What Time Does the EU Market Open in GMT?

What time does EU market open GMT? The EU market, also known as the European Union market, is a significant financial market that operates within the …

Read Article

When it comes to trading options, one of the most important factors to consider is the price of the option. But, how do you determine whether an option price is good or not? In this article, we will provide you with expert tips and insights on how to evaluate option prices effectively.

First and foremost, it’s crucial to understand that the price of an option is determined by various factors, including the current stock price, the strike price, the time until expiration, and the volatility of the underlying asset. These factors interact with each other and influence the price of the option.

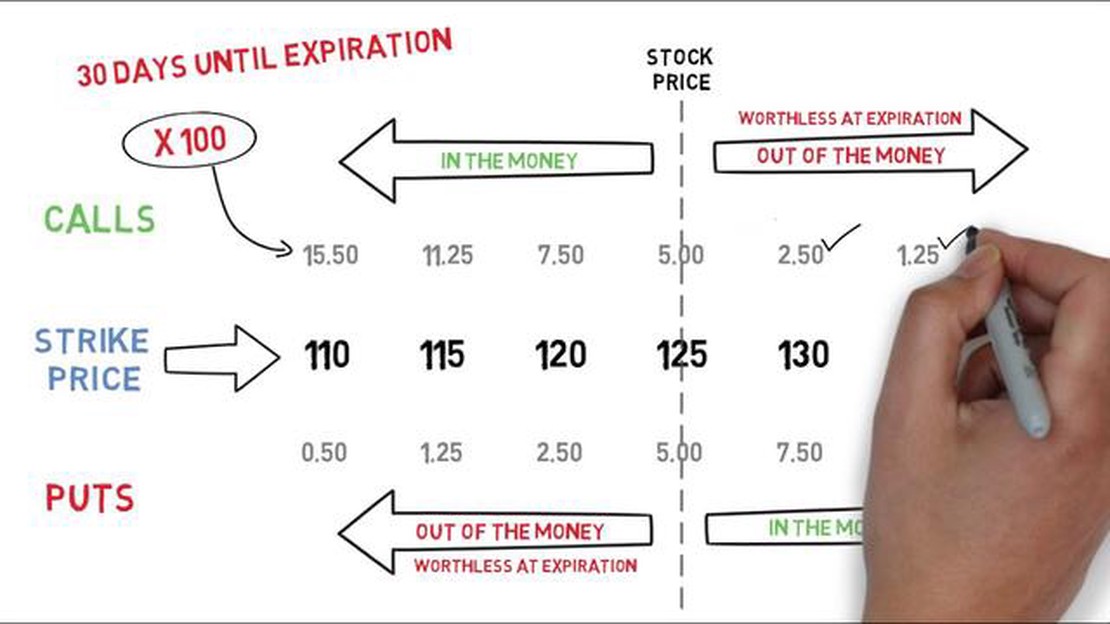

One key indicator to consider is the option’s intrinsic value, which is the difference between the current stock price and the strike price. If the intrinsic value is positive, it means that the option is in-the-money and has a higher likelihood of being profitable. On the other hand, if the intrinsic value is zero or negative, the option is out-of-the-money or at-the-money, respectively, and may have a lower probability of generating a profit.

Another important metric to look at is the option’s extrinsic value, which is the price of the option minus its intrinsic value. The extrinsic value is influenced by factors such as time decay and implied volatility. It represents the market’s expectation of potential future price movements and other uncertainties. A higher extrinsic value indicates that the option may have a greater potential for generating profits, while a lower extrinsic value suggests a higher level of risk.

Ultimately, determining whether an option price is good requires a comprehensive analysis of multiple factors. It is essential to assess the intrinsic and extrinsic values of the option, as well as consider other indicators such as historical volatility and market trends. By using these expert tips and insights, you can make more informed decisions when trading options and increase your chances of success.

When evaluating an option price, it is important to take into account several factors that can significantly impact its value. These factors can help you determine whether an option price is good or not. Some of the key factors to consider include:

1. Underlying Asset Price: The price of the underlying asset plays a major role in determining the value of an option. Generally, the higher the price of the underlying asset, the more valuable the option will be.

2. Strike Price: The strike price is the price at which the underlying asset can be bought or sold if the option is exercised. The relationship between the strike price and the current price of the underlying asset affects the value of the option. In general, an option with a strike price close to the current price of the underlying asset will have a higher value.

3. Time to Expiration: The time remaining until the option expires also affects its value. Generally, options with longer expiration periods will have higher premiums, as there is more time for the underlying asset’s price to move in a favorable direction.

4. Volatility: Volatility measures the magnitude of price movements in the underlying asset. Higher volatility generally leads to higher option prices, as there is a greater likelihood of significant price movements during the option’s lifespan.

5. Interest Rates: Interest rates can have an impact on option prices, especially for options that have a significant time period until expiration. Higher interest rates can increase the cost of carry, which in turn can lower the value of call options and increase the value of put options.

Read Also: How much stock do startups typically grant to their employees?

6. Dividends: If the underlying asset pays dividends, it can affect the price of the option. Generally, the higher the dividend yield, the lower the call option price and the higher the put option price.

