Does Forex Offer Western Union Services? | Find Out Here

Forex and Western Union: Is there a Connection? If you are involved in the world of Forex trading, you may be wondering whether Forex offers Western …

Read Article

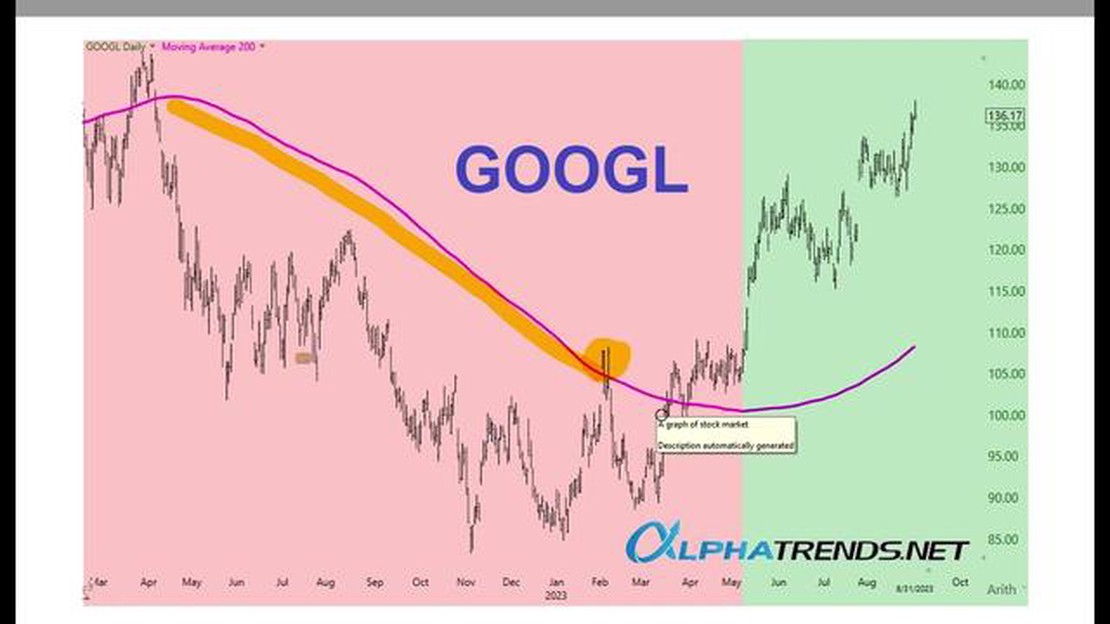

Investors and traders are constantly seeking out new strategies to gain an edge in the financial markets. One strategy that has gained popularity in recent years is the 200-day moving average strategy. This strategy involves using the 200-day moving average as a key indicator to make buy or sell decisions on stocks, ETFs, and other assets.

The 200-day moving average is a simple yet powerful tool that can give investors insights into the long-term trend of an asset. It is calculated by taking the average price of an asset over the past 200 trading days. By plotting this average on a chart, traders can visually see whether the asset is trending upwards or downwards.

Many investors use the 200-day moving average as a signal to enter or exit a position. When the price of an asset crosses above the 200-day moving average, it is seen as a bullish signal and a potential buying opportunity. Likewise, when the price crosses below the 200-day moving average, it is seen as a bearish signal and a potential selling opportunity.

“The 200-day moving average strategy is a useful tool for trend-following investors,” says John Smith, a seasoned trader with years of experience. “By using this strategy, investors can filter out short-term noise and focus on the long-term trend of an asset, which can lead to more profitable trades.”

While the 200-day moving average strategy is not foolproof and should be used in conjunction with other indicators and analysis, it has proven to be a valuable tool for many traders. By unlocking the secret of the 200-day moving average strategy, investors can enhance their decision-making process and potentially improve their investment returns.

The 200 day moving average strategy is a popular tool used by traders and investors to analyze and predict market trends. It involves calculating the average price of a security over a period of 200 days to identify potential buy or sell signals.

By plotting the 200 day moving average on a price chart, traders can visually assess whether the current price is above or below the average. When the price is above the moving average, it is generally seen as a bullish signal, indicating an uptrend in the market. Conversely, when the price falls below the moving average, it is considered a bearish signal, suggesting a downtrend.

Traders often use this strategy to determine entry and exit points for their trades. For example, if the price is trading above the 200 day moving average, it may be a good time to buy the security, as the trend is upward. On the other hand, if the price falls below the moving average, it may be a signal to sell or short the security, as the trend is downward.

It is important to note that the 200 day moving average strategy is not foolproof and should not be relied upon as the sole indicator for making trading decisions. It is best used in conjunction with other technical analysis tools and indicators to confirm or validate its signals.

Overall, understanding the 200 day moving average strategy can be a valuable tool in a trader’s arsenal. By analyzing and interpreting the moving average, traders can gain insights into market trends and make more informed trading decisions. However, it is crucial to always do thorough research and exercise caution when implementing any trading strategy.

