Is the Forex Market Open on Sunday GMT?

Is the Forex market open on Sunday GMT? Forex, or foreign exchange market, is a global decentralized market for trading currencies. It is open 24 …

Read Article

An option contract is a financial instrument that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. The price at which the option contract is bought or sold is crucial and needs to be calculated accurately to ensure a fair deal for both parties involved.

The fair price of an option contract is determined by several factors, including the current market price of the underlying asset, the strike price of the option, the time remaining until the option expires, and the volatility of the underlying asset. These factors are combined using mathematical models and pricing formulas to estimate the fair value of the option.

One popular model used to calculate the fair price of an option contract is the Black-Scholes model. This model takes into account the current market price of the underlying asset, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset. By plugging in these values, the Black-Scholes model produces an estimated fair price for the option contract.

In addition to the Black-Scholes model, there are other pricing models and strategies used to calculate the fair price of option contracts. These include the binomial options pricing model, the Monte Carlo simulation, and various option pricing calculators available online. Traders and investors rely on these models to determine the fair value of an option and make informed decisions in the options market.

Understanding the fair price of an option contract is essential for both buyers and sellers. Buyers want to ensure that they are paying a reasonable price for the option, and sellers want to receive a fair premium for taking on the risk associated with selling the option. By evaluating the various factors that influence the fair price and using the appropriate pricing models, individuals can make informed choices when trading options.

Ultimately, the fair price of an option contract is a reflection of market conditions and the perceived value of the underlying asset. By staying informed and keeping track of the factors that influence option pricing, individuals can navigate the options market effectively and discover the right price for their option contracts.

An option contract is a financial derivative instrument that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. The underlying asset can be stocks, bonds, commodities, or currencies.

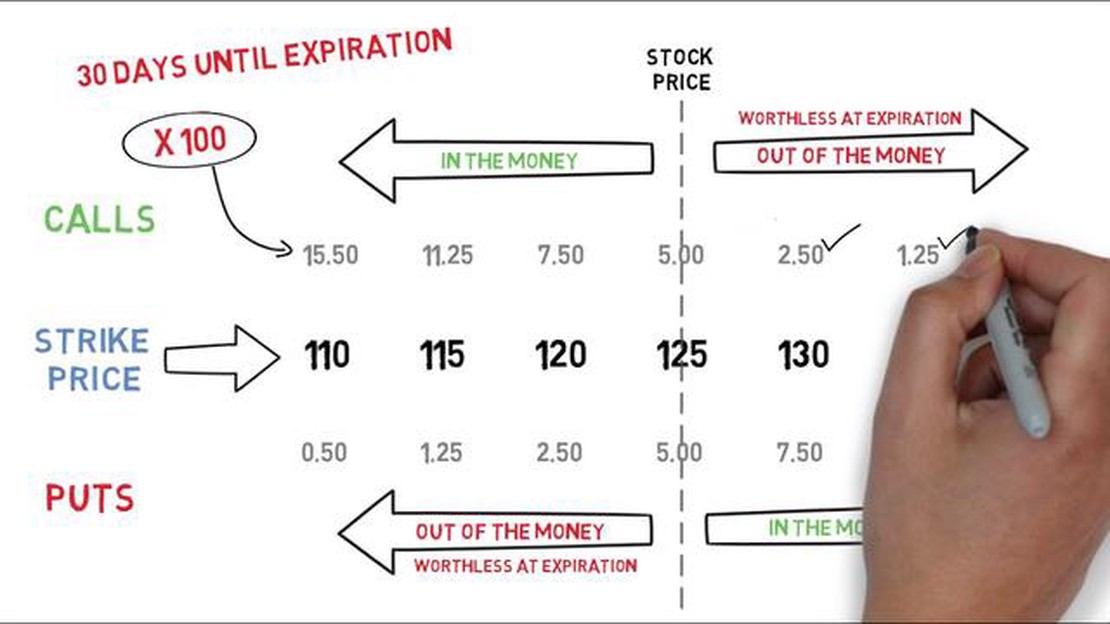

There are two types of option contracts: call options and put options. A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

Option contracts have several key elements:

| Element | Description |

|---|---|

| Underlying Asset | The asset on which the option contract is based, such as a stock or commodity. |

| Strike Price | The price at which the underlying asset can be bought or sold. |

| Expiration Date | The date on which the option contract expires and becomes void. |

| Option Premium | The price that the buyer pays to the seller for the option contract. |

Option contracts provide flexibility for investors and traders to hedge their positions, speculate on price movements, and generate income through options trading strategies. They can be used to protect against potential losses, take advantage of market volatility, and generate additional income.

