Full form of GBP and INR: Explained and Compared

Full Form of GBP and INR: Definitions and Descriptions The acronyms GBP and INR are commonly used to represent the currencies of two different …

Read Article

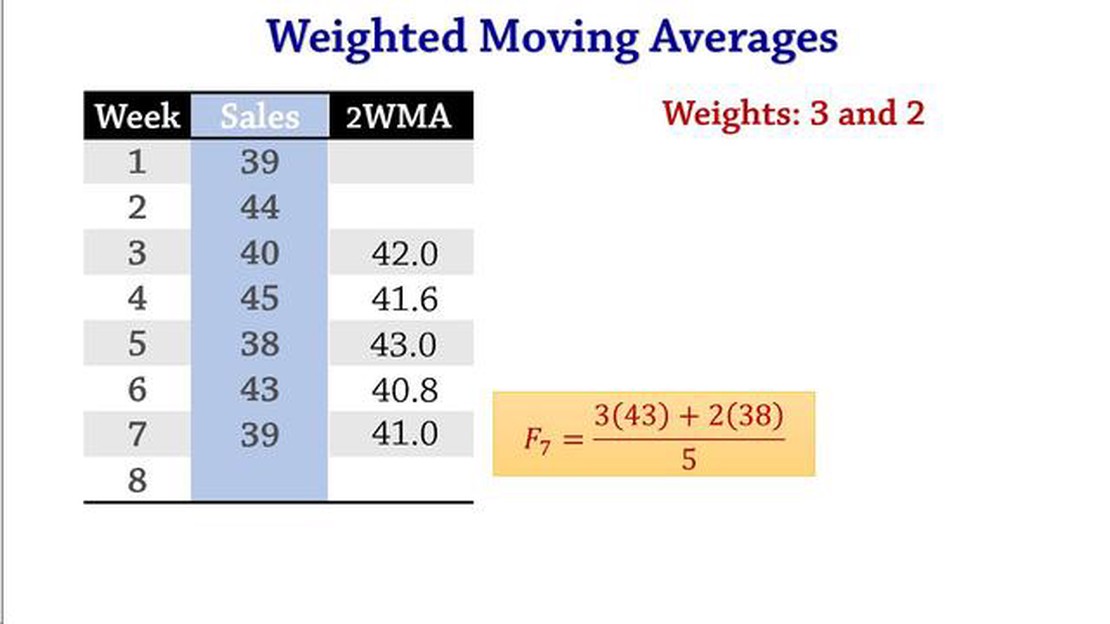

Forecasting is an essential tool for businesses to plan for the future and make informed decisions. One popular method of forecasting is the weighted average method, which allows for a more accurate prediction by assigning different weights to different periods of data. This comprehensive guide will provide an in-depth understanding of the weighted average method and how it can be used effectively.

The weighted average method takes into account the fact that some periods may be more relevant than others when forecasting. For example, in sales forecasting, the most recent data may carry more weight than data from several months ago. By assigning weights to each period, the weighted average method emphasizes the significance of recent data and provides a more realistic forecast.

How are weights determined? As a general rule, more recent data is assigned higher weights, while older data is assigned lower weights. However, the exact weighting scheme will depend on the specific industry, market conditions, and the nature of the data being forecasted.

For example, in financial forecasting, a business may assign a weight of 0.6 to the most recent quarter, 0.3 to the previous quarter, and 0.1 to the quarter before that. This weighting scheme reflects the belief that the most recent data is the most accurate indicator of future performance. However, this weighting scheme can be adjusted according to the business’s specific needs and past performance.

Once the weights are determined, the weighted average method calculates the forecast by multiplying each data point by its corresponding weight and summing the results. This weighted sum provides a more accurate estimate of future performance.

The weighted average method of forecasting is a powerful tool that can help businesses make more informed decisions and plan for the future effectively. By assigning weights to different periods of data, this method allows for a more accurate prediction that takes into account the importance of recent data. Understanding and implementing the weighted average method can provide businesses with a competitive advantage and help them stay ahead in a dynamic marketplace.

The weighted average method is a commonly used technique for forecasting in various industries. It involves assigning weights to different historical data points based on their importance or reliability. These weights then determine the extent to which each data point contributes to the overall forecast.

Here are the basic steps involved in using the weighted average method:

The weighted average method allows you to take into account different factors when making forecasts. By assigning higher weights to more recent or accurate data, you can ensure that your forecast is more responsive to recent changes or trends in the data.

Furthermore, the weighted average method is flexible and can be easily adjusted to reflect changing business conditions. If a particular historical data point becomes less relevant or reliable, you can simply adjust its weight or exclude it from the calculation altogether.

Read Also: Understanding the Distinction between Call and Put FX Options

Overall, the weighted average method provides a straightforward and intuitive way to forecast future values based on historical data. By properly assigning weights and updating them as needed, you can improve the accuracy and usefulness of your forecasts, leading to better decision-making and planning in your organization.

| Advantages | Disadvantages |

|---|---|

| The weighted average method is easy to understand and implement. | The method assumes that historical patterns will continue into the future, which may not always be the case. |

| It allows for flexibility in adjusting weights to reflect changing business conditions. | The method may not be suitable for highly volatile or unpredictable data. |

| It can be used with any type of historical data, making it applicable to a wide range of forecasting scenarios. | The method may not capture sudden or unexpected changes in the data. |

Read Also: Understanding the Mechanics of FX Spread: A Comprehensive Guide

Calculating a weighted average forecast involves several straightforward steps:

By following these steps, you can calculate a weighted average forecast that takes into account the relative importance of different data points. This method can be particularly useful when dealing with data that exhibits varying levels of significance or volatility over time.

It’s important to note that while the weighted average method can provide valuable insights, it is not a foolproof forecasting technique. Other factors, such as market conditions, competitor actions, and external events, may also influence the accuracy of the forecast.

| Step | Description |

|---|---|

| 1 | Identify the historical data |

| 2 | Determine the weights |

| 3 | Calculate the weighted average |

| 4 | Analyze the forecast |

| 5 | Adjust and iterate |

The weighted average method of forecasting is a technique used to predict future values by giving different weights to historical data points. It takes into account the importance or relevance of each data point in the forecasting process.

The weighted average method works by assigning weights to different data points based on their importance or relevance. These weights are then multiplied by the corresponding data values and summed up to calculate the forecasted value.

The advantages of using the weighted average method include its simplicity and ability to incorporate different levels of importance to historical data points. It also allows for easy adjustment of weights based on changing business conditions.

Yes, there are some limitations to the weighted average method. It assumes that historical patterns will repeat in the future, which may not always be the case. It also does not take into account other factors or variables that may impact the forecast, such as seasonality or trends.

Full Form of GBP and INR: Definitions and Descriptions The acronyms GBP and INR are commonly used to represent the currencies of two different …

Read ArticleIs XM Forex Trusted? When it comes to choosing a forex broker, trust is one of the most important factors to consider. XM Forex is a well-known name …

Read ArticleInvesting in the US Stock Market from Indonesia: A Comprehensive Guide For Indonesians looking to diversify their investment portfolios and explore …

Read ArticleUnderstanding Exposure with Example Exposure is one of the fundamental concepts in photography, and understanding how it works is crucial for …

Read ArticleHow to Find a Good Stock for Options Trading Options trading is a popular investment strategy that offers the potential for significant returns. …

Read ArticleWhat is the RSI of Dish TV share? Relative Strength Index (RSI) is a technical indicator used to analyze the strength and momentum of a stock’s price …

Read Article