Is Forex Trading App Legal in India? Know the Rules and Regulations

Is Forex Trading App Legal in India? The forex trading market has been growing in popularity around the world, and India is no exception. Many people …

Read Article

The Elliott Wave Theory is a widely known and followed approach to trading and investing in financial markets, particularly in the field of technical analysis. Developed by Ralph Nelson Elliott in the late 1920s and early 1930s, this theory is based on the principle that the price movements of financial assets follow repetitive patterns. These patterns, known as waves, are said to be influenced by the psychology of market participants and can be used to forecast future price movements.

Proponents of the Elliott Wave Theory argue that it provides a powerful tool for identifying trends, reversals, and key levels of support and resistance in financial markets. They believe that by understanding the underlying wave structure, traders and investors can gain an edge in their decision-making process and improve their risk-to-reward ratio.

However, critics of the Elliott Wave Theory question its effectiveness and reliability. They argue that the theory is highly subjective and open to interpretation, making it difficult to consistently apply in real-world trading situations. Additionally, they suggest that the patterns identified by the theory can often be ambiguous and overlap with each other, making it challenging to determine the correct wave count.

In this article, we will delve into the Elliott Wave Theory and explore its strengths and weaknesses. By examining both sides of the argument, we hope to shed light on whether this widely used theory is truly effective or simply a product of subjective analysis.

The Elliott Wave Theory is a popular technical analysis tool used by traders and investors to predict future price movements in financial markets. Developed by Ralph Nelson Elliott in the 1930s, it is based on the idea that market trends can be predicted by analyzing repetitive wave patterns.

Proponents of the Elliott Wave Theory argue that it provides valuable insights into market behavior and can help identify profitable trading opportunities. They believe that by studying the price charts and identifying specific wave patterns, they can accurately predict the direction and duration of market trends.

However, critics of the Elliott Wave Theory question its effectiveness and argue that it is nothing more than a subjective and unreliable method of analysis. They argue that there are no scientific or empirical evidence to support the theory and that it is based on vague and subjective principles.

One of the main criticisms of the Elliott Wave Theory is its subjective nature. Different analysts may interpret the same price chart differently, leading to conflicting predictions and strategies. This lack of consistency undermines the credibility of the theory and makes it difficult to rely on for making investment decisions.

Another criticism is the complex and time-consuming nature of wave analysis. Identifying and labeling wave patterns requires a deep understanding of the theory and extensive chart analysis. This can be overwhelming for novice traders and investors, who may not have the time or expertise to fully utilize the theory.

Furthermore, critics argue that the predictive power of the Elliott Wave Theory is questionable. While some proponents claim to have successfully predicted market trends using the theory, there are also many instances where the predictions have been inaccurate. This inconsistency raises doubts about the reliability and practicality of the theory in real-world trading scenarios.

Despite these criticisms, it is important to note that some traders and investors continue to use the Elliott Wave Theory as part of their technical analysis toolkit. They argue that while it may not be a foolproof method, it can still provide valuable insights when used in conjunction with other technical indicators and analysis techniques.

In conclusion, the effectiveness of the Elliott Wave Theory remains a subject of debate among traders and investors. While some believe in its predictive power and find it useful, others question its reliability and argue that it is too subjective and complex to be effective. Ultimately, the decision to use the theory lies with the individual trader or investor and their personal beliefs and strategies.

The Elliott Wave Theory is a method used by market analysts and traders to predict future market trends. It is based on the concept that financial markets follow repetitive patterns or waves, and that these waves can be used to forecast future price movements.

Read Also: How to Use ATR to Set Stop Loss Orders and Limit Your Trading Risks

The theory is named after Ralph Nelson Elliott, who proposed the idea in the 1930s after studying market price patterns. He believed that market movements are influenced by a combination of investor psychology and external factors, and that these factors create distinct patterns that can be analyzed and categorized.

