Understanding the Meaning and Implications of a Pending Order

What does a pending order mean? A pending order refers to an order that has been submitted by a customer but has not yet been processed or fulfilled …

Read Article

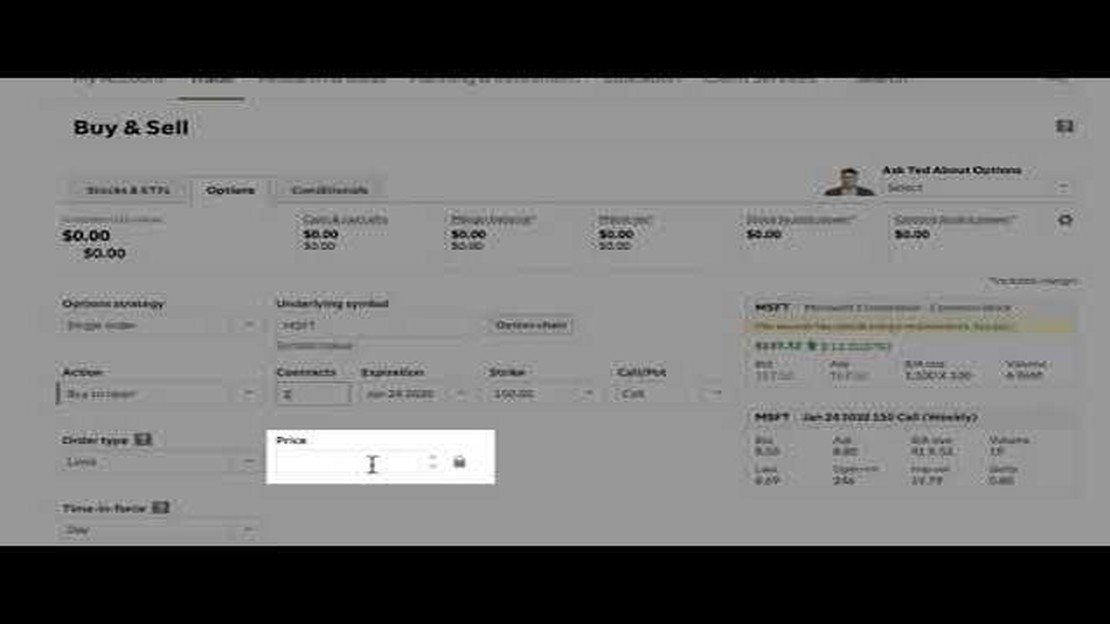

If you’re considering trading options with TD Ameritrade, one of the first things you’ll want to know is how much money you need to get started. Luckily, TD Ameritrade offers a variety of pricing options to suit different trading needs and budgets. Understanding the costs associated with trading options can help you make informed decisions and plan your trading strategy accordingly.

TD Ameritrade’s pricing for options trading is based on a per-contract fee, as well as a base commission. The per-contract fee is $0.65, while the base commission is $0. TD Ameritrade also offers a commission-free pricing option for options trades, which allows you to trade options without paying any commission fees. This is a great option for those who plan to make frequent trades or have a smaller trading budget.

It’s important to note that in addition to the fees associated with trading options, there may be other costs to consider. These can include regulatory fees, exchange fees, and other charges. It’s a good idea to familiarize yourself with all of the potential costs before you start trading, so you can factor them into your overall trading plan and budget.

In conclusion, the amount of money you need to trade options with TD Ameritrade will depend on the pricing option you choose and your trading goals. Whether you’re a beginner or an experienced trader, TD Ameritrade offers flexible pricing options to suit your needs. By understanding the costs involved and planning accordingly, you can start trading options with confidence.

When it comes to trading options with TD Ameritrade, the amount of money you need will depend on various factors such as your trading goals, risk tolerance, and the specific options strategies you plan to use. However, it’s important to note that trading options generally requires a higher level of capital compared to trading stocks.

With TD Ameritrade, the minimum deposit required to open an options trading account is $0. This means that you can technically start trading options with no initial capital. However, it’s recommended to have a sufficient amount of funds in your account to support your trading activities and manage potential risks.

