Current Currency in Afghanistan: What is Today's Official Currency?

Current Currency in Afghanistan Afghanistan, a country located in Central Asia, has a rich cultural heritage and a complex history. One of the key …

Read Article

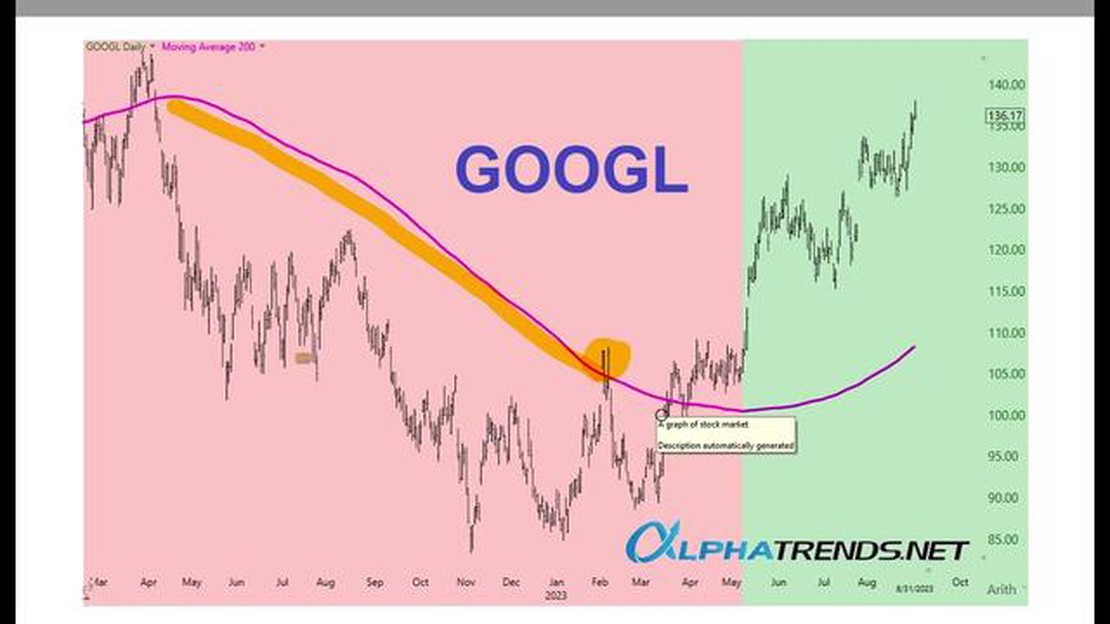

Utilizing technical analysis is an important aspect of successful trading, and one popular tool is the 200-day moving average. The 200-day moving average is a trend-following indicator that shows the average price of a security over a specified period. Traders often use it to identify the overall direction of a stock or market, and to make informed decisions about when to buy or sell.

One way to effectively utilize the 200-day moving average is to use it as a long-term trend indicator. By looking at the average price over 200 days, traders can gain insight into the long-term movement of a stock or market. If the price is consistently above the 200-day moving average, it indicates a bullish trend, suggesting that it may be a good time to buy. On the other hand, if the price is consistently below the 200-day moving average, it indicates a bearish trend, suggesting that it may be a good time to sell.

Another way to utilize the 200-day moving average is to use it as a support or resistance level. When a stock or market approaches the 200-day moving average, it tends to either bounce off and continue in the direction it was moving, or break through and reverse its direction. Traders can use this information to make informed decisions about when to enter or exit a trade.

It is important to note that the 200-day moving average is not a foolproof indicator, and should be used in conjunction with other technical indicators and analysis methods. It is just one tool among many that can help traders make more informed decisions. By understanding how to effectively utilize the 200-day moving average, traders can improve their chances of success in the market.

The 200-day moving average is a commonly used technical indicator in trading. It is a line that represents the average price of an asset over a 200-day period. Traders and investors use this moving average to identify trends and make informed decisions about buying or selling a particular asset.

The 200-day moving average is considered to be a long-term indicator as it reflects the average price movement over a significant period. This makes it useful for identifying the overall trend of an asset. If the price is consistently above the 200-day moving average, it indicates an uptrend, while if the price is consistently below the 200-day moving average, it indicates a downtrend.

One common strategy involving the 200-day moving average is the “golden cross” and “death cross”. The golden cross occurs when the price crosses above the 200-day moving average, indicating a bullish signal. On the other hand, the death cross occurs when the price crosses below the 200-day moving average, indicating a bearish signal.

Traders also use the 200-day moving average as a support or resistance level. If the price dips below the 200-day moving average but quickly bounces back, it can be seen as a buying opportunity as the moving average acts as a support level. Similarly, if the price rises above the 200-day moving average but fails to sustain, it can act as a resistance level and be seen as a selling opportunity.

