Current Dollar Rate in Nepal Today: Latest Exchange Rate Updates

Current Dollar Rate in Nepal Welcome to our daily update on the current dollar rate in Nepal. We provide you with the most recent exchange rate …

Read Article

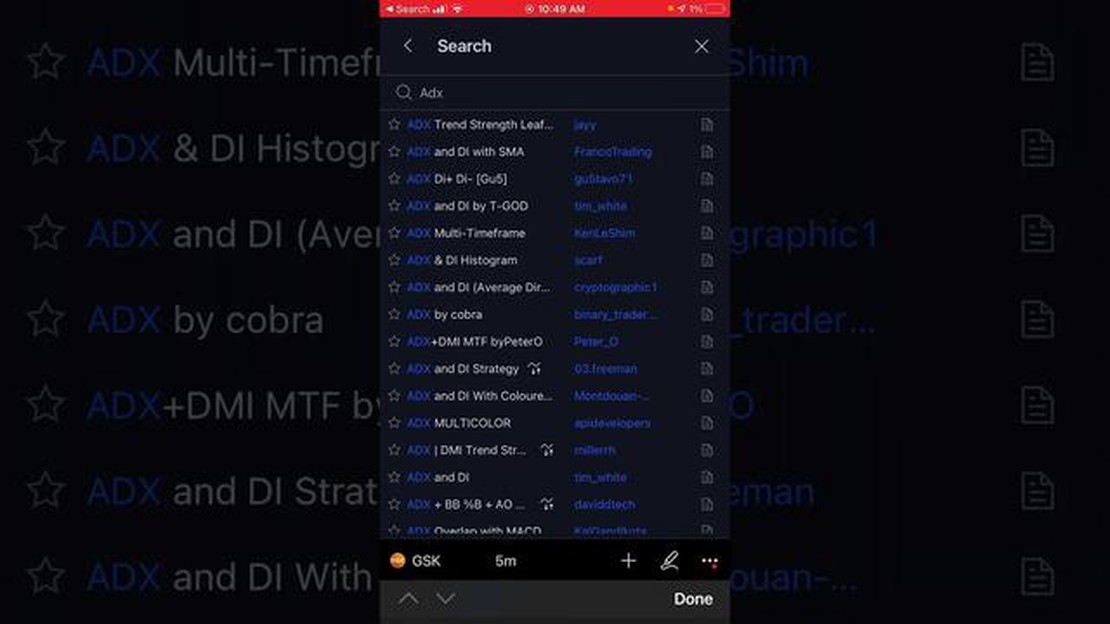

The Average Directional Index (ADX) is an indicator used in technical analysis to measure the strength of a trend. It provides valuable information to traders about the momentum of a stock or asset, helping them make informed decisions.

One of the key components of the ADX is the ADX histogram, a visual representation of the ADX line. The histogram consists of vertical bars that fluctuate in height based on the ADX values. By understanding how to interpret the ADX histogram, traders can gain insights into potential changes in market trends.

The ADX histogram serves as a tool to identify the strength of a trend. When the histogram bars are high, it indicates a strong trend, while low bars suggest a weak trend. Traders can use this information to determine whether to enter or exit a position, as well as to manage their risk and set stop-loss levels.

Furthermore, the ADX histogram can help identify market reversals. When the histogram switches from positive to negative, it signifies a potential reversal. This provides traders with an opportunity to adjust their trading strategies accordingly.

In this comprehensive guide, we will delve deeper into the ADX histogram and explore various ways traders can utilize it to enhance their trading capabilities. We will discuss how to interpret the histogram, identify trend strength, and spot potential trend reversals. By the end of this guide, you will have a solid understanding of the ADX histogram and be able to incorporate it into your trading strategy effectively.

The Average Directional Index (ADX) histogram is a technical indicator that is used to measure the strength of a trend. It is a popular tool among traders and investors as it provides valuable insights into the market’s direction and momentum.

The ADX histogram consists of two lines - the positive directional movement line (DMI+) and the negative directional movement line (DMI-). These lines oscillate between 0 and 100, with higher values indicating a stronger trend.

The ADX histogram is derived from the difference between the DMI+ and DMI- lines. When the DMI+ line is above the DMI- line, the histogram turns positive. Conversely, when the DMI+ line is below the DMI- line, the histogram turns negative. This information helps traders and investors identify whether a trend is bullish or bearish.

Traders often use the ADX histogram in conjunction with other technical indicators to make more informed trading decisions. For example, they may look for a crossover between the ADX histogram and a moving average to confirm a trend reversal or continuation.

