Exclusion Items for AMT: What You Need to Know

Exclusion Items for AMT: A Comprehensive Guide When it comes to paying taxes, most people are familiar with the regular tax system. However, there is …

Read Article

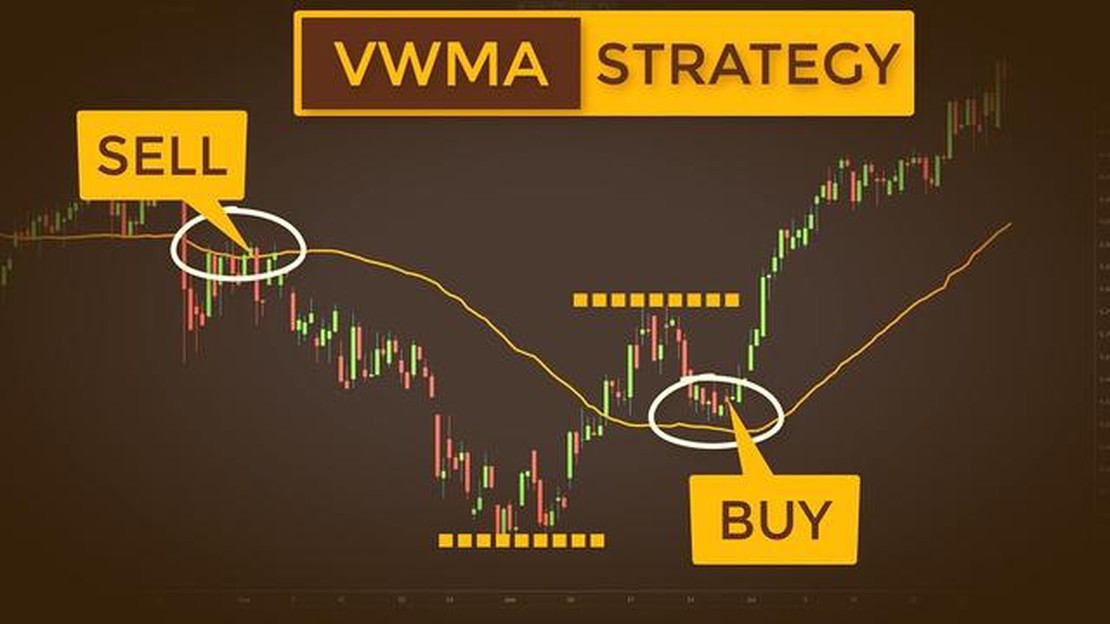

In the world of trading, the weighted moving average (WMA) is a popular technical analysis tool used by traders to identify trends and potential entry or exit points. Unlike other moving averages, the WMA assigns different weights to each data point in the time series, giving more significance to recent data.

The WMA is calculated by multiplying each data point by a weight and then summing the results. The weights are typically assigned based on the number of periods in the moving average, with more recent data given higher weights. This gives the WMA a smoother line compared to other moving averages.

Using the WMA, traders can identify the direction and strength of a trend, as well as potential support and resistance levels. The strategy involves using multiple WMA lines with different periods to confirm signals and establish entry and exit points. Traders will typically look for a crossover of shorter-term WMA lines above or below longer-term lines as a signal to enter or exit a trade.

To implement the WMA strategy, traders should first identify the time frame and asset they want to trade. They then need to calculate the WMA values for the selected periods using the appropriate weighting. These values can be plotted on a chart to visualize the trend and potential entry or exit points. Traders can also use additional indicators or patterns to confirm signals and minimize false signals.

It is important to note that like any trading strategy, the WMA strategy is not foolproof and should be used in conjunction with other technical and fundamental analysis tools. Traders should also consider factors such as market conditions, volatility, and risk management before entering any trades. With careful analysis and practice, the WMA strategy can be a valuable tool in a trader’s arsenal.

“The weighted moving average trading strategy is a powerful tool in a trader’s arsenal, helping to identify trends and potential entry or exit points. By assigning different weights to each data point, the WMA provides a smoother line and can be used in conjunction with other indicators to confirm signals. However, traders should always exercise caution and consider other factors when implementing any trading strategy.”

A Weighted Moving Average (WMA) is a technical analysis indicator used to smooth out price fluctuations over a specified period of time. Unlike Simple Moving Average (SMA), which gives equal weight to each data point, WMA assigns different weights to each data point in the calculation.