While the 200-day moving average is a popular tool, it is not foolproof and should be used in conjunction with other indicators and analysis methods. Traders should consider other factors such as volume, market sentiment, and news events to make informed trading decisions.

The 200-day moving average is a commonly used technical analysis tool in trading. It is a simple moving average that calculates the average price of an asset over the past 200 trading days. This moving average is widely followed by traders and investors as it provides a smooth and accurate representation of the asset’s long-term trend.

Read Also: How Many Days is the Moving Average Indicator? Understanding the Timeframe

The 200-day moving average is often considered a key indicator of an asset’s overall direction, whether it is in an uptrend or a downtrend. When the price of an asset is above the 200-day moving average, it is typically seen as a bullish signal, indicating that the asset is in an uptrend. On the other hand, when the price is below the 200-day moving average, it is viewed as bearish, suggesting that the asset is in a downtrend.

Traders and investors use the 200-day moving average in various ways to make trading decisions. Some traders use it as a basis for determining entry and exit points. For example, they may look to buy an asset when its price crosses above the 200-day moving average and sell when it crosses below. Others use it as a confirmation tool, waiting for the price to break above or below the 200-day moving average before initiating a trade.

It’s important to note that the 200-day moving average is not a standalone indicator and should be used in conjunction with other technical analysis tools and indicators. It is also worth mentioning that the 200-day moving average may not be suitable for all types of assets and market conditions. Traders should consider the specific characteristics of the asset they are trading and adapt their trading strategies accordingly.

The 200-day moving average is an important tool for traders and investors because it provides a clear and reliable indicator of the long-term trend of a security or market index. It is widely used in technical analysis to determine the overall direction of a stock or market and to identify potential buying or selling opportunities.

One of the main reasons why the 200-day moving average is important is its ability to smooth out short-term price fluctuations and noise, allowing traders to focus on the bigger picture. By calculating the average price over a longer period of time, it filters out the day-to-day volatility and provides a more accurate representation of the underlying trend.

Another reason why the 200-day moving average is highly regarded is its significance as a support and resistance level. When a stock or market index is trading above its 200-day moving average, it is generally considered to be in an uptrend, signaling a bullish sentiment. Conversely, when the price falls below the 200-day moving average, it is seen as a bearish signal, indicating a potential downtrend.

Read Also: Discover the Opportunities of Options Trading in the USA

In addition, the 200-day moving average is often used as a tool for determining the strength and reliability of a trend. Traders will look for the price to consistently stay above or below the average, which confirms the strength of the trend. If the price repeatedly crosses above and below the 200-day moving average, it may signal a potential trend reversal or a period of consolidation.

Furthermore, the 200-day moving average is widely followed by institutional and professional traders, which can lead to increased buying or selling pressure when the price approaches this key level. Many traders will use the 200-day moving average as a reference point for determining entry and exit points, leading to increased trading activity around this level.

In conclusion, the 200-day moving average is an important and widely used tool for traders and investors. It provides a clear indication of the long-term trend, filters out short-term noise, acts as a support and resistance level, and can help determine the strength of a trend. By understanding and effectively utilizing the 200-day moving average, traders can improve their decision-making process and increase their chances of success in the markets.

The 200-day moving average is a technical indicator that is calculated by adding up the closing prices of a security over the past 200 trading days and dividing the sum by 200. It is commonly used to identify the overall trend of a security.

The 200-day moving average can be used as a signal for determining the overall trend of a security. Traders often use it to confirm bullish or bearish trends, identify potential entry or exit points, and set stop loss orders.

No, the 200-day moving average should not be used as the sole indicator for predicting market trends. It is most effective when used in combination with other technical analysis tools and indicators.

The 200-day moving average should be reassessed periodically, depending on the trading time frame and the volatility of the security being analyzed. Some traders may reassess it on a daily basis, while others may do so on a weekly or monthly basis.

Yes, the 200-day moving average can be applied to any financial market, including stocks, bonds, commodities, and forex. It is a versatile technical indicator that can be used across different markets and time frames.

Current Currency in Afghanistan Afghanistan, a country located in Central Asia, has a rich cultural heritage and a complex history. One of the key …

Read ArticleUnderstanding the Mechanics of Open Interest in Futures Trading Futures trading is a complex and dynamic form of investment that allows individuals to …

Read ArticleDuration of Swing Trades: How Long Can They Last? Swing trading is a popular trading strategy that aims to capture short- to medium-term gains in the …

Read ArticleUnderstanding Leverage for Beginners: All You Need to Know In the world of financial trading, leverage plays a crucial role. But what exactly is …

Read ArticleAre SPX Index Options Cash Settled? When it comes to options trading, one of the most popular and widely traded products is the SPX index options. But …

Read ArticleUnderstanding the Moving Average: A Simple Explanation When it comes to technical analysis in financial markets, the moving average is a widely used …

Read Article