How to Find a Forex Mentor: A Step-by-Step Guide

Find the Perfect Forex Mentor to Accelerate Your Trading Success If you’re new to the world of Forex trading, finding a mentor can be a crucial step …

Read Article

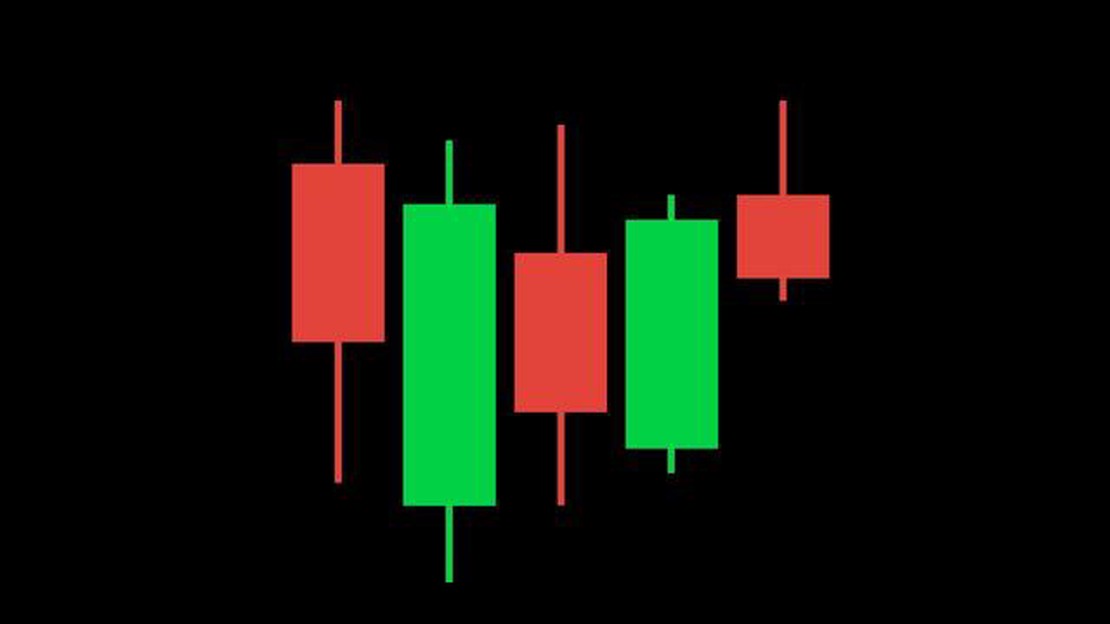

The Japanese candlestick charting technique is a popular tool used by traders to analyze and predict future price movements in financial markets. It originated in Japan in the 18th century and became widely known in the Western world in the 1980s and 1990s. This technique uses visual patterns formed by candlestick bars to identify market trends and potential reversals.

The effectiveness of the Japanese candlestick technique has been a subject of debate among traders and analysts. Some believe that it provides valuable insights into market behavior and can be used as a standalone trading strategy. Others argue that it is subjective and unreliable, and should be used in combination with other technical analysis tools.

Proponents of the Japanese candlestick technique argue that its visual nature makes it easy to identify patterns and trends, even for novice traders. Candlestick patterns, such as doji, hammer, and shooting star, can provide signals of potential trend reversals or continuation. By studying these patterns, traders can make more informed decisions about when to enter or exit a position.

However, critics of the technique point out that candlestick patterns can be subjective and open to interpretation. Different traders may draw different conclusions from the same pattern, leading to inconsistent results. They argue that relying solely on candlestick patterns may lead to overtrading or false signals, and that it should be used in conjunction with other technical indicators and fundamental analysis.

In conclusion, while the Japanese candlestick technique can be a useful tool for analyzing market trends and signals, its effectiveness may vary depending on the trader’s skill and experience. It is important to approach it with caution and use it as part of a comprehensive trading strategy that incorporates other indicators and analysis methods.

Japanese candlestick charts are a popular tool used by technical analysts to predict future price movements in the financial markets. The method is based on the use of candlestick patterns, which are visual representations of price data over a given time period.

