Is Zebra Technologies Stock a Good Buy? | Expert Analysis and Forecasts

Is Zebra Technologies stock a buy? When it comes to investing in stocks, it’s important to assess the potential of a company before making a decision. …

Read Article

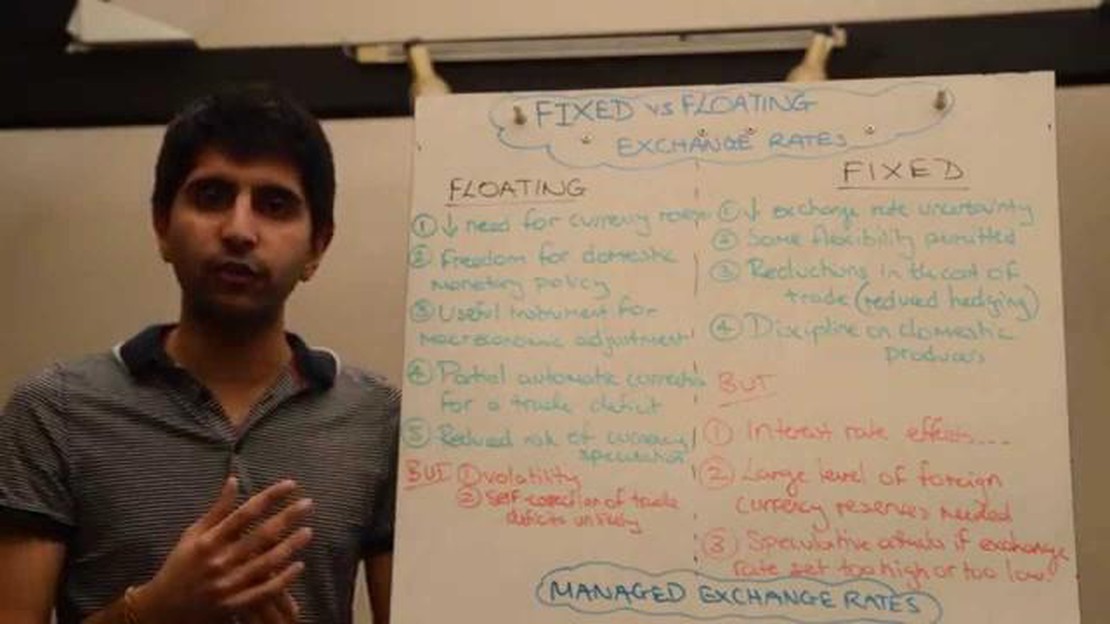

The choice between fixed and flexible exchange rates is a topic of great debate among economists and policymakers. Both approaches have their advantages and disadvantages, and the decision of which system to adopt can have significant implications for a country’s economy.

Under a fixed exchange rate system, the value of a country’s currency is fixed to another currency, usually a major international currency like the US dollar or the euro. This means that the government or central bank will actively intervene in the foreign exchange market to maintain a specific exchange rate. Proponents of fixed exchange rates argue that they provide stability and predictability, making it easier for businesses to plan and invest. Additionally, fixed exchange rates can help control inflation and maintain a country’s competitiveness in the global market.

On the other hand, a flexible exchange rate system allows the value of a country’s currency to fluctuate freely in response to market forces. This means that exchange rates are determined by supply and demand factors, and the government or central bank does not intervene to maintain a specific rate. Advocates of flexible exchange rates argue that they allow for automatic adjustment to changes in the economy, such as changes in trade balances or capital flows. This flexibility can help cushion the impact of external shocks and promote competitiveness.

However, flexible exchange rates are not without their drawbacks. They can be volatile and unpredictable, which can create uncertainty for businesses and investors. In extreme cases, sharp currency depreciations or appreciations can lead to financial crises and economic instability. Furthermore, flexible exchange rates can make it harder for governments to control inflation and demand, as they do not have direct control over the exchange rate.

In conclusion, there is no one-size-fits-all answer to the question of whether fixed or flexible exchange rates are better. The choice depends on a country’s specific circumstances and priorities. Some countries may prioritize stability and choose a fixed exchange rate system, while others may value flexibility and opt for a flexible exchange rate system. Ultimately, policymakers must carefully consider the potential benefits and risks of each option and weigh them against their country’s unique economic conditions.

