The Psychology of Trading Options: Understanding the Mindset for Success

The Psychology of Trading Options: Understanding Your Mindset for Success Trading options can be a highly lucrative endeavor, but it also comes with …

Read Article

Trading in the financial markets can be a risky endeavor. One wrong move and you may end up losing a significant amount of money. That’s why it’s important to have a solid trading strategy in place. One popular strategy among traders is the Fakey pattern strategy.

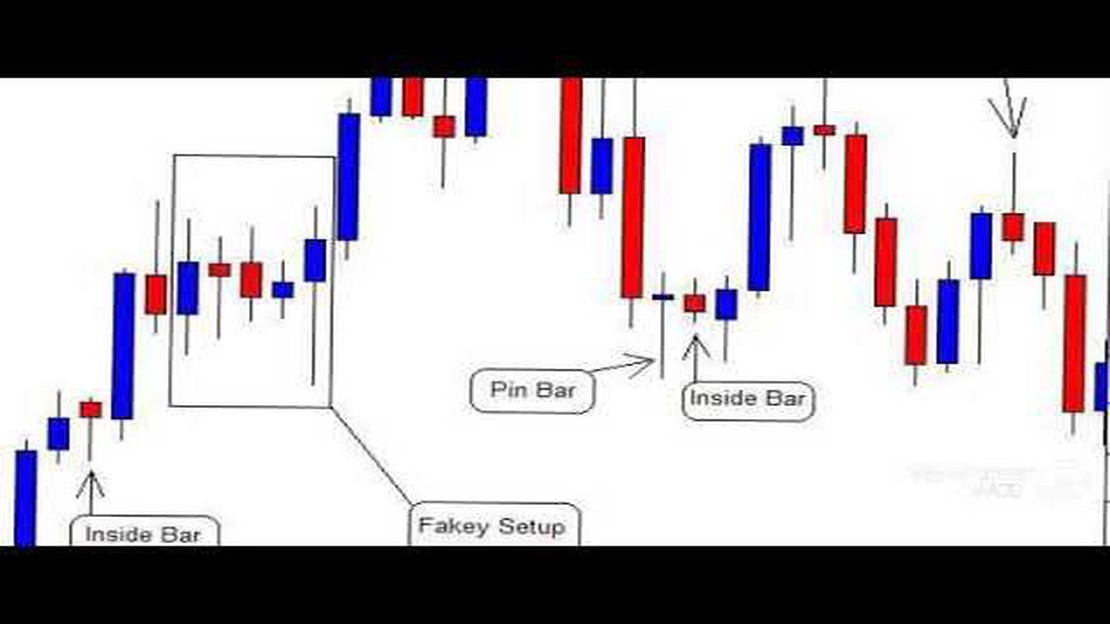

The Fakey pattern strategy is a powerful tool that can help traders identify potential trend reversals and take advantage of market inefficiencies. It involves looking for a “false breakout” of a key level of support or resistance, followed by a reversal in the opposite direction.

To identify a Fakey setup, traders look for a specific price action pattern on their charts. This pattern typically consists of a false breakout, where price initially moves beyond a key level, only to reverse and move in the opposite direction. Traders often look for additional confirmation signals, such as a pin bar or an inside bar, to validate the setup.

Once a Fakey setup is identified, traders can take advantage of the potential trend reversal by entering a trade in the opposite direction of the initial breakout. This can allow them to profit from the market inefficiencies caused by traders who were caught on the wrong side of the initial breakout.

The Fakey pattern strategy is a versatile tool that can be applied to various timeframes and markets. It can be used in both trending and range-bound markets, making it suitable for swing traders and day traders alike. However, it’s important to note that no strategy is foolproof, and traders should always practice proper risk management.

In conclusion, the Fakey pattern strategy is a powerful tool for trading success. By identifying false breakouts and potential trend reversals, traders can capitalize on market inefficiencies and increase their chances of making profitable trades. However, it’s important to combine this strategy with proper risk management and additional technical analysis to further enhance its effectiveness.

The Fakey pattern strategy is a powerful tool used by traders to identify potential market reversals and trade in the opposite direction of the initial price movement. It is based on the concept of false breakouts, where the market temporarily moves in one direction, only to reverse and create a new trend in the opposite direction.

The strategy involves looking for a specific price action pattern that confirms the presence of a fakey setup. The pattern consists of a false breakout, followed by a reversal candlestick pattern. The false breakout occurs when the market breaks through a key level of support or resistance, attracting traders to enter in the direction of the breakout. However, the market fails to sustain the breakout and quickly reverses, trapping those traders who entered in the initial direction.

The reversal candlestick pattern is a key component of the fakey setup. It confirms the failure of the breakout and signals a potential reversal of the trend. This pattern can be a bullish or bearish engulfing pattern, a pin bar or a doji, among others. The presence of this pattern adds further validity to the fakey setup and increases the likelihood of a successful trade.

