Is the Forex Market Open on Sunday GMT?

Is the Forex market open on Sunday GMT? Forex, or foreign exchange market, is a global decentralized market for trading currencies. It is open 24 …

Read Article

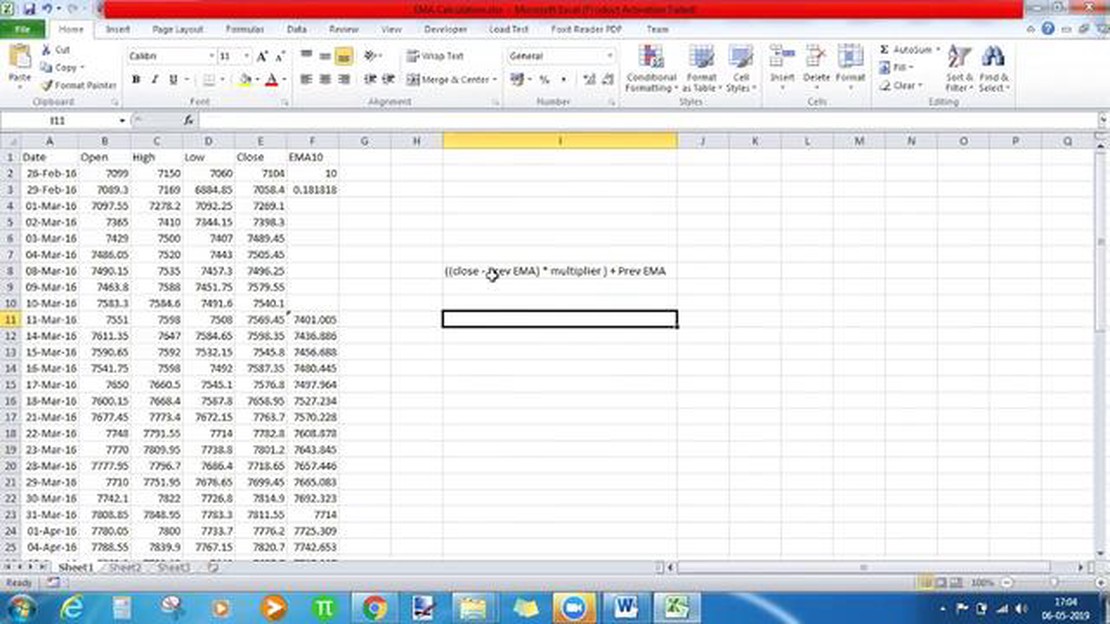

Calculating the 20-day Exponential Moving Average (EMA) is an important tool for traders and investors to analyze stock price trends and identify potential entry or exit points. The EMA is a type of moving average that weighs recent prices more heavily than older prices, providing a more responsive indicator of price trends. By calculating the 20-day EMA, traders can gain insight into short-term price movements and make informed trading decisions.

To calculate the 20-day EMA, follow these simple steps:

Using the 20-day EMA can help traders identify short-term trends, confirm breakouts or breakdowns, and determine dynamic support and resistance levels. It is important to note that the EMA is a lagging indicator and may produce delayed signals. Therefore, it should be used in conjunction with other technical analysis tools and indicators for a comprehensive trading strategy.

In conclusion, calculating the 20-day EMA involves gathering closing prices, calculating the SMA, choosing a smoothing factor, calculating the multiplier, and finally, calculating the EMA for each day in the 20-day period. By understanding and utilizing the 20-day EMA, traders can enhance their analysis and make more informed trading decisions.

The Exponential Moving Average (EMA) is a popular technical analysis tool used to identify trends in financial markets. It is a type of moving average that gives more weight to recent data points, making it more responsive to changes in price. The EMA is calculated using a smoothing factor that determines the weight given to each data point.

The formula for calculating the EMA is as follows:

| EMA | = | EMAprevious day | + | (Closetoday - EMAprevious day) | × | Smoothing factor |

|---|

The smoothing factor is a value between 0 and 1 and determines the weight given to the most recent data point. A higher smoothing factor gives more weight to recent data, while a lower smoothing factor gives more weight to older data. The most common values used for the smoothing factor are 0.2, 0.3, and 0.5.

The EMA is a lagging indicator, meaning it takes into account past prices to determine the current trend. It is useful for identifying long-term trends and is often used in conjunction with other technical analysis tools to generate trading signals.

Traders often use the 20-day EMA to identify short-term trends. When the price crosses above the 20-day EMA, it is seen as a bullish signal, indicating an upward trend. Conversely, when the price crosses below the 20-day EMA, it is seen as a bearish signal, indicating a downward trend.

