Can You Really Make a Profit from Binary Trading? Find Out the Truth Now

Is it possible to earn profit from binary trading? Binary trading has become increasingly popular in recent years, with many people believing it to be …

Read Article

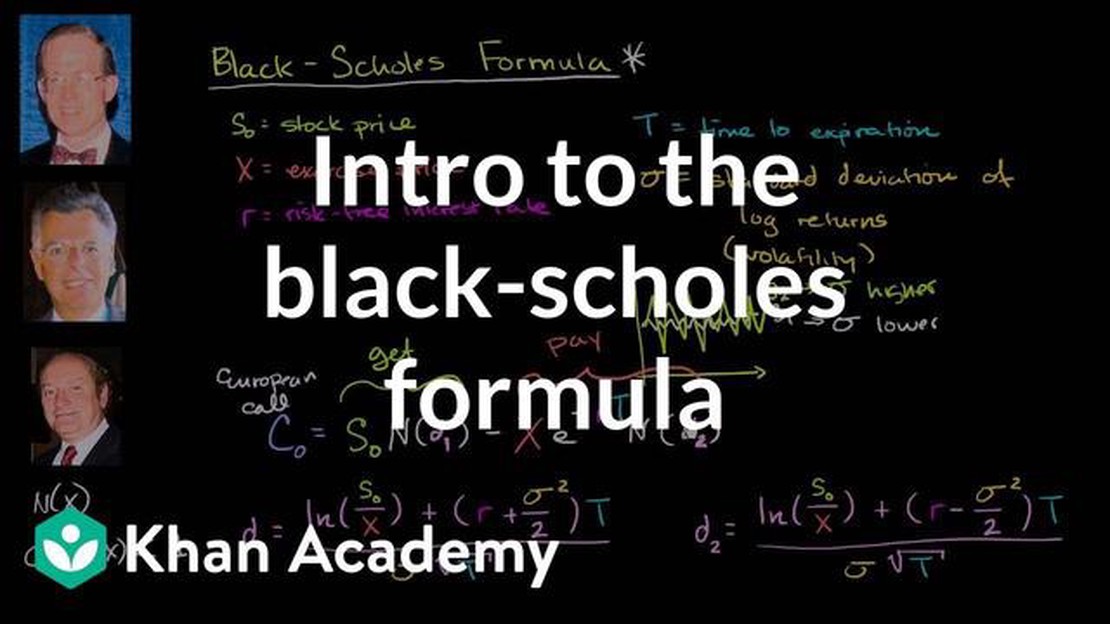

The Black-Scholes model, developed by economists Fischer Black and Myron Scholes in 1973, is a widely used mathematical model for pricing options. It has revolutionized the financial industry and provided valuable insights into the pricing of derivatives. The model is based on five key inputs that determine the value of an option: the current stock price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

The current stock price represents the market value of the underlying asset and is a crucial input in the Black-Scholes model. It reflects the expectations and sentiments of market participants regarding the future performance of the stock. The accuracy of this input is critical for accurate option pricing.

The strike price is the price at which the option holder has the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset. It plays a significant role in determining the profitability of the option at expiration. A higher strike price increases the potential profit for the holder of a call option and decreases the potential profit for the holder of a put option.

The time to expiration refers to the period remaining until the option contract expires. It is a crucial input in the Black-Scholes model, as it affects the probability of the option expiring in-the-money. The longer the time to expiration, the higher the probability of the option being profitable.

The risk-free interest rate is the rate of return an investor could expect from a risk-free investment, such as a treasury bond. It is a critical input in the Black-Scholes model, as it represents the cost of financing the purchase of the underlying asset. A higher risk-free interest rate decreases the present value of the option, leading to a lower option price.

The volatility of the underlying asset is a measure of the price fluctuations of the underlying asset. It represents the standard deviation of the asset’s returns over a specific period. Volatility is a crucial input in the Black-Scholes model, as it reflects the price uncertainty and affects the probability of the option expiring in-the-money. Higher volatility results in higher option prices, as it increases the probability of large price movements.

Understanding the five inputs of the Black-Scholes model is essential for anyone involved in the options market, whether as an investor, trader, or financial analyst. By comprehending the significance of these inputs and their interplay, market participants can make informed decisions regarding option pricing and risk management. The Black-Scholes model stands as a testament to the power of mathematics in understanding and analyzing complex financial instruments.

The Black-Scholes model is a mathematical model used to calculate the theoretical price of options. It was developed by economists Fischer Black and Myron Scholes in 1973, and later refined by Robert Merton.

