Exploring the Pros and Cons of ESOPs: How Do They Affect Shareholders?

Is ESOP beneficial or detrimental to shareholders? Employee Stock Ownership Plans (ESOPs) have become increasingly popular among businesses as a means …

Read Article

