Understanding the Distinction: Margin vs. Leverage in Forex Trading

Understanding the Difference between Margin and Leverage in Forex Trading Forex trading has become increasingly popular in recent years, attracting …

Read Article

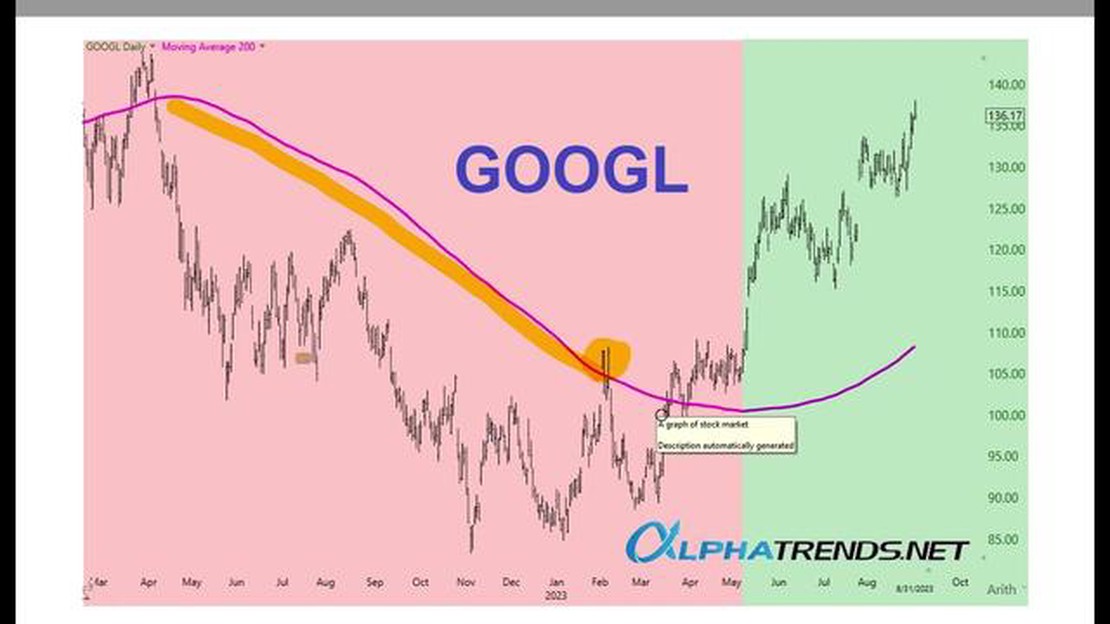

When it comes to analyzing the stock market, there are numerous indicators and tools that investors use to make informed decisions. One such tool is the 200-day moving average. This metric is often used by traders and analysts to determine the overall trend of a stock, and it can be particularly useful when applied to a company as influential as Apple.

The 200-day moving average is a simple yet powerful indicator that helps investors identify the long-term trend of a stock. It is calculated by summing up the closing prices of a stock over the past 200 trading days and dividing that sum by 200. The resulting average is then plotted on a chart, creating a line that represents the stock’s long-term trend.

For Apple, a company that is known for its volatile stock price, the 200-day moving average can provide valuable insights. By comparing the current price of Apple’s stock to its 200-day moving average, investors can get a sense of whether the stock is trading above or below its long-term trend. If the stock is trading above the moving average, it suggests that the stock is in an uptrend, while trading below the moving average indicates a downtrend.

It’s important to note that the 200-day moving average is just one tool in a trader’s arsenal, and it should be used in conjunction with other indicators and analysis methods. However, it can be a helpful tool for investors who are looking to gain a better understanding of the overall trend of Apple’s stock and make more informed trading decisions.

The 200-day moving average is a commonly used technical indicator in stock market analysis. It is calculated by averaging the closing prices of a stock over the past 200 trading days. In the case of Apple, this indicator is used to understand the long-term trend of the stock’s price movement.

The 200-day moving average is considered a significant indicator because it smooths out short-term fluctuations and provides a clearer picture of the overall trend. It is widely used by traders and investors to identify potential buying or selling opportunities.

When the stock price is trading above the 200-day moving average, it is generally seen as a bullish signal, indicating that the stock is in an uptrend. This suggests that the stock’s price is likely to continue rising in the future. On the other hand, when the stock price is trading below the 200-day moving average, it is generally seen as a bearish signal, indicating that the stock is in a downtrend. This suggests that the stock’s price is likely to continue falling.

Traders and investors often use the 200-day moving average as a reference point to determine their entry and exit points for a stock. For example, a trader may decide to buy a stock when its price crosses above the 200-day moving average, indicating a potential uptrend. Conversely, a trader may choose to sell a stock when its price crosses below the 200-day moving average, indicating a potential downtrend.

It is important to note that the 200-day moving average is just one tool among many in technical analysis. It should always be used in conjunction with other indicators and analysis methods to make informed investment decisions.