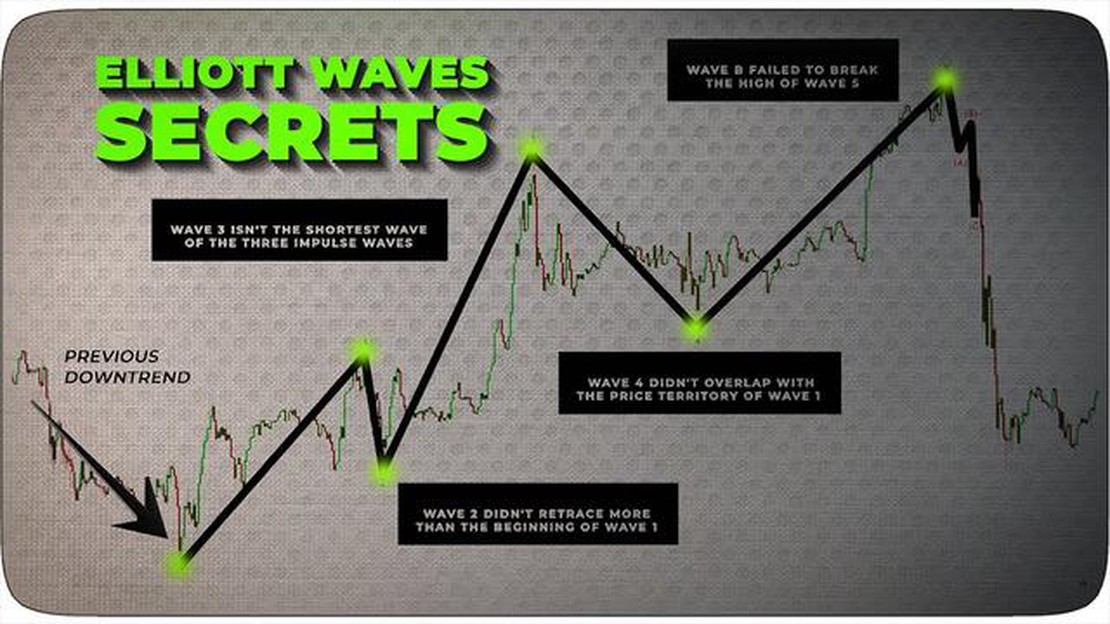

According to Elliott, these patterns consist of waves of various lengths and sizes, which he called impulse waves and corrective waves. Impulse waves, also known as motive waves, move in the direction of the primary trend and consist of five smaller waves: three upward waves (labelled 1, 3, and 5) and two downward waves (labelled 2 and 4). On the other hand, corrective waves move against the primary trend and consist of three smaller waves: two upward waves (labelled A and C) and one downward wave (labelled B).

Read Also: Understanding Moving Average Cost and How It Impacts Your Finances

The Elliott Wave Theory also introduces the concept of Fibonacci ratios, which are used to determine the length and duration of waves. These ratios, such as 0.618 and 1.618, are derived from the Fibonacci sequence and are believed to reflect the natural order found in financial markets.

Traders and analysts who use the Elliott Wave Theory try to identify these waves and patterns on price charts to make predictions about future market movements. They look for specific wave formations, such as a five-wave impulse followed by a three-wave correction, to confirm the validity of the theory.

While the Elliott Wave Theory has gained popularity among some traders, it is not without its critics. Critics argue that the theory is subjective and open to interpretation, making it difficult to apply consistently. Additionally, the theory relies on the assumption that market participants behave in predictable patterns, which may not always hold true in reality.

In conclusion, the Elliott Wave Theory is an analysis tool used to predict future market trends based on repetitive wave patterns. It introduces the concept of impulse waves and corrective waves, as well as Fibonacci ratios, to identify and analyze these patterns. However, its effectiveness and practicality are still a subject of debate among traders and analysts.

The Elliott Wave Theory is a technical analysis approach that predicts future price movements in financial markets by analyzing recurring wave patterns.

The Elliott Wave Theory was developed by Ralph Nelson Elliott in the late 1920s.

The acceptance of the Elliott Wave Theory varies within the financial community. While some traders and analysts swear by its effectiveness, others are skeptical and prefer to use different approaches.

One of the main criticisms of the Elliott Wave Theory is its subjectivity. Different analysts can interpret the wave patterns differently, leading to conflicting predictions. Additionally, some critics argue that the theory relies too heavily on hindsight and can be prone to false signals.

Yes, there have been success stories of traders who have used the Elliott Wave Theory to make profitable trades. However, it is important to note that trading success is not solely dependent on the use of a particular theory, but also on other factors such as risk management and market conditions.

The Elliott Wave Theory is a technical analysis tool that attempts to predict market trends in financial markets. It is based on the belief that markets move in predictable patterns, which can be identified and analyzed.

The Elliott Wave Theory was developed by Ralph Nelson Elliott, an American accountant, and author, in the 1930s. He believed that market movements are not random and that they follow a repetitive pattern.

Is Forex Trading App Legal in India? The forex trading market has been growing in popularity around the world, and India is no exception. Many people …

Read ArticleUnderstanding the Direction of a Put Spread: Bullish or Bearish? When it comes to trading options, a put spread is a popular strategy that traders use …

Read ArticleIs Forex Legal in Australia? Forex trading, also known as foreign exchange trading, is a popular investment option for many individuals around the …

Read ArticleGet custom option value in Magento 2: a step-by-step guide When working with the Magento 2 platform, you may encounter a situation where you need to …

Read ArticleUnderstanding the 9 times rule in HKEx The Hong Kong Exchange and Clearing Limited (HKEx) has introduced the 9 Times Rule to regulate stock trading in …

Read ArticleBest Places to Exchange Dollar to Peso in Makati City If you’re visiting Makati, the financial capital of the Philippines, and need to exchange your …

Read Article