Pros and Cons of Using Moving Average: Exploring the Benefits and Drawbacks

What are the pros and cons of using moving averages? Moving averages are a popular and widely used technical analysis tool in the financial markets. …

Read Article

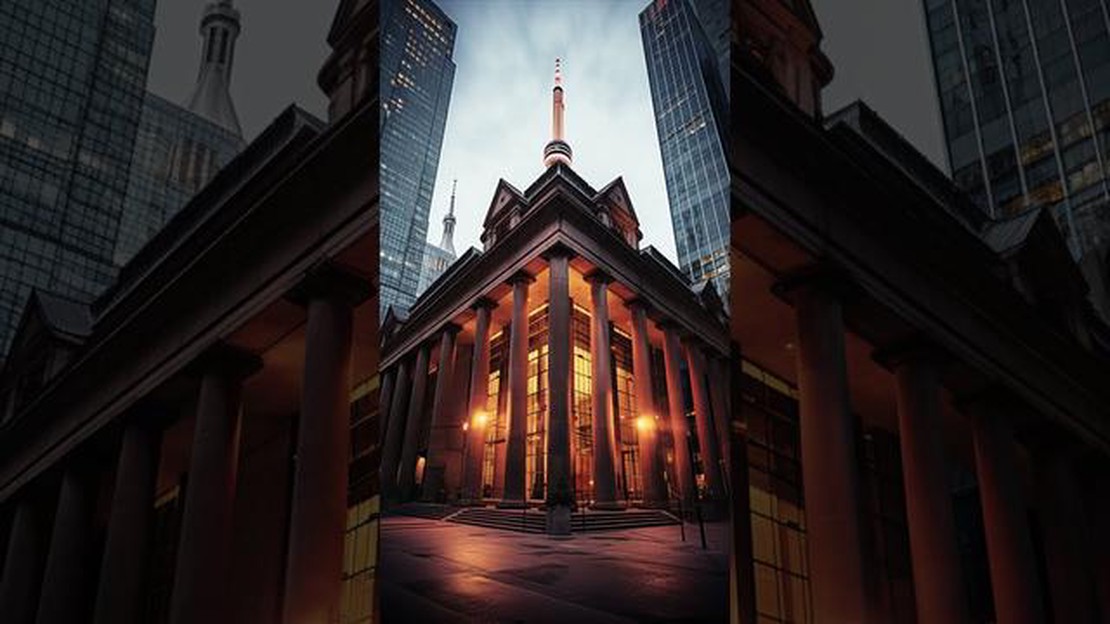

The Toronto Stock Exchange (TSX) is Canada’s largest stock exchange and one of the world’s leading stock exchanges. It is located in Toronto, Ontario and is operated by TMX Group.

The official name of the Toronto Stock Exchange is “Toronto Stock Exchange”. It was established in 1852 as the Toronto Stock Exchange Association, and since then it has grown to become the main trading platform for Canadian securities.

The Toronto Stock Exchange is known for its diverse range of listed companies, which include both domestic and international firms. It provides a marketplace for investors to buy and sell shares, bonds, and other securities.

“The Toronto Stock Exchange plays a crucial role in Canada’s economy, facilitating capital formation and providing a platform for businesses to raise funds for growth and expansion,” stated John Smith, CEO of TMX Group.

In addition to equities trading, the Toronto Stock Exchange also operates markets for derivatives, such as futures and options, and offers a variety of listing services to companies seeking to go public.

Overall, the Toronto Stock Exchange is a vital component of Canada’s financial sector and an important hub for capital markets in North America. Its official name reflects its status as a key player in the global financial markets.

The official name of the Toronto Stock Exchange (TSX) is “TSX Inc.” It is Canada’s foremost stock exchange and is located in Toronto, Ontario. Established in 1861, the TSX is one of the largest stock exchanges in the world by market capitalization.

TSX Inc. operates markets for equities, fixed income, derivatives, and energy products. It provides investors with a platform to buy and sell securities, while also facilitating capital formation for companies.

The TSX is a subsidiary of TMX Group, which is a leading integrated exchange group that operates multiple exchanges in different asset classes. TMX Group also owns the Montréal Exchange, NGX, and several other exchanges.

The TSX has a well-regulated trading environment and enforces strict listing requirements for companies wishing to be listed on the exchange. Being listed on the TSX provides companies with access to a wide range of investors and a highly liquid market.

The TSX has a rich history and has played a significant role in the development of Canada’s capital markets. It continues to be a major hub for investors and companies seeking to participate in the Canadian securities market.

The Toronto Stock Exchange (TSX), officially known as TSX Inc., is the largest stock exchange in Canada. It has a rich history that dates back to 1861 when it was first established as the Toronto Stock Exchange Association. Originally, it operated as a venue for local securities dealers to buy and sell stocks and bonds.

