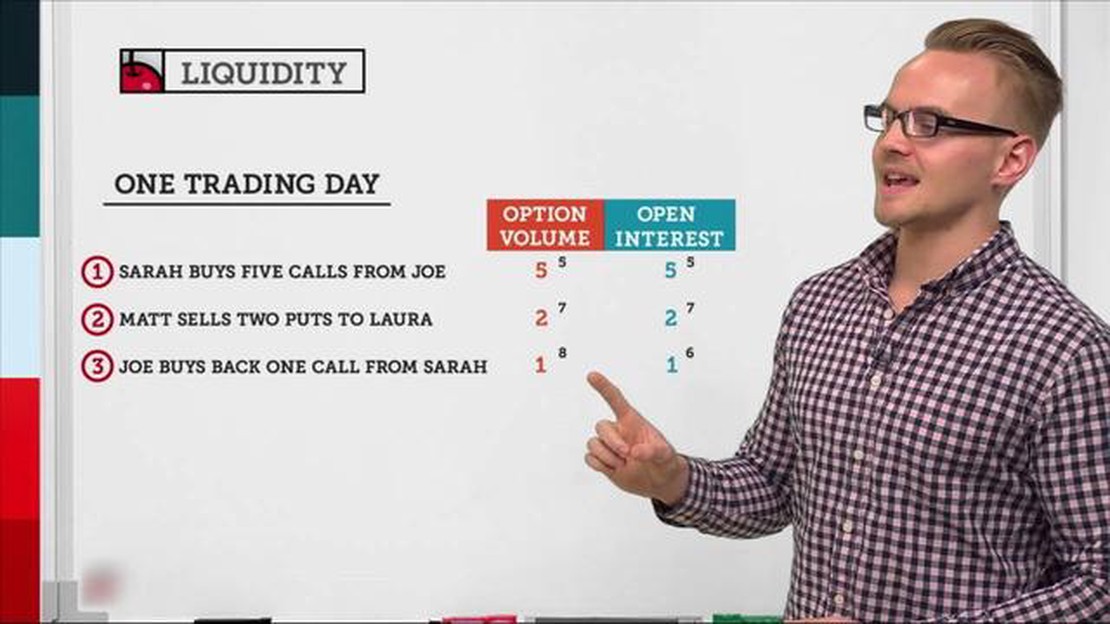

Open interest is different from trading volume, which simply reflects the number of contracts that are bought or sold during a specific period. Instead, open interest represents the number of contracts that have not been offset by an opposing trade. Therefore, it provides insight into the total number of contracts that are still active and can potentially be traded.

Open interest is a useful metric for investors and traders as it can provide an indication of market sentiment and potential future price movements. High open interest suggests a high level of participation and interest in a particular security or asset, which may signal a strong trend or potential levels of support or resistance. Conversely, low open interest may indicate limited market interest and potentially less reliable price movements.

However, it’s important to note that open interest alone should not be relied upon as the sole indicator for making investment decisions. It should be used in conjunction with other technical and fundamental analysis tools to gain a comprehensive understanding of market conditions and potential trading opportunities.

Overall, open interest is a valuable metric for investors and traders to monitor when assessing market trends and potential trading strategies. By understanding open interest, individuals can gain a better understanding of market sentiment and make more informed investment decisions.

Open interest is a term commonly used in financial markets, especially in the context of futures and options trading. It refers to the total number of outstanding contracts that are held by market participants at a given point in time. These contracts have not yet been offset, exercised, or expired.

Open interest provides important information about the liquidity and depth of a particular market. It is an indicator of the level of investor interest and can be used to gauge market sentiment and potential price movements.

Unlike trading volume, which represents the total number of contracts traded during a specific period, open interest is a static figure that can increase or decrease over time as new positions are opened or existing positions are closed.

High open interest suggests that a market has a large number of participants with active positions, which may indicate a more liquid and competitive market. On the other hand, low open interest may suggest a lack of interest or participation in a market and can result in lower liquidity and wider bid-ask spreads.

Read Also: What is Box 20 on Schedule K1? All You Need to Know

Open interest can also be used as a tool for technical analysis. Traders often look for patterns and trends in open interest to identify potential turning points in the market or to confirm existing price trends.

