Understanding the Impact of the 200 EMA crossing the 50 EMA on Trading

Understanding the Effects of a 200 EMA Crossing 50 EMA Technical analysis plays a crucial role in the decision-making process of traders. One commonly …

Read Article

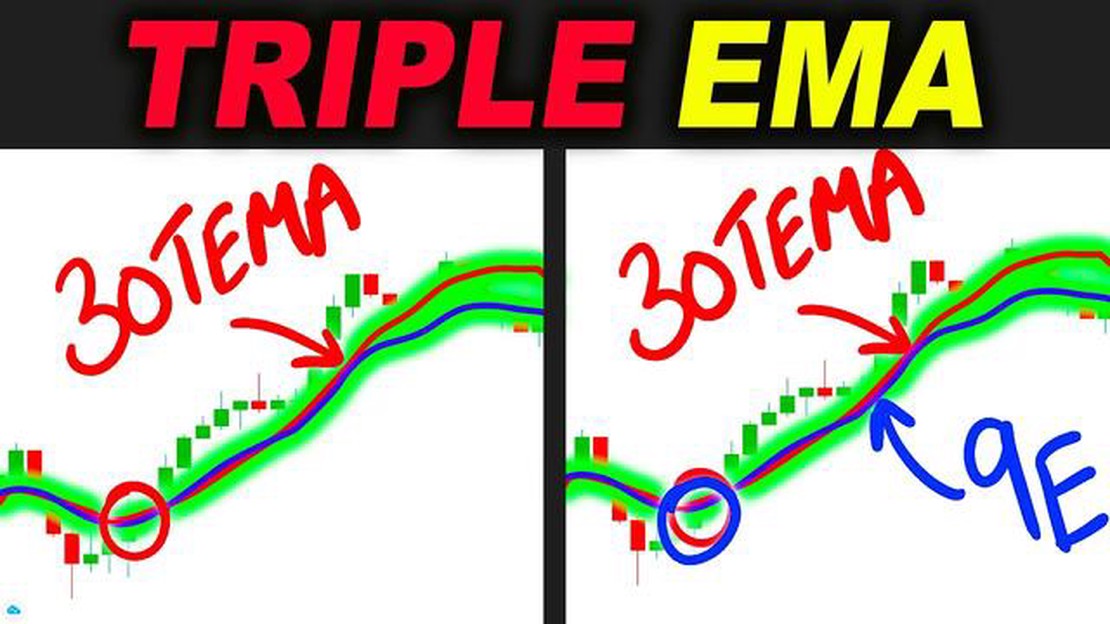

The Triple Exponential Moving Average (TEMA) is a technical indicator used in trading to analyze and forecast price movements. It is a variation of the more common Exponential Moving Average (EMA), but with the added benefit of reducing lag and providing more accurate signals.

The TEMA calculates the exponential moving average of the difference between the EMA of the price and the EMA of the EMA. This triple smoothing technique helps to filter out short-term price fluctuations and provide a more reliable trend indication. By using multiple moving averages, the TEMA aims to provide a clearer representation of the underlying price trend.

The TEMA is often used by traders to identify potential entry and exit points in the market. When the TEMA line is rising, it indicates an uptrend, while a falling TEMA line indicates a downtrend. Traders may look for crossovers with other indicators or use the TEMA as a standalone signal to make trading decisions.

MT4, also known as MetaTrader 4, is a popular trading platform that allows traders to analyze financial markets, execute trades, and develop and test trading strategies. MT4 provides a wide range of technical indicators, including the TEMA, which can be easily applied to price charts for analysis.

Understanding and utilizing the TEMA in MT4 can provide traders with valuable insights into market trends and help them make more informed trading decisions. By combining the power of the TEMA with other technical indicators and trading strategies, traders can enhance their trading strategies and potentially increase their profitability. Whether you are a beginner or an experienced trader, the TEMA is a useful tool to have in your trading arsenal.

The Triple Exponential Moving Average (TEMA) is a technical indicator used in financial markets to analyze and predict price movements. It is a variation of the traditional Exponential Moving Average (EMA) that aims to reduce lag and provide more accurate signals.

The TEMA is calculated by taking the EMA of the EMA of the EMA of the price data. This triple smoothing helps to filter out noise and highlight the underlying trend.

The TEMA is typically used by traders and analysts to identify trends, determine entry and exit points, and generate buy and sell signals. It can be applied to various timeframes, from short-term trading to long-term investing.

One of the advantages of the TEMA is that it reacts more quickly to price changes compared to other moving averages. This can be beneficial in fast-moving markets where timely decision-making is crucial.

Traders often use the TEMA in conjunction with other technical indicators or chart patterns to confirm signals and improve accuracy. It is important to note that no indicator is perfect and should be used in conjunction with other forms of analysis.

In conclusion, the Triple Exponential Moving Average (TEMA) is a powerful tool for analyzing price movements in financial markets. It helps traders and analysts identify trends, generate buy and sell signals, and make informed trading decisions. However, it is important to use the TEMA in conjunction with other forms of analysis to improve accuracy and avoid false signals.