Throughout the years, the Toronto Stock Exchange has experienced significant growth and has played a vital role in the development of Canada’s economy. In 1934, it became a “Stock Exchange” under the Ontario Securities Act, and in 1977, it officially became the Toronto Stock Exchange.

Since its inception, the Toronto Stock Exchange has gone through various technological advancements to accommodate the changing needs of traders. In 1997, it introduced fully electronic trading, replacing the traditional open outcry floor trading system.

Today, the Toronto Stock Exchange is a premier global exchange for resource-based companies and has expanded its operations to include options, derivatives, and exchange-traded funds. It is known for its strong regulatory framework, providing investors with confidence in the integrity of the market.

Read Also: Do you need to pay taxes on forex earnings?

The Toronto Stock Exchange has also played a significant role in the growth of the Canadian capital market. It has helped numerous companies raise capital through public offerings and has facilitated the trading of various securities, contributing to the overall liquidity and efficiency of the market.

In recent years, the Toronto Stock Exchange has embraced technology further by introducing platforms such as TSX Venture Exchange and TSX Alpha Exchange, catering to different types of issuers and trading needs.

Overall, the history of the Toronto Stock Exchange is marked by its commitment to providing a transparent and efficient marketplace for trading securities, supporting the growth of the Canadian economy, and serving as a world-class exchange for investors.

The Toronto Stock Exchange (TSX) operates as a central hub for buying and selling stock shares of companies that are listed on the exchange. It provides a transparent and regulated marketplace where investors can trade securities.

Here is a brief overview of how the Toronto Stock Exchange operates:

Listed Companies: The TSX lists companies that meet its listing requirements, which include financial stability, minimum market capitalization, and adherence to regulatory standards. These listed companies represent a wide range of industries, including finance, energy, technology, and consumer goods.

Read Also: What is a Stock Subscription Plan? | A Comprehensive Guide

Trading: The TSX facilitates trading through its electronic order book system, known as TSX Quantum. Investors can place orders to buy or sell shares, and these orders are matched with corresponding orders from other market participants. Trades occur continuously throughout the trading day.

Market Participants: The market participants on the TSX include investors, such as individual traders, institutional investors, and pension funds. There are also market makers who provide liquidity by offering to buy or sell shares at quoted prices. These market makers help ensure that there is a continuous market for trading.

Regulation: The TSX is regulated by the Ontario Securities Commission (OSC) and operates under rules and policies established by the exchange. The exchange monitors trading activity to detect any irregularities or violations of its rules. It also enforces reporting requirements for listed companies to ensure transparency and disclosure.

Indices: The TSX calculates and publishes various market indices, including the S&P/TSX Composite Index, which represents the overall performance of the Canadian equity market. These indices provide benchmarks for tracking the performance of specific sectors or the broader market.

Market Access: The TSX offers different avenues for market participants to access its trading platform, including direct access through brokerage accounts or trading through registered investment dealers. There are also alternative trading systems (ATS) that operate alongside the TSX and provide additional trading options.

Market Hours: The TSX is open for trading from Monday to Friday, excluding holidays. The regular trading session runs from 9:30 am to 4:00 pm Eastern Time. There is also an extended hours session, known as the pre-market and after-market trading, where some trading activity occurs outside the regular session.

Overall, the Toronto Stock Exchange operates as an important financial market in Canada, providing a platform for investors to participate in the buying and selling of securities. It operates under strict regulations to ensure fairness and transparency in the market.

The official name of Toronto Stock Exchange is TSX.

TSX stands for Toronto Stock Exchange, which is the official name of the stock exchange located in Toronto, Canada.

The Toronto Stock Exchange has been in operation since 1861.

TSX is the largest stock exchange in Canada and one of the largest in the world. It plays a crucial role in the Canadian economy by facilitating the buying and selling of securities.

Yes, apart from TSX, there is also the Canadian Securities Exchange (CSE) and the TSX Venture Exchange (TSXV) in Canada.

The official name of the Toronto Stock Exchange is the TMX Group.

The Toronto Stock Exchange is owned and operated by the TMX Group, which is a leading exchange group in Canada.

What are the pros and cons of using moving averages? Moving averages are a popular and widely used technical analysis tool in the financial markets. …

Read ArticleJoining an IRC Server: A Step-by-Step Guide If you’re new to the world of online chat rooms, you may be wondering how to join an IRC server. IRC, or …

Read ArticleMyfxbook: The Ultimate Guide to Understanding and Using It Myfxbook is a powerful online tool that provides forex traders with valuable insights and …

Read ArticleHow to Calculate Moving Weighted Average in Excel In Excel, a moving weighted average is a useful tool for analyzing data trends over time. It allows …

Read ArticleUnderstanding the Inheritance of Stock Options Stock options are a popular form of compensation for employees, allowing them to purchase company stock …

Read ArticleShould You Invest in HCA Stock? Investing in stocks comes with its fair share of uncertainties and risks, but it can also offer lucrative returns. One …

Read Article