In conclusion, open interest is a key metric in financial markets that provides insight into market activity and can be used as a valuable tool for both traders and investors.

Open interest is an important metric in the options market that measures the number of outstanding contracts at a given time. It represents the total number of options contracts that are currently “open” or have not been closed or expired.

When evaluating whether $1,000 is a good open interest, it’s essential to consider the context. Open interest can vary significantly depending on the underlying asset, the options market, and the specific contract being traded.

Read Also: Unveiling the Mechanism of Golden Keys in Borderlands 2: A Comprehensive Guide

A higher open interest generally indicates a more active and liquid options market, which can be advantageous for traders. It means that there are more buyers and sellers in the market, increasing the likelihood of finding counterparties and facilitating smooth trading.

However, a high open interest alone does not necessarily indicate a good or profitable trade. Ultimately, the quality of open interest depends on the individual trader’s objectives, strategy, and risk tolerance.

For some traders, a lower open interest may be preferable as it can potentially lead to better price discovery and tighter spreads. In contrast, others may seek higher open interest to ensure ease of entry and exit in the market.

Additionally, open interest should be analyzed relative to historical levels and compared to similar options contracts and their respective open interests. This analysis can provide insights into market sentiment, potential price movements, and trading opportunities.

Furthermore, it’s crucial to consider other factors such as volume, volatility, and the overall market conditions when assessing the significance of open interest. These factors can impact the liquidity and trading dynamics of the options market.

| Advantages of High Open Interest | Advantages of Low Open Interest |

|---|---|

| Increased liquidity and trading activity | Potential for better price discovery |

| More counterparties for trading | Tighter spreads |

| Likelihood of better market prices | Potential for less crowded trades |

In conclusion, whether $1,000 is considered a good open interest depends on various factors and individual trading preferences. It’s essential to analyze open interest in the context of the specific options market, underlying asset, and the trader’s objectives. Evaluating open interest in conjunction with other market indicators can provide a more comprehensive understanding of trading conditions and potential opportunities.

Open interest in trading refers to the total number of outstanding derivative contracts, such as futures and options, that are held by market participants. It represents the total number of contracts that have not been closed or delivered.

Whether $1,000 is considered a good open interest depends on the context and the specific market being analyzed. In some markets, $1,000 may be a significant amount, while in others it may be relatively low. It is important to compare the open interest to the overall market activity and trading volume to make a proper assessment.

Open interest is calculated by adding the total number of long positions (buyers) to the total number of short positions (sellers) for a particular futures or options contract. Each contract can have multiple long or short positions, so the open interest represents the net sum of all these positions.

Open interest is important in trading because it provides insights into the liquidity and overall interest in a particular market or contract. High open interest suggests active trading and increased liquidity, which can lead to greater price stability and tighter bid-ask spreads. It also indicates the number of participants with exposure to a particular contract.

Several factors can influence open interest, including market sentiment, trading volume, delivery or expiration dates of contracts, and overall market activity. News events, economic data, and changes in market conditions can also impact open interest as traders adjust their positions based on new information or expectations.

Open interest refers to the total number of outstanding or open contracts in a financial market at any given time. It represents the total amount of interest or positions that are active and not yet squared off or expired.

Where can you trade EU ETS? The European Union Emissions Trading System (EU ETS) is the largest international cap-and-trade system for greenhouse gas …

Read ArticleUnderstanding the Dragon Pattern Chart in Trading The Dragon Pattern Chart is a powerful tool that is commonly used by traders and investors to …

Read ArticleWhere to Trade Currency Derivatives in India? Welcome to our comprehensive guide on currency derivatives trading in India. Currency derivatives refer …

Read ArticleWhy was MT4 banned from Apple? In recent years, many traders and investors have embraced the convenience and accessibility of mobile trading …

Read ArticleCan you hedge options with options? If you’re involved in the world of finance or investing, you’ve likely heard of hedging. Hedging is a risk …

Read ArticleRockwell Trading Software: Pricing and Costs Rockwell Trading Software has gained popularity among traders looking for a reliable and effective …

Read Article