Where to Find the Best Currency Exchange Rates

Where to Find the Best Currency Exchange Rate When traveling to another country, one of the most important things to consider is how to exchange your …

Read Article

Options trading is a complex financial practice that requires a deep understanding of various market factors. One crucial factor that options traders must consider is volatility. Volatility is a measure of the rate at which an underlying asset’s price fluctuates, and it plays a significant role in options pricing. However, volatility is not static; it can vary across different strike prices and expiration dates.

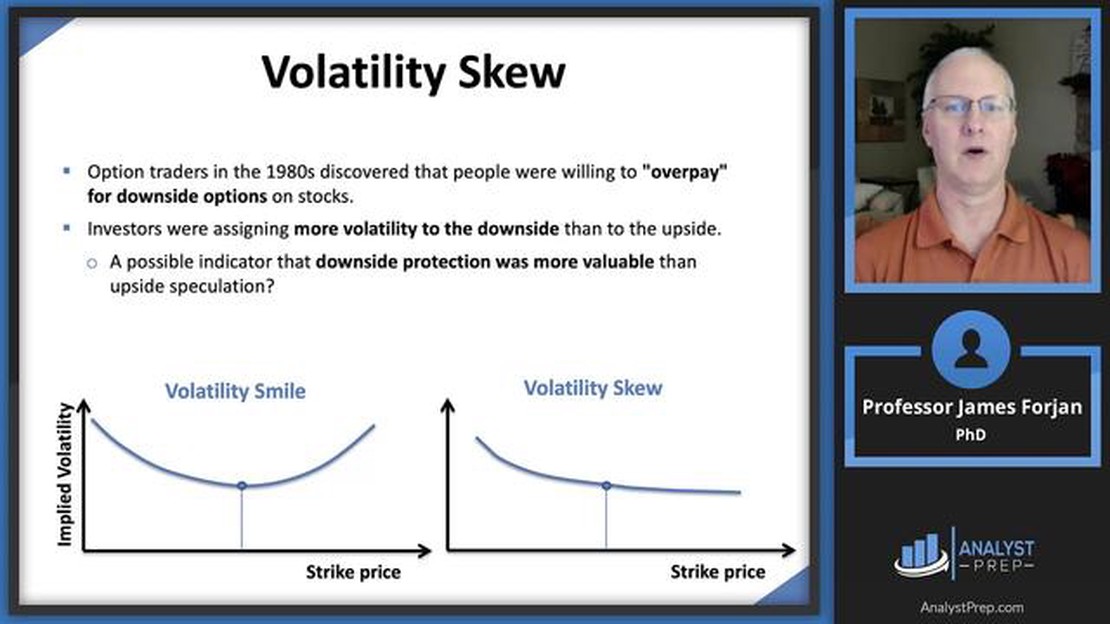

The volatility skew smile refers to the graphical representation of the implied volatility levels across different strike prices in the options market. It is called a “skew smile” because the graph typically takes the form of a smile or a smirk. This volatility skew smile holds valuable information for options traders and can help them make more informed decisions.

The skew smile pattern emerges due to market participants’ perception of risk. In general, investors are more concerned about potential losses on the downside than on the upside. As a result, market demand for out-of-the-money put options tends to be higher, causing their prices to be relatively more expensive compared to out-of-the-money call options. This imbalance in supply and demand creates the skew smile pattern.

Understanding the volatility skew smile is crucial for options traders because it can provide insights into market sentiment and potential trading opportunities. For example, a steeper skew smile indicates that investors are more concerned about downside risk, suggesting that bearish strategies might be more profitable. Conversely, a flatter skew smile suggests a more balanced market sentiment, where both bullish and bearish strategies may have potential.

The volatility skew smile, also known as the volatility skew, is a graphical representation of the implied volatility of options at different strike prices. It is a term used in options trading to describe the relationship between the strike price and the implied volatility of options on the same underlying asset.

In a typical options market, the implied volatility tends to be higher for options with strike prices that are far below or above the current price of the underlying asset. This results in a U-shaped curve when the implied volatility is plotted against the strike price, resembling a smile, hence the name “volatility skew smile”.

One possible explanation for the volatility skew smile is that it reflects market participants’ uncertainty regarding the future movements of the underlying asset. Traders may perceive higher risks of large price movements, particularly downward movements, and demand higher premiums for options that provide downside protection.

Another possible explanation is that the skew reflects the supply and demand dynamics of the options market. For example, in a market where there is a high demand for protective put options, the prices of these options may be bid up, leading to a higher implied volatility at lower strike prices.

The volatility skew smile is important for options traders as it can affect the pricing and trading strategies for options. Traders who are aware of the skew can take advantage of trading opportunities by implementing strategies that exploit the skew. For example, traders may choose to sell options with higher implied volatility and buy options with lower implied volatility, in order to capitalize on the differences in premiums.

Overall, the volatility skew smile is a key concept in options trading as it provides valuable information about market participants’ perception of risk and can help traders make more informed decisions when trading options.

The volatility skew smile represents the different implied volatilities for options with the same expiration date but different strike prices. It is called a “smile” because when plotted on a graph, the curve resembles a smiley face. This smiley face shape indicates that options with different strike prices have different implied volatilities.