When it comes to determining the exchange rate between countries, there are two main systems that can be implemented: fixed exchange rate and flexible exchange rate. Each system has its pros and cons and can greatly impact a country’s economy. Let’s take a closer look at the differences between the two systems.

In a fixed exchange rate system, the value of a country’s currency is fixed or pegged to another currency or a basket of currencies. This means that the exchange rate is set by the government or central bank and remains constant over a certain period of time. The main advantage of a fixed exchange rate is stability. It helps to promote trade and investment by providing certainty in the value of the currency.

However, maintaining a fixed exchange rate can be challenging. In order to keep the exchange rate constant, the government or central bank needs to intervene in the foreign exchange market, buying or selling its own currency to maintain the desired rate. This can lead to a depletion of foreign reserves and may limit the country’s ability to pursue independent monetary policies.

In a flexible exchange rate system, the value of a country’s currency is determined by the foreign exchange market, based on supply and demand. This means that the exchange rate can fluctuate freely. The main advantage of a flexible exchange rate is that it allows for automatic adjustments to changes in the economy. For example, if a country experiences an increase in exports, its currency may appreciate, making its exports more expensive and imports cheaper.

However, a flexible exchange rate can also introduce uncertainty and volatility into the economy. Fluctuations in the exchange rate can affect the competitiveness of industries and impact inflation rates. It can also increase the risk for businesses involved in international trade.

When comparing the fixed and flexible exchange rate systems, it is important to consider the specific needs and circumstances of each country. While a fixed exchange rate may provide stability, it can restrict the ability to pursue independent monetary policies. On the other hand, a flexible exchange rate allows for automatic adjustments but can introduce volatility and uncertainty.

Overall, there is no one-size-fits-all solution, and the choice between fixed and flexible exchange rates depends on a country’s economic goals, level of trade, and monetary policy objectives. Some countries may choose to adopt a fixed exchange rate to promote stability and attract foreign investment, while others may opt for a flexible exchange rate to allow for greater flexibility and economic adjustments.

Read Also: 3 Common Hedging Strategies Explained: A Comprehensive Guide

In conclusion, the fixed and flexible exchange rate systems have different advantages and disadvantages. It is important for policymakers to carefully consider the trade-offs and choose the system that best aligns with the economic goals and circumstances of their country.

In the realm of international finance, a fixed exchange rate is a type of exchange rate regime where the value of one currency is fixed against the value of another currency or a basket of currencies. This means that the exchange rate between the two currencies remains constant and is not subject to fluctuations in the foreign exchange market.

Under a fixed exchange rate system, the government or central bank of a country plays a key role in determining and maintaining the exchange rate. This is typically achieved through active intervention in the foreign exchange market, where the central bank buys or sells foreign currency reserves to maintain the fixed exchange rate.

There are a few motives behind implementing a fixed exchange rate. One is to provide stability and predictability for businesses and individuals engaged in international trade. With a fixed exchange rate, they can plan their transactions and investments without the risk of sudden changes in the value of their currency.

Read Also: How to Navigate the Change of Control Clause: Expert Tips & Advice

Another motive is to control inflation. A fixed exchange rate can help to anchor inflation expectations and discourage excessive government spending, as it limits the ability to simply print more money to finance budget deficits. This can be particularly beneficial in countries with a history of high inflation.

However, there are also potential downsides to a fixed exchange rate. One major criticism is that it limits a country’s ability to use monetary policy as a tool to manage its economy. With a fixed exchange rate, a country cannot independently adjust interest rates or the money supply to stimulate economic growth or combat recession. This lack of flexibility can be problematic in times of economic shocks or external market pressures.

| Advantages of Fixed Exchange Rate | Disadvantages of Fixed Exchange Rate |

|---|---|

| Stability and predictability for international trade | Limited control over monetary policy |

| Inflation control | Vulnerability to economic shocks |

Overall, the choice between a fixed exchange rate and a flexible exchange rate depends on the specific circumstances and goals of a country. Fixed exchange rates can provide stability and control inflation, but they may limit a country’s ability to respond to economic challenges. Flexibility and adaptability are the key advantages of a flexible exchange rate, but it can also lead to uncertainty and volatility in international trade.