The effectiveness of Japanese candlestick analysis has been a subject of debate among traders and analysts. While some argue that it is a powerful tool for predicting price movements, others believe that it is unreliable and subjective. To determine whether Japanese candlestick works, it is essential to evaluate its advantages and limitations.

| Advantages | Limitations |

|---|---|

| 1. Easy to interpret and understand. | 1. Candlestick patterns may not always be accurate. |

| 2. Provides valuable insights into market psychology. | 2. Can be subjective and open to interpretation. |

| 3. Can be used in conjunction with other technical indicators. | 3. Historical data may not be an accurate representation of future market behavior. |

| 4. Can assist in identifying potential trend reversals. | 4. Requires consistent and disciplined analysis. |

While Japanese candlestick analysis can provide traders with valuable information, it should not be solely relied upon for making trading decisions. It is essential to combine candlestick patterns with other technical indicators and fundamental analysis to gain a comprehensive understanding of market conditions.

Read Also: Understanding the Distinction between Restricted Stock Awards and RSUs

In conclusion, Japanese candlestick analysis can be a useful tool for traders when used correctly and in conjunction with other analysis methods. However, it is crucial to be aware of its limitations and not solely rely on candlestick patterns for making trading decisions.

The Japanese candlestick technique is a popular trading method used by many traders to predict market trends and make profitable trading decisions. This technique originated in Japan in the 18th century and has gained widespread popularity due to its simplicity and effectiveness.

One of the main advantages of the Japanese candlestick technique is its ability to provide visual representation of the price movement. Each candlestick represents a specified time interval and shows the opening, closing, highest, and lowest prices during that period. This visual representation allows traders to easily interpret market sentiment and identify potential reversals or continuations in the price trend.

Furthermore, the Japanese candlestick technique provides traders with several key patterns that help predict future price movements. These patterns, such as doji, hammer, and shooting star, indicate potential trend changes or reversals. Traders can use these patterns to identify entry and exit points, set stop-loss orders, and maximize their profit potential.

Read Also: Is Dahabshiil Legit? Unbiased Review 2021 | Pros and Cons

However, it is important to note that the effectiveness of the Japanese candlestick technique is not guaranteed. Like any trading method, it relies on the accuracy of the trader’s analysis and interpretation of the market data. Traders need to understand the underlying concepts and principles of the Japanese candlestick technique and constantly update their knowledge and skills to adapt to changing market conditions.

Additionally, traders should not solely rely on the Japanese candlestick technique but use it in conjunction with other technical indicators and analysis tools. Combining multiple techniques and indicators can help validate trading signals and increase the probability of making profitable trades.

In conclusion, the Japanese candlestick technique is a valuable trading tool that can help traders analyze market trends and make informed trading decisions. Its visual representation and predictive patterns provide traders with valuable insights into the price movements. However, traders should not solely rely on this technique and should combine it with other analysis tools to increase its effectiveness.

Japanese Candlestick is a charting technique used in technical analysis to represent the price movement of an asset. It consists of individual candlestick patterns that provide information about the opening, closing, high, and low prices of a specific time period.

Japanese Candlestick works by analyzing the patterns formed by the candlesticks to predict future price movements. Traders use these patterns to identify potential reversals, continuations, and trend strength in the market.

Some common candlestick patterns include doji, hammer, engulfing, shooting star, and spinning top. Each of these patterns has a specific interpretation and can be used to signal different market conditions.

Japanese Candlestick has been widely used and has shown effectiveness in analyzing and predicting price movements. However, it is important to note that no trading technique is 100% accurate, and it should be used in conjunction with other technical analysis tools and risk management strategies.

Japanese Candlestick can help identify potential market trends by analyzing the patterns formed by the candlesticks. Certain patterns, such as bullish or bearish engulfing patterns, can indicate a reversal in market direction and potential trend change.

Find the Perfect Forex Mentor to Accelerate Your Trading Success If you’re new to the world of Forex trading, finding a mentor can be a crucial step …

Read ArticleIs GBP JPY a major pair? Forex trading involves the simultaneous buying and selling of different currencies. Major forex pairs are those that include …

Read ArticleOptions Trading Basic Concepts Explained Welcome to our comprehensive guide on options trading! Whether you’re a beginner or an experienced investor, …

Read ArticleUnderstanding Stock Options for Employees: A Complete Guide Stock options are a valuable form of compensation that many employees receive as a part of …

Read ArticleIs Trade Legal in Malaysia? In Malaysia, trade is an essential part of the country’s economy. As a member of the World Trade Organization (WTO) and …

Read ArticleIs options trading available in USA? Options trading has become increasingly popular in recent years, providing investors with the opportunity to …

Read Article