Can I Exchange Money at M Lhuillier? Discover the Currency Conversion Services Offered

Can I exchange money at M Lhuillier? Are you planning a trip abroad? Need to exchange your currency? Look no further than M Lhuillier! This trusted …

Read Article

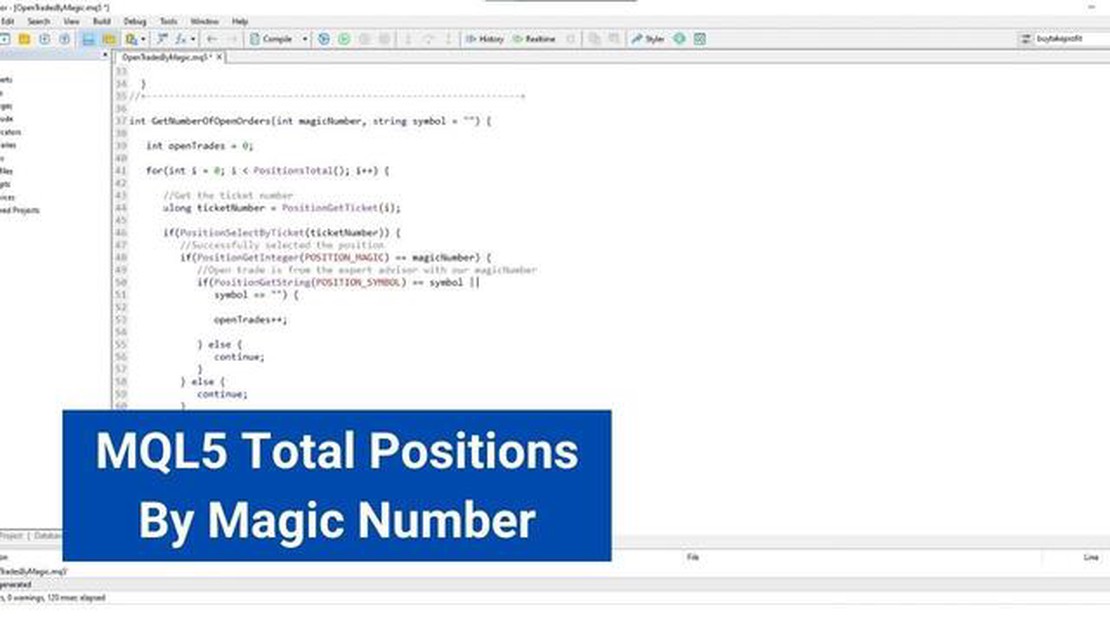

Expert Advisors, also known as EAs, are automated trading systems that allow traders to invest in the financial markets with the help of computer algorithms. These algorithms are designed to analyze market conditions and execute trades on behalf of the trader. One important aspect of creating a successful EA is determining the magic number.

A magic number is a unique identifier that is assigned to each trade executed by an EA. It helps the EA keep track of its own trades and to distinguish them from those executed by other EAs or manual trades. This is especially useful when multiple EAs are running on the same trading platform.

By assigning a magic number to each trade, traders can easily monitor the performance of their EAs and identify which trades were profitable and which ones were not. This allows them to make informed decisions about their trading strategies and make necessary adjustments to optimize their profits.

But how do you choose the right magic number for your EA? There is no one-size-fits-all answer to this question. The choice of magic number depends on various factors such as the trading system used, the financial instrument traded, and the trader’s own preferences and risk tolerance.

Some traders prefer to use a random or sequential number as their magic number, while others may use a combination of numbers that hold some personal significance. Whatever the choice, it is important to ensure that the magic number is unique and not used by any other EAs or manual trades on the same trading platform.

Discovering the magic number is an essential step in developing a successful EA. It allows traders to effectively manage and analyze their trades, ultimately improving their chances of success in the financial markets.

Expert Advisor (EA) trading is a popular method used by traders to automate their trading strategies in the forex market. EAs are computer programs that are designed to execute trades based on pre-defined rules and parameters.

One of the key benefits of using EAs is their ability to remove the emotional aspect of trading. By automating the trading process, EAs ensure that trades are executed based on logic and predetermined criteria, rather than human emotions such as fear or greed.

EAs can be created using programming languages such as MQL4 or MQL5, which are specific to the MetaTrader platform. These languages allow traders to define the rules and conditions for entering and exiting trades, as well as manage risk and execute different trading strategies.

When designing an EA, it is important to backtest it using historical data to evaluate its performance and identify any potential issues. Backtesting involves running the EA on past market data to simulate how it would have performed under different market conditions. This helps traders to assess the profitability and reliability of the EA before deploying it in live trading.

