Forex vs Trading: Which One is Right for You?

Forex or Trading: Which One is Better? When it comes to financial markets, Forex and trading are two popular options that attract many individuals. …

Read Article

The foreign exchange market, also known as forex or FX, is a decentralized global marketplace where currencies are traded. It operates 24 hours a day, five days a week, allowing participants from around the world to engage in currency trading. Forex markets play a crucial role in the global economy, facilitating international trade and investment by enabling the exchange of one currency for another.

Understanding how forex markets integrate is essential for anyone interested in trading currencies or having exposure to foreign exchange risks. The integration of forex markets refers to the interconnections and interdependencies between different currencies and their respective markets. These connections are influenced by various factors, including economic fundamentals, geopolitical events, market sentiment, and technological advancements.

One of the key drivers of forex market integration is the concept of exchange rates. Exchange rates determine the relative value of different currencies and play a vital role in facilitating international trade. Changes in exchange rates can have significant impacts on the competitiveness of goods and services, making them a crucial consideration for businesses and policymakers alike.

Another factor that influences the integration of forex markets is capital flows. Investors and speculators around the world allocate their capital to different countries and currencies based on various factors such as interest rates, economic growth prospects, and political stability. These capital flows contribute to the interconnectedness of forex markets, as investors seek opportunities for returns and diversification.

In this comprehensive guide, we will explore the various aspects of forex market integration, including the role of exchange rates, capital flows, and the impact of global events on currency movements. We will also delve into the factors that drive market integration and the tools and strategies used by traders to navigate these interconnected markets. By gaining a deeper understanding of forex market integration, you will be better equipped to make informed decisions when participating in currency trading or managing foreign exchange risks.

Forex trading, also known as foreign exchange trading or currency trading, is the buying and selling of currencies on the global market. It is the largest and most liquid financial market in the world, with trillions of dollars being traded every day.

The forex market operates 24 hours a day, five days a week, allowing traders to participate in trading activities at any time. Unlike other financial markets, such as the stock market, forex trading does not have a central exchange. Instead, it is conducted electronically over-the-counter (OTC), which means that transactions are carried out directly between participants.

Read Also: Is it a good idea to trade during earnings season?

The main participants in the forex market are commercial banks, central banks, corporations, institutional investors, and retail traders. Each participant plays a different role in the market, with commercial banks being the largest and most influential players.

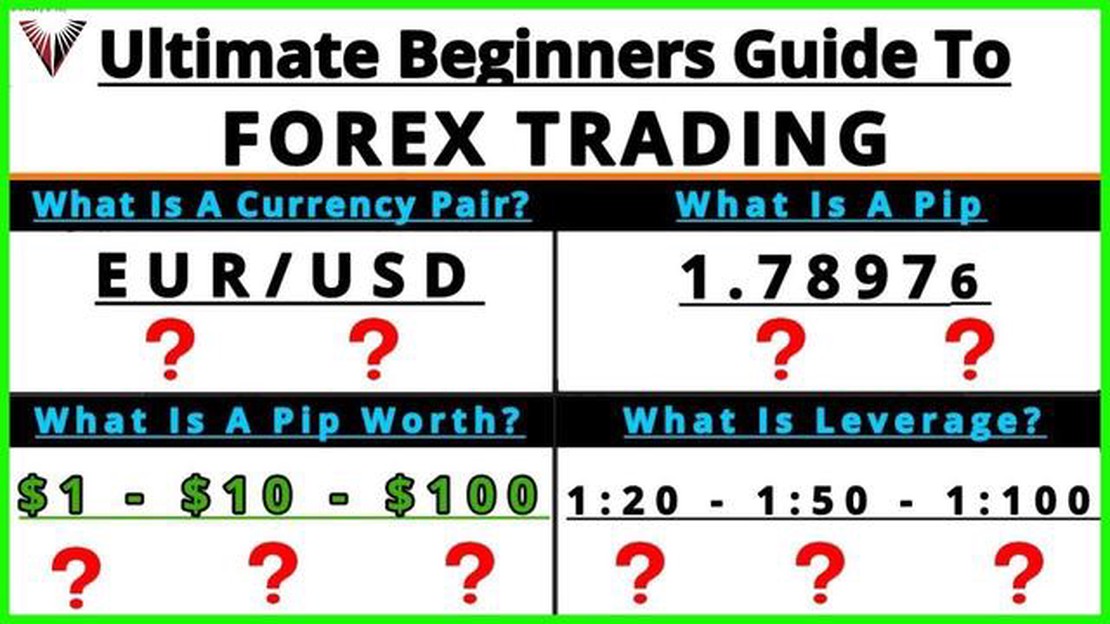

Forex trading involves speculating on the price movements of currency pairs. A currency pair consists of two currencies, with the value of one currency being quoted against the value of the other. For example, the EUR/USD pair represents the exchange rate between the Euro and the US Dollar.

