1 PHP to 1 yen: Discover the current exchange rate and convert your currency

1 PHP to 1 yen: The Current Exchange Rate and Conversion Are you planning a trip to Japan and wondering about the current exchange rate between the …

Read Article

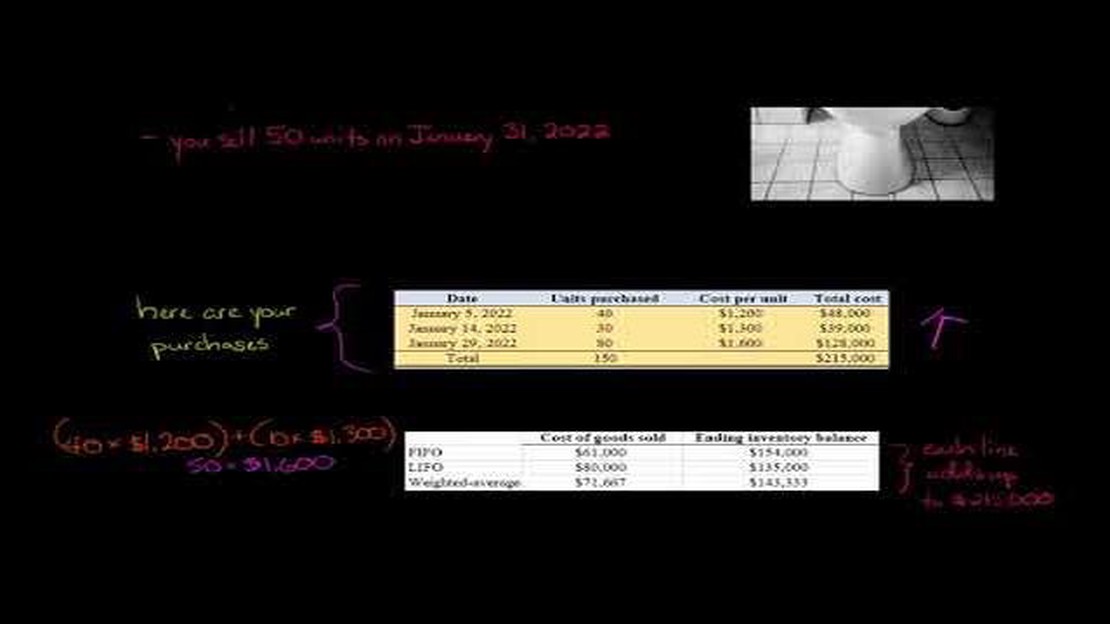

Inventory valuation is an important aspect of accounting for businesses. It involves determining the value of the inventory on hand at the end of a reporting period. Two commonly used methods for inventory valuation are FIFO (First-In, First-Out) and weighted average. Each method has its own advantages and disadvantages, and the choice between them depends on several factors.

FIFO is based on the principle that the first items purchased are the first items sold. Under this method, the cost of goods sold is calculated using the cost of the oldest inventory, while the value of the ending inventory is determined using the cost of the most recent purchases. FIFO is often preferred in industries where there is a risk of obsolescence or spoilage, as it ensures that the cost of older inventory is expensed first, reducing the risk of carrying obsolete or spoiled goods.

On the other hand, the weighted average method calculates the average cost of all the units in the inventory, regardless of when they were purchased. This average cost is then used to determine both the cost of goods sold and the value of the ending inventory. Weighted average is often used in industries where the inventory consists of homogeneous products and there is little risk of obsolescence or spoilage. It provides a more balanced approach to inventory valuation and smooths out the effects of price fluctuations.

The choice between FIFO and weighted average depends on several factors such as the nature of the inventory, industry practices, and management objectives. It is important for businesses to assess these factors and select the method that best meets their needs. Ultimately, the goal is to accurately reflect the value of the inventory on the balance sheet, while also considering the impact on the cost of goods sold and the overall financial performance of the business.

When it comes to valuing inventory, two commonly used methods are First In, First Out (FIFO) and Weighted Average. Both methods have advantages and disadvantages, and the choice between them depends on the specific needs and circumstances of each business.