The fair price of an option contract is determined by various factors, including the current price of the underlying asset, the strike price, the time remaining until expiration, the volatility of the underlying asset, and interest rates. Financial models, such as the Black-Scholes model, are used to calculate the fair value of option contracts.

Understanding option contracts is essential for anyone interested in derivatives trading. It is important to evaluate the risks and rewards associated with options trading and to develop a sound trading strategy based on thorough analysis and research.

An option contract is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period of time. The underlying asset can be a stock, a bond, a commodity, or even a currency.

Read Also: Is ION Group a FinTech company? Everything you need to know

There are two main types of option contracts:

1. Call Option:

A call option gives the buyer the right to buy the underlying asset at the predetermined price, known as the strike price, on or before the expiration date of the option contract.

For example, if an investor purchases a call option on a stock with a strike price of $50 and an expiration date of one month, they have the right to buy the stock at $50 per share anytime within the next month. If the stock price goes up to $60, the investor can exercise the call option and buy the stock at the lower strike price of $50, making a profit of $10 per share.

Read Also: Beginner's guide: How to trade options on a call

2. Put Option:

A put option gives the buyer the right to sell the underlying asset at the strike price on or before the expiration date of the option contract.

Using the same example, if an investor purchases a put option on a stock with a strike price of $50 and an expiration date of one month, they have the right to sell the stock at $50 per share anytime within the next month. If the stock price drops to $40, the investor can exercise the put option and sell the stock at the higher strike price of $50, avoiding a loss of $10 per share.

Option contracts are commonly used by investors and traders for speculation, hedging, or income generation. They provide flexibility and leverage, allowing investors to participate in the price movements of the underlying asset without owning it outright.

It is important to note that options carry risks, and the buyer may lose the entire premium paid for the option contract if it expires worthless.

In summary, option contracts are financial instruments that give the buyer the right to buy or sell an underlying asset at a predetermined price within a specified period of time. They can be call options, which provide the right to buy, or put options, which provide the right to sell. Option contracts are used for various purposes in the financial markets, but they also come with risks that should be carefully considered.

The fair price of an option contract is determined by several factors, including the current price of the underlying asset, the strike price of the option, the time remaining until expiration, the risk-free interest rate, and the volatility of the underlying asset.

The current price of the underlying asset has a direct impact on the fair price of an option contract. If the price of the underlying asset is higher than the strike price of the option, the option contract will have a higher fair price. Conversely, if the price of the underlying asset is lower than the strike price, the option contract will have a lower fair price.

The time remaining until expiration is a critical factor in determining the fair price of an option contract. As the expiration date approaches, the time value of the option decreases. This means that options with longer time to expiration will have a higher fair price compared to options with less time remaining until expiration.

Volatility is a measure of how much the price of the underlying asset is expected to fluctuate in the future. Higher volatility leads to higher option prices, as there is a greater chance of the option ending up in-the-money. Conversely, lower volatility leads to lower option prices.

The risk-free interest rate is used in option pricing models to determine the present value of the expected future cash flows from the option. A higher interest rate decreases the present value of the option, leading to lower option prices. Conversely, a lower interest rate increases the present value and leads to higher option prices.

The fair price of an option contract is determined by several factors, including the current market price of the underlying asset, the strike price of the option, the time remaining until the option expires, the volatility of the underlying asset’s price, and the risk-free interest rate.

Is the Forex market open on Sunday GMT? Forex, or foreign exchange market, is a global decentralized market for trading currencies. It is open 24 …

Read ArticleReading Forex Volume: A Complete Guide When it comes to analyzing market trends in the forex market, one important metric to consider is trading …

Read ArticleBritish forex boss convicted: Who was he? The financial world was shocked last week as news broke of the conviction of a prominent British forex boss. …

Read ArticleIs binary option trading legal in Singapore? Binary option trading has gained popularity in recent years as a way to make quick profits in the …

Read ArticleWhat are the charges on foreign transactions in Axis Bank? When it comes to making international transactions, it’s important to understand the fees …

Read ArticleUnderstanding the Significance of the 20-Day Moving Average When it comes to trading, one of the most important tools for technical analysis is the …

Read Article