Discover the Optimal Settings for the DeMarker Indicator

Optimal Settings for the DeMarker Indicator The DeMarker Indicator is a popular technical analysis tool used by traders to identify potential trend …

Read Article

In the world of forex trading, one of the most important concepts to grasp is the exchange rate. The exchange rate represents the value of one currency in relation to another, and it is constantly changing as economic and political factors influence the market. For individuals and businesses involved in international trade, understanding currency exchange rates is crucial for accurately valuing goods and services.

When it comes to forex trading, the exchange rate of a currency pair is often displayed as 1.0, representing the value of one unit of the base currency in terms of the quote currency. For example, if the exchange rate for the EUR/USD currency pair is 1.0, it means that one euro is equal to one US dollar.

However, it is important to note that the exchange rate is not a fixed value. It can fluctuate throughout the day as traders buy and sell currencies based on market demand. Factors such as interest rates, inflation, and geopolitical events can all have a significant impact on exchange rates, leading to fluctuations in the value of currencies.

To stay informed about current exchange rates, forex traders rely on real-time data from financial institutions and online trading platforms. By monitoring exchange rates and understanding their drivers, traders can make more informed decisions and potentially profit from fluctuations in currency values.

Understanding currency exchange rates is essential for anyone involved in international trade or forex trading. The value of one currency in relation to another can have a significant impact on business profits and investment returns. By staying informed about exchange rates and the factors that influence them, traders can make more accurate predictions and enhance their trading strategies.

Forex, short for foreign exchange, is the global marketplace for buying and selling different currencies. It is also commonly referred to as currency trading. Forex allows individuals, corporations, and financial institutions to trade one currency for another at agreed-upon exchange rates.

The forex market operates 24 hours a day, five days a week, and is the largest and most liquid financial market in the world, with an average daily turnover of over $6 trillion. Participants in the forex market include banks, hedge funds, central banks, retail traders, and multinational corporations.

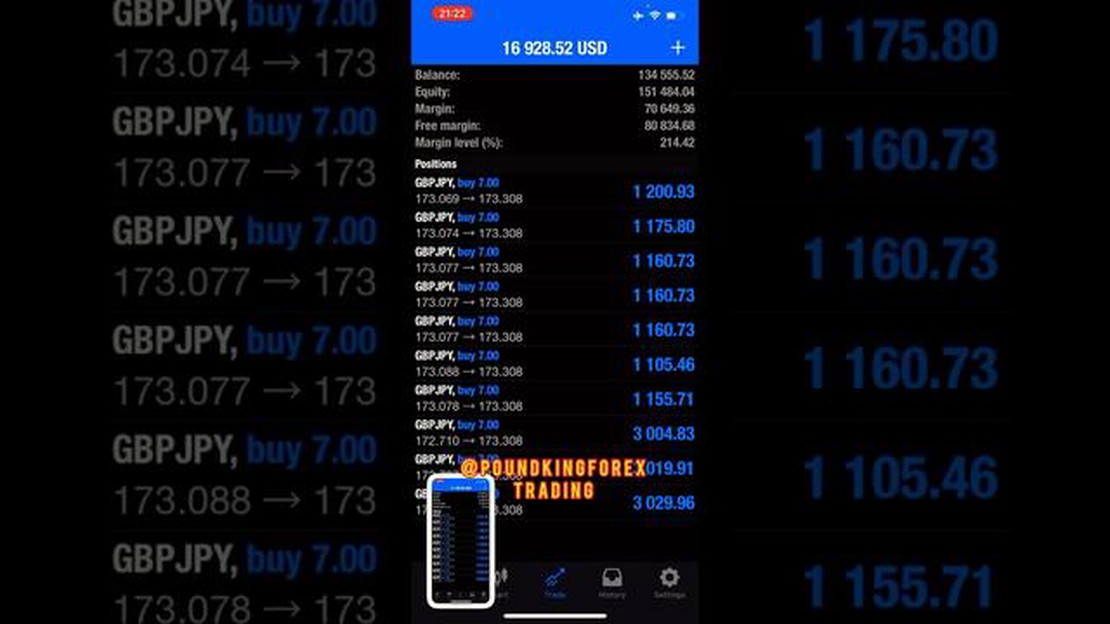

The main purpose of forex trading is to take advantage of fluctuations in currency exchange rates. Currencies are traded in pairs, such as EUR/USD (euro against US dollar), GBP/JPY (British pound against Japanese yen), or AUD/CAD (Australian dollar against Canadian dollar). When trading forex, you are essentially speculating on the future direction of one currency against another.

Forex trading involves buying one currency and simultaneously selling another. To make a profit, traders attempt to predict whether a currency will appreciate or depreciate in value compared to the counter currency. If their prediction is correct, they can close the trade at a higher price and make a profit. However, if their prediction is wrong, they may incur losses.