The most recent data point in the WMA calculation receives the highest weight, while the oldest data point receives the lowest weight. The weights typically follow a linear or exponential pattern, depending on the method selected by the trader.

The formula for calculating the Weighted Moving Average is as follows:

WMA = (P1 * W1 + P2 * W2 + … + Pn * Wn) / (W1 + W2 + … + Wn)

Where:

The WMA calculation is most commonly used in technical analysis to determine trend direction and generate trading signals. Traders often compare the WMA to the price of an asset to identify potential entry and exit points in the market.

Using a Weighted Moving Average can help reduce the impact of short-term price fluctuations, providing a smoother representation of the underlying trend. This can be particularly useful when trading in volatile markets.

Read Also: What is a travel currency card? Learn all about it!

It’s important to note that the choice of the weighting method and the period over which the WMA is calculated can significantly impact the results. Traders should carefully consider the specific requirements of their trading strategy and adjust the parameters accordingly.

The Weighted Moving Average (WMA) is a popular technical analysis indicator used by traders to identify trends and make trading decisions. It is similar to the Simple Moving Average (SMA), but places more emphasis on recent price data. The WMA assigns weights to each data point in the moving average calculation, giving more weight to recent prices.

Read Also: Learn about the cost of eSignal exchange fees: A comprehensive guide

To calculate the WMA, you first need to determine the number of periods or time intervals you want to include in the moving average. For example, if you are using a 10-period WMA, you would include the prices from the past 10 time intervals in your calculation.

Next, you assign weights to each data point based on its position in the moving average. The most recent data point is assigned the highest weight, while the oldest data point is assigned the lowest weight. The weight assigned to each data point is calculated using a formula:

| Period | Weight |

|---|---|

| 1 | n |

| 2 | n-1 |

| … | … |

| n | 1 |

Where n is the number of periods in the moving average. Once you have assigned weights to each data point, you multiply the price of each data point by its corresponding weight. Finally, you sum up the weighted prices and divide by the sum of the weights to get the WMA value for a specific time interval.

The WMA gives more weight to recent price data, making it more responsive to price changes compared to the SMA. Traders use the WMA to identify trends and generate trading signals. When the WMA is trending upwards, it indicates a bullish trend, while a downward trend suggests a bearish trend. Traders can use crossovers of the WMA with the price line or other moving averages to generate buy or sell signals.

A weighted moving average (WMA) trading strategy is a technical analysis tool used by traders to identify potential buying and selling opportunities in financial markets. It calculates the average of a specified number of price data points, giving more weight to recent data points.

A weighted moving average trading strategy works by calculating the average of a certain number of price data points, giving more weight to recent data points. This is done to give more significance to recent price movements and determine potential trends in the market.

Some advantages of using a weighted moving average trading strategy include the ability to quickly adapt to recent price movements, the potential to identify trends earlier than other moving average methods, and the flexibility to customize the weights based on market conditions.

One drawback of using a weighted moving average trading strategy is that it can be more sensitive to market noise and false signals due to the emphasis on recent price data. Additionally, determining the appropriate weights to use can be subjective and require constant adjustment.

Yes, a weighted moving average trading strategy can be used for any financial market, including stocks, forex, commodities, and cryptocurrencies. The strategy’s effectiveness may vary depending on the characteristics and volatility of the specific market.

A weighted moving average is a type of moving average where different weights are assigned to different data points. This assigns more importance to certain data points and can provide a more accurate representation of the underlying trend.

A weighted moving average is calculated by multiplying each data point by a respective weight, summing the results, and dividing the sum by the sum of weights. The weights are typically assigned based on certain criteria, such as the importance or relevance of each data point.

Exclusion Items for AMT: A Comprehensive Guide When it comes to paying taxes, most people are familiar with the regular tax system. However, there is …

Read ArticleDoes BMO offer trading services? Bank of Montreal (BMO) is one of the biggest banks in Canada, providing a range of financial services to its …

Read ArticleUnderstanding the Meaning of 20 Pips in Forex Trading Forex trading is a complex and fast-paced market, full of unique terms and jargon that can be …

Read ArticleDo I Need to Report Option Trades to the IRS? When it comes to trading options, taxes can be a complex and confusing topic. Many traders wonder if …

Read ArticleCEO of GFI: Who is it? If you are curious about the person who leads Global Finance Inc. (GFI), one of the biggest financial institutions in the …

Read ArticleWhat is the formula for forward forward rate? When it comes to understanding the formula for the forward forward rate, it is essential to consult the …

Read Article