Best Software for Trading: Find the Right Choice for You

Choosing the Best Software for Trading Trading in today’s fast-paced financial markets requires sophisticated and reliable software. With so many …

Read Article

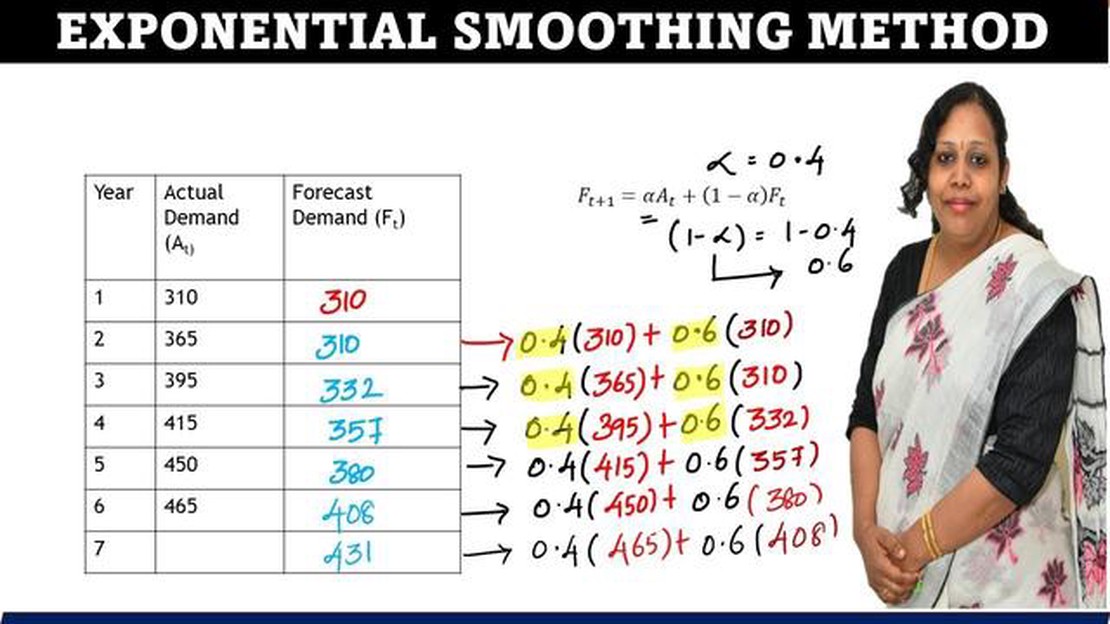

Exponential smoothing is a widely used technique in forecasting and time series analysis. It is a method that uses weighted averaging to forecast future values based on past observations. One of the key parameters in exponential smoothing is the smoothing constant, also known as the alpha parameter. The value of the smoothing constant determines how much weight is given to the most recent observations. The higher the value of the smoothing constant, the more weight is given to recent observations and the less weight is given to older observations.

The value of the smoothing constant is typically chosen based on the characteristics of the data and the desired level of smoothing. A value close to 1 will give more weight to recent observations, resulting in a faster response to changes in the data. A value close to 0 will give equal weight to all observations, resulting in a slower response to changes in the data. The choice of the smoothing constant depends on the trade-off between responsiveness and stability of the forecast.

It is important to note that the value of the smoothing constant is not fixed and can be adjusted over time. This allows for adjustments to be made based on the changing characteristics of the data. For example, if the data becomes more volatile, a lower value of the smoothing constant may be chosen to reduce the impact of outliers. Conversely, if the data becomes more stable, a higher value of the smoothing constant may be chosen to give more weight to recent observations.

In conclusion, the value of the smoothing constant in exponential smoothing is an important parameter that determines how much weight is given to the most recent observations. The choice of the smoothing constant depends on the characteristics of the data and the desired level of smoothing. It is a parameter that can be adjusted over time to account for changes in the data. The value of the smoothing constant plays a crucial role in the accuracy and effectiveness of the exponential smoothing method.

Exponential smoothing is a time series forecasting method that is used to predict future values based on past observations. It is a simple and powerful technique that puts more weight on recent data while giving less importance to older data. The method involves assigning weights to each observation in the series, with higher weights assigned to more recent observations. The smoothing constant, also known as alpha or the smoothing factor, determines the rate at which the weights decrease.

The purpose of exponential smoothing is to create a smoothed series that captures the underlying trend and pattern in the data, while minimizing the effect of random fluctuations or random noise. By smoothing out the data, the method helps to remove or reduce the impact of outliers, anomalies, or irregularities, making it easier to analyze the overall trend and make accurate forecasts.

Exponential smoothing can be applied to a wide range of time series data, such as sales figures, stock prices, or weather data, to forecast future values and make informed decisions. It provides a flexible and flexible forecasting tool that is relatively simple to understand and implement, making it popular among practitioners and analysts in various industries.

The smoothing constant is a crucial parameter in the exponential smoothing method, used for forecasting and time series analysis. It determines the weight given to past observations when calculating the forecast value for the next period.

By adjusting the value of the smoothing constant, analysts can choose the level of responsiveness in the forecasting model. A smaller value would result in a more stable forecast that reacts slowly to changes, while a larger value would make the forecast more sensitive to recent fluctuations.

