What do options brokers do? Exploring the role of options brokers in the financial market

What do options brokers do? Options brokers play a crucial role in the financial market, facilitating trading in options contracts. Options are …

Read Article

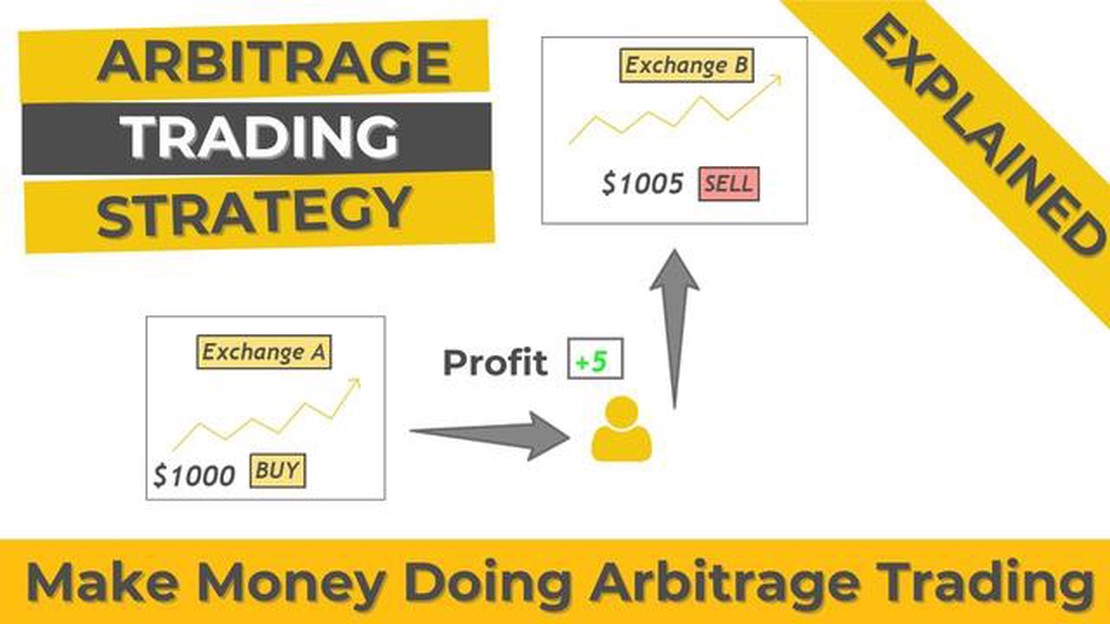

In the world of forex trading, many traders are constantly looking for ways to make profitable trades and maximize their returns. One strategy that is often discussed is arbitrage - the practice of taking advantage of price differences between different markets or assets.

Arbitrage in forex trading involves buying a currency at a lower price in one market and selling it at a higher price in another, thereby making a profit from the price disparity. This concept may seem like a surefire way to make money, but it is not as simple as it sounds. It requires a deep understanding of the market, quick execution, and access to multiple trading platforms.

While arbitrage opportunities do exist in the forex market, they are often short-lived and difficult to exploit. This is because the currency market is highly liquid and efficient, meaning prices adjust quickly to reflect new information. As a result, any discrepancies in prices are typically small and short-lived, making it challenging to execute profitable arbitrage trades.

Furthermore, arbitrage opportunities in forex trading are often limited to institutional traders who have access to advanced trading technology and can process trades at lightning speed. Retail traders, on the other hand, may find it difficult to compete with these large players and may not have the resources to take advantage of such opportunities.

It is worth noting that even if an arbitrage opportunity presents itself, there are risks involved. Execution delays, slippage, and transaction costs can eat into the potential profits, making the trade less lucrative. Additionally, engaging in arbitrage can be seen as market manipulation and may be prohibited or restricted by regulatory bodies.

In conclusion, while arbitrage can be profitable in forex trading, it is not a guaranteed success and requires careful analysis, sophisticated trading technology, and access to multiple markets. Retail traders should be cautious when considering arbitrage as a trading strategy and should focus on developing and implementing other proven strategies for profitable forex trading.

Forex arbitrage refers to the practice of taking advantage of price discrepancies between different currency pairs or markets to make a profit. The goal of arbitrage is to exploit the inefficiencies in the market and generate risk-free profits.

While forex arbitrage theoretically presents an opportunity for profit, it is important to note that it is a complex trading strategy that requires sophisticated technology and constant monitoring. Furthermore, arbitrage opportunities in the forex market are relatively rare and short-lived, as the market quickly adjusts to eliminate any discrepancies.

That being said, successful forex arbitrage traders can potentially make profits by executing trades at lightning-fast speeds and leveraging large amounts of capital. By taking advantage of small price differences, these traders can execute a large number of trades within a short period, profiting from the price differentials.