It is important to note that the ADX histogram is not a standalone indicator and should be used in combination with other tools and analysis techniques. Additionally, like all technical indicators, it is not foolproof and should not be solely relied upon for making trading decisions.

Overall, the ADX histogram is a useful tool for traders and investors to gauge the strength and direction of a trend. By understanding the basics of the ADX histogram, market participants can make more informed trading decisions and potentially improve their overall profitability.

Read Also: Exploring the Use of Bars in Forex Trading: A Comprehensive Guide

The Average Directional Index (ADX) Histogram is a key component of technical analysis and is used to measure the strength of a trend in a particular stock or market. It helps traders to identify whether a trend is gaining or losing momentum, and can provide valuable insight into potential buying or selling opportunities.

By analyzing the ADX Histogram, traders can determine whether a stock or market is in a trend or in a range-bound phase. The ADX Histogram is derived from the ADX line, which represents the overall strength of a trend. When the ADX line rises above a certain threshold, it indicates a strong trend, while a decline below the threshold suggests a weakening trend or a range-bound phase.

The ADX Histogram provides a visual representation of the ADX line, making it easier for traders to interpret the information. The histogram is plotted above or below a zero line, with positive values indicating bullish trends and negative values suggesting bearish trends. The wider the histogram, the stronger the trend, while a narrow histogram indicates a weaker trend or a lack of clear direction.

One of the main advantages of the ADX Histogram is that it is a leading indicator, meaning it can provide traders with early signals of potential trend reversals. By monitoring the changes in the histogram, traders can anticipate shifts in market sentiment and adjust their trading strategies accordingly.

Read Also: Looking for an Alternative to 1000pip Builder? Here's What You Need to Know!

Additionally, the ADX Histogram can be used in conjunction with other technical indicators to confirm or validate trading signals. For example, if the histogram shows a strong upward trend while another indicator, such as the Moving Average Convergence Divergence (MACD), also provides a bullish signal, it further strengthens the probability of a successful trade.

In conclusion, the ADX Histogram is a valuable tool in technical analysis as it provides traders with a clear and visual representation of trend strength. By analyzing the ADX Histogram and combining it with other indicators, traders can improve their trading decisions and enhance their profitability in the market.

The ADX histogram is a technical indicator that measures the strength of a trend. It is derived from the Average Directional Index (ADX), which is a popular tool used by traders to determine whether a market is trending or ranging.

The ADX histogram is calculated by taking the difference between the +DI and -DI lines, both of which are derived from the ADX indicator. The +DI line measures the strength of the positive trend, while the -DI line measures the strength of the negative trend. The ADX histogram provides a visual representation of the difference between these two lines.

A positive ADX histogram indicates that the positive trend is stronger than the negative trend. This suggests that there is momentum in the market and that the trend may continue. Traders may interpret this as a buy signal and look for opportunities to enter long positions.

A negative ADX histogram indicates that the negative trend is stronger than the positive trend. This suggests that there may be a reversal or a weakening of the current trend. Traders may interpret this as a sell signal and look for opportunities to enter short positions or close existing long positions.

The reliability of the ADX histogram as an indicator depends on various factors, such as the market conditions and the time frame being observed. It is important to use the ADX histogram in conjunction with other technical indicators and analysis techniques to get a more comprehensive understanding of the market. Additionally, it is always advisable to practice proper risk management and use stop-loss orders when trading based on any indicator.

The ADX histogram is a graphical representation of the Average Directional Index (ADX) indicator. It helps traders understand the strength and direction of a trend in the market.

The ADX histogram can be used to identify strong trends in the market. Traders can look for high values on the histogram, indicating a strong trend, and use this information to enter or exit trades.

Current Dollar Rate in Nepal Welcome to our daily update on the current dollar rate in Nepal. We provide you with the most recent exchange rate …

Read ArticleScalping: A Comprehensive Guide to Understanding and Executing Successful Scalping Strategies Day trading is a fast-paced and exciting way to …

Read ArticleUnderstanding Stock Options at Microsoft Stock options are a popular form of equity compensation offered to employees of many companies, including …

Read ArticleIs Forex Trading Allowed by RBC? If you are considering forex trading and are a client of RBC, you may be wondering whether or not it is allowed by …

Read ArticleUnderstanding Pullback Entry in Trading In the world of trading and investing, it is crucial to have a solid understanding of market corrections and …

Read ArticleDiscover OANDA’s Leverage: Everything You Need to Know When it comes to trading in the forex market, leverage is a crucial factor that can greatly …

Read Article