The future of WDC stock: expert analysis and predictions

The Future of WDC Stock: Expert Predictions and Analysis In recent years, Western Digital Corporation (WDC) has become one of the leading players in …

Read Article

Winter can bring changes to the forex market, which means it’s important for traders to stay informed about the best times to trade. The forex market operates 24 hours a day, but the trading sessions vary in terms of liquidity and volatility. Understanding the winter forex session time can help traders make more informed decisions and maximize their profits.

During the winter months, the forex market experiences some notable changes. One of the most significant changes is the overlapping of trading sessions. In the winter, there is a higher chance of multiple sessions being active at the same time, which can lead to increased liquidity and volatility. This can present both opportunities and challenges for forex traders.

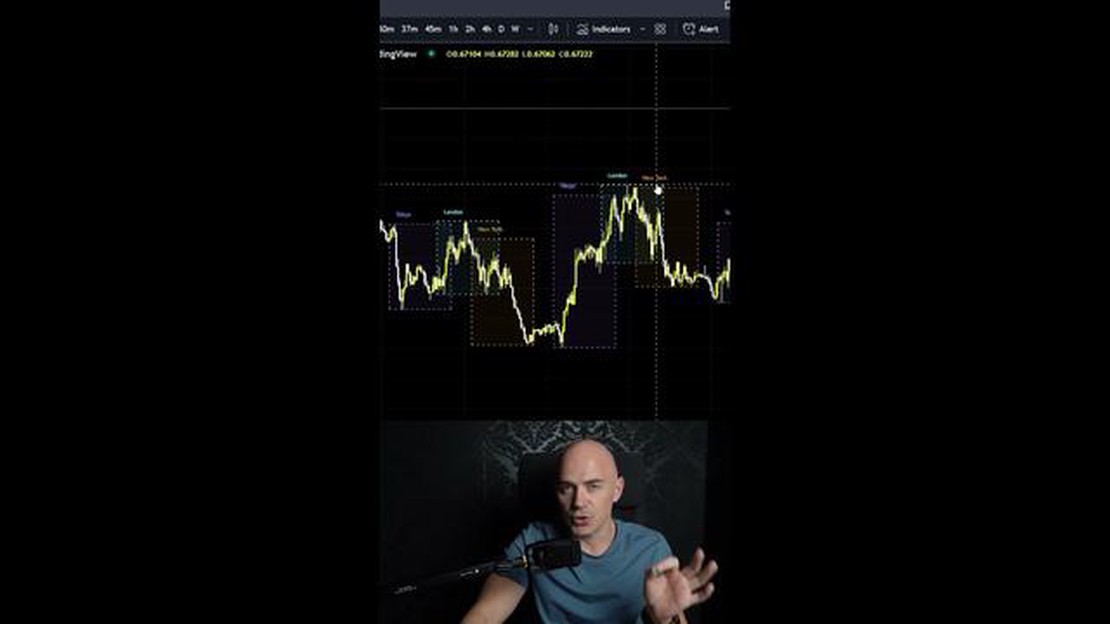

Knowing when the major forex sessions overlap during the winter can be valuable for traders. The Tokyo, London, and New York sessions are the most important trading sessions and have the highest trading volume. When these sessions overlap, there tends to be increased market activity and greater trading opportunities. Traders should pay close attention to these overlapping hours to take advantage of potential trading opportunities.

Additionally, traders should be aware of the daylight saving time changes that occur during the winter months. Different countries have different daylight saving time schedules, which can affect the forex market’s operating hours. Traders should keep track of these changes to ensure they are trading during the most active and volatile periods. This will help them make the most of their trading strategies and achieve better results.

In the winter months, the Forex market experiences some unique trading opportunities. Understanding the best times to trade during this season can help traders maximize their profits and minimize risks. There are certain factors to consider when determining the best time to trade Forex in winter:

Overall, the best time to trade Forex in winter is during the overlap of trading sessions, particularly the London and New York sessions. However, traders should also consider economic data releases, trading activity during the Asian session, time zone differences, and adapt their strategies to account for volatility. By being aware of these factors and planning their trades accordingly, traders can increase their chances of success in the Forex market during the winter months.