The main difference between fixed and flexible exchange rates is how they are determined. In a fixed exchange rate system, the value of a currency is fixed or pegged to the value of another currency or a basket of currencies, and it does not fluctuate freely in the foreign exchange market. In contrast, in a flexible exchange rate system, the value of a currency is determined by market forces of supply and demand, and it can fluctuate freely in response to various economic factors.

Both fixed and flexible exchange rate systems have their own advantages and disadvantages when it comes to economic stability. A fixed exchange rate system can provide stability by reducing uncertainty and speculation in the foreign exchange market. It allows businesses and individuals to plan for the future without worrying about sudden and unpredictable changes in the value of their currency. However, a fixed exchange rate system can also be vulnerable to external shocks and may require a country to implement strict monetary and fiscal policies to maintain the fixed exchange rate. On the other hand, a flexible exchange rate system can provide automatic adjustment mechanisms to shocks and can help prevent balance of payments crises. It allows the currency to reflect changes in economic fundamentals and can help countries maintain competitiveness. However, it can also lead to increased volatility and uncertainty in the short term.

A fixed exchange rate can affect international trade in several ways. Firstly, it can provide stability and predictability for businesses engaging in cross-border trade. With a fixed exchange rate, businesses can more accurately calculate the costs and prices of goods and services in different currencies, which can facilitate international trade. Secondly, a fixed exchange rate can also influence competitiveness. If a country’s currency is undervalued due to a fixed exchange rate, its goods and services may be more affordable and competitive in foreign markets, boosting exports. Conversely, if a country’s currency is overvalued, its goods and services may become more expensive and less competitive, potentially leading to a decrease in exports.

There are several reasons why countries may choose to adopt a fixed exchange rate. Firstly, a fixed exchange rate can provide stability and reduce exchange rate volatility, which can be attractive to businesses and investors. It can create a stable environment for economic growth and encourage foreign investment. Secondly, a fixed exchange rate can also help countries control inflation. By pegging their currency to a stable currency or a basket of currencies, countries can limit the impact of external inflationary pressures and maintain price stability. Lastly, a fixed exchange rate can be a strategic choice for countries seeking to promote exports and boost competitiveness in international markets.

A fixed exchange rate system has several disadvantages. Firstly, it can be vulnerable to external shocks and speculative attacks. If the pegged currency comes under pressure, the country may be forced to devalue or revalue its currency, which can have negative consequences for the economy. Secondly, a fixed exchange rate system may require a country to implement strict monetary and fiscal policies to maintain the fixed exchange rate. This can limit a country’s ability to pursue independent monetary policy and may result in higher unemployment or reduced economic growth. Lastly, a fixed exchange rate system may also limit a country’s ability to respond to changes in economic fundamentals, as the exchange rate cannot adjust freely to reflect market conditions.

Fixed exchange rates are when the value of a currency is fixed to another currency or a basket of currencies. Flexible exchange rates, on the other hand, fluctuate based on market forces such as supply and demand.

Is Zebra Technologies stock a buy? When it comes to investing in stocks, it’s important to assess the potential of a company before making a decision. …

Read ArticleWho Manages Forex? - Exploring the Key Players in the Forex Market Forex, or foreign exchange, is the largest financial market in the world. It is …

Read ArticleIs it Possible to Day Trade Every Day? Day trading, the practice of buying and selling financial instruments within the same day, has become …

Read ArticleAre Bollinger Bands Effective in Technical Analysis? Bollinger Bands are a popular technical analysis tool used by traders to identify potential price …

Read ArticleCalculating PCR Ratio: Methods and Formulas PCR ratio is a crucial parameter used in molecular biology research to determine the relative amount of …

Read ArticleThe Most Efficient Day Trading Strategy: Techniques and Tips Day trading is an exciting and fast-paced investment strategy that offers the potential …

Read Article