Can I buy options on Merrill Edge? | Merrill Edge trading guide

Can I buy options on Merrill Edge? Options trading is a popular investing strategy that allows investors to potentially profit from the price …

Read Article

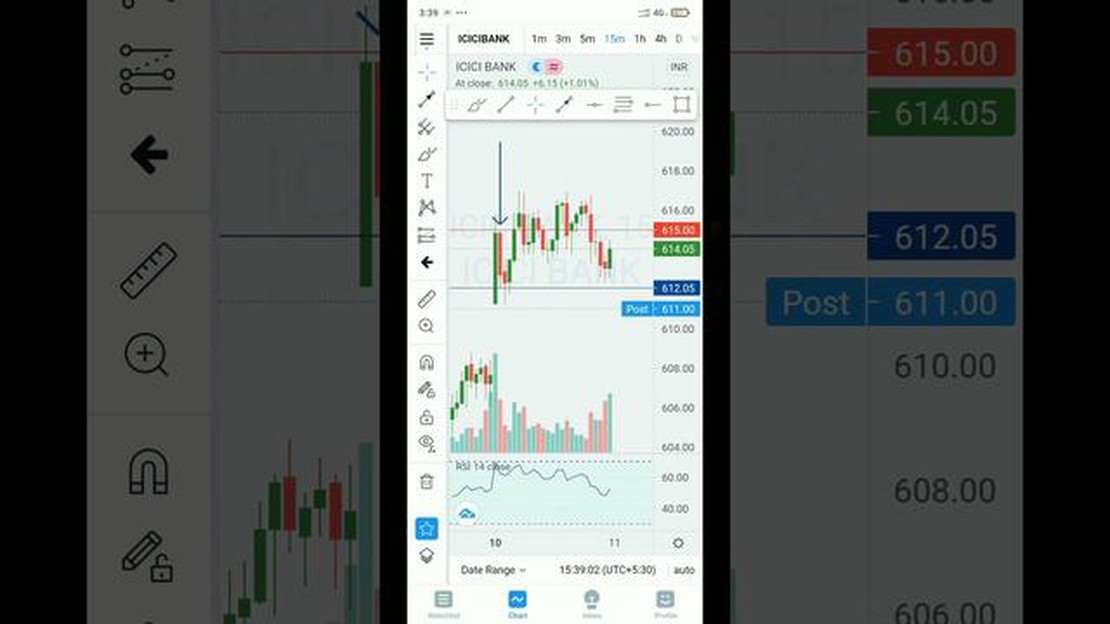

ICICI Bank is a leading Indian multinational banking and financial services company. With a strong presence in the Indian banking sector, ICICI Bank has a significant impact on the stock market. Traders and investors often use technical indicators to analyze the price movements of ICICI Bank’s stock and make informed trading decisions. One such popular indicator is the Relative Strength Index (RSI).

The Relative Strength Index, also known as RSI, is a momentum oscillator that measures the speed and change of price movements. It provides insights into the overbought or oversold conditions of a stock. RSI is a widely used indicator among traders and analysts for its simplicity and effectiveness in predicting short-term price movements.

The RSI is calculated using a mathematical formula based on the average gain and loss over a specified period. The values range from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions. Traders use these thresholds as potential signals to enter or exit trades.

When analyzing the ICICI Bank RSI, traders pay attention to the RSI values and their trends. They look for bullish or bearish divergences between the RSI and the stock price, which can indicate potential reversals. Additionally, traders use RSI as a confirmation tool alongside other technical indicators to validate their trading decisions.

In conclusion, the Relative Strength Index (RSI) is a popular technical indicator used by traders and investors to analyze the price movements of ICICI Bank and other stocks. By understanding the RSI values and trends, traders can gain insights into the overbought or oversold conditions and make informed trading decisions.

The Relative Strength Index (RSI) is a powerful technical indicator used by traders and investors to analyze the momentum and strength of a particular stock or financial instrument. It provides insights into whether a stock is overbought or oversold, and can help identify potential turning points in the market.

ICICI Bank, one of India’s largest private sector banks, is a popular stock among investors. By understanding the RSI of ICICI Bank, traders can make informed decisions about buying or selling its shares.

The RSI is calculated using a formula that takes into account the average gain and average loss over a certain period of time. The RSI ranges from 0 to 100, with readings above 70 indicating that a stock is overbought, and readings below 30 indicating that a stock is oversold.

When the RSI of ICICI Bank is above 70, it suggests that the stock is overbought and may be due for a price correction. On the other hand, when the RSI is below 30, it suggests that the stock is oversold and may be due for a price rebound. Traders can use these signals to make decisions about when to enter or exit a position.

However, it is important to note that the RSI is just one tool in a trader’s toolbox and should be used in conjunction with other technical indicators and analysis techniques. It is not a standalone indicator and should be used as part of a comprehensive trading strategy.

In conclusion, the ICICI Bank RSI is a powerful technical indicator that can provide valuable insights into the momentum and strength of the stock. By understanding and interpreting the RSI, traders can make informed decisions about buying or selling ICICI Bank shares.

