Understanding the Trading Up and Trading Down Strategy: A Comprehensive Guide

Exploring the Trading Up and Trading Down Strategy When it comes to making purchase decisions, consumers often find themselves torn between the desire …

Read Article

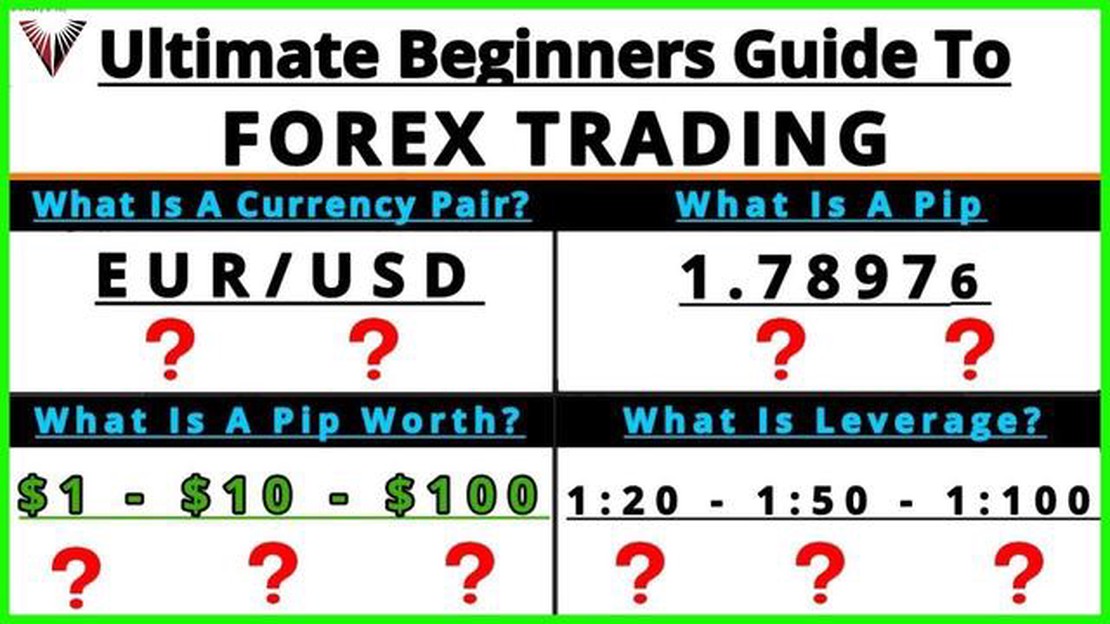

Welcome to the beginner’s guide on how to trade forex online! If you’re new to forex trading and looking to explore the exciting world of foreign exchange, you’ve come to the right place. In this guide, we will break down the basics of forex trading and provide you with the knowledge and tools to get started.

Forex, also known as foreign exchange, is the largest financial market in the world. It involves buying and selling currencies in order to profit from their fluctuations in value. Unlike other financial markets, such as the stock market, forex is decentralized and operates 24 hours a day, 5 days a week.

Trading forex online has become increasingly popular in recent years, thanks to advancements in technology and the accessibility of online trading platforms. Whether you’re a beginner or an experienced trader, the forex market offers vast opportunities for profit, but it also carries a certain level of risk. That’s why it’s important to educate yourself and develop a solid trading strategy.

In this guide, we will cover the basics of forex trading, including the key terms and concepts you need to understand, the different types of forex orders, and the factors that influence currency movements. We will also dive into technical and fundamental analysis, risk management techniques, and the psychology of trading. By the end of this guide, you will have a solid foundation to start trading forex online with confidence.

Forex trading, also known as foreign exchange trading or currency trading, is the process of buying and selling currencies in the foreign exchange market. It is the largest and most liquid financial market in the world, with trillions of dollars being traded on a daily basis.

In forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is called the base currency, while the second currency is called the quote currency. The exchange rate between the two currencies determines how much of the quote currency is needed to buy one unit of the base currency.

Forex trading allows individuals and institutions to speculate on the value of different currencies and profit from the fluctuations in their exchange rates. Traders can take advantage of both rising and falling markets, making money by buying a currency pair at a low price and selling it at a higher price, or vice versa.

