7 Types of Statistical Analysis: A Comprehensive Guide

Types of Statistical Analysis: Understanding the 7 Key Methods Statistical analysis plays a crucial role in many fields, from business and finance to …

Read Article

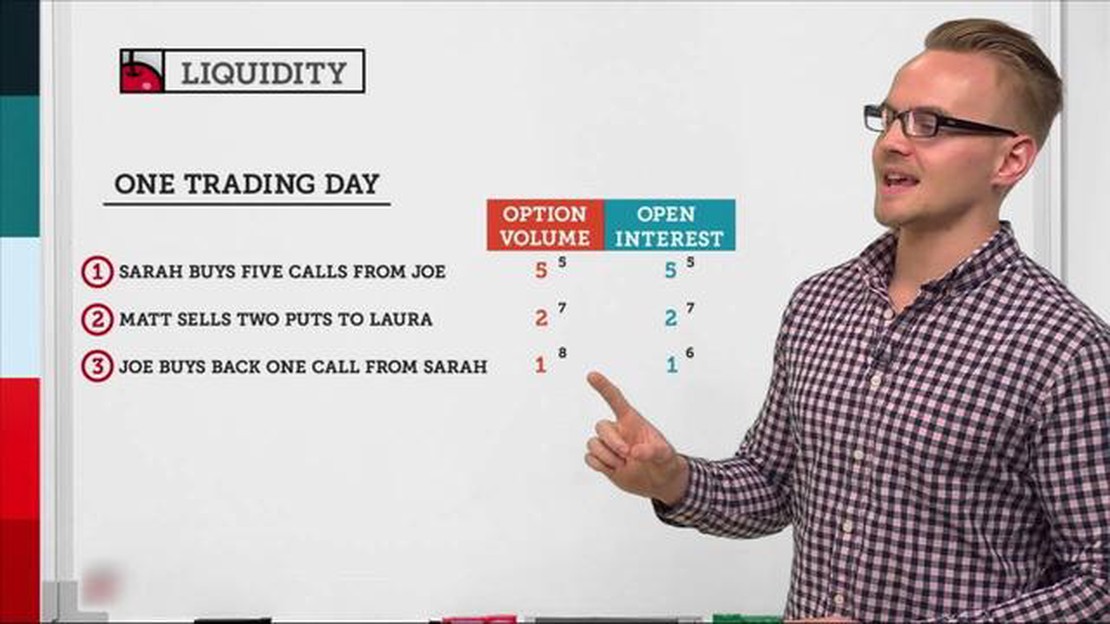

When it comes to trading options, understanding volume and open interest is crucial. Volume refers to the number of contracts traded in a particular option, while open interest refers to the total number of outstanding contracts. Both volume and open interest play significant roles in evaluating the liquidity and popularity of an option.

Higher option volume indicates increased market activity and interest in a particular option. This can be a promising sign for traders, as higher volume generally leads to tighter bid-ask spreads and better liquidity. It also suggests that there is more opportunity for traders to enter and exit positions at favorable prices.

Furthermore, higher option volume can provide valuable insights into the overall market sentiment and direction. If a particular option sees a surge in volume, it could be an indication that traders expect a significant move in the underlying asset. This information can be used to make informed trading decisions and potentially profit from market trends.

Open interest, on the other hand, represents the total number of contracts that have not been closed or delivered. It is a measure of the total number of participants with a vested interest in a particular option. Higher open interest generally indicates a more liquid market and greater trading activity.

By understanding and monitoring both volume and open interest, traders can gain a better understanding of market dynamics and make more informed decisions. It is important to keep in mind, however, that volume and open interest should not be used in isolation. They should be considered alongside other technical and fundamental indicators to get a comprehensive view of the market.

In conclusion, higher option volume and open interest matter because they indicate increased market activity, tighter bid-ask spreads, and better liquidity. They also provide valuable insights into market sentiment and direction. By paying attention to these metrics, traders can make more informed decisions and potentially capitalize on market trends.

Option volume refers to the number of contracts traded in a particular option during a given time period. It represents the level of activity and interest in a specific option contract. Option volume is an important metric for traders and investors as it can provide insights into market sentiment and trends.

When the volume of a specific option is high, it indicates that there is significant interest and activity in that option. High option volume can indicate that traders and investors are actively buying and selling the option, which suggests that there may be a higher level of liquidity and trading opportunities for that option.

Option volume is typically reported on a daily basis and is often used in conjunction with other market indicators to gauge the overall sentiment and strength of a particular option or stock. Traders and investors may use option volume to identify potential trading opportunities or to confirm their trading strategies.

It’s important to note that option volume alone does not provide a complete picture of market activity. It should be used in combination with other factors, such as open interest and price movements, to get a more comprehensive understanding of market dynamics and trends.

In summary, option volume refers to the number of contracts traded in a specific option during a given time period. It is a key metric used by traders and investors to assess market sentiment and trading opportunities. By analyzing option volume along with other market indicators, traders can make more informed decisions and improve their trading strategies.

Open interest refers to the total number of options contracts that are currently outstanding or open in the market. It represents the total number of contracts that have not been exercised, closed, or expired. Open interest is updated and reported daily by the options exchanges.