The Relative Strength Index (RSI) is a technical indicator used in the analysis of financial markets. It is a momentum oscillator that measures the speed and change of price movements. The RSI can be used to identify overbought and oversold conditions, as well as to determine the strength of a trend.

The RSI is calculated using a formula that compares the average of the price gains to the average of the price losses over a specified period of time. The result is a value between 0 and 100, where values above 70 typically indicate an overbought condition, and values below 30 typically indicate an oversold condition.

Read Also: Understanding mat moving annual turnover and its significance

Traders and investors use the RSI to generate buy and sell signals. When the RSI moves above 70, it is often considered a signal that the market is overbought and a trend reversal may be imminent. Conversely, when the RSI moves below 30, it is often considered a signal that the market is oversold and a trend reversal may be forthcoming.

However, it is important to note that the RSI is not a standalone indicator and should be used in conjunction with other technical analysis tools and information. It is also important to consider the timeframe and the specific market being analyzed, as different securities and markets may have different RSI characteristics.

In conclusion, the Relative Strength Index is a powerful tool for analyzing the strength and momentum of price movements in financial markets. By understanding how the RSI works and how to interpret its signals, traders and investors can make more informed decisions and potentially improve their trading performance.

The Relative Strength Index (RSI) is a popular technical indicator used by traders to analyze the strength and momentum of a stock’s price movement. When applied to ICICI Bank stock, the RSI can provide valuable insights to make informed trading decisions.

Read Also: What is the average size of a moving van? | Expert tips for choosing the right moving van size

The ICICI Bank RSI ranges from 0 to 100. A reading above 70 is considered overbought, indicating that the stock may be due for a price correction. On the other hand, a reading below 30 is considered oversold, suggesting that the stock may be undervalued and due for a potential price rebound.

When the ICICI Bank RSI reaches extreme levels, it can signal a potential trend reversal. If the RSI is above 70 and starts to decline, it may indicate that the uptrend is losing steam, and a price reversal might occur. Conversely, if the RSI is below 30 and begins to rise, it may suggest that the downtrend is weakening, and a possible trend reversal could be on the horizon.

Divergence occurs when the price of a stock and its RSI move in opposite directions. If ICICI Bank’s stock price is making higher highs, but the RSI is making lower highs, it could indicate a bearish divergence, implying that the stock’s price may soon reverse lower. Conversely, if the stock price is making lower lows, but the RSI is making higher lows, it could suggest a bullish divergence, indicating a potential price reversal higher.

The ICICI Bank RSI can be used alongside other technical indicators to confirm trading signals. For example, if a stock is in an uptrend, a bullish signal from the RSI can provide further confirmation for entering a long position. Similarly, if a stock is in a downtrend, a bearish signal from the RSI can reinforce a short-selling opportunity.

It’s important to consider the timeframe when interpreting the ICICI Bank RSI. Shorter timeframes, such as daily or hourly, may provide more frequent and short-term trading opportunities, while longer timeframes, such as weekly or monthly, may offer more reliable signals for longer-term positions.

Overall, the ICICI Bank RSI is a valuable tool for traders to assess the momentum and potential reversals in the stock’s price movement. By understanding how to interpret the RSI, traders can make more informed trading decisions when trading ICICI Bank stock.

The Relative Strength Index (RSI) is a technical indicator used in the analysis of financial markets. It is a momentum oscillator that measures the speed and change of price movements. RSI ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a security.

The Relative Strength Index is calculated using a formula that takes into account the average gain and average loss over a certain period of time. The formula is: RSI = 100 - (100 / (1 + RS)), where RS is the average of the gains divided by the average of the losses.

An overbought condition is when the RSI reaches or exceeds a certain threshold, typically around 70. This indicates that the security may be due for a price correction or reversal. Traders often use this as a signal to sell their positions.

The RSI is not a standalone indicator and should be used in conjunction with other technical analysis tools. While it can provide insight into market conditions and potential reversals, it does not guarantee future price movements.

The RSI can be used to identify potential entry or exit points in a trading strategy. For example, a trader may look for securities with RSI values below 30 as a potential buying opportunity, indicating an oversold condition. On the other hand, RSI values above 70 may be seen as a signal to sell. Traders often combine the RSI with other indicators and patterns to make more informed trading decisions.

The Relative Strength Index (RSI) is a technical indicator that measures the magnitude and velocity of price movements. It is used to analyze and interpret the overbought or oversold conditions of a financial instrument.

Can I buy options on Merrill Edge? Options trading is a popular investing strategy that allows investors to potentially profit from the price …

Read ArticleHow are incentive stock options taxed? Incentive Stock Options (ISOs) are a popular form of compensation for employees offered by many companies in …

Read ArticleThe Downside of Phantom Stock: Pros and Cons Explained Phantom stock plans have gained popularity as an alternative to traditional stock options for …

Read ArticleTrading Options with a Vanguard Brokerage Account Many investors are aware of Vanguard’s reputation as a leading provider of low-cost index funds and …

Read ArticleExploring the Intriguing Vegas Tunnels: Secrets Unveiled Las Vegas is known for its bright lights, bustling casinos, and vibrant entertainment scene. …

Read ArticleIs Moving Average the Best Indicator? The moving average is one of the most widely used technical indicators in the field of financial analysis. …

Read Article