This model is widely used by financial professionals and investors to determine the fair value of options, and it has become a fundamental tool in the field of quantitative finance.

Read Also: Everything you need to know about TD Ameritrade trading

The Black-Scholes model takes into account various factors, including the current price of the underlying asset, the strike price of the option, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

By inputting these variables into the formula, the Black-Scholes model can calculate the fair value of a European-style option. European-style options can only be exercised on the expiration date, unlike American-style options which can be exercised at any time before expiration.

The theoretical price calculated by the Black-Scholes model represents the market value of the option and guides investors in making informed decisions about buying or selling options.

It is important to note that the Black-Scholes model makes several assumptions, such as constant volatility and a risk-free interest rate, which may not reflect real-world conditions. As a result, the model may not always accurately predict the actual price of options.

Despite its limitations, the Black-Scholes model remains a valuable tool in options pricing and has contributed significantly to the field of finance.

Understanding the inputs of the Black-Scholes model is essential for investors and traders who want to make informed decisions regarding options pricing. These inputs, also known as the five “Greeks,” provide valuable information about the factors that influence the pricing of options contracts.

By understanding these inputs, investors can analyze and assess the potential risks and rewards associated with a specific options contract. They can determine the likelihood of the option reaching a certain price, the sensitivity of the option’s value to changes in underlying asset price, volatility, time to expiration, and interest rates.

Each input plays a significant role in determining the price of an options contract and has its own unique characteristics and interpretation. For example, delta measures how much the price of an option will change in relation to a change in the price of the underlying asset. Gamma measures the rate of change in delta. Vega measures the sensitivity of the option’s value to changes in volatility. Theta measures the rate of time decay of an options contract. Rho measures the sensitivity of the option’s value to changes in interest rates.

Read Also: Why Do We Use Average Filter?

Without a thorough understanding of these inputs, investors may make misinformed decisions and potentially lose money. For example, they may underestimate the impact of changes in volatility on the value of options contracts or fail to account for the effects of time decay. By understanding the inputs, investors can make more accurate predictions about the future movement of an option’s price and adjust their investment strategies accordingly.

In conclusion, understanding the inputs of the Black-Scholes model is crucial for investors and traders who want to effectively analyze and evaluate options contracts. By comprehending the factors that influence options pricing, investors can make informed decisions and increase their chances of success in the options market.

The inputs of the Black-Scholes model are the price of the underlying asset, the exercise price of the option, the time to expiration of the option, the risk-free interest rate, and the volatility of the underlying asset.

The price of the underlying asset is a crucial input in the Black-Scholes model. As the price of the underlying asset increases, the price of a call option will also increase, while the price of a put option will decrease. This is because a higher price of the underlying asset increases the potential for profits with a call option, while decreasing the potential for profits with a put option.

The exercise price, also known as the strike price, is the price at which the option can be exercised. In the Black-Scholes model, a higher exercise price for a call option will lead to a decrease in its price, as it becomes less likely that the option will be exercised at a profit. Conversely, a higher exercise price for a put option will lead to an increase in its price, as it becomes more likely that the option will be exercised at a profit.

The time to expiration is a critical input in the Black-Scholes model because it represents the amount of time remaining until the option contract expires. As the time to expiration decreases, the value of the option decreases, as there is less time for the underlying asset price to move in a favorable direction. Conversely, as the time to expiration increases, the value of the option increases, as there is more time for the underlying asset price to move in a favorable direction.

The risk-free interest rate is an essential input in the Black-Scholes model because it represents the cost of borrowing money to purchase the underlying asset. A higher risk-free interest rate will lead to an increase in the price of both call and put options, as the cost of borrowing money increases. Conversely, a lower risk-free interest rate will lead to a decrease in the price of both call and put options.

The inputs of the Black-Scholes model are the underlying asset price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

Is it possible to earn profit from binary trading? Binary trading has become increasingly popular in recent years, with many people believing it to be …

Read ArticleExploring the 15-minute Forex Strategy Are you interested in trading on the Forex market but feel overwhelmed by the complexity and time commitment it …

Read ArticleWhat is H4 Forex Timing? Forex trading is a fast-paced and volatile financial market, making it crucial for traders to have a strong understanding of …

Read ArticleDiscover the Best Software for Guiding Stock Purchases and Sales Staying informed and keeping a close eye on the stock market is crucial for any …

Read ArticleUnderstanding Short Leg and Long Leg in Options Trading Options trading is a popular investment strategy that allows traders to speculate on the price …

Read ArticleIs TeleTrade regulated? TeleTrade is a well-known brokerage firm that offers a wide range of financial services. With its long-standing presence in …

Read Article