However, it is crucial to note that forex arbitrage carries risks and challenges. Firstly, it requires significant capital to engage in arbitrage trading due to the need for large trade volumes. Additionally, the execution of arbitrage trades must be near-instantaneous to capitalize on fleeting opportunities, necessitating advanced trading technology and direct market access.

Read Also: Understanding the Distinction: Moving Average Filter vs Median Filter

Furthermore, the forex market operates globally, with different trading sessions and liquidity providers. This can lead to differences in prices and spreads between different brokers and markets, creating potential opportunities for arbitrage. However, regulatory restrictions and latency issues may limit the ability to execute arbitrage trades successfully.

In conclusion, while forex arbitrage can be profitable, it is a highly specialized and challenging trading strategy that requires advanced knowledge, sophisticated technology, and significant capital. Traders considering arbitrage should carefully assess the risks and challenges involved before delving into this complex trading strategy.

Forex arbitrage is a trading strategy that takes advantage of discrepancies in currency prices in different markets. It involves exploiting market inefficiencies to make a risk-free profit. Arbitrageurs typically look for price differences between currency pairs in different markets or between spot and futures markets.

Forex arbitrage can be done in two main ways: spatial arbitrage and temporal arbitrage.

Spatial arbitrage involves taking advantage of price differences for the same currency pair in different markets. Traders can buy the currency at a lower price in one market and sell it at a higher price in another market, making a profit from the price discrepancy.

Temporal arbitrage, on the other hand, involves taking advantage of price differences for the same currency pair at different points in time. Traders can exploit the time lag between pricing updates in different markets to buy the currency at a lower price and sell it at a higher price once the prices align, making a profit.

Both spatial and temporal arbitrage require quick execution and advanced trading technology. Traders need to monitor multiple markets and execute trades instantly to capitalize on the price differences before they disappear.

Forex arbitrage can be a profitable trading strategy for experienced traders who have access to advanced trading tools and can identify and take advantage of market inefficiencies. However, it is important to note that arbitrage opportunities are rare and short-lived in the forex market, and competition among arbitrageurs is intense.

Read Also: Understanding the RSI with MA Strategy: A Comprehensive Guide

| Advantages of Forex Arbitrage: | Disadvantages of Forex Arbitrage: |

| - Potential for risk-free profits | - Requires advanced trading technology and fast execution |

| - Can be done without taking market direction into consideration | - Arbitrage opportunities are rare and short-lived |

| - Diversifies trading strategies | - Intense competition among arbitrageurs |

| - Can be done with low capital | - Possibility of errors or execution delays |

Overall, forex arbitrage can be a profitable strategy for traders who have the skills, resources, and technology to take advantage of market inefficiencies. However, it is important to analyze the risks, costs, and potential profits before implementing an arbitrage strategy in forex trading.

Arbitrage in forex trading refers to taking advantage of price discrepancies between different forex markets or different currency pairs to make a profit.

Arbitrage works by exploiting the differences in exchange rates or prices of currency pairs between different forex markets. Traders can buy a currency at a lower price in one market and sell it at a higher price in another market to make a profit.

Arbitrage can be profitable in forex trading if executed correctly. However, it requires quick execution, advanced trading technology, and access to multiple markets. It is also important to keep in mind that arbitrage opportunities may be limited and can disappear quickly due to market efficiency.

Arbitrage in forex trading involves various risks, including execution risk (delays in executing trades), liquidity risk (not being able to buy or sell at desired prices), and market risk (price volatility and sudden market movements). Additionally, regulatory and legal risks can arise when dealing with multiple exchanges or brokers.

There are several strategies that traders can employ to increase profitability in forex arbitrage, such as using advanced trading technology, automating the trading process, minimizing execution time, and hedging against potential risks. It is also crucial to stay updated with market information and constantly monitor for arbitrage opportunities.

Yes, arbitrage can be profitable in forex trading. It involves taking advantage of price discrepancies between different forex markets or brokers to make a profit.

Arbitrage in forex trading involves taking advantage of temporary price differences between different forex markets or brokers. Traders buy a currency at a lower price and sell it at a higher price in another market, making a profit from the price discrepancy.

What do options brokers do? Options brokers play a crucial role in the financial market, facilitating trading in options contracts. Options are …

Read ArticleWhich system is non-invertible? When studying systems, one important concept to understand is invertibility. In mathematical terms, a system is …

Read ArticleAre managed futures a good investment? Managed futures are a type of investment strategy that involves trading futures contracts with the guidance of …

Read ArticleIs Absa open on Saturdays? Absa Bank is one of the leading banks in South Africa, offering a wide range of financial services to its customers. As a …

Read ArticleIs Forex Trading Permissible in Islam? Forex trading, or trading in foreign currencies, has become increasingly popular in recent years. However, for …

Read ArticleHow to Calculate 20 Pips in Forex: A Step-by-Step Guide Forex trading is a popular way to invest in the global currency market and potentially earn …

Read Article