Comparing Moving Averages: Finding the Best Indicator for Your Trading Strategy

Choosing the Best Moving Average Indicator When it comes to trading in the financial markets, finding the best indicator for your strategy is crucial. …

Read Article

The Weighted Moving Average (WMA) is a popular technical analysis tool used by traders to identify trends and make informed trading decisions. By assigning different weights to each data point, the WMA gives more importance to recent data, making it a more responsive indicator than the Simple Moving Average (SMA) and Exponential Moving Average (EMA).

In this comprehensive guide, we will delve into the mechanics of the Weighted Moving Average in Ninjatrader, a powerful trading platform widely used by active traders. We will explore how the WMA is calculated, how to interpret its signals, and how to use it effectively in your trading strategy.

First, we will start by explaining the concept of weighting in the WMA calculation. Unlike the SMA, which treats all data points equally, the WMA assigns greater weight to more recent data. This means that the WMA is more responsive to recent price changes, allowing traders to capture trends earlier.

Next, we will discuss the formula for calculating the WMA in Ninjatrader. Understanding the formula is crucial for both manual calculation and automated trading strategies. We will break down the formula step by step and provide examples for better comprehension.

Finally, we will explore practical applications of the WMA in trading. We will discuss how to interpret the WMA signals, including crossovers, divergences, and trend reversals. Additionally, we will provide guidelines on setting up the WMA in Ninjatrader and optimizing its parameters for different markets and timeframes.

Whether you are a beginner or an experienced trader, understanding the Weighted Moving Average in Ninjatrader is essential for successful trading. Follow this comprehensive guide to master the WMA and enhance your technical analysis skills.

A weighted moving average is a type of moving average that assigns different weights to the data points in the calculation. Unlike a simple moving average that gives equal weight to each data point, a weighted moving average is designed to give more weight to newer or more relevant data points.

The weights assigned to the data points in a weighted moving average can be linear or non-linear, depending on the desired effect. For example, a linear weighting scheme may assign increasing weights to the more recent data points, while a non-linear weighting scheme may assign exponentially decreasing weights to the data points.

The calculation of a weighted moving average involves multiplying each data point by its corresponding weight and then summing all of the products. The sum is then divided by the sum of the weights to get the weighted moving average value.

Weighted moving averages are commonly used in technical analysis to smooth out price data and reduce noise, making it easier to identify trends and patterns. They are especially useful when there is a need to react quickly to changes in market conditions.

Read Also: Choosing the Best Forex Quote: A Comprehensive Guide

Overall, a weighted moving average is a powerful tool for traders and analysts as it provides a more accurate representation of recent data and can be tailored to specific needs through the choice of weighting schemes.

The Weighted Moving Average (WMA) is a popular technical indicator used in trading and investing to analyze price trends. It is a type of moving average that assigns different weights to each data point, giving more importance to recent prices.

The WMA calculates the average by multiplying each data point by a weight and summing the results. The weights decrease in a linear manner, with the oldest data points receiving the least weight. This means that the most recent prices contribute more to the average than older prices.

The WMA is useful for traders and investors because it provides a smoother line than other moving averages, such as the Simple Moving Average (SMA). The WMA reacts faster to changes in price trends, making it more responsive to market fluctuations.