Traders using the fakey pattern strategy typically look for these setups on higher timeframes, such as the daily or weekly charts, to allow for greater accuracy and reliability. They also pay attention to key levels of support and resistance, as these areas are often where false breakouts occur. By waiting for the confirmation of a reversal candlestick pattern, traders aim to enter the market at the optimal point to maximize their profit potential.

It is important to note that the fakey pattern strategy is not foolproof and does carry risks, like any other trading strategy. Traders must have a solid understanding of technical analysis and price action, as well as disciplined money management skills, to effectively use this strategy. It is also recommended to combine the fakey pattern strategy with other technical indicators or analysis methods to increase the overall probability of success.

| Advantages | Disadvantages |

| Provides a clear entry and exit strategy | Requires patience and discipline to wait for confirmation |

| Can be used in any market and timeframe | May result in false signals |

| Can be combined with other strategies or indicators | Requires technical analysis skills |

Read Also: Stock Options as Income: Understanding the Tax Implications

In summary, the fakey pattern strategy is a valuable tool for traders looking to identify potential market reversals. By understanding and recognizing the patterns that confirm a fakey setup, traders can enter the market at the optimal point and increase their chances of success. However, it is essential to always practice good risk management and combine this strategy with other analysis methods to enhance its effectiveness.

The Fakey pattern strategy is a powerful tool that traders can use to identify potential reversals in the market, providing them with opportunities to profit from price movements. Understanding the basics of this strategy is essential for traders who want to enhance their trading success.

Read Also: Understanding the Mechanics of Option Clearing for Beginners

The Fakey pattern is formed when the market initially breaks out of a key level or a pattern, but then quickly reverses and closes back within the range. This false breakout can often trick inexperienced traders into taking positions in the wrong direction, leading to losses. However, experienced traders who can recognize the Fakey pattern can use it to their advantage by taking trades in the opposite direction of the false breakout.

To identify a Fakey pattern, traders should look for the following elements:

Traders often use additional confirmation tools, such as support and resistance levels or other technical indicators, to validate the Fakey pattern and increase the probability of a successful trade. They can then enter a trade in the direction of the reversal, placing stop-loss orders above the high (in a bearish Fakey) or below the low (in a bullish Fakey) of the reversal candle.

The Fakey pattern strategy can be applied to various timeframes and markets, making it a versatile tool for traders. By using this strategy, traders can make more informed decisions and increase their chances of profiting from market reversals.

The Fakey pattern strategy is a popular trading strategy that involves identifying false breakout patterns and trading against them. It is based on the concept of market manipulation and aims to take advantage of the traps that are set by market participants.

The Fakey pattern strategy works by identifying price action patterns that indicate a false breakout. Essentially, it involves looking for a price that initially breaks out of a key level or pattern, but then quickly reverses and closes back within the range. This signals a trap for traders who went long or short on the initial breakout, and by trading against it, the Fakey pattern strategy aims to profit from their mistakes.

The key components of the Fakey pattern strategy are the inside bar pattern, the false breakout, and the reversal. The inside bar pattern is a two-bar pattern where the second bar is contained within the high and low of the first bar. The false breakout occurs when price breaks out of a key level or pattern but then quickly reverses. Finally, the reversal is the movement of price in the opposite direction of the false breakout, creating a trading opportunity.

While the Fakey pattern strategy can be effective on its own, some traders may choose to use additional indicators or tools to increase the accuracy of their trades. Commonly used tools include support and resistance levels, trend lines, moving averages, and oscillators like the Relative Strength Index (RSI) or Stochastic oscillator. These tools can help confirm the validity of the Fakey pattern and provide additional insights for trade entry and exit points.

Yes, the Fakey pattern strategy can be used in any market and timeframe. It is a versatile strategy that can be applied to various instruments such as stocks, forex, commodities, and cryptocurrencies. Traders can adjust the timeframe to match their preferred style of trading, whether it’s short-term scalping or long-term investing. However, it’s important to note that different markets and timeframes may require adjustments in terms of stop-loss placement, target profits, and overall risk management.

The Fakey Pattern strategy is a trading strategy that helps traders identify false breakouts in the market. It involves looking for a pattern where price initially breaks through a key level, but then quickly reverses, trapping traders who entered the breakout. This reversal often results in a strong price move in the opposite direction.

The Psychology of Trading Options: Understanding Your Mindset for Success Trading options can be a highly lucrative endeavor, but it also comes with …

Read ArticleWhat programming language is MQL5 based on? When it comes to automated trading in the Forex market, one of the most popular programming languages used …

Read ArticleFour benefits of implementing an ESOP in an organization If you’re a business owner or executive looking for innovative ways to attract and retain top …

Read ArticleUnderstanding Discounted Options: What You Need to Know When it comes to investing, there are many different options available to choose from. One …

Read ArticleEurope’s Emissions Trading Scheme: An Overview Europe’s Emissions Trading Scheme (EU ETS) is a pioneering carbon market established in the European …

Read ArticleChoosing the Best Algorithm for Forex Trading If you’re an aspiring trader in the Forex market, you know how crucial it is to have the right tools and …

Read Article