The 200 day moving average is a technical indicator used in financial markets. It represents the average price of a security over a 200-day period, and is used by traders and investors to analyze trends and make investment decisions.

The 200 day moving average is calculated by adding up the closing prices of a security over the past 200 days and dividing the sum by 200. This provides a smoothed line on a price chart, which helps to filter out short-term noise and highlight long-term trends.

Read Also: Do Robots Use Binary Code: Understanding the Language of Machines

Traders use the 200 day moving average as a tool to determine support and resistance levels in the market. When a security is trading above its 200 day moving average, it is considered to be in an uptrend and the moving average level acts as a support level. On the other hand, when a security is trading below its 200 day moving average, it is considered to be in a downtrend and the moving average level acts as a resistance level.

The 200 day moving average is also used as a signal for entering or exiting positions in the market. Traders may wait for a security to cross above the 200 day moving average as a buy signal, indicating that the security is gaining strength and may continue to rise. Conversely, they may wait for a security to cross below the 200 day moving average as a sell signal, indicating that the security is losing strength and may continue to fall.

Overall, the 200 day moving average is a widely followed indicator in technical analysis and can provide valuable insights into market trends and potential trading opportunities.

The 200 day moving average is an important tool used by traders and investors to determine the overall trend of a stock or market. It is a widely followed strategy that helps identify potential entry and exit points for trading.

Read Also: What are CTA stocks? Understanding the role of Commodity Trading Advisors

One of the reasons why the 200 day moving average strategy is so important is because it provides a long-term view of the market. By looking at the average price over a 200 day period, traders are able to filter out short-term fluctuations and noise in the market. This allows them to focus on the bigger picture and make more informed decisions about when to buy or sell.

Another reason why the 200 day moving average strategy is important is because it acts as a dynamic support or resistance level. When the price of a stock or market is above the 200 day moving average, it is considered to be in an uptrend and the moving average acts as a support level. Conversely, when the price is below the 200 day moving average, it is considered to be in a downtrend and the moving average acts as a resistance level.

Traders often use the 200 day moving average strategy in conjunction with other technical indicators to confirm or validate their trading decisions. By analyzing multiple indicators together, they are able to gain more confidence in their trades and increase their chances of success.

Overall, the 200 day moving average strategy is an important tool for traders and investors. It helps provide a long-term view of the market, filters out short-term noise, and acts as a support or resistance level. By incorporating this strategy into their trading approach, traders can improve their decision-making process and increase their profitability.

The 200 Day Moving Average strategy is a popular technical analysis tool used by traders and investors to identify trends. It involves calculating the average price of a security over the past 200 trading days and using it as a reference point for buying or selling decisions.

The 200 Day Moving Average strategy works by comparing the current price of a security to its average price over the past 200 trading days. If the current price is above the 200-day moving average, it is considered a bullish signal and may indicate a buying opportunity. If the current price is below the 200-day moving average, it is considered a bearish signal and may indicate a selling opportunity.

The effectiveness of the 200 Day Moving Average strategy depends on various factors, including the market conditions and the specific security being analyzed. While it can be a useful tool for identifying trends and making informed trading decisions, it is not a foolproof strategy and should be used in conjunction with other analysis techniques.

Using the 200 Day Moving Average strategy has several advantages. It helps traders and investors identify long-term trends in the market, filter out short-term fluctuations, and make more informed buying and selling decisions. It can also be used as a tool for setting stop-loss orders and managing risk.

Yes, there are some limitations to the 200 Day Moving Average strategy. It may not work well in highly volatile markets or during periods of sudden price changes. It is also a lagging indicator, meaning it may not provide timely signals for short-term trading. Additionally, it may not be suitable for all types of securities or investment strategies.

The 200 day moving average strategy is a popular investment strategy that involves buying or selling a security when its price crosses above or below its 200 day moving average. The strategy is based on the idea that the 200 day moving average is a key level of support or resistance, and crossing above or below this level can indicate a significant change in the security’s trend.

Forex and Western Union: Is there a Connection? If you are involved in the world of Forex trading, you may be wondering whether Forex offers Western …

Read ArticleGuide to Setting a 5 Day Moving Average Trend analysis is a powerful tool for traders and investors to make informed decisions in the financial …

Read ArticleTaxation of Canadian Stock Options in the US Investing in the stock market can be a lucrative opportunity, and for Canadians who have stock options in …

Read ArticleUnderstanding the Interpretation of Unit Roots Unit roots are a key concept in time series analysis and econometrics. They provide insights into the …

Read ArticleUnderstanding the Significance of Option Volume Surpassing Open Interest When it comes to trading options, understanding volume and open interest is …

Read ArticleTrading the 10-Year Treasury: Strategies and Tips If you are new to trading and interested in the world of bonds, the 10 Year Treasury is an excellent …

Read Article