Step-by-Step Guide: Creating an Expert Advisor in MT4

Guide to Creating an Expert Advisor in MT4 If you’re a trader looking to automate your trading strategies, MetaTrader 4 (MT4) can be a powerful tool. …

Read Article

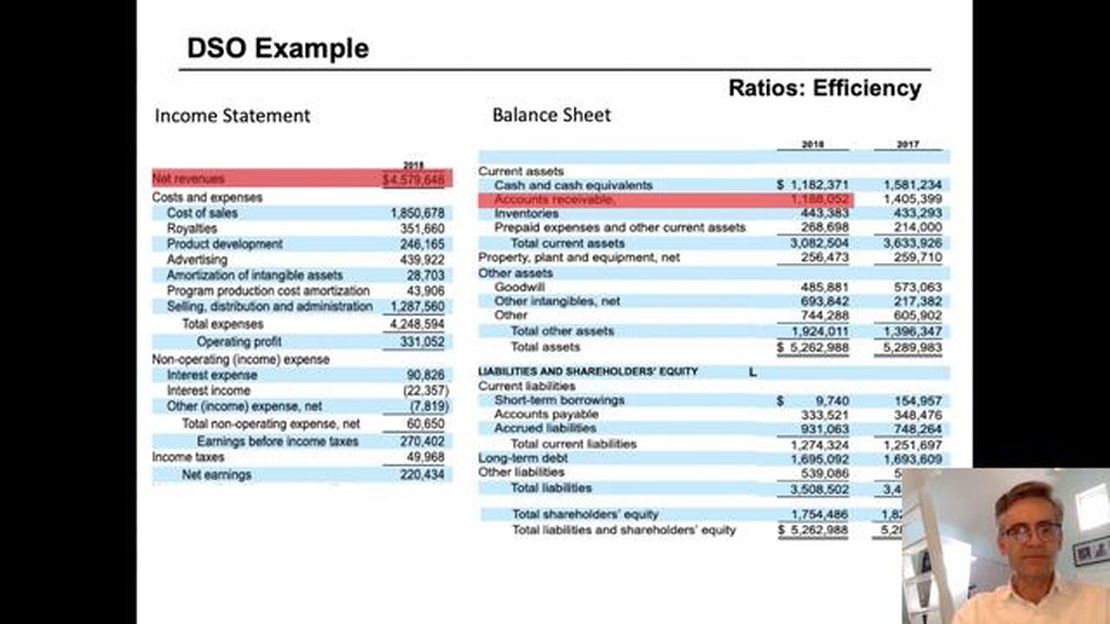

Days Sales Outstanding (DSO) is a key metric for businesses to assess the efficiency of their accounts receivable management. It measures the average number of days it takes for a company to collect payment from its customers after a sale has been made. By calculating DSO, businesses can gain insight into their cash flow and identify potential issues with late payments or collections.

To calculate DSO, you will need to divide the total accounts receivable for a specific period by the average daily sales. The resulting figure represents the average number of days it takes for your company to collect payment from its customers. This metric is crucial in helping businesses understand their cash flow and take necessary steps to improve it.

Step 1: Determine the period for which you want to calculate the DSO. This could be a month, a quarter, or a year. An appropriate time frame allows for a meaningful analysis of your accounts receivable and helps to identify any trends or issues over time.

Step 2: Calculate the total accounts receivable for the chosen period. This includes all outstanding invoices that your company is expecting to be paid.

Step 3: Determine the average daily sales for the chosen period. This can be calculated by dividing the total sales for the period by the number of days in that period.

Step 4: Finally, divide the total accounts receivable by the average daily sales to obtain the DSO. This figure represents the average number of days it takes for your company to collect payment from its customers.

By regularly calculating and monitoring the DSO, businesses can effectively manage their cash flow and identify potential issues with late payments. It also provides valuable insights into the overall financial health of the company and helps in making informed decisions to improve profitability.

DSO, or Days Sales Outstanding, is a financial metric that measures the average number of days it takes for a company to collect payment from its customers after a sale has been made. DSO is calculated by dividing accounts receivable by average daily sales. It is an important metric for businesses to track as it provides insight into their cash flow and liquidity.

