Resetting a Waveform in LabVIEW: Simple Steps and Tips

Resetting a Waveform in LabVIEW: Step-by-Step Guide LabVIEW is a powerful programming language commonly used for data acquisition and control systems. …

Read Article

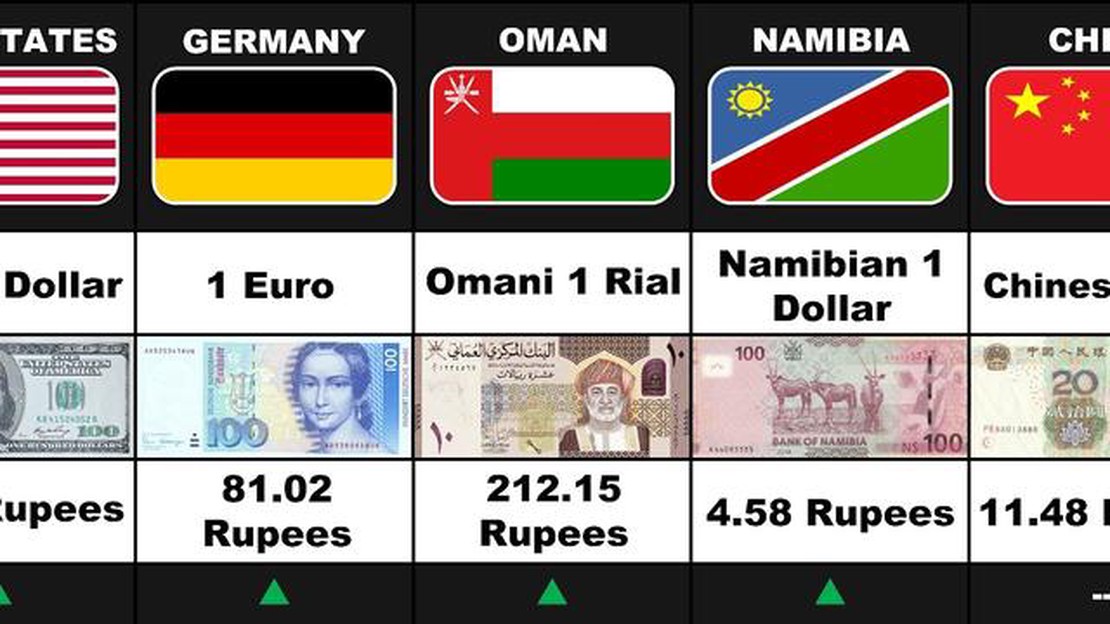

Are you planning a trip to India and want to get the best exchange rate for your money? Look no further! In this article, we will explore the current state of the Indian rupee and how you can make the most of your currency exchange.

The Indian rupee is the official currency of India, and it is widely accepted throughout the country. As of [insert date], the exchange rate for 1 USD is [insert exchange rate]. This means that every dollar you exchange will give you [insert rupee amount].

One of the factors that affects the exchange rate of the Indian rupee is the country’s economic stability. India has a rapidly growing economy, and its currency has been performing well against other major currencies. In recent years, the Indian rupee has seen a steady appreciation, making it an attractive currency for investors and travelers alike.

Pro tip: To get the highest exchange rate with the Indian rupee, it is advisable to exchange your currency at authorized exchange centers such as banks, airports, and reputable exchange bureaus. Avoid exchanging money on the street or with unauthorized individuals, as you may end up with counterfeit currency or unfavorable exchange rates.

When planning your trip to India, it is also important to keep an eye on the current exchange rate and any fluctuations in the market. This will help you make informed decisions about when to exchange your money and how much you will receive in return.

By staying informed and following these tips, you can discover the highest exchange rate with the Indian rupee and make the most out of your money during your trip to India.