It’s also worth mentioning that options trading involves leveraging your positions, which means you can control a larger amount of shares with a smaller amount of capital. This can enable you to potentially generate higher returns, but it also amplifies the potential losses.

Considering these factors, it’s generally recommended to have at least $2,000 to $5,000 in your options trading account to have enough capital to trade with flexibility and manage potential risks adequately. However, the actual amount will depend on your individual circumstances and risk tolerance.

Read Also: What is an example of a smoothed moving average? | Explanation and Illustration

Furthermore, it’s essential to have a solid understanding of options trading before you start investing large sums of money. Options can be complex financial instruments, and it’s crucial to educate yourself about the strategies and risks involved. TD Ameritrade offers various educational resources and tools that can help you learn more about options trading and make informed decisions.

In conclusion, while there is no specific minimum requirement to start trading options with TD Ameritrade, it’s advisable to have a sufficient amount of capital to support your trading activities and manage risks effectively. It’s also essential to educate yourself about options trading and make well-informed investment decisions.

When it comes to trading options, it is important to understand the pricing structure offered by TD Ameritrade. As of 2021, TD Ameritrade charges a base fee of $0 per trade for options. This means that you can enter and exit option trades without incurring any commission fees.

In addition to the base fee, there are other potential fees to consider. TD Ameritrade charges a contract fee of $0.65 per options contract. This fee applies to both buying and selling options contracts. For example, if you buy 10 options contracts, you would incur a total contract fee of $6.50.

It is worth noting that TD Ameritrade does not charge any additional fees for exercising or assigning options contracts. However, there may be fees imposed by the options exchange or the Options Clearing Corporation (OCC) for such actions.

When trading options with TD Ameritrade, it is also important to consider the impact of bid-ask spreads. These spreads represent the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a particular options contract. The wider the bid-ask spread, the higher the cost of executing trades.

In conclusion, TD Ameritrade offers competitive pricing for options trading in 2021. With a base fee of $0 per trade and a contract fee of $0.65 per options contract, it provides a cost-effective platform for traders to engage in options trading. It is important to consider the potential impact of bid-ask spreads when trading options to effectively manage costs.

The minimum amount of money required to trade options with TD Ameritrade is $0. However, there may be other account minimums or trading requirements that you need to meet.

Read Also: Learn about the Apple covered call strategy | All you need to know

The fees for options trading with TD Ameritrade are $0.65 per contract. There may also be additional fees for exercises and assignments.

There is no specific account minimum for options trading with TD Ameritrade. However, there may be other account minimums or trading requirements that you need to meet.

Yes, you can trade options with a small amount of money on TD Ameritrade. There is no minimum amount required to trade options, but keep in mind that options trading can be risky and it’s important to have a solid understanding of the market before getting started.

Some tips for trading options with TD Ameritrade include: educating yourself about options trading, creating a trading plan and sticking to it, starting with a small amount of money and gradually increasing your investments, and using stop-loss orders to manage risk.

The minimum amount of money required to trade options with TD Ameritrade depends on various factors such as your trading experience, risk tolerance, and the specific options strategy you plan to use. Generally, it is recommended to have at least $2,000 available for options trading as it allows for more flexibility and reduces the risk of margin calls.

Yes, you can trade options with TD Ameritrade even if you have a small account balance. However, it is important to note that options trading involves risks, and a smaller account balance may limit the number of options contracts you can trade or the strategies you can employ. It is always advisable to have a sufficient amount of capital to cover potential losses and meet margin requirements.

What does a pending order mean? A pending order refers to an order that has been submitted by a customer but has not yet been processed or fulfilled …

Read ArticleUnderstanding the Mechanism of Currency Fixing When it comes to financial markets, one important concept to understand is currency fixing. Currency …

Read ArticleDiscover Citibank Currency Exchange Rate When it comes to international banking and finance, staying up to date with currency exchange rates is …

Read ArticleMastering Price Action in Forex: Strategies and Techniques Forex trading is a complex and dynamic market, where success often hinges on the ability to …

Read Article1 USD to 1 PKR: Exchange Rate and Conversion Exchange rates play a crucial role in international trade and finance. They determine the value of one …

Read ArticleWhen do listed options expire? Options trading is a popular financial strategy that gives investors the right, but not the obligation, to buy or sell …

Read Article