FIFO Method:

Weighted Average Method:

Ultimately, the choice between FIFO and weighted average inventory valuation methods depends on various factors, such as the nature of the business, industry dynamics, and tax implications. It is important for businesses to carefully consider these factors and select the method that best aligns with their specific needs and goals.

Inventory valuation is an important aspect of accounting for businesses that carry inventory. Two popular methods for valuing inventory are the First-In, First-Out (FIFO) method and the Weighted Average method. Each method has its own advantages and disadvantages, and understanding them can help businesses make informed decisions about which method is best for their inventory valuation needs.

The FIFO method assumes that the first inventory items bought are the first ones sold. In other words, the cost of the first items purchased is matched with the revenue generated by selling those items. This method can be useful when prices are rising because it results in a higher cost of goods sold and a lower net income. It is also considered to reflect the actual flow of goods in many industries.

Read Also: How does the moving average algorithm work? | Explained

The Weighted Average method, on the other hand, calculates the average cost of all goods available for sale during a period and uses this average cost to value both the cost of goods sold and the ending inventory. This method is beneficial when prices are fluctuating because it smooths out the cost of goods sold and provides a more stable net income. It is also considered easier to calculate and understand.

When comparing the FIFO and Weighted Average methods, it’s important to consider factors such as the nature of the business, the industry, and the current market conditions. FIFO method might be preferable for businesses that deal with perishable goods or industries with rapidly changing prices. The Weighted Average method might be a better choice for businesses with relatively stable prices or industries with slow inventory turnover.

Read Also: What is a Custom Exchange Rate? | All You Need to Know

| Advantages | FIFO | Weighted Average |

|---|---|---|

| Reflects actual flow of goods | ✓ | - |

| Higher cost of goods sold during rising prices | ✓ | - |

| Lower net income during rising prices | ✓ | - |

| Smoothes out cost of goods sold | - | ✓ |

| Provides more stable net income | - | ✓ |

| Easier to calculate and understand | - | ✓ |

Ultimately, determining which method is best for inventory valuation depends on the specific circumstances of the business. Careful analysis and consideration of the advantages and disadvantages of both FIFO and Weighted Average can help businesses make the best decision to accurately reflect the value of their inventory.

The FIFO (First-In, First-Out) inventory valuation method assumes that the first items purchased or produced are the first ones sold or used. It means that the cost of older inventory is recognized before the cost of newer inventory.

The weighted average inventory valuation method calculates the average cost of inventory by dividing the total cost of inventory by the total number of units. This average cost is then used to value the inventory and allocate the cost of goods sold.

The choice between FIFO and weighted average method depends on various factors such as the nature of the business, the industry, and the specific circumstances. Both methods have their advantages and disadvantages. It is advisable to consult with an accountant or financial advisor to determine which method is best for a particular business.

The advantages of using the FIFO method include better matching of current costs with current revenues, higher accuracy in determining the cost of goods sold, and a more realistic representation of the actual flow of goods in the business.

The advantages of using the weighted average method include simplicity in calculation, smoother fluctuations in the cost of goods sold, and less impact from price fluctuations compared to the FIFO method.

FIFO stands for “first in, first out.” It is an inventory valuation method in which the oldest or first acquired inventory is used to determine the cost of goods sold (COGS). This means that the cost of the items that were purchased first are matched with the revenues from sales first.

1 PHP to 1 yen: The Current Exchange Rate and Conversion Are you planning a trip to Japan and wondering about the current exchange rate between the …

Read ArticleIs discretionary trading profitable? Discretionary trading, also known as manual trading, is a popular approach used by many traders in the financial …

Read ArticleIs Day trading allowed in Japan? Day trading is a popular investment strategy for individuals looking to make quick profits by exploiting the …

Read ArticleExploring the M15 Strategy in Forex Trading If you’re looking to enhance your trading success in the fast-paced world of forex, then the M15 forex …

Read ArticleCurrent Euro Rate in India Today If you’re planning a trip to India or you’re a business person who needs to make financial transactions, knowing the …

Read ArticleWhat is the average return of a hedge fund? Hedge funds are investment vehicles that pool capital from accredited individuals and institutional …

Read Article