Open interest is an important metric for understanding the liquidity and activity of a particular options contract. It provides insight into the level of participation and interest from market participants. Higher open interest generally indicates more active trading and greater liquidity.

Open interest is calculated by counting the number of open long contracts (contracts held by buyers) and open short contracts (contracts held by sellers) for a specific options contract. A buyer of an options contract is said to have an open long position, while a seller is said to have an open short position.

Open interest can change throughout the trading day as contracts are opened or closed. Increases in open interest can indicate new positions being established, while decreases in open interest can suggest positions being closed or expired.

Read Also: Understanding FASB ASC 470: Everything you need to know

Traders and investors often monitor changes in open interest as it can provide valuable insights into the sentiment and direction of the market. For example, if open interest is increasing while the price of the underlying asset is rising, it may indicate bullish sentiment and the potential for further price appreciation. Conversely, if open interest is decreasing while the price is falling, it may suggest bearish sentiment and the possibility of further price declines.

It is important to note that open interest alone does not provide information on the direction or magnitude of future price movements. It should be used in conjunction with other technical and fundamental analysis tools to make informed trading decisions.

Read Also: When Does the Forex Market Close and Open? Find Out the Trading Hours

Option volume refers to the number of option contracts traded in a specific time period. When option volume is higher, it indicates increased interest and activity in the options market. This can be significant for several reasons:

1. Liquidity: Higher option volume generally leads to greater liquidity in the options market. Liquidity refers to the ability to buy or sell an option contract with ease and at a fair price. When there is high volume, it means there are more buyers and sellers, reducing the chance of experiencing delays or difficulties when executing trades.

2. Tighter Bid-Ask Spreads: Bid-ask spreads represent the difference between the price at which buyers are willing to buy an option (the bid) and the price at which sellers are willing to sell it (the ask). Higher option volume typically leads to tighter bid-ask spreads, as there are more participants willing to trade at slightly different prices. This benefits traders by reducing their transaction costs.

3. Increased Market Efficiency: Higher option volume can contribute to greater market efficiency. Market efficiency refers to the ability of prices to accurately reflect all available information. When option volume is high, it suggests that there is more information and analysis being incorporated into the market’s pricing. This can lead to more accurate and efficient pricing of options.

4. Enhanced Price Discovery: Price discovery refers to the process by which the market determines the fair value of an option. Higher option volume can improve price discovery by providing more data points for market participants to assess and analyze. The increased volume can help reveal trends, patterns, and market sentiment, enabling traders to make more informed decisions.

In conclusion, higher option volume matters because it improves liquidity, tightens bid-ask spreads, enhances market efficiency, and facilitates price discovery. Traders should pay attention to option volume as it can provide valuable insights into market dynamics and help inform their trading strategies.

Option volume refers to the total number of option contracts traded on a particular day. Open interest, on the other hand, refers to the total number of outstanding option contracts that have not been closed or exercised.

Higher option volume is important because it indicates a higher level of interest and activity in options trading. It suggests that there is more liquidity in the options market, allowing traders to enter and exit positions more easily. It can also provide valuable insights into market sentiment and potential price movements.

Higher option volume generally leads to greater liquidity in the options market. When there is higher volume, there are more buyers and sellers in the market, making it easier to execute trades at desired prices. This liquidity can be especially beneficial for options traders who need to enter and exit positions quickly.

Option volume measures the total number of contracts traded in a day, while open interest measures the total number of contracts that are still outstanding. The relationship between the two can provide insights into market activity. For example, if option volume is increasing while open interest is decreasing, it could indicate that positions are being closed out. On the other hand, if both option volume and open interest are increasing, it suggests new positions are being established.

Option volume and open interest can provide valuable signals about market sentiment and potential price movements. For example, if there is a significant increase in option volume and open interest for call options, it could suggest that market participants are bullish and expect the underlying asset’s price to rise. Conversely, an increase in option volume and open interest for put options may indicate bearish sentiment and an expectation of a price decline.

Option volume refers to the total number of option contracts that have been traded during a given time period. Open interest, on the other hand, refers to the total number of option contracts that are currently open and have not yet been exercised, closed, or expired.

Higher option volume is important because it indicates increased market activity and liquidity in the options market. It also suggests that there is more interest and participation from traders and investors, which can lead to more accurate pricing and a more efficient market.

Types of Statistical Analysis: Understanding the 7 Key Methods Statistical analysis plays a crucial role in many fields, from business and finance to …

Read ArticleEuropean to US Dollar Exchange Rate The euro to dollar exchange rate is an important metric for individuals and businesses alike, as it represents the …

Read ArticleHow many branches of SBI are there in India? The State Bank of India, also known as SBI, is one of the largest banks in India and has a vast network …

Read ArticleTrading Gold and Oil in Forex: A Comprehensive Guide Trading gold and oil in forex can be an exciting and potentially profitable venture for …

Read ArticleIs options trading club legit? Options trading has gained popularity in recent years as a way to potentially earn high returns on investment. However, …

Read ArticleHow to Confirm a Pinbar Candlestick Pattern In the world of trading, there are many different candlestick patterns that can indicate potential price …

Read Article