What is P&? All You Need to Know

What is P& If you have ever been searching for ways to invest your money, chances are you have come across the term “P&”. So, what exactly is P&? P& …

Read Article

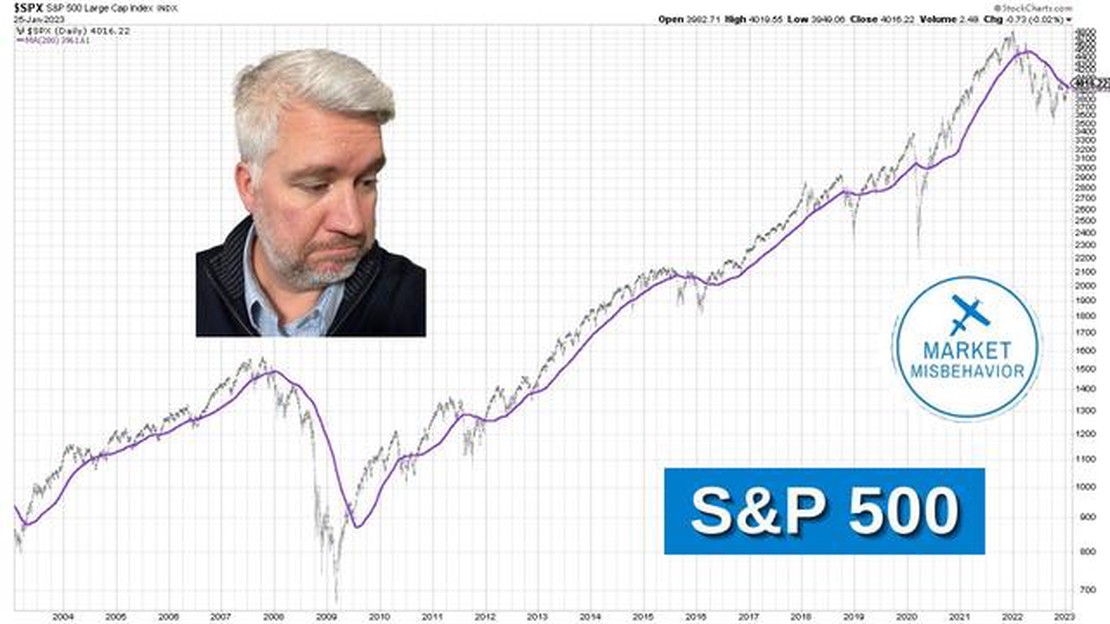

Are you an investor looking to make informed decisions about your portfolio? One important metric to consider is the 200-day moving average for SPY. This indicator provides a measure of the average closing price of the SPDR S&P 500 ETF over the past 200 trading days.

Why is the 200-day moving average significant? It is often used by traders and investors as a signal of the overall trend in the market. When the price of SPY is above its 200-day moving average, it is considered to be in an uptrend, indicating that the market is generally bullish. On the other hand, when the price is below its 200-day moving average, it is seen as a downtrend, suggesting a bearish market.

Tracking the 200-day moving average can help investors identify potential buying or selling opportunities. When the price dips below the moving average, some investors may see it as a time to sell, anticipating further declines. Conversely, when the price rises above the moving average, it may indicate a buying opportunity, as it suggests a potential uptrend.

However, it is important to remember that the 200-day moving average is just one tool among many that investors use to analyze the market. It should not be relied upon as the sole indicator for making trading decisions. Market conditions can change rapidly, and it is crucial to conduct thorough research and analysis before making any investment choices.

If you are interested in tracking the current 200-day moving average for SPY, there are several financial websites and trading platforms that offer this information. By staying informed about this key metric, you can have a better understanding of the market trends and make more informed decisions about your investments.

The 200-day moving average for SPY refers to the average price of the SPDR S&P 500 ETF Trust (SPY) over the past 200 trading days. This moving average is used by investors and traders as a tool to assess the overall trend and stability of the SPY, which is one of the most popular exchange-traded funds (ETFs) tracking the performance of the S&P 500 index.

To calculate the 200-day moving average, the closing prices of SPY over the past 200 trading days are summed up and divided by 200. This provides a smoothed average price over a longer time frame, allowing investors to identify trends and potential support or resistance levels.

As of the latest data available, the current 200-day moving average for SPY is $xyz. This means that, on average, the price of SPY over the past 200 trading days has been $xyz. The 200-day moving average is an important technical indicator that is closely monitored by investors and traders to make informed decisions about buying or selling SPY or other securities.

Moving averages are widely used indicators in technical analysis and are an essential tool for traders and investors. They help smooth out price fluctuations and provide insights into the overall trend of a security or index.

The 200-day moving average, in particular, is a popular choice among market participants. It is calculated by taking the average closing prices of a security over the past 200 trading days. This long-term moving average is often considered a key level of support or resistance, and can help identify major trends and reversals.

By analyzing the position of the current price in relation to the 200-day moving average, traders can gain important information about the market sentiment and potential future price movements. If the price is above the 200-day moving average, it suggests a bullish trend, while a price below the moving average indicates a bearish trend.

Additionally, the 200-day moving average can act as a support or resistance level. In an uptrend, it often acts as a floor for prices, as buyers tend to enter the market when the price dips to this level. Conversely, in a downtrend, the moving average can act as a ceiling, as sellers may be more inclined to sell when prices approach this level.