Winter brings certain changes to the forex trading schedule due to shifts in daylight saving time across different countries. While the forex market is open 24 hours a day, 5 days a week, it is important to be aware of the winter session times to optimize trading opportunities and avoid unnecessary risks.

Read Also: Understanding the Difference between XAU and Gold: Explained

The winter forex session time refers to the specific hours during which trading activities are most active and volatile in different financial centers around the world. Understanding these session times can provide valuable insights into market liquidity and potential trading strategies.

During winter, the forex market is influenced by the opening and closing times of major financial centers, including London, New York, Tokyo, and Sydney. Each of these centers has its own primary trading hours, which overlap at certain times, creating periods of increased market activity.

London, which is one of the largest forex trading hubs, operates from 8:00 AM to 4:00 PM GMT during winter. This period is often referred to as the London session. It is known for its high liquidity, as it overlaps with the end of the Asian session and the start of the New York session.

The New York session, which opens at 1:00 PM GMT during winter, is particularly important as it coincides with the closing of the London session. This overlap leads to increased trading volume and volatility, making it an opportune time for day traders and scalpers.

The Tokyo session, opening at 12:00 AM GMT during winter, is significant for traders interested in the Asian markets. It often displays high volatility, especially during the overlap with the London session.

The Sydney session, starting at 10:00 PM GMT during winter, is the first major session to open after the weekend. Although it has relatively lower trading volumes compared to other sessions, it can still present attractive trading opportunities, especially during the overlapping period with the Tokyo session.

Understanding the winter forex session time allows traders to align their trading activities with periods of high liquidity and volatility. Traders can plan their strategies based on these session times and take advantage of market movements. It is important to note that while the forex market operates 24/5, not all hours are equally active or suitable for trading.

Traders should also consider any upcoming news releases or economic events that might impact market volatility during specific session times. By combining an understanding of the winter forex session time with other fundamental and technical analysis, traders can increase their chances of making profitable trades.

Read Also: How to Effectively Use DoM in Forex Trading: A Comprehensive Guide

In the winter forex session time, the trading hours in the forex market are adjusted to accommodate the time changes due to daylight saving time. This allows traders to continue trading during the winter months without any disruption.

The winter forex session time affects traders by changing the trading hours. Traders need to be aware of the adjusted market hours in order to plan their trading accordingly and not miss out on any potential opportunities.

The winter forex session hours vary depending on the location and the specific currency pairs being traded. However, in general, the forex market is open 24 hours a day from Sunday evening until Friday evening. Traders should check their trading platform or consult a reliable source for the accurate winter session hours.

Yes, you can trade forex during the winter session. The winter forex session time does not restrict trading, but rather adjusts the market hours to accommodate the time changes. It is important to stay updated with the accurate trading hours to ensure smooth trading during the winter months.

There are potential advantages to trading during the winter session. The adjusted market hours may lead to different market conditions and trading opportunities. Traders who are adaptable and well-informed can take advantage of these changes and potentially make profitable trades during the winter session.

The Future of WDC Stock: Expert Predictions and Analysis In recent years, Western Digital Corporation (WDC) has become one of the leading players in …

Read ArticleTips for Being Successful in Intraday Trading in India Are you interested in making money through intraday trading in India? Intraday trading can be a …

Read ArticleUnderstanding the Mechanics of Equity Stock Options Equity stock options are an integral part of the financial world, offering individuals and …

Read ArticleThe Profit of 100 Dollars on Forex: Explained Forex, also known as the foreign exchange market, is a decentralized global market where currencies are …

Read ArticleHow many USD is 1 SDR? The Special Drawing Right (SDR) is an international reserve asset created by the International Monetary Fund (IMF). It is a …

Read ArticleUnderstanding Interest Rates in Options Trading Interest rates play a crucial role in the world of options trading. Whether you are a beginner or an …

Read Article