Read Also: Understanding the Distinction: Gamma vs. Vanna in Options Trading

The EMA is a versatile tool that can be applied to various timeframes and markets. It helps traders filter out noise and focus on the most relevant price movements. By understanding how the EMA is calculated and interpreting its signals, traders can make more informed trading decisions.

The 20-day exponential moving average (EMA) is a popular tool used by traders and investors to analyze market trends and make informed trading decisions. Here are some of the key benefits of using the 20-day EMA:

Read Also: Understanding FX Options Trading: A Comprehensive Guide

| 1. Smooths Out Price MovementsThe 20-day EMA is designed to smooth out price movements and filter out short-term fluctuations. This helps traders to identify the overall trend of a security and avoid getting caught up in minor price swings. By focusing on the longer-term trend, traders can make more accurate predictions and avoid false signals. |

| 2. Provides Clear Buy and Sell SignalsThe 20-day EMA is widely used as a signaling tool. When the price of a security crosses above the 20-day EMA, it is considered a bullish signal, indicating that it may be a good time to buy. On the other hand, when the price crosses below the 20-day EMA, it is seen as a bearish signal, suggesting that it may be a good time to sell or short the security. |

| 3. Helps Identify Support and Resistance LevelsThe 20-day EMA can also be used to identify potential support and resistance levels. When the price of a security bounces off the 20-day EMA multiple times, it indicates that the EMA is acting as a strong support level. Conversely, when the price consistently fails to break above the 20-day EMA, it suggests that the EMA is acting as a strong resistance level. |

| 4. Works Well with Other Technical IndicatorsThe 20-day EMA can be used in combination with other technical indicators to confirm trading signals and improve the accuracy of the analysis. For example, traders often use the 20-day EMA in conjunction with the 50-day EMA to identify the direction of the long-term trend. Additionally, the 20-day EMA can be used in conjunction with other oscillators, such as the Relative Strength Index (RSI), to determine overbought and oversold conditions. |

| 5. Easy to Calculate and InterpretThe 20-day EMA is relatively easy to calculate and interpret, making it accessible to traders of all skill levels. It is calculated by taking the average of the closing prices over the past 20 days, giving more weight to the most recent data points. Traders can plot the 20-day EMA on their charts and visually analyze the slope and position of the line to make informed trading decisions. |

In conclusion, the 20-day exponential moving average is a versatile tool that can help traders and investors analyze market trends, identify trading signals, and make more informed trading decisions. By understanding the benefits of using the 20-day EMA, traders can incorporate this indicator into their trading strategies and improve their chances of success in the markets.

The 20-day Exponential Moving Average (EMA) is a technical analysis tool that is commonly used by traders and investors to track the price trend of a particular asset over a 20-day period.

To calculate the 20-day Exponential Moving Average, you need to take the closing prices of the asset for the past 20 days and multiply them by a weighting factor. The weighting factor is a constant value that determines the weight given to each price point in the calculation.

The 20-day Exponential Moving Average is popular among traders because it provides a smoothed line that reflects the average price movement over a 20-day period. It helps traders identify the direction of the trend and make informed trading decisions.

Yes, the 20-day Exponential Moving Average can be used for short-term trading. Traders can use it to identify short-term price trends and generate trading signals based on its crossover with other moving averages or price patterns.

While the 20-day Exponential Moving Average is a useful tool, it is important to note that it is a lagging indicator and may not always accurately reflect the current price trend. Additionally, it may generate false signals during periods of high volatility. Traders should use it in conjunction with other technical analysis tools for better decision-making.

A 20-day exponential moving average is a technical indicator that calculates the average price of a security over the past 20 trading days, with greater weight placed on more recent prices.

The 20-day exponential moving average is commonly used by traders because it helps identify short-term trends and signals potential buy or sell opportunities. It can also provide support and resistance levels.

Is the Forex market open on Sunday GMT? Forex, or foreign exchange market, is a global decentralized market for trading currencies. It is open 24 …

Read ArticleWhat is the Value of a Euro Currency Tick? Currency conversion is an essential aspect of international trade and investment. Understanding the value …

Read ArticleForex Card vs Debit Card: Which is the Better Option? When it comes to managing money while traveling abroad, there are several options available, …

Read ArticleATR: Leading or Lagging Indicator? ATR stands for Average True Range, which is a technical indicator used in forex trading to measure the volatility …

Read ArticleUnderstanding Executive Stock Compensation Mechanisms Executive stock compensation is a crucial component of many executives’ compensation packages. …

Read ArticleAre Bollinger Bands Effective in Technical Analysis? Bollinger Bands are a popular technical analysis tool used by traders to identify potential price …

Read Article