Is options trading legal and possible in Canada?

Options Trading in Canada: Everything You Need to Know Options trading is a popular investment strategy that allows traders to speculate on the price …

Read Article

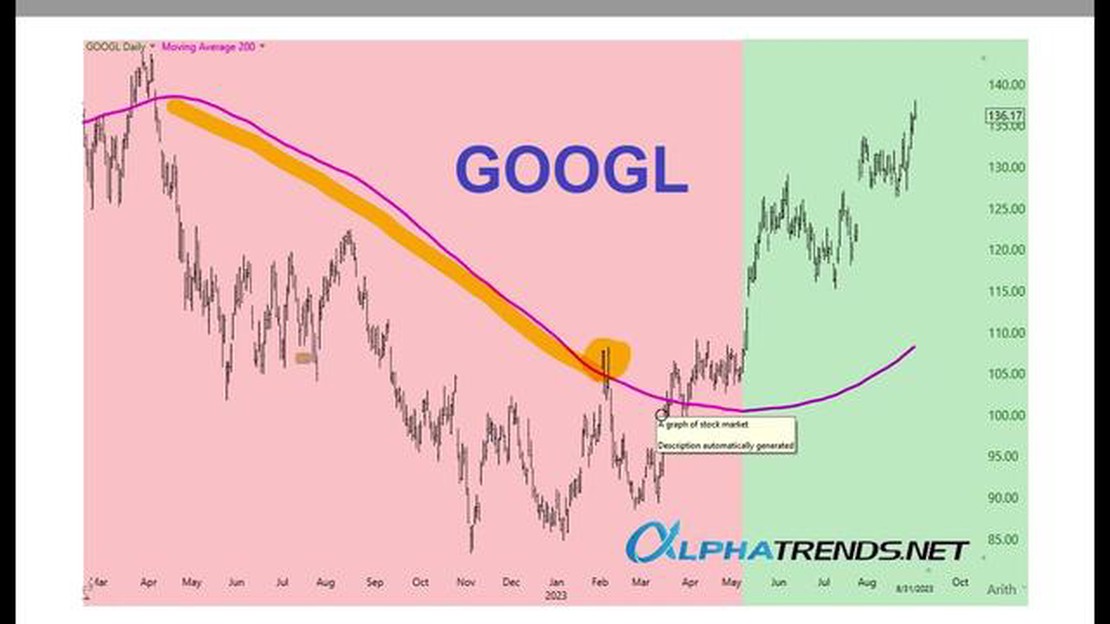

The 200-day moving average is a technical indicator used to analyze the long-term trend of a stock or an index. It is a widely followed tool among traders and investors and is often used as a measure of the overall market sentiment.

The formula for calculating the 200-day moving average is quite simple. It involves adding up the closing prices of a stock or an index for the past 200 trading days and then dividing the sum by 200. This calculation is repeated on a daily basis to get the current value of the moving average.

Formula:

200-day Moving Average = Sum of Closing Prices for the Past 200 Trading Days / 200

The 200-day moving average is considered to be a significant level of support or resistance. When the price of a stock or an index is trading above its 200-day moving average, it is generally considered to be in an uptrend. Conversely, when the price is below the 200-day moving average, it is considered to be in a downtrend.

The 200-day moving average is often used in conjunction with other technical indicators to make trading decisions. It can help traders identify potential entry and exit points and can also provide signals for trend reversals.

Overall, the 200-day moving average is a powerful tool for technical analysis and can provide valuable insights into the long-term trend of a stock or an index.

The 200-day moving average is a popular technical indicator used in financial markets to analyze the long-term trend of an asset’s price. It is calculated by adding up the closing prices of an asset for the past 200 trading days and then dividing the sum by 200. The result is a smoothed line that represents the average price of the asset over a longer period of time.

The 200-day moving average is often used by traders and investors to determine the overall direction of the market and identify potential support and resistance levels. If the price of an asset is trading above its 200-day moving average, it is generally considered to be in an uptrend, while a price below the moving average indicates a downtrend. Traders may use this information to make trading decisions, such as buying when the price is above the moving average or selling when it is below.

The 200-day moving average is considered to be a significant indicator because it provides a smoothed average price over a long period of time, reducing the impact of short-term price fluctuations. This can help filter out noise and provide a clearer picture of the asset’s overall trend. However, it is important to note that no indicator is perfect and should not be relied upon solely for making trading decisions. It is always recommended to use the moving average in conjunction with other technical indicators and analysis techniques.

In conclusion, the 200-day moving average is a widely used tool in technical analysis that helps investors and traders identify long-term trends in the market. By calculating the average price of an asset over a 200-day period, it provides a smoothed line that can be used to determine the overall direction of the market. It is important to use the moving average in conjunction with other indicators and analysis techniques for a comprehensive understanding of the market.

Read Also: What does hyper trading do? Learn about the benefits of hyper trading

The purpose of the 200-day moving average is to provide investors and traders with a long-term trend indicator for a particular security or asset. It is commonly used in technical analysis to determine the overall direction of a security’s price movement over a longer time frame.

The 200-day moving average is calculated by averaging the closing prices of a security over a 200-day period. This average is plotted on a chart, and can act as a support or resistance line. Traders will often use the 200-day moving average as a reference point for making trading decisions.

One of the main purposes of the 200-day moving average is to smooth out short-term price fluctuations and provide a more accurate representation of the underlying trend. By looking at a longer-term moving average, traders can identify the overall direction of a security and avoid making rash decisions based on short-term price movements.

Another purpose of the 200-day moving average is to identify potential areas of support or resistance. When a security’s price is above the 200-day moving average, it is generally considered to be in an uptrend and the moving average can act as a support level. Conversely, when a security’s price is below the 200-day moving average, it is considered to be in a downtrend and the moving average can act as a resistance level.

Furthermore, the 200-day moving average can be used as a signal for when to buy or sell a security. When a security’s price crosses above the 200-day moving average, it is seen as a bullish signal and a potential buying opportunity. On the other hand, when a security’s price crosses below the 200-day moving average, it is seen as a bearish signal and a potential selling opportunity.

In conclusion, the purpose of the 200-day moving average is to provide a long-term trend indicator, smooth out short-term price fluctuations, identify areas of support or resistance, and generate trading signals. It is an important tool for investors and traders looking to analyze the overall direction of a security’s price movement.

To calculate the 200-day moving average, you need to follow these steps:

As you continue to calculate and plot the 200-day moving average, the oldest data point will be dropped from the calculation, and the newest one will be added. This process helps smooth out any short-term fluctuations in the price and provides a clearer picture of the long-term trend.

Read Also: How much is $100 Singapore to US dollar? - Conversion rates and calculators

The 200-day moving average is commonly used in technical analysis to identify the direction of the overall trend. Traders and investors may use it to generate buy or sell signals when the price crosses above or below the 200-day moving average line.

It’s worth noting that the 200-day moving average is just one of many moving average periods that traders can use. Other common periods include the 50-day and 100-day moving averages, which provide shorter-term trends.

The formula for calculating the 200-day moving average is to sum up the closing prices of the asset over the past 200 days and then divide it by 200.

The 200-day moving average is considered significant because it provides a long-term trend indicator. It smooths out short-term price fluctuations and helps determine the overall direction of the price movement.

In technical analysis, the 200-day moving average is often used as a signal for trend reversals. When the price crosses above the 200-day moving average, it is considered a bullish signal, while a cross below indicates a bearish signal.

Yes, the 200-day moving average can be applied to any asset, such as stocks, commodities, or cryptocurrencies. It is a widely used technical indicator in various financial markets.

No, there are various moving averages used in trading, such as the 50-day, 100-day, and 200-day moving averages. Traders choose different moving averages based on their trading strategy and time frame preference.

A moving average is an indicator used in technical analysis that helps to smooth out price data by creating a constantly updated average price.

The 200-day moving average is considered to be a long-term trend indicator. It helps traders and investors identify the overall direction of a security or market. When the price is above the 200-day moving average, it is generally seen as a bullish signal, while a price below it is considered bearish.

Options Trading in Canada: Everything You Need to Know Options trading is a popular investment strategy that allows traders to speculate on the price …

Read ArticleChoosing the Right Moving Average Period When it comes to technical analysis in the stock market, one of the most commonly used tools is the moving …

Read ArticleIs RSI Divergence Effective in Forex Trading? Technical analysis is an essential tool for traders in the forex market. One popular indicator used by …

Read ArticleStrategies for Maximizing Profit in Option Trading Option trading can be a highly lucrative investment strategy if approached with the right knowledge …

Read ArticleIs it profitable to play on the stock exchange? Investing in the stock exchange can be a lucrative venture. With the potential for high returns, many …

Read ArticleWhere to Exchange Currency for Euros Exchanging currency for euros can be a daunting task, especially if you are unfamiliar with the best places to do …

Read Article