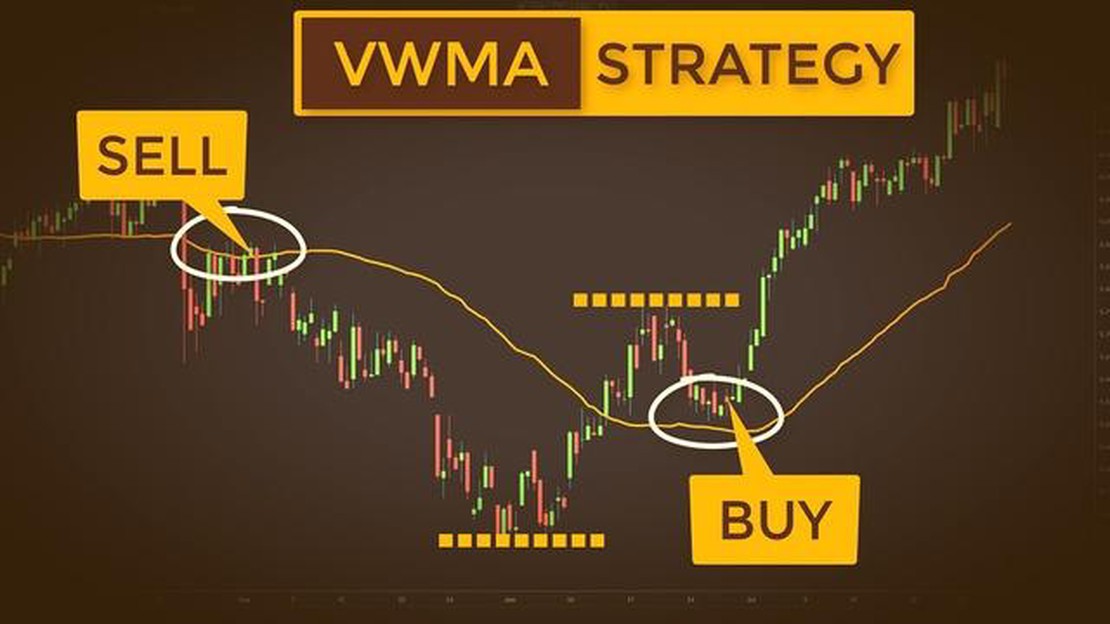

The WMA is often used in combination with other technical indicators to confirm or validate trading signals. Traders may look for crossovers between the WMA and other moving averages, or use the WMA as a support or resistance level.

Overall, the Weighted Moving Average is a valuable tool for analyzing price trends and making informed trading decisions. Its ability to give more weight to recent prices allows traders to react quickly to market changes and stay ahead of the curve in an ever-changing financial landscape.

Read Also: How to Activate Your Net Banking Card: A Step-by-Step Guide

Calculating the Weighted Moving Average (WMA) is a useful tool for traders looking to identify trends and make informed trading decisions. It is a technical analysis tool that gives more weight to recent data points, making it more responsive to changes in price movement.

Here are the steps to calculate the Weighted Moving Average in Ninjatrader:

Ninjatrader provides a built-in indicator, called the WeightedMovingAverage, that simplifies the calculation process. Traders can simply add the indicator to their chart and customize the input parameters, such as the length of the moving average and the calculation mode.

By understanding how to calculate the Weighted Moving Average in Ninjatrader, traders can gain valuable insights into price trends and potential trading opportunities. It is important to note that the WMA is just one of many technical indicators available and should be used in conjunction with other analysis tools to make well-informed trading decisions.

A weighted moving average is a type of moving average that assigns more weight to the most recent data points, allowing it to react more quickly to the latest price changes.

The weighted moving average is calculated by multiplying each data point by a predetermined weight, summing up the products, and dividing the result by the sum of the weights.

The advantages of using a weighted moving average include its ability to respond quickly to price changes, providing a more accurate representation of the current market conditions. It also gives more weight to recent data points, making it useful for short-term trend analysis.

Yes, the weighted moving average can be used in combination with other technical indicators to confirm trading signals and enhance the accuracy of the analysis. Traders often use it in conjunction with other moving averages or oscillators to identify potential buy and sell signals.

Choosing the Best Moving Average Indicator When it comes to trading in the financial markets, finding the best indicator for your strategy is crucial. …

Read ArticleInstaForex and MT5: What You Need to Know InstaForex is a well-known online trading platform that offers various trading options to its clients. One …

Read ArticleGuide to Setting a 5 Day Moving Average Trend analysis is a powerful tool for traders and investors to make informed decisions in the financial …

Read ArticleUnderstanding RSSI based location estimation In recent years, the emergence of wireless technologies has revolutionized the way we communicate and …

Read ArticleHow to Activate Net Banking Card Activating your net banking card is an essential step in managing your finances online. With the convenience of …

Read ArticleInvesting in Commodities Options: A Comprehensive Guide Investing in commodities options can be an exciting and lucrative endeavor for beginners. …

Read Article