Is Trading 212 suitable for beginners? A comprehensive review

Is Trading 212 Suitable for Beginners? When it comes to trading in the financial markets, beginners often find themselves overwhelmed by the sheer …

Read Article

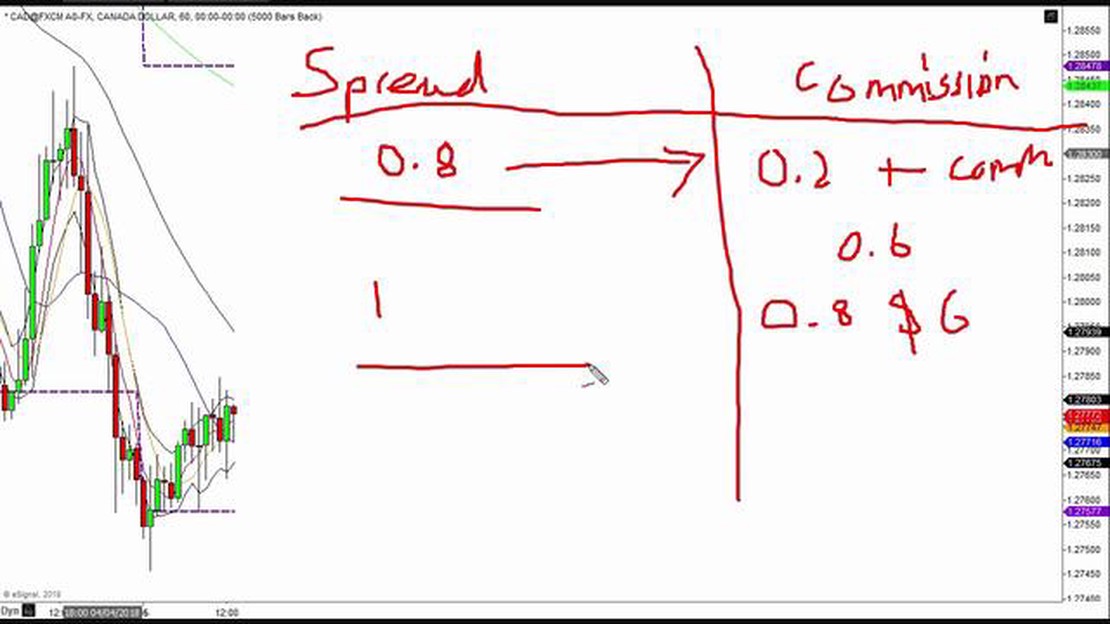

When it comes to trading, every penny counts. That’s why it’s important to know the commission structure of your broker and how it can impact your trading profits. One key factor to consider is the HFM commission per lot.

HFM, or High-Frequency Market Making, is a popular trading strategy that involves placing a large number of orders at very high speeds. This strategy can be highly profitable, but it also comes with significant costs in the form of commissions.

Knowing the HFM commission per lot can help you make informed trading decisions and maximize your profits. The commission per lot can vary depending on factors such as your broker, the type of asset being traded, and the volume of your trades.

By understanding the HFM commission per lot, you can calculate the costs associated with your trades and adjust your trading strategy accordingly. This knowledge can help you optimize your profit margins and make the most of every trade.

Don’t overlook the importance of understanding the HFM commission per lot. It can make a big difference in your trading results. Take the time to research and compare commission rates and choose a broker with a competitive commission structure. By doing so, you can maximize your trading profits and achieve your financial goals.

So, if you’re serious about trading and want to make the most of your investment, take the time to find out the HFM commission per lot and make informed trading decisions. It’s an essential step in maximizing your trading profits and achieving long-term success in the market.

In the world of trading, it is essential to understand all the costs associated with your trades. One crucial factor to consider is the commission charged by your broker per lot traded. This commission can significantly affect your trading gains and overall profitability.

At HFM, we are committed to transparency, and we provide our clients with competitive commission rates. By knowing the HFM commission per lot, you can make informed decisions about your trading strategy and maximize your profits.

Our commission structure is designed to be fair and competitive, ensuring that you get the most out of every trade. We offer a tiered pricing system based on trading volume, which means that the more you trade, the lower your commission per lot becomes.

Here’s how the HFM commission per lot structure works:

By choosing HFM as your broker, you can benefit from our competitive commission rates and potentially boost your trading gains.

Read Also: What is the current Average True Range? Learn more about this volatility indicator.

It’s important to note that while commission per lot is a significant factor in trading profitability, it is not the only one. Other costs, such as spreads, swap rates, and slippage, should also be taken into account when calculating your overall trading costs.

At HFM, we strive to offer our clients a transparent and cost-effective trading environment. By uncovering the HFM commission per lot and considering other trading costs, you can make more informed decisions and work towards maximizing your trading profits.

Read Also: What is an Expert Advisor in Forex? All You Need to Know

Calculating the commission charges for trading with HFM can be a crucial aspect in maximizing your trading profits. Understanding how the HFM commission structure works is essential for traders who want to achieve optimal results. In this article, we will guide you through the process of calculating the HFM commission charges, empowering you to make informed trading decisions.

It is important to note that the HFM commission charges are based on the lot size of your trades. The lot size refers to the volume of assets that you are trading. To calculate the commission charges, you will need to take into account the lot size and the applicable commission rate set by HFM.

Let’s break down the calculation process step by step:

Once you have calculated the commission charges, you can factor them into your trading strategy. By understanding how the HFM commission charges work, you can make more accurate predictions about your potential trading profits and adjust your trading approach accordingly.

It is important to note that commission charges can vary depending on various factors, such as the type of account you have with HFM, your trading volume, and your trading frequency. It is recommended to regularly review the commission charges and stay updated with any changes made by HFM.

By learning how to calculate HFM commission charges, you can take control of your trading costs and optimize your trading strategy. Remember to consider the lot size and the applicable commission rate to accurately calculate the commission charges for each trade. Utilize this knowledge to make better-informed trading decisions and maximize your trading profits with HFM.

HFM commission is a fee charged by the broker for each lot traded on their platform. It is usually a fixed amount or a percentage of the trade value.

You can find out the HFM commission per lot by checking your broker’s fee schedule or contacting their customer support. The commission may vary depending on the type of account you have and the volume of your trades.

Knowing the HFM commission per lot is important because it helps you calculate your trading costs and determine the profitability of your trades. By minimizing the commission fees, you can maximize your trading profits.

By knowing the HFM commission per lot, you can choose the most cost-effective trading strategy and minimize your trading costs. This can be done by selecting a broker with low commission fees or by optimizing your trade size to reduce the impact of the commission on your overall profits.

Is Trading 212 Suitable for Beginners? When it comes to trading in the financial markets, beginners often find themselves overwhelmed by the sheer …

Read ArticlePrediction for NMDC NMDC is a public sector undertaking (PSU) in India engaged in the exploration, mining, and processing of iron ore. As one of the …

Read ArticleWhen does the Tokyo trading session open? The Tokyo trading session is one of the major forex trading sessions in the world. It is known for its high …

Read ArticleUnderstanding Stock Options in India Welcome to our comprehensive guide on understanding stock options in India. In this article, we will delve into …

Read ArticleUnderstanding Binary and Forex Options: A Beginner’s Guide When it comes to investing, there are several options available in the market. Two popular …

Read Article1 Dollar to Rupiah Conversion The exchange rate between the US Dollar (USD) and the Indonesian Rupiah (IDR) is an important aspect of international …

Read Article