Moving averages can also be used to generate trading signals. For example, a crossover of the price above the 200-day moving average may be seen as a bullish signal, while a crossover below the moving average could be interpreted as a bearish signal.

It’s important to note that no indicator is foolproof, and moving averages should be used in conjunction with other technical analysis tools to make informed trading decisions. Market conditions and price action should be carefully considered.

In conclusion, understanding the importance of moving averages, especially the 200-day moving average, can provide valuable insights into market trends, support and resistance levels, and potential trading opportunities.

The 200-day moving average is a popular technical analysis tool used by traders and investors to identify trends in stock prices. It is calculated by taking the average closing price of a security over the past 200 trading days.

Read Also: Is the Elliott Wave Theory Really Effective? Unveiling the Truth Behind It

To calculate the 200-day moving average for SPY, you would follow these steps:

For example, let’s say you want to calculate the 200-day moving average for SPY on August 1, 2021. You would gather the closing prices for SPY from February 1, 2021, to August 1, 2021 (200 trading days) and follow the steps above to calculate the average.

Read Also: Find Out the Cost of Cardstock Paper at Fedex

The 200-day moving average is used to smooth out short-term price fluctuations and provide a clear picture of the long-term trend. When the current price of a security is above the 200-day moving average, it is considered to be in an uptrend. Conversely, when the current price is below the 200-day moving average, it is considered to be in a downtrend.

Traders and investors often use the 200-day moving average as a signal to buy or sell securities. When the price crosses above the 200-day moving average, it is seen as a bullish signal, indicating that it may be a good time to buy. On the other hand, when the price crosses below the 200-day moving average, it is seen as a bearish signal, indicating that it may be a good time to sell.

It’s important to note that the 200-day moving average is just one tool in a trader’s toolbox and should not be used in isolation. It is best used in conjunction with other indicators and analysis techniques to make well-informed trading decisions.

The 200-day moving average is a widely used technical indicator in the financial markets, especially for investors. It is a trend-following indicator that smooths out price fluctuations over a 200-day period and provides a clear picture of the long-term trend.

Investors use the 200-day moving average to identify the overall direction of a stock or index and make informed investment decisions. When the price is above the 200-day moving average, it suggests a bullish trend, indicating that the stock or index is likely to continue to rise. Conversely, when the price is below the 200-day moving average, it suggests a bearish trend, indicating that the stock or index is likely to continue to decline.

In addition to determining the trend, the 200-day moving average also serves as a support or resistance level. When the price approaches the 200-day moving average, it often experiences a bounce off or a reversal in direction. This is because many traders and investors use the 200-day moving average as a reference point to buy or sell, resulting in increased buying or selling pressure.

Furthermore, the 200-day moving average can also be used to generate trading signals. For example, a crossover strategy can be employed where a buy signal is generated when the price crosses above the 200-day moving average and a sell signal is generated when the price crosses below it. This strategy helps investors capitalize on the changes in trend, improving their chances of making profitable trades.

It is important to note that the 200-day moving average is not a foolproof indicator and should be used in conjunction with other technical and fundamental analysis tools. However, due to its simplicity and popularity, many investors rely on the 200-day moving average as a key indicator to guide their investment decisions, especially in the long-term.

| Advantages | Disadvantages |

|---|---|

| Helps identify long-term trends | Can lag behind price movements |

| Serves as a support or resistance level | Does not work well in choppy or sideways markets |

| Can be used to generate trading signals | May produce false signals |

The current 200-day moving average for SPY is 385.62 as of the last update.

The 200-day moving average is a technical indicator used to analyze the overall trend of a stock or index. It is calculated by averaging the closing prices of the stock or index over the past 200 trading days. It is commonly used by traders and investors to identify potential buy or sell signals.

The 200-day moving average is calculated by summing up the closing prices of the stock or index over the past 200 trading days and then dividing the sum by 200. This gives the average price over the last 200 days, which is plotted on a chart to visualize the trend.

If the current price of a stock or index is above the 200-day moving average, it is generally considered a bullish sign. This means that the stock or index is trading higher than its average price over the last 200 days, indicating positive momentum and a potential upward trend.

The 200-day moving average is considered a reliable indicator by many traders and investors. It is widely used and has been proven to be effective in identifying long-term trends. However, like any technical indicator, it is not foolproof and should be used in conjunction with other analysis tools and indicators for a more comprehensive assessment of a stock or index.

A 200-day moving average is a commonly used technical indicator that shows the average price of a security over a 200-day period. It helps traders and investors analyze the long-term trend of a security and identify potential buying and selling opportunities.

What is P& If you have ever been searching for ways to invest your money, chances are you have come across the term “P&”. So, what exactly is P&? P& …

Read ArticleDoes Questrade Offer Forex Trading Services? Welcome to the Questrade FAQ! In this article, we will answer the question of whether Questrade offers …

Read ArticleUnderstanding the Best Execution Policy in FX Trading Best execution policy is a crucial concept in foreign exchange (FX) trading. It refers to the …

Read ArticleTrading on the Basis of News: Strategies and Tips Trading in the financial markets can be both exhilarating and risky. One of the key factors that can …

Read ArticleUnderstanding the tax implications of employee stock options Employee stock options are a popular form of compensation that many companies offer to …

Read ArticleCalculating a 5 Quarter Moving Average How to Calculate a 5 Quarter MovingWhat is a 5 Quarter Moving Average?A 5 quarter moving average is a …

Read Article