The Triple Exponential Moving Average (TEMA) is a technical indicator that is used to identify trends and generate trading signals in the MT4 platform. It is a modified version of the Exponential Moving Average (EMA) that provides a smoother and more responsive line.

The TEMA indicator is calculated using three exponential moving averages of different time periods. The first step is to calculate the single exponential moving average. Then, the difference between the current price and the single EMA is calculated and multiplied by a smoothing factor. This difference is added to the single EMA to get the first TEMA value.

The second and third EMA values are calculated in a similar way, but using different time periods and smoothing factors. The three TEMA values are then combined to form the TEMA line on the MT4 chart.

Traders use the TEMA indicator to determine the strength and direction of a trend. When the TEMA line is moving upwards, it indicates an uptrend, and when it is moving downwards, it indicates a downtrend. Traders can use this information to enter or exit trades based on their trading strategy.

Read Also: Is future and option trading safe? Exploring the risks and rewards

The TEMA indicator is also used to generate trading signals. When the TEMA line crosses above the price, it is considered a bullish signal, indicating a potential buy trade. Conversely, when the TEMA line crosses below the price, it is considered a bearish signal, indicating a potential sell trade.

It is important to note that the TEMA indicator is not foolproof and should be used in conjunction with other technical indicators and analysis tools. It is always recommended to test the indicator on a demo account before using it in a live trading environment.

Read Also: Understanding the Commission Rate of a Broker in Nepal: Explained

In conclusion, the TEMA indicator is a powerful tool that can help traders identify trends and generate trading signals. By understanding the basics of how the TEMA indicator is calculated and how it can be used in the MT4 platform, traders can make more informed trading decisions and increase their chances of success.

The Triple Exponential Moving Average (TEMA) is a unique type of moving average that differs from other moving averages in several ways.

Firstly, TEMA is a trend-following indicator that is designed to filter out short-term price fluctuations and provide a smoother representation of the underlying trend. It achieves this by applying a triple smoothing technique, which involves applying three exponential moving averages to the price data.

Secondly, TEMA places more emphasis on recent price data compared to other moving averages. It achieves this by using a weighted multiplier that assigns a higher weight to the most recent price data, gradually decreasing the weight for older data points. This weighting scheme allows TEMA to respond more quickly to changes in price direction compared to other moving averages.

Thirdly, TEMA is less prone to whipsaws or false signals compared to other moving averages. This is because the triple smoothing technique and the use of a weighted multiplier help to reduce the impact of short-term price fluctuations on the indicator’s output. As a result, TEMA tends to provide more accurate signals when identifying trends or trend reversals.

Lastly, TEMA can be customized to suit individual trading preferences. Traders can adjust the parameters of the indicator, such as the period lengths of the exponential moving averages or the weighting multiplier, to optimize the indicator’s performance for different timeframes or trading strategies.

| TEMA | Other Moving Averages |

|---|---|

| Uses a triple smoothing technique | Uses a single or double smoothing technique |

| Places more emphasis on recent price data | Places equal weight on all price data points |

| Less prone to whipsaws or false signals | More sensitive to short-term price fluctuations |

| Adjustable parameters to suit different trading preferences | Fixed parameters |

The Triple Exponential Moving Average (TEMA) is a technical indicator that is used to smooth out price data over a certain period of time and identify trends.

The TEMA is calculated by applying three different exponential moving averages (EMA) to the price data. These EMAs are then combined to create the final TEMA value.

The main difference between TEMA and other moving averages is that TEMA uses multiple EMAs to calculate the final value, whereas other moving averages only use one.

TEMA can be used in trading to identify trends and potential buy or sell signals. Traders often look for crossovers between the TEMA and the price data to determine when to enter or exit a trade.

Yes, TEMA can be used in conjunction with other indicators to confirm signals and improve trading decisions. For example, traders may use TEMA in combination with the Relative Strength Index (RSI) to identify overbought or oversold conditions.

The Triple Exponential Moving Average (TEMA) is a technical analysis indicator that smooths out price data and provides a trend-following signal. It is calculated using multiple exponential moving averages in order to filter out noise and provide a more accurate signal.

Understanding the Effects of a 200 EMA Crossing 50 EMA Technical analysis plays a crucial role in the decision-making process of traders. One commonly …

Read ArticleWhat happens if an option falls below the strike price? Options are financial instruments that give traders the right to buy or sell an underlying …

Read ArticleUnderstanding the Significance of High Open Interest Compared to Volume on Options Options trading is a complex financial instrument that involves …

Read ArticleUnderstanding SP 100 Options Options trading can be a complex and intimidating endeavor for beginners. However, gaining a deep understanding of the …

Read ArticleDD broker: Everything you need to know A DD broker, also known as a direct dealing broker, is a financial intermediary that facilitates the direct …

Read ArticleWhat is the Average GBP to Euro in 10 Years? The exchange rate between the Great British Pound (GBP) and the Euro (EUR) is an important measure of the …

Read Article