How to Become an Expert in Option Trading: Tips and Strategies

Mastering Option Trading: Expert Tips and Strategies Option trading can be a lucrative and exciting way to invest your money, but it can also be a …

Read Article

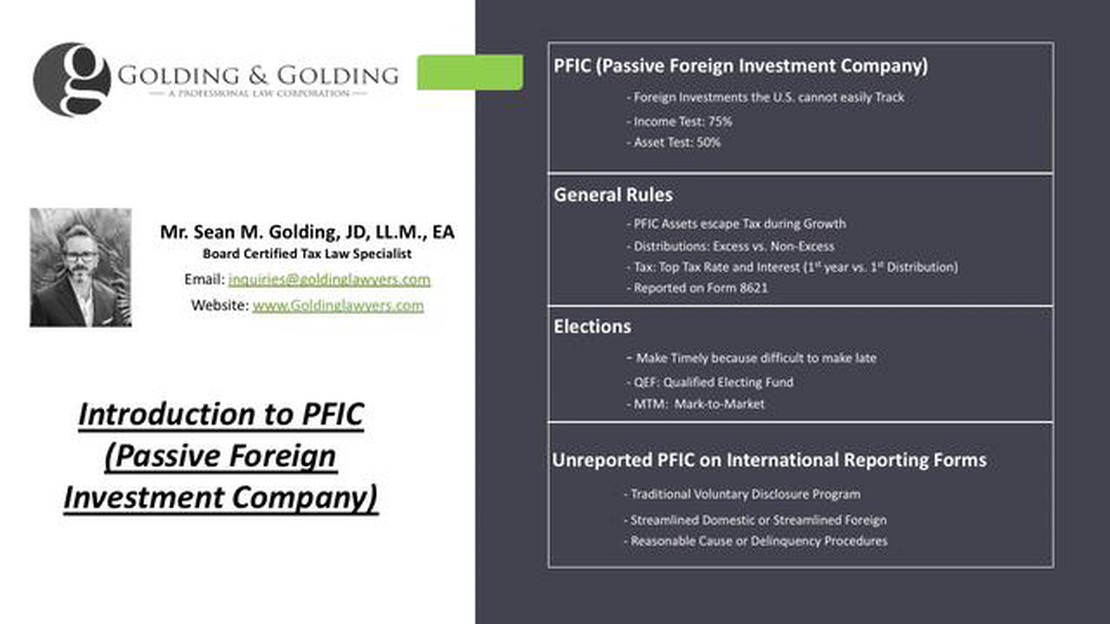

Passive Foreign Investment Companies (PFICs) are a complex and often misunderstood aspect of international investing. They are investment vehicles that are subject to unique tax rules and regulations, and can have significant implications for investors.

Put simply, a PFIC is a foreign corporation that meets certain criteria set by the Internal Revenue Service (IRS) of the United States. These criteria are designed to determine whether the majority of the company’s income is derived from passive sources, such as investments, rather than active business operations.

One of the key implications of investing in a PFIC is the tax treatment of any income or gains derived from the investment. Unlike regular investments, where taxes are generally paid annually on the income earned, PFIC investments are subject to a different set of rules known as the “PFIC tax regime.”

The PFIC tax regime requires investors to report their share of the PFIC’s income each year, regardless of whether any distributions are received. This income is then subject to a potentially higher tax rate and complex calculations that can result in unexpected tax liabilities for investors.

The complexities and potential tax consequences of investing in PFICs make it crucial for investors to fully understand the implications before committing to such investments. Professional tax advice is highly recommended to navigate the intricate rules surrounding PFICs and to ensure compliance with tax reporting requirements.

Overall, a clear understanding of PFICs and their implications is essential for investors who are considering international investments or who already hold shares in foreign corporations. By being aware of the unique tax rules and potential tax liabilities associated with PFIC investments, investors can make informed decisions and efficiently manage their tax obligations.

A Passive Foreign Investment Company (PFIC) is a classification given to certain foreign corporations that meet specific criteria set by the Internal Revenue Service (IRS) in the United States. The criteria include the percentage of passive income and passive assets that a foreign corporation generates.

PFICs can include various types of investment vehicles such as mutual funds, foreign trusts, and certain foreign corporations. These entities are classified as PFICs if they meet the IRS criteria.

The significance of PFIC classification lies in the tax implications it carries for U.S. taxpayers who own shares or interests in PFICs. U.S. taxpayers who own PFIC shares or interests must report their investments on their tax returns and are subject to specific tax rules, including the PFIC excess distribution regime and the mark-to-market regime.