The 200-day moving average is a technical indicator used in the stock market to analyze the long-term trend of a stock’s price. It is calculated by taking the average closing price of a stock over the past 200 trading days. The moving average is continually updated as each new trading day’s data is added, so it reflects the most recent movements of the stock price.

Read Also: Understanding the Basics of Binary Option Trading: A Comprehensive Guide

The 200-day moving average is considered significant because it smooths out short-term price fluctuations and helps identify the overall direction of a stock’s price trend. Traders and investors often use the 200-day moving average as a reference point to determine whether a stock is in an uptrend or a downtrend.

When the current price of a stock is above its 200-day moving average, it is often seen as a bullish signal, indicating that the stock is in an uptrend. Conversely, when the current price falls below the 200-day moving average, it is generally considered a bearish signal, suggesting that the stock is in a downtrend.

Additionally, the 200-day moving average can also act as a support or resistance level for a stock. If the stock’s price approaches the moving average and bounces off it, the moving average may act as a support, indicating that the stock price is likely to continue its upward trend. On the other hand, if the stock’s price breaks below the moving average, it may act as a resistance level, suggesting that the stock price could decline further.

| Pros: | Cons: |

|---|---|

| Helps identify the long-term trend of a stock. | May lag behind sudden changes in price. |

| Smooths out short-term fluctuations. | Doesn’t provide information about the stock’s volatility. |

| Can act as support or resistance level. | Should be used in conjunction with other technical indicators. |

Overall, the 200-day moving average is a useful tool for traders and investors to gauge the direction of a stock’s long-term price trend. However, it should not be used as the sole indicator for making buy or sell decisions, but rather as part of a comprehensive analysis that includes other technical indicators and fundamental analysis.

The 200-day moving average is a widely used technical indicator for determining the long-term trend of a stock’s price. It is calculated by averaging the closing prices of the stock over the past 200 trading days. The 200-day moving average is important for Apple because it helps investors and traders identify the overall direction of the stock’s price movement.

Read Also: 5 Mistakes to Avoid in Options Trading

The 200-day moving average is considered a key support or resistance level. If the stock’s price is above the 200-day moving average, it is generally considered bullish and indicates that the stock is in an uptrend. On the other hand, if the stock’s price is below the 200-day moving average, it is generally considered bearish and indicates that the stock is in a downtrend.

Investors and traders often use the 200-day moving average as a signal to buy or sell Apple stock. When the stock’s price crosses above the 200-day moving average, it is seen as a bullish signal and may indicate a buying opportunity. Conversely, when the stock’s price crosses below the 200-day moving average, it is seen as a bearish signal and may indicate a selling opportunity.

The 200-day moving average also helps smooth out short-term fluctuations in the stock’s price, providing a more reliable trend indication. It can act as a support level during price pullbacks or corrections, where the stock’s price may find buying pressure and reverse its downtrend. Additionally, the 200-day moving average can act as a resistance level during price rallies, where the stock’s price may find selling pressure and reverse its uptrend.

Overall, the 200-day moving average is an important tool for investors and traders to analyze the long-term trend of Apple stock. It can help identify potential buying or selling opportunities and provide a more reliable indication of the stock’s price movement. However, it is important to remember that technical indicators should not be used in isolation and should be used in conjunction with other forms of analysis to make informed investment decisions.

The 200-day moving average is a technical indicator used by traders and investors to analyze the long-term trend of a stock or market. It is calculated by taking the average closing price of a stock over a 200-day period.

The 200-day moving average is important for Apple because it can help determine the overall trend of the stock. If the current price of Apple is above the 200-day moving average, it suggests that the stock is in an uptrend. If the price is below the 200-day moving average, it suggests that the stock is in a downtrend.

As of the latest data, Apple’s stock price has been consistently above the 200-day moving average. This indicates that the stock has been in an uptrend.

The 200-day moving average of Apple can be compared to the 200-day moving averages of other stocks to analyze their relative performance. If Apple’s stock price is above its 200-day moving average while other stocks are below theirs, it suggests that Apple is performing better than the overall market.

Understanding the Difference between Margin and Leverage in Forex Trading Forex trading has become increasingly popular in recent years, attracting …

Read ArticleHow to Create a Quant Strategy Quantitative trading strategies have become increasingly popular in recent years, as investors look for ways to …

Read ArticleAn Example of Intermarket Analysis When it comes to making investment decisions, there are many factors to consider. One approach that can provide …

Read ArticleHow to Calculate Pips in Forex PDF Are you new to forex trading and unsure how to calculate pips? Don’t worry, our comprehensive PDF guide will walk …

Read Article4 Types of API: A Comprehensive Guide Application Programming Interfaces (APIs) play a crucial role in modern software development. They allow …

Read ArticleUnderstanding Triangular Arbitrage with Examples Triangular arbitrage is a popular strategy in the world of finance and investing. It involves taking …

Read Article