Traders can take long or short positions on currency pairs, depending on whether they believe the value will appreciate or depreciate. They can make profits by selling a currency at a higher price than they bought it or by buying at a lower price and selling at a higher price.

Forex trading is often seen as a high-risk, high-reward investment strategy. It requires extensive knowledge, experience, and analysis of economic and geopolitical factors that can affect currency prices. Traders use various tools and techniques, such as charts, indicators, and fundamental analysis, to make informed trading decisions.

In conclusion, forex trading is the buying and selling of currencies on the global market. It offers opportunities for traders to profit from fluctuations in currency prices, but it also carries significant risks. Successful forex trading requires a deep understanding of the market, careful risk management, and continuous learning.

Forex trading, also known as foreign exchange trading, has gained immense popularity in recent years. There are several reasons why it has become a preferred option for investors and traders alike.

| 1. High Liquidity: | The forex market is the largest financial market in the world with a daily trading volume that exceeds trillions of dollars. This high liquidity ensures that traders can enter and exit positions quickly and easily, without causing significant price movements. |

| 2. Accessibility: | Forex trading is accessible to anyone with an internet connection and a computer or smartphone. There is no need for a centralized exchange, and trading can take place 24 hours a day, five days a week, allowing traders to engage in the market at their convenience. |

| 3. Leverage: | Forex brokers offer high leverage ratios, which enables traders to control larger positions with a smaller initial investment. This allows traders to amplify potential profits, but it also carries an increased risk of losses if not managed properly. |

| 4. Diverse Range of Trading Opportunities: | The forex market offers a wide range of trading opportunities, allowing traders to speculate on movements in various currency pairs. Additionally, there are numerous technical indicators, charts, and tools available that aid in analyzing the market, making it an appealing option for those who enjoy technical analysis. |

| 5. Volatility: | The forex market is known for its volatility, which can provide significant profit opportunities. Traders can take advantage of both upward and downward price movements, maximizing their potential returns. |

| 6. Staying Ahead of Global Developments: | Forex trading allows traders to stay informed and react quickly to global events and economic developments. Currencies are highly influenced by geopolitical events, news releases, and economic data, making forex trading an attractive option for those who closely follow such factors. |

| 7. Low Transaction Costs: | The transaction costs associated with forex trading are generally low compared to other financial markets. Forex brokers often charge a small commission or make money through the spread between bid and ask prices, making it cost-effective for traders. |

These factors, among others, contribute to the popularity of forex trading. However, it is essential for individuals to understand the risks involved and develop a solid trading strategy before engaging in forex trading.

Read Also: Can You Trade Pokemon Black with Black 2? Find Out Now!

Forex trading refers to the buying and selling of currencies on the foreign exchange market. It is the largest and most liquid financial market in the world, where trillions of dollars are traded daily.

Forex trading involves the simultaneous buying of one currency and selling of another. Currency pairs are traded on the foreign exchange market, and the value of a currency is determined by its supply and demand. Traders speculate on the movements of currency exchange rates and make profits by buying low and selling high.

Forex trading offers several benefits, including high liquidity, 24-hour trading availability, leverage, and the ability to profit from both rising and falling markets. It also provides a wide range of currency pairs to trade, allowing traders to diversify their investments.

The major participants in the Forex market include banks, central banks, corporations, hedge funds, and individual traders. Banks are the largest players, accounting for a significant portion of the daily trading volume. Central banks also influence the foreign exchange market through their monetary policies.

Several factors can influence the Forex market, including economic indicators, central bank decisions, geopolitical events, and market sentiment. Economic indicators such as GDP, inflation, and employment data can have a significant impact on currency exchange rates. Central bank decisions, such as interest rate changes, can also cause volatility in the market.

Forex market integration refers to the level of interconnectedness and similarity between different forex markets around the world. It measures how closely related and synchronized these markets are in terms of price movements, liquidity, and trading volume.

Forex or Trading: Which One is Better? When it comes to financial markets, Forex and trading are two popular options that attract many individuals. …

Read ArticleHow to Make 50 Pips a Day: Effective Strategies and Tips Welcome to the world of Forex trading, where fortunes are made and lost in the blink of an …

Read ArticleDoes divergence trading work? Divergence trading is a popular approach among Forex and stock traders, based on the belief that divergences between …

Read ArticleWhat is Trident trading? Trident Trading is a financial investment strategy that focuses on taking advantage of short-term market fluctuations. It is …

Read ArticleWhich country has the lowest currency? In the world of currency exchange rates, there are many countries that have a low valuation for their currency. …

Read ArticleAre Chat Rooms Still Relevant Today? In the fast-paced digital age, where social media and instant messaging applications dominate the landscape, one …

Read Article