The PFIC excess distribution regime requires that any excess distribution received by a U.S. taxpayer from a PFIC must be allocated evenly over the holding period of the investment and subject to punitive tax rates. This can result in higher taxes for U.S. taxpayers who receive distributions from PFIC investments.

The mark-to-market regime, on the other hand, requires U.S. taxpayers to include the annual gain or loss on their PFIC investments on their tax returns, regardless of whether the investment has been sold or not. This measurement is based on the fair market value of the investment at the end of each tax year.

Read Also: How to calculate the monthly moving average: the formula explained

Overall, understanding the definition of PFIC and its significance is crucial for investors who own shares or interests in foreign investment vehicles. It can help them to navigate the complex tax rules and obligations associated with PFIC ownership and make informed investment decisions.

In order to understand the implications and rules surrounding PFIC, it is crucial to have a clear understanding of the tax classification. The Internal Revenue Service (IRS) classifies foreign corporations into three different categories:

1. Passive Foreign Investment Company (PFIC):

A PFIC is a foreign corporation that meets either the income test or asset test set by the IRS. Under the income test, a corporation is considered a PFIC if 75% or more of its gross income is passive income. Passive income includes dividends, interest, royalties, rents, and gains from the sale of stocks or securities. Under the asset test, a corporation is considered a PFIC if 50% or more of its assets produce passive income. If a foreign corporation meets either of these tests, it is automatically classified as a PFIC.

Read Also: Does Expert Option Accept PayPal? Find Out Here!

2. Controlled Foreign Corporation (CFC):

A CFC is a foreign corporation in which U.S. shareholders own more than 50% of the total voting power or value of the corporation’s stock. The ownership of a CFC allows U.S. shareholders to have control over the corporation’s operations and management. CFCs are subject to certain taxation rules, including the Subpart F income taxation, which requires U.S. shareholders to include certain types of income generated by the CFC in their own tax returns.

3. Active Foreign Corporation:

An active foreign corporation is a foreign corporation that does not meet the criteria to be classified as a PFIC or CFC. An active foreign corporation typically engages in a trade or business and generates active income. Active income includes income from the sale of goods or services provided by the corporation.

Understanding the tax classification is essential for investors to determine the tax consequences of investing in a foreign corporation. PFICs in particular have strict reporting requirements and may be subject to punitive taxation rules. It is important for investors to consult with a tax professional or advisor to understand the implications of investing in a PFIC and to ensure compliance with IRS regulations.

A PFIC, or Passive Foreign Investment Company, is a term used by the United States Internal Revenue Service (IRS) to describe a foreign corporation that meets certain criteria related to its income and assets. Generally, it is a company based outside the United States that generates passive income or holds passive assets.

Investing in a PFIC can have significant tax implications for US taxpayers. The IRS has strict rules regarding taxation of income from PFICs, and the default tax treatment can be quite unfavorable. This may result in higher tax rates and complex reporting requirements for investors.

Passive income refers to earnings derived from activities in which the taxpayer is not materially involved. Examples of passive income include dividends, interest, rents, royalties, and capital gains. It is in contrast to active income, which is earned through the taxpayer’s direct participation in a business or trade.

Determining whether an investment is classified as a PFIC can be complex. One way to determine if an overseas investment is a PFIC is by analyzing the income and asset tests outlined by the IRS. If the foreign company meets these criteria, it may be classified as a PFIC. Consulting with a tax professional is recommended for a comprehensive analysis.

Investors in PFICs are required to file Form 8621, “Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund,” with their tax returns. The form provides information about the PFIC investment, including the calculation of the tax liability and any elections made by the investor. Failure to comply with the reporting requirements can result in penalties.

Mastering Option Trading: Expert Tips and Strategies Option trading can be a lucrative and exciting way to invest your money, but it can also be a …

Read ArticleTrading Economic Events: Strategies and Tips Economic events play a crucial role in the world of trading. Whether it’s an interest rate decision, a …

Read ArticleManaging Risk in Binary Trading: Strategies and Techniques Binary trading is a popular form of investment that involves predicting whether the price …

Read ArticleRegulation of Forward Contracts in India Forward contracts are an essential tool in the financial market that allow parties to secure the future …

Read ArticleHow to Read Stock Option Symbols When it comes to trading options, understanding stock symbol codes is crucial. These codes provide information about …

Read ArticleWhat is the moving average of an ETF? When it comes to investing in exchange-traded funds (ETFs), understanding the moving average can be a valuable …

Read Article