7. Option Type: The type of option, whether it’s a call or a put, also influences its price. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell the underlying asset. Depending on market conditions and the investor’s outlook, a call option may have a higher or lower value than a put option.

8. Market Conditions: Overall market conditions, such as supply and demand dynamics, macroeconomic factors, and geopolitical events, can also influence option prices. It’s important to consider the broader market context when evaluating an option price.

By considering these factors, investors can make more informed decisions and determine whether an option price is good or not. It’s important to analyze the overall risk-reward profile of the option and understand how each factor can impact its value. Always consult with a financial advisor or professional before making any investment decisions.

Market conditions and volatility play a crucial role in determining whether an option price is good. The level of volatility in the market can greatly affect the price of options.

Volatility refers to the amount of price fluctuation in the underlying asset. Higher volatility generally leads to higher option prices because there is a greater likelihood of the option ending up in the money. Conversely, lower volatility typically results in lower option prices.

Read Also: Price of 1 Euro in Pakistan Open Market - Latest Update

There are a few key factors to consider when analyzing market conditions and volatility:

| Factor | Description |

|---|---|

| Historical Volatility | Examining the past price movements of the underlying asset can provide insights into its historical volatility. Higher historical volatility may indicate a higher likelihood of future price swings, which can impact option prices. |

| Implied Volatility | Implied volatility is derived from the current option prices and indicates the market’s expectations for future volatility. Higher implied volatility generally leads to higher option prices, as traders are willing to pay a premium for the potential for larger price moves. |

| Market Sentiment | Market sentiment refers to the overall attitude of traders and investors towards the market. Positive market sentiment can lead to increased demand for options, driving up their prices. Conversely, negative market sentiment can result in decreased demand and lower option prices. |

| Event Risk | Event risk refers to the occurrence of significant news or events that can impact the market. Events such as earnings announcements, economic reports, or geopolitical developments can cause increased volatility and affect option prices. |

When evaluating option prices, it is important to consider the current market conditions and volatility. Assessing historical and implied volatility, market sentiment, and event risk can provide valuable insights into whether an option price is favorable.

There are several factors you can consider to determine whether an option price is good. First, you should look at the underlying stock’s price and how it has been performing. You should also consider the expiration date and the time value of the option. Additionally, you should analyze the implied volatility and the option’s strike price. By considering all of these factors, you can make a more informed decision about whether an option price is good or not.

Implied volatility is a key factor in determining whether an option price is good. It reflects the market’s expectations of future price movements of the underlying stock. Generally, higher implied volatility means higher option prices, as there is a greater likelihood of significant price fluctuations. However, if implied volatility is too high, it can make the option price too expensive. On the other hand, if implied volatility is low, it may indicate a good opportunity to buy options at a relatively lower price.

The expiration date of an option is an important factor in determining its price. As the expiration date approaches, the time value of the option decreases, causing the option price to decline. This is because the likelihood of the option expiring in-the-money decreases as time passes. Therefore, if you are considering buying an option, it is important to factor in the expiration date and choose one that allows sufficient time for the underlying stock to reach your desired price target.

The strike price is the price at which the underlying stock can be bought or sold when exercising the option. It is an important factor in option pricing because it determines the intrinsic value of the option. If the strike price is far away from the current stock price, the option will have a lower intrinsic value and, therefore, a lower price. Conversely, if the strike price is close to the current stock price, the option will have a higher intrinsic value and, consequently, a higher price.

Yes, there are other factors to consider when determining whether an option price is good. For instance, you should assess the overall market conditions and any upcoming events that may impact the stock’s price. Another important factor to consider is the option’s liquidity, as higher liquidity generally leads to tighter bid-ask spreads and better execution prices. Additionally, it may be beneficial to look at the option’s historical price movements and volume to gauge its popularity and potential profitability.

There are several factors to consider when determining whether an option price is good. One important factor is the current market price of the underlying asset. You should also consider the volatility of the market and the time remaining until the option expires. Additionally, it can be helpful to compare the option price to similar options in the market to see if it is overpriced or underpriced.

The market price of the underlying asset is an important factor to consider when evaluating an option price because it directly affects the value of the option. If the market price of the underlying asset is higher than the strike price of the option, the option is said to be “in the money” and has intrinsic value. If the market price is lower than the strike price, the option is “out of the money” and has no intrinsic value. The market price of the underlying asset also affects the likelihood of the option reaching its strike price before expiration.

What time does EU market open GMT? The EU market, also known as the European Union market, is a significant financial market that operates within the …

Read ArticleFast Moving Average vs Slow Moving Average: Understanding the Difference When it comes to analyzing the stock market and making investment decisions, …

Read ArticleUnderstanding OpenTable’s Additional Seating Options OpenTable has revolutionized the way people make restaurant reservations. With just a few clicks, …

Read ArticleWho owns Moex? The Moscow Exchange (MOEX) is the largest exchange group in Russia and ranks among the top 30 globally in terms of market …

Read ArticleBest Forex Trading Platform in Malaysia Malaysia has emerged as one of the leading players in the global forex trading market. The country’s strategic …

Read ArticleIQ Option Ownership: Who is the Owner? IQ Option has emerged as one of the leading online trading platforms in recent years, attracting millions of …

Read Article