One of the key features of forex trading is leverage, which allows traders to control larger positions with a smaller amount of capital. Leverage can amplify both profits and losses, so it is important to use it responsibly and have a solid risk management strategy in place.

To trade forex online, you will need a forex broker that provides a trading platform where you can access the market and execute trades. The trading platform will often include features such as real-time price charts, technical analysis tools, and order execution capabilities.

Overall, forex trading offers a wide range of opportunities for both beginners and experienced traders. It requires a good understanding of the market, fundamental and technical analysis, and risk management principles. With proper education and practice, anyone can learn how to trade forex and potentially generate profits in the global currency market.

Trading forex online has become increasingly popular among beginner traders for several reasons:

Read Also: How to join a forex trading company: A step-by-step guide

In conclusion, trading forex online can be an attractive option for beginners due to its accessibility, low start-up costs, leverage opportunities, diverse trading options, educational resources, and the flexibility of the 24/5 market.

When it comes to trading forex online, the first step is to choose a reliable and reputable forex broker. Look for a broker that is regulated by a trusted financial authority and offers competitive spreads, low fees, and a user-friendly trading platform.

Once you have chosen a broker, you will need to open a trading account. This typically involves providing some personal and financial information, as well as verifying your identity. Make sure to carefully read and understand the terms and conditions before opening an account.

After opening your trading account, you will need to deposit funds into it. This can usually be done through bank transfer, credit card, or electronic payment methods. Make sure to start with an amount that you can afford to lose, as forex trading involves significant risks.

Next, familiarize yourself with the forex market and its key concepts. Learn about currency pairs, pips, leverage, and margin trading. Take advantage of the educational resources provided by your broker, such as tutorials, webinars, and demo accounts.

Once you feel confident in your knowledge and skills, you can start practicing by placing trades in a demo account. This will allow you to get a feel for the trading platform and test out different strategies without risking real money.

Read Also: Discover the Magic Number in Expert Advisor Trading

When you are ready to start trading with real money, it is important to develop a trading plan and stick to it. Set clear goals, determine your risk tolerance, and establish a strategy for entering and exiting trades. Remember to always stay disciplined and avoid letting emotions guide your trading decisions.

Finally, monitor your trades and keep track of your performance. Analyze your successes and failures to learn from them and improve your trading strategy. Stay updated on market news and developments to make informed trading decisions.

Trading forex online can be an exciting and potentially profitable venture, but it requires dedication, discipline, and continuous learning. With the right mindset and tools, you can begin your journey as a forex trader and work towards achieving your financial goals.

Forex trading is the process of buying and selling currencies on the foreign exchange market. It allows traders to speculate on the price movements of different currency pairs.

To start trading forex, you will need to find a reputable online forex broker, open a trading account, deposit funds, and choose a trading platform. You will also need to learn about forex trading strategies and risk management techniques.

A forex broker is a company that acts as an intermediary between traders and the forex market. They provide trading platforms, real-time quotes, and access to the market. It is important to choose a reliable and regulated broker.

A currency pair is the combination of two different currencies in forex trading. For example, EUR/USD represents the euro against the US dollar. The first currency is the base currency and the second currency is the quote currency.

There are several popular forex trading strategies, including trend following, breakout trading, and range trading. Each strategy has its own set of rules and indicators that traders use to identify potential trading opportunities.

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies. It involves trading one currency for another with the goal of making a profit from the fluctuations in exchange rates.

Exploring the Trading Up and Trading Down Strategy When it comes to making purchase decisions, consumers often find themselves torn between the desire …

Read ArticleUnderstanding the Fundamental Trade in Forex Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the …

Read ArticleBest Pivot Points in Tradingview When it comes to successful trading, having a reliable indicator is crucial. One such indicator that has gained …

Read ArticleCalculating Moving Average in Forex Forex trading is a complex and dynamic market where traders analyze various technical indicators to predict future …

Read ArticleUnderstanding the Mechanisms of Binary Options Trading Binary options trading is a popular form of investing that allows traders to speculate on the …

Read ArticleWhat is the Best Forex Platform for Day Traders? Forex trading has become increasingly popular among day traders, as it allows individuals to engage …

Read Article