DSO is used primarily by companies that offer credit terms to their customers. It helps them understand how long it takes for customers to pay their invoices, which in turn affects their cash flow and working capital. A high DSO can indicate problems with collections, such as slow-paying customers or inefficient collection processes. On the other hand, a low DSO may suggest that a company is effectively managing its credit and collection activities.

DSO is often compared to the company’s credit terms or industry benchmarks to assess its efficiency in collecting payments. By monitoring DSO trends over time, companies can identify areas where improvement is needed and take appropriate actions to streamline their collections processes.

Read Also: How to Obtain Forex Data for Analysis: A Comprehensive Guide

In conclusion, DSO is a key financial metric that measures the average number of days it takes for a company to collect payment from its customers. It provides valuable insights into a company’s cash flow and liquidity, and can help identify areas for improvement in collections processes.

Monitoring the Days Sales Outstanding (DSO) metric is crucial for businesses because it provides valuable insights into their cash flow and liquidity. DSO measures the average number of days it takes for a company to collect payment from its customers after a sale has been made.

By closely monitoring DSO, businesses can identify trends and patterns in their collection process. If DSO is increasing over time, it may indicate that there are issues with the company’s credit and collection policies, or that customers are taking longer to pay. This can lead to a strain on cash flow and affect the company’s ability to meet its financial obligations.

On the other hand, if DSO is decreasing, it may indicate that the company is collecting payment more efficiently and effectively. This can result in improved cash flow and increased liquidity, allowing the company to invest in growth opportunities or meet financial obligations more easily.

By regularly monitoring DSO, businesses can also benchmark their performance against industry averages or competitors. This can help them identify areas for improvement or potential challenges in their collection process. It can also provide insights into how the company’s credit and collection policies compare to industry standards.

Overall, monitoring DSO is essential for businesses to maintain a healthy cash flow, optimize collection processes, and make informed decisions about credit and collection policies. It helps businesses ensure they have sufficient liquidity to meet their financial obligations and pursue growth opportunities.

Read Also: The Expanding Forex Market of 2023: A Closer Look at Its Size and Potential

The first step in calculating the Days Sales Outstanding (DSO) metric is to gather the necessary data. DSO is a measure of how long it takes for a company to collect payment from its customers.

To calculate DSO, you will need the following data:

You can retrieve the accounts receivable balance and net credit sales from your company’s financial statements, such as the balance sheet and income statement. The number of days in the period can be determined based on the timeframe you are analyzing.

Once you have gathered all the necessary data, you can proceed to the next step of the DSO calculation process.

DSO stands for Days Sales Outstanding. It is a financial metric that measures the average number of days it takes for a company to collect payment from its customers after a sale has been made.

DSO is calculated by dividing accounts receivable by average daily sales. The formula is: DSO = (Accounts Receivable / Average Daily Sales) x Number of Days.

A high DSO indicates that a company takes a longer time to collect payment from its customers. This can be a sign of cash flow problems or issues with collecting payments, which may affect the company’s financial health.

There are several ways to improve DSO, such as offering discounts for early payment, implementing stricter credit policies, improving invoicing and collections processes, and using technology to automate and streamline the accounts receivable process.

Guide to Creating an Expert Advisor in MT4 If you’re a trader looking to automate your trading strategies, MetaTrader 4 (MT4) can be a powerful tool. …

Read ArticleHow to Determine if a Broker Operates a B Book Model When it comes to choosing a broker for your investments, it’s essential to understand the …

Read ArticleUnderstanding Poi Trading: An Introduction to This Art and Practice Welcome to our comprehensive guide to poi trading! Whether you’re new to the world …

Read ArticleWhat is the 4 week rule trend trading? Are you looking to gain a better understanding of trend trading? If so, the 4 Week Rule is a crucial concept to …

Read ArticleDoes RBC offer option trading? Option trading is a popular financial instrument that allows investors to speculate on the price movement of an …

Read ArticleWhat is open API for FX rates? Foreign exchange rates are an essential part of the global financial system. They determine the value of one currency …

Read Article