The volatility skew smile is consequential in options trading because it provides valuable insights into the market’s expectations for future volatility. By analyzing the shape and slope of the skew smile, traders can gain a better understanding of how market participants perceive the risk and uncertainty associated with different strike prices.

One reason why the volatility skew smile matters is that it can impact the pricing and profitability of options strategies. Since options with different strike prices have different implied volatilities, their prices will also vary. This means that traders who are aware of the volatility skew smile can potentially identify mispriced options and take advantage of profit opportunities.

Read Also: Is it possible to start trading with $0? Find out here!

Furthermore, the skew smile can be used as a risk management tool. Traders can adjust their options positions based on the outlook for volatility. For example, if the skew smile is steeper on the left side (lower strike prices), indicating higher implied volatilities, a trader may decide to buy protective puts or reduce exposure to downside risk.

Overall, understanding the volatility skew smile is crucial for options traders as it can provide valuable information about market expectations and help optimize trading strategies. By analyzing the skew smile, traders can identify mispriced options and make informed decisions to manage risk and maximize profitability.

Risk and uncertainty are two important concepts in the field of options trading. While they may seem similar, they actually have distinct meanings and implications.

Risk refers to the potential for loss or failure in a particular investment. In options trading, this can be the possibility that the option will expire worthless or that the investor will not be able to achieve the desired profit. Risk is often measured by the standard deviation of the underlying asset’s price, also known as volatility.

Read Also: Choosing the Best Forex Quote: A Comprehensive Guide

Example: If an investor buys a call option, they are taking on the risk that the price of the underlying asset will not rise above the strike price before the expiration date. If this happens, the option will expire worthless and the investor will lose their initial investment.

Uncertainty, on the other hand, relates to the lack of knowledge or predictability about future events. It is the presence of unknown factors that can affect the outcome of an investment. In options trading, uncertainty can arise from various sources such as political events, economic data releases, or unexpected market developments.

Example: Let’s say an investor holds a put option on a stock. There is uncertainty about the company’s upcoming earnings report, as it could either exceed or fall short of market expectations. This uncertainty can lead to increased volatility in the stock price, which can in turn impact the value of the put option.

Understanding risk and uncertainty is essential for options traders as it helps them make informed decisions and manage their portfolios effectively. By analyzing the volatility skew smile, which represents the market’s perception of risk and uncertainty, traders can adjust their strategies accordingly and potentially profit from price movements.

To summarize: Risk is the potential for loss or failure in a particular investment, while uncertainty refers to the lack of knowledge or predictability about future events. Both concepts play a crucial role in options trading and should be carefully considered by investors.

Volatility skew smile refers to the uneven distribution of implied volatility across different strike prices of options. It matters in options trading because it indicates the market’s perception of potential price movements and can affect option pricing and trading strategies.

Volatility skew smile affects option pricing by increasing the cost of options with lower strike prices and decreasing the cost of options with higher strike prices. This is because the market perceives a higher likelihood of large price drops, leading to higher implied volatility for options with lower strikes.

The significance of volatility skew smile in risk management is that it highlights the potential downside risks in the market. Traders can use this information to adjust their options positions and hedge against potential losses. Understanding the volatility skew smile helps in managing risk more effectively.

Traders can take advantage of volatility skew smile by implementing trading strategies that benefit from it. For example, one can construct a vertical spread to profit from the difference in implied volatility between options with different strike prices. Traders can also use the skew to identify mispriced options and execute profitable trades.

One drawback of relying on volatility skew smile is that it is based on market perceptions and expectations, which can change rapidly. The skew may not always accurately predict future price movements. Additionally, the skew can vary across different markets and assets, so traders need to be aware of its limitations when applying it to their trading strategies.

The volatility skew smile refers to the asymmetrical shape of the implied volatility curve in the options market. It shows the relationship between the strike price and implied volatility. In general, the volatility skew smile indicates that investors are willing to pay more for out-of-the-money options, resulting in higher implied volatility for these options compared to at-the-money or in-the-money options.

The volatility skew smile is important in options trading because it provides valuable information about market sentiment and investor expectations. It can indicate whether investors are expecting a potential increase or decrease in stock prices. Traders can use this information to make more informed decisions when buying or selling options. Additionally, the volatility skew smile can affect option pricing, so understanding it can help traders assess the fair value of options and identify potential opportunities for profit.

Where to Find the Best Currency Exchange Rate When traveling to another country, one of the most important things to consider is how to exchange your …

Read ArticleIs a stock plan subject to ERISA? Employee Retirement Income Security Act (ERISA) is a federal law that sets minimum standards for retirement plans …

Read ArticleStockPlan Connect: Everything You Need to Know Are you a professional trader or investor looking for a comprehensive stock planning tool? Look no …

Read ArticleImpact of Dividends on Earnings per Share Earnings per share (EPS) is a financial ratio that measures the profitability of a company. It is calculated …

Read ArticleIs Forex the same as binary options? Forex and binary options are both popular ways to trade financial markets, but they have key differences that set …

Read ArticleUnderstanding the Significance of the 50-Day Moving Average When it comes to analyzing financial markets, investors and traders rely on a wide range …

Read Article