Discovering the highest exchange rate can provide several benefits for individuals and businesses looking to exchange Indian Rupees. Here are some key advantages:

1. Increased purchasing power: By finding the highest exchange rate, you can maximize the value of your Indian Rupees and get more for your money when exchanging it into another currency. This can result in increased purchasing power and allow you to buy more goods and services.

2. More savings: When you find the highest exchange rate, you can save money on the exchange transaction itself. By getting a better rate, you will receive more foreign currency in exchange for your Indian Rupees, allowing you to save on the overall cost of the transaction.

3. Better returns on investments: If you are an investor looking to invest in foreign markets or currencies, discovering the highest exchange rate can be beneficial. By exchanging your Indian Rupees at a favorable rate, you can potentially earn higher returns on your investments when the foreign currency appreciates.

Read Also: What is the permissible limit of foreign currency? | Explained

4. Competitive advantage for businesses: For businesses engaged in international trade or having overseas operations, finding the highest exchange rate can provide a competitive advantage. By getting a better rate, businesses can lower their costs, increase profit margins, and potentially offer more competitive prices to customers.

5. Hedging against currency fluctuations: Discovering the highest exchange rate can also allow individuals and businesses to hedge against currency fluctuations. By exchanging their Indian Rupees at a favorable rate, they can protect themselves from potential losses caused by unfavorable exchange rate movements in the future.

Overall, discovering the highest exchange rate with the Indian Rupee can have significant advantages, including increased purchasing power, more savings, better returns on investments, a competitive advantage for businesses, and hedging against currency fluctuations. It is essential to stay informed about the latest exchange rates and compare different options to make the most of your currency exchange.

When converting your currency to Indian Rupees, it’s important to find the best conversion rate possible. This will ensure that you get the most value for your money. Here are some tips to help you find the best conversion rate:

Read Also: Discovering the Drawbacks: What are the Disadvantages of EMA?5. Use online comparison tools: There are online comparison tools available that can help you compare conversion rates across different providers. These tools can save you time and help you find the best rate available.

By following these tips, you can find the best conversion rate when exchanging your currency to Indian Rupees. This will help you maximize the value of your money and make the most out of your trip or investment in India.

When it comes to exchanging currency, it’s important to make the most out of your money. Here are some tips to help you maximize the value of your currency:

By following these tips, you can maximize the value of your currency when exchanging it for Indian Rupees or any other currency. Remember to always stay updated on exchange rates and choose the most favorable options available to you.

The current exchange rate for the Indian Rupee is X against the US Dollar.

You can find the highest exchange rate for the Indian Rupee at various online currency exchange platforms, such as X, X, and X.

The exchange rate for the Indian Rupee fluctuates due to factors such as economic conditions, interest rates, inflation, and market demand and supply.

It depends on various factors such as exchange rate offered, fees, convenience, and safety. Banks generally offer more secure transactions but may have higher fees, while currency exchange offices might offer better rates but may not provide the same level of security.

There might be certain restrictions on exchanging Indian Rupees depending on the country you are in. It is advisable to check the local regulations or consult with a financial institution or currency exchange service to ensure compliance with the laws.

Resetting a Waveform in LabVIEW: Step-by-Step Guide LabVIEW is a powerful programming language commonly used for data acquisition and control systems. …

Read ArticleWhat is the term for buying low and selling high? One of the most fundamental principles in investing is the concept of buying low and selling high. …

Read ArticleUnderstanding the ESPP Plan for Gilead: Key Details and Benefits Gilead Sciences, Inc. is a renowned biopharmaceutical company that is dedicated to …

Read ArticleCan Speculative Trading Be Profitable? Speculative trading, also known as speculative investing or trading, refers to the practice of buying and …

Read ArticleIs Crypto Trading Legal in Luxembourg? Cryptocurrency trading has gained significant popularity worldwide, with many investors attracted to the …

Read ArticleWhat is the Best Affiliate Program in the World? Are you looking to make money online and own your own business? Look no further than the top …

Read Article