Read Also: Understanding the Significance of 911 in Stocks: Exploring Its Impact on the Financial Market

It is also essential to consider the market conditions and adapt the EA accordingly. Markets are constantly changing, and what may have been a winning strategy in the past may not necessarily work in the future. Traders should regularly monitor and update their EAs to ensure they remain effective in current market conditions.

Furthermore, risk management is crucial when using EAs. Traders should carefully define the risk parameters of their EAs, such as stop loss and take profit levels, to protect their trading capital. Additionally, it is important to consider the impact of slippage and spread on the EA’s performance, as these factors can affect the execution of trades.

In conclusion, understanding expert advisor trading is essential for traders who wish to automate their trading strategies. EAs provide numerous benefits, such as eliminating emotional bias and allowing for efficient execution of trades. However, it is important to carefully design, backtest, and adapt EAs according to market conditions, as well as implement appropriate risk management measures. With the right approach, EAs can be powerful tools for enhancing trading performance in the forex market.

When it comes to expert advisor trading, numbers play a crucial role in determining profitability and success. From setting the lot size to defining risk management parameters, every decision relies on numbers.

The first and foremost number that comes into play is the lot size. This represents the quantity of a financial instrument that is being traded. It is important to carefully consider the lot size as it directly impacts the potential profit and loss of a trade. Setting a lot size that is too large can lead to excessive risk, while a lot size that is too small may limit profitability.

In addition to the lot size, setting stop loss and take profit levels also requires careful consideration of numbers. These levels determine at which point a trade will be closed to limit losses or secure profits. By setting appropriate stop loss and take profit levels, traders can effectively manage their risk and safeguard their accounts.

Another crucial number in expert advisor trading is the risk-to-reward ratio. This ratio represents the potential reward in relation to the potential risk of a trade. A higher risk-to-reward ratio indicates a trade with potentially higher profits, but also higher risk. Traders must carefully analyze and determine the optimal risk-to-reward ratio based on their trading strategies and risk tolerance.

Moreover, numbers are also important when it comes to analyzing and evaluating the performance of an expert advisor. Traders often rely on metrics such as profit factor, drawdown, and win rate to assess the profitability and reliability of their trading systems. These numbers provide valuable insights into the effectiveness of the expert advisor and help in making informed decisions for future trading.

Read Also: Calculating the Moving Average Channel: A Step-by-Step Guide

Overall, in the realm of expert advisor trading, numbers hold great importance. Traders must pay close attention to various numbers involved in the process to optimize their trading strategies, manage risk effectively, and ultimately achieve success in the forex market.

Table: Key Numbers in Expert Advisor Trading

| Number | Definition |

|---|---|

| Lot Size | The quantity of a financial instrument being traded |

| Stop Loss | The level at which a trade will be closed to limit losses |

| Take Profit | The level at which a trade will be closed to secure profits |

| Risk-to-Reward Ratio | The potential reward in relation to the potential risk of a trade |

| Profit Factor | The ratio of gross profit to gross loss of a trading system |

| Drawdown | The peak-to-trough decline of an investment during a specific period |

| Win Rate | The percentage of winning trades out of the total number of trades |

The magic number in expert advisor trading is a unique identifier that allows the trader to distinguish between different trades or different instances of the same expert advisor.

The magic number is important in expert advisor trading because it helps the trader keep track of the different trades or instances of the same expert advisor. This is particularly useful when analyzing performance or making adjustments to specific trades or instances.

You can set the magic number in your expert advisor by using the SetMagicNumber() function in MQL4 or MQL5. This function allows you to assign a unique identifier to your expert advisor.

No, you cannot use the same magic number for multiple trades. Each trade or instance of the expert advisor should have a unique magic number.

If you don’t assign a magic number to your expert advisor, the trades or instances of the expert advisor will not have a unique identifier. This can make it difficult to track performance or make adjustments to specific trades or instances.

Can I exchange money at M Lhuillier? Are you planning a trip abroad? Need to exchange your currency? Look no further than M Lhuillier! This trusted …

Read ArticleGuide to buying copper contracts If you are interested in investing in copper or looking to diversify your portfolio, buying copper contracts can be a …

Read ArticleEssential Requirements for Trading Forex If you are interested in trading Forex, there are a few essential tools and knowledge you will need to have …

Read ArticleUnderstanding Stock Incentives: How They Work and Their Benefits Stock incentives are an integral part of modern compensation packages that many …

Read ArticleGuide to Using Connors RSI for Successful Trading If you are looking to improve your trading skills and make more profitable trades, then you need to …

Read ArticleShort Selling Options: An Example Short selling is a strategy used by investors to profit from a decline in the price of an asset. It involves …

Read Article