The choice of the smoothing constant depends on the nature of the data and the specific forecasting goals. For example, if the data reveals a high level of noise or volatility, a smaller smoothing constant may be preferred to smooth out the erratic fluctuations. On the other hand, if the data has a clear trend or seasonality pattern, a larger smoothing constant may better capture these underlying patterns.

However, it is important to note that selecting the optimal smoothing constant is not an easy task. It often requires experimentation and validation with different values to determine which one produces the best forecast accuracy. Analysts may use statistical techniques such as mean squared error or cross-validation to assess and compare the performance of different smoothing constants.

Additionally, the choice of the smoothing constant also has implications for the forecast horizon. A smaller smoothing constant may work well for shorter-term forecasts with frequent updates, while a larger smoothing constant may be better suited for longer-term forecasts with less frequent updates.

Read Also: Top Strategies for Successful Options Trading in 2021 | Expert Tips

In summary, the smoothing constant plays a critical role in the exponential smoothing method. Its value determines the balance between responsiveness and stability in the forecast, and should be carefully chosen based on the data characteristics and forecasting objectives.

The smoothing constant, also known as the alpha value, is a parameter in the exponential smoothing method that controls the rate at which the forecast adjusts to changes in the data. It plays a crucial role in determining the smoothness and responsiveness of the forecast.

To determine the appropriate value for the smoothing constant, several factors need to be considered. The choice of the smoothing constant should strike a balance between the desire for a smooth forecast and the responsiveness to recent changes in the data. A higher value of the smoothing constant will lead to a more reactive forecast, quickly incorporating new information, but it may also amplify random fluctuations and noise in the data. Conversely, a smaller value will result in a smoother forecast, but it may lag behind changes in the data.

There are several methods to determine the value of the smoothing constant. One approach is to use a trial and error process, where different values are tested to see how well they fit the historical data. This can be done manually or by using optimization algorithms. Another method is the mean absolute deviation (MAD), which calculates the average absolute difference between the actual and forecasted values. The smoothing constant that minimizes the MAD is considered the optimal choice.

Read Also: Does restricted stock qualify for QSBS? | Guide to Qualified Small Business Stock

Additionally, time series analysis techniques such as autocorrelation and partial autocorrelation can provide insights into the underlying patterns and seasonality in the data, which can guide the selection of the smoothing constant. Domain knowledge and expert judgment also play a significant role in determining the appropriate value, considering factors such as the nature of the data, frequency of updates, and the desired level of responsiveness.

It is important to validate the chosen value of the smoothing constant by assessing the accuracy of the forecast against actual data. Adjustments may need to be made if the forecast consistently underperforms or overreacts to changes in the data. Regular monitoring and evaluation of the forecasting performance can help identify any necessary adjustments to the smoothing constant.

In conclusion, determining the value of the smoothing constant in exponential smoothing is a complex task that requires a thoughtful consideration of the desired forecast characteristics, data patterns, and expert judgment. Through careful selection and evaluation, an appropriate value can be chosen that balances the need for a smooth forecast with responsiveness to changes in the data.

The smoothing constant, also known as the alpha parameter, is used to control the weight given to past observations in the exponential smoothing method. It determines how quickly the influence of older observations diminishes over time.

The value of the smoothing constant is typically determined through a process of trial and error or through the use of optimization techniques. It is often selected based on historical data or expert judgment to achieve the desired level of smoothing and forecast accuracy.

If the smoothing constant is set to a value close to zero, the exponential smoothing method will give more weight to recent observations and less weight to past observations. This can result in a forecast that is more responsive to recent changes in the data, but also more prone to noise or random fluctuations.

If the smoothing constant is set to a value close to one, the exponential smoothing method will give equal weight to all observations, regardless of their age. This can result in a forecast that is less responsive to recent changes in the data, but more stable and less prone to noise.

Yes, the value of the smoothing constant can be adjusted or updated over time in the exponential smoothing method. This can be done to adapt the model to changing patterns or behavior in the data, or to improve the accuracy of the forecasts.

The purpose of the smoothing constant in exponential smoothing method is to control the weight given to previous observations when forecasting future values. It determines the rate at which the influence of past observations decays over time.

The value of the smoothing constant in exponential smoothing method is determined by the analyst or forecaster. It is typically chosen based on the characteristics of the time series being analyzed and the specific forecasting goals. A higher value of the smoothing constant places more weight on recent observations, while a lower value places more weight on past observations.

Choosing the Best Software for Trading Trading in today’s fast-paced financial markets requires sophisticated and reliable software. With so many …

Read ArticleExploring the Trading Empire of the Mapungubwe The Mapungubwe Trading Empire was a renowned civilization that thrived in Southern Africa from the 9th …

Read ArticleMA vs VWMA: Understanding the Key Differences When it comes to analyzing financial markets, moving averages (MA) and volume-weighted moving averages …

Read ArticleMinimum Deposit in FBS: What’s the Amount? Introduction: Table Of Contents What is the Minimum Deposit in FBS? FBS: Overview Minimum Deposit in 2021 …

Read ArticleWhat is the value of 1 pip? Forex trading is a popular form of investment where traders buy and sell currencies on the foreign exchange market. …

Read ArticleCan forex trading be done in part-time? Forex trading, also known as foreign exchange trading, has gained popularity among individuals interested in …

Read Article