Read Also: Recording stock options in accounting: A comprehensive guide

There are several factors that influence currency exchange rates, including economic indicators, geopolitical events, interest rates, inflation, and market sentiment. Traders use various tools and techniques, such as technical analysis, fundamental analysis, and market sentiment analysis, to make informed trading decisions.

Forex trading offers numerous advantages, such as high liquidity, low transaction costs, leverage, and the ability to trade in both rising and falling markets. However, it is also a highly volatile and risky market, and traders should carefully consider their risk tolerance and trading strategies.

In conclusion, forex trading is the buying and selling of currencies with the aim of making a profit from fluctuations in exchange rates. It is a global market that operates 24/5 and is the largest financial market in the world. Understanding the basics of currency trading is essential for anyone looking to get involved in forex and navigate the complexities of the market.

Currency exchange rates play a crucial role in facilitating international trade and foreign investments. They determine the value of one currency relative to another and can have a significant impact on the global economy. Understanding how currency exchange rates work is essential for businesses, travelers, and investors alike.

At its core, a currency exchange rate represents the amount of one currency that can be exchanged for another. For example, if the exchange rate between the US dollar and the euro is 1.10, it means that one US dollar is equivalent to 1.10 euros. Exchange rates fluctuate constantly due to various factors, including supply and demand, inflation rates, interest rates, political stability, and market speculation.

There are two types of exchange rates: floating exchange rates and fixed exchange rates. In a floating exchange rate system, currencies are allowed to fluctuate freely based on market forces. Governments and central banks can intervene in the foreign exchange market to stabilize their currencies if necessary. On the other hand, in a fixed exchange rate system, a country’s currency is pegged to a specific value, usually another currency or a basket of currencies. The pegged currency’s value is maintained by the central bank buying and selling foreign currency reserves.

Exchange rates are typically quoted in currency pairs, such as USD/EUR or GBP/JPY. The first currency in the pair is called the base currency, while the second currency is the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency. For example, if the USD/EUR exchange rate is 1.10, it means that 1.10 euros are needed to buy one US dollar.

Market participants in the foreign exchange market include banks, corporations, governments, central banks, and individual investors. They engage in currency trading or exchange currency for various reasons, such as hedging against currency risks, speculating on future exchange rate movements, or facilitating international transactions. The foreign exchange market operates 24 hours a day, five days a week, across different time zones.

Read Also: The full form of Forex in tourism and its importance in the industry

Exchange rates have a significant impact on the economy. A strong currency can make a country’s exports more expensive and imports cheaper, potentially leading to a trade deficit. Conversely, a weak currency can make a country’s exports cheaper and imports more expensive, potentially boosting exports and reducing the trade deficit. Exchange rate fluctuations can also affect inflation rates, interest rates, and economic growth.

Overall, understanding how currency exchange rates work is crucial for anyone involved in international trade, travel, or investment. Keeping track of exchange rates and staying informed about global economic factors can help individuals and businesses make informed decisions and manage currency risks effectively.

Forex, also known as foreign exchange or FX, is the global marketplace for trading national currencies against one another. It operates as a decentralized market, where participants can buy, sell, exchange, and speculate on different currencies.

The exchange rate in Forex is determined by various factors, including interest rates, economic performance, political stability, and market sentiment. Supply and demand for different currencies also play a significant role in determining exchange rates.

Currency exchange rates fluctuate due to several reasons. Changes in economic conditions, inflation rates, interest rates, and geopolitical events can all impact the value of a country’s currency. Speculation, market sentiment, and global trade also contribute to the fluctuations in exchange rates.

To calculate the value of 1.0 in Forex, you need to look at the exchange rate between the two currencies in question. For example, if the exchange rate between the US dollar and the euro is 1.20, then 1.0 in Forex would be equal to 1.20 euros.

Currency exchange rates directly impact international trade. A weaker currency can make exports more competitive, as they become cheaper for foreign buyers. On the other hand, a stronger currency can make imports more affordable for domestic consumers. Fluctuations in exchange rates can affect the profitability and competitiveness of businesses involved in international trade.

In Forex, “1.0” refers to one unit of a particular currency. It is used as a standard unit of measurement for currency exchange rates.

Optimal Settings for the DeMarker Indicator The DeMarker Indicator is a popular technical analysis tool used by traders to identify potential trend …

Read ArticleExploring talib library in Python: A Comprehensive Guide Talib, or the Technical Analysis Library, is a popular Python library used for calculating …

Read ArticleUnderstanding the Moving Average Estimation Method Whether you are new to finance or a seasoned investor, understanding the moving average estimation …

Read ArticleThe Future of the Dollar: Forecasting its Direction The value of the dollar is an important factor in global economics and can have a significant …

Read ArticleChoosing the Best Currency to Buy: A Guide for Investores Investing in foreign currencies can be a lucrative opportunity, but with so many options …

Read ArticleWhat is the average IB business score? If you are a student pursuing an International Baccalaureate (IB) diploma, you may be curious about the average …

Read Article