Calculating seasonal indexes with the moving average method

Calculating Seasonal Indexes Using the Moving Average Method The moving average method is a commonly used technique in statistical analysis for …

Read Article

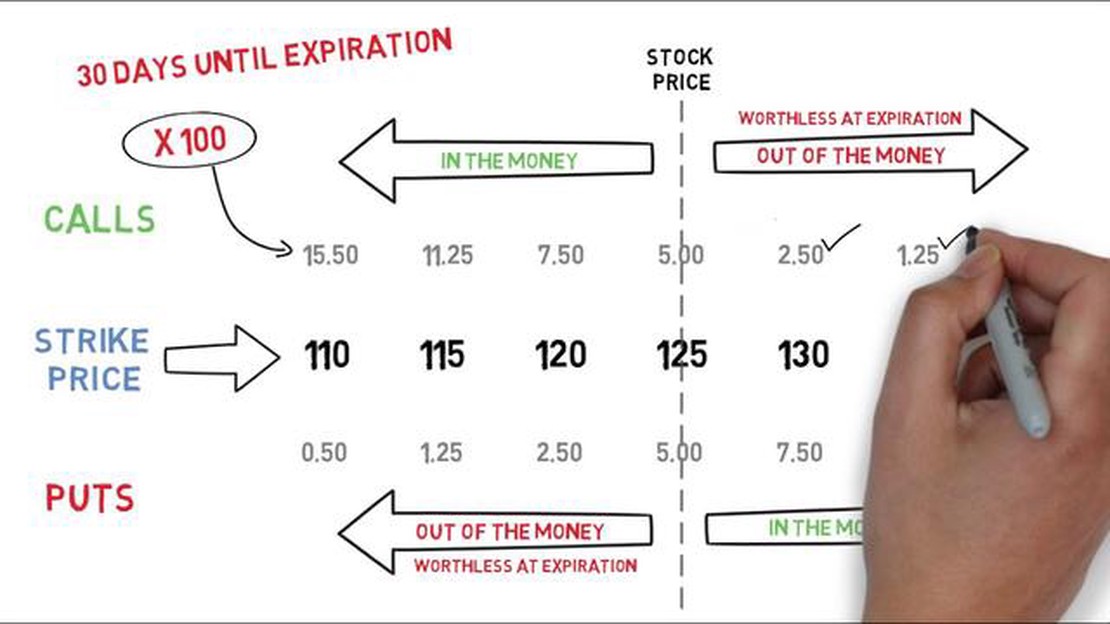

Option value calculator is a powerful tool used in financial markets to determine the value of an option contract. Options are derivatives that give traders the right, but not the obligation, to buy or sell an underlying asset at a predefined price within a specific time frame. The value of an option is influenced by various factors, such as the price of the underlying asset, the time remaining until expiration, and the volatility of the market.

The option value calculator uses mathematical models, such as the Black-Scholes model, to estimate the fair value of an option. This calculation takes into account the current price of the underlying asset, the strike price, the time to expiration, the risk-free interest rate, and the implied volatility. By inputting these parameters into the calculator, traders can get an estimate of the option’s value.

The option value calculator is a valuable tool for traders and investors as it helps them in making informed decisions about buying or selling options. It allows them to compare the calculated value of an option with its market price and assess whether it is undervalued or overvalued. Additionally, the calculator can be used to analyze different scenarios and understand the impact of changes in underlying asset price, time to expiration, and volatility on the option’s value.

Example: Let’s consider a call option on a stock with a current market price of $50. The strike price is $55, and the option has an expiration of 30 days. The risk-free interest rate is 2% and the implied volatility is 20%. By using the option value calculator, we can estimate the fair value of the call option and determine whether it is a good investment opportunity.

In conclusion, the option value calculator is a powerful tool that allows traders and investors to determine the value of an option contract based on various factors. By using this calculator, they can make informed decisions and analyze different scenarios to optimize their trading strategies. It is essential to understand the key parameters that influence option value and consider them when using the calculator.

An option value calculator is a tool used by investors and traders to estimate the value of an options contract. Options contracts give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (known as the strike price) within a specific time frame.

The calculator takes into account various factors such as the current price of the underlying asset, the strike price, the time remaining until expiration, and the expected volatility of the underlying asset. It uses these inputs to generate a value, known as the option’s fair value or theoretical price.

The option value calculator uses complex mathematical models, such as the Black-Scholes model, to calculate the fair value. These models consider factors such as the current price of the underlying asset, the expected future price movement, interest rates, and dividends.

By using an option value calculator, investors and traders can evaluate the attractiveness of different options contracts and make informed decisions. It allows them to compare the current market price of an option with its fair value, helping them determine if the option is overvalued or undervalued.

Read Also: Unlock the Secrets of 123 Method Trading and Skyrocket Your Profits

It’s important to note that option value calculators provide estimates and predictions based on various assumptions. They do not guarantee the future performance of options contracts, as market conditions and other factors can change rapidly.

Overall, an option value calculator is a useful tool for investors and traders looking to assess the potential profitability and risk of options contracts. It helps them make more informed decisions by providing insights into the fair value of options and the factors affecting their prices.

An option value calculator is a tool used by traders and investors to determine the value of an option contract. The calculator uses mathematical models and various inputs to estimate the fair value of the option.

Here are some key steps involved in the calculation process:

Option value calculators can provide valuable insights for traders and investors. By using these tools, users can assess the potential profit or loss of an option position, make informed trading decisions, and manage their risk effectively.

It’s important to note that option value calculators rely on assumptions and estimations, and the actual market value of an option may differ from the calculated value. Factors such as market conditions, supply and demand dynamics, and other external events can impact the actual price of an option.

Read Also: Is MetaTrader a Good Choice for Trading? Exploring the Benefits and Drawbacks

Overall, option value calculators are useful tools for evaluating options and understanding their potential value. However, it’s essential to consider other factors and conduct thorough research before trading or investing in options.

An option value calculator is a tool used to estimate the value of an options contract based on various factors such as the underlying asset price, strike price, time to expiration, volatility, and interest rates.

An option value calculator works by using mathematical models, such as the Black-Scholes model, to calculate the theoretical value of an options contract. It takes into account various inputs, such as the current price of the underlying asset, the strike price, time to expiration, volatility, and interest rates, and calculates the option’s value based on these factors.

An option value calculator typically requires inputs such as the current price of the underlying asset, the strike price, time to expiration, volatility, and interest rates. These inputs are used to calculate the theoretical value of the option.

No, an option value calculator cannot predict the future price of the underlying asset. It can only estimate the value of the option based on the inputs provided. The future price of the underlying asset is uncertain and can be influenced by various factors.

An option value calculator is useful because it helps investors and traders estimate the value of an options contract and make more informed decisions. It allows them to evaluate different options strategies, determine the potential profitability of an options trade, and assess the risk-reward profile of an options position.

An option value calculator is a tool used by investors and traders to determine the value of an options contract. It takes into account various factors such as the current price of the underlying asset, the strike price of the option, the time remaining until expiration, and the expected volatility of the underlying asset. The calculator uses mathematical models, such as the Black-Scholes model, to compute the theoretical value of the option.

An option value calculator works by using mathematical models, such as the Black-Scholes model, to compute the theoretical value of an options contract. The calculator takes into account various factors including the current price of the underlying asset, the strike price of the option, the time remaining until expiration, and the expected volatility of the underlying asset. It then uses these inputs to generate an estimated value for the option.

Calculating Seasonal Indexes Using the Moving Average Method The moving average method is a commonly used technique in statistical analysis for …

Read ArticleBenefits of Pyramiding: Maximizing Returns in Investments Pyramiding, also known as a pyramid scheme, is a controversial business model that promises …

Read ArticleTrading Futures: A Beginner’s Guide Welcome to our comprehensive guide on how to trade futures for beginners. Futures trading can be an exciting and …

Read ArticleFiltering Stocks for Options Trading Options trading can be a lucrative investment strategy, but it requires careful selection of stocks to maximize …

Read ArticleUnderstanding TLS in Trading: Explained Trading is a volatile and high-stakes world, where every second counts and security is of utmost importance. …

Read ArticleWhat is the 100 moving average in forex? When it comes to trading in the foreign exchange market, having a strong understanding of technical analysis …

Read Article