Discovering Dream Fox Services Limited: Your Ultimate Guide

Discovering Dream Fox Services Limited: Everything You Need to Know Welcome to Dream Fox Services Limited, the premier provider of top-quality dream …

Read Article

FXCM, one of the leading online forex trading platforms, offers a wide range of services to cater to the needs of different types of traders. One of the key factors to consider when choosing a forex broker is the commission they charge per lot. In this article, we will explore how much FXCM charges per lot and how it compares to other brokers in the industry.

FXCM follows a transparent pricing structure, making it easier for traders to understand the costs involved in their trades. The commission per lot varies depending on the type of account you choose. For example, the commission for a standard account is typically lower compared to the commission for an ECN account.

It’s important to note that the commission per lot is just one aspect to consider when evaluating a broker. Other factors, such as spreads, trading platform, customer support, and regulation, should also be taken into account. However, understanding the commission per lot can give you a better idea of the overall cost involved in trading with FXCM.

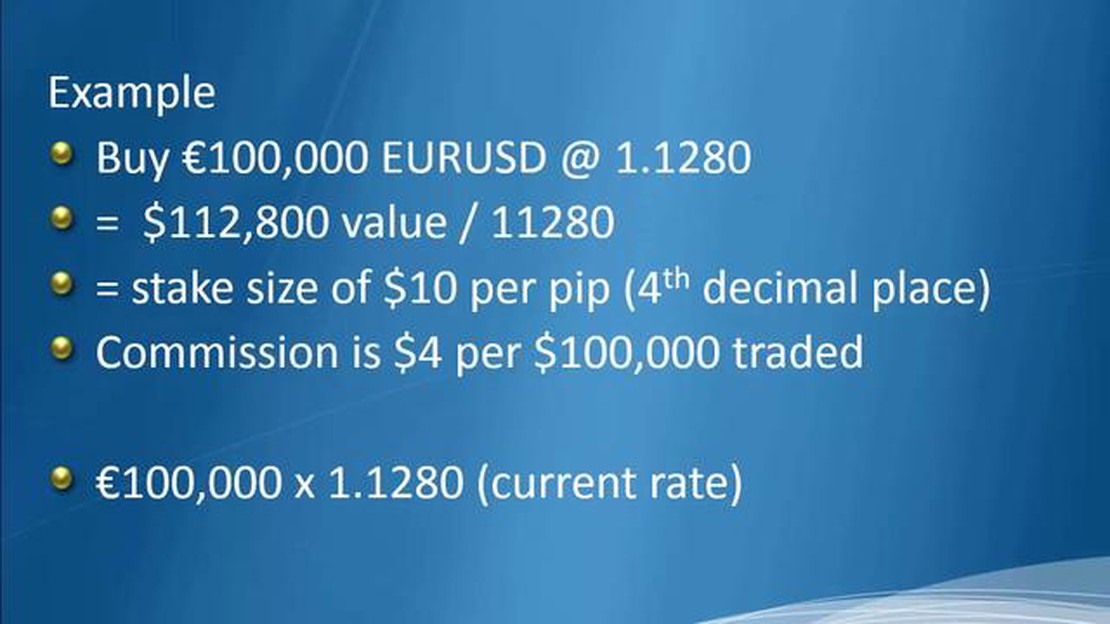

FXCM’s commission per lot can range from $0 to $4, depending on the account type and the currency pair being traded. This commission is in addition to the spread, which is the difference between the bid and ask price. It’s worth noting that FXCM offers competitive spreads, which can help offset the commission cost.

In conclusion, the commission per lot charged by FXCM varies depending on the account type and currency pair. Traders should carefully consider these costs along with other factors when choosing a broker. It’s recommended to compare the commission rates of different brokers to ensure you are getting the best value for your trades.

When trading with FXCM, it is important to understand the commission structure and how it can impact your trading costs. One aspect of this is the commission per lot charged by FXCM.

The commission per lot is the fee that traders pay to FXCM for each lot traded. A lot is a standardized unit of trading in the foreign exchange market, and the size of a lot can vary depending on the currency pair being traded.

FXCM charges commission based on a tiered structure, which means that the commission per lot can vary depending on your trading volume. Generally, the more you trade, the lower your commission rate will be.

It is important to note that the commission per lot is separate from other trading costs, such as spreads. Spreads are the difference between the bid and ask price of a currency pair, and they can vary depending on market conditions. While spreads are a cost of trading, the commission per lot is a separate fee.

To calculate the commission per lot, you need to know your trading volume and the commission rate applicable to your account. FXCM offers a range of account types with different commission rates, so it is important to choose an account that suits your trading needs.

Overall, understanding the FXCM commission per lot is important for traders to effectively manage their trading costs. By knowing the commission structure and how it varies based on trading volume, traders can make informed decisions and optimize their trading strategies.

FXCM (Forex Capital Markets) is a leading online forex trading and CFD (Contract for Difference) broker, providing access to a wide range of financial markets. As a broker, FXCM charges a commission for their services. This commission is a fee that is levied on each trade executed through the FXCM platform.

The commission charged by FXCM is typically based on a per lot basis. A lot is a standardized trading unit in the forex market, and it represents a specific amount of the base currency being traded. The commission amount charged per lot may vary depending on the type of account and the trading instrument.

It is important to note that while FXCM charges a commission for their services, they also offer commission-free trading options for certain account types or trading instruments. The commission structure may vary based on various factors, such as the trading volume or the type of account held by the trader.

Traders should carefully review the commission structure offered by FXCM before selecting their account type and trading strategy. Understanding the commission charged by the broker is essential for proper trade planning and risk management. Traders should also consider other factors, such as spreads, execution speed, and customer support, when choosing a forex broker.

Read Also: Mastering Advanced Price Action: Best Tips and Strategies for Learning

FXCM is a reputable forex broker that offers competitive trading conditions to its clients. One of the costs that traders should be aware of when trading with FXCM is the commission per lot charged by the broker.

The commission per lot at FXCM depends on the type of trading account you have. There are three main types of accounts available: Standard, Active Trader, and Professional. Each account type has its own commission structure.

Read Also: What Happens to Options When Trading is Halted? Unraveling the Implications

| Account Type | Commission Per Lot |

|---|---|

| Standard | $0 |

| Active Trader | Volume-based pricing |

| Professional | Volume-based pricing |

For Standard accounts, there is no commission charged per lot. This means that when you trade with a Standard account, you only pay the spread on your trades.

Active Trader and Professional accounts have a volume-based pricing structure. This means that the commission per lot decreases as your trading volume increases. The more you trade, the lower the commission per lot will be.

It’s important to note that FXCM’s commission per lot is transparent and disclosed upfront. This allows traders to calculate the cost of their trades accurately and plan their trading strategies accordingly.

To find out the specific commission per lot for your trading account, you can visit FXCM’s website or contact their customer support. They will provide you with detailed information about the commission structure and help you understand how it applies to your trading activity.

Understanding the commission per lot charged by FXCM is crucial for traders who want to accurately assess the costs involved in their trades. By being aware of the commission structure, traders can make informed decisions about their trading strategies and manage their risk effectively.

FXCM charges a commission of $4 per 1,000 currency units traded, which is equivalent to $0.40 per micro lot or $4 per standard lot traded.

In addition to the commission, FXCM may charge other fees such as rollover fees for holding positions overnight, deposit/withdrawal fees, and inactivity fees. It is important to review and understand all the fees associated with trading with FXCM before opening an account.

Yes, the commission rates may vary depending on the type of account you have with FXCM. The commission rates mentioned above are applicable to the standard accounts. For other account types, such as the Active Trader account, different commission rates may apply.

No, the commission charged by FXCM may vary depending on the currency pair being traded. Different currency pairs may have different commission rates, and it is important to check the commission schedule provided by FXCM to see the specific rates for each currency pair.

The commission rates charged by FXCM are non-negotiable. The rates are set by FXCM and apply to all traders. However, it is possible to qualify for discounted commission rates if you meet certain trading volume requirements or if you have a specific type of account with FXCM.

The commission rate charged by FXCM per lot depends on the type of account. For the Standard account, the commission rate is $25 per lot. For the Active Trader account, the commission rate starts at $5 per lot.

FXCM calculates the commission per lot based on the type of account and the trading volume. For the Standard account, the commission is $25 per lot, regardless of the trading volume. For the Active Trader account, the commission starts at $5 per lot and can be reduced based on the trading volume. The more lots traded, the lower the commission per lot.

Discovering Dream Fox Services Limited: Everything You Need to Know Welcome to Dream Fox Services Limited, the premier provider of top-quality dream …

Read ArticleIs Forex Trading Legal in Pakistan? Forex trading has gained significant popularity in Pakistan in recent years, with more and more individuals and …

Read ArticleLearn the 5 Essential Hand Signals for Driving When it comes to safe driving, clear communication is key. While most drivers rely on their turn …

Read ArticleReasons for Warriors Trading Poole The Golden State Warriors shocked fans and analysts alike when they announced their trade of guard Jordan Poole to …

Read ArticleCan you make a living off covered calls? Investing in the stock market can be a lucrative way to grow your wealth, but it can also come with its fair …

Read ArticleManchester City’s Cryptocurrency Sponsorship: Who’s Involved? In a groundbreaking move, Manchester City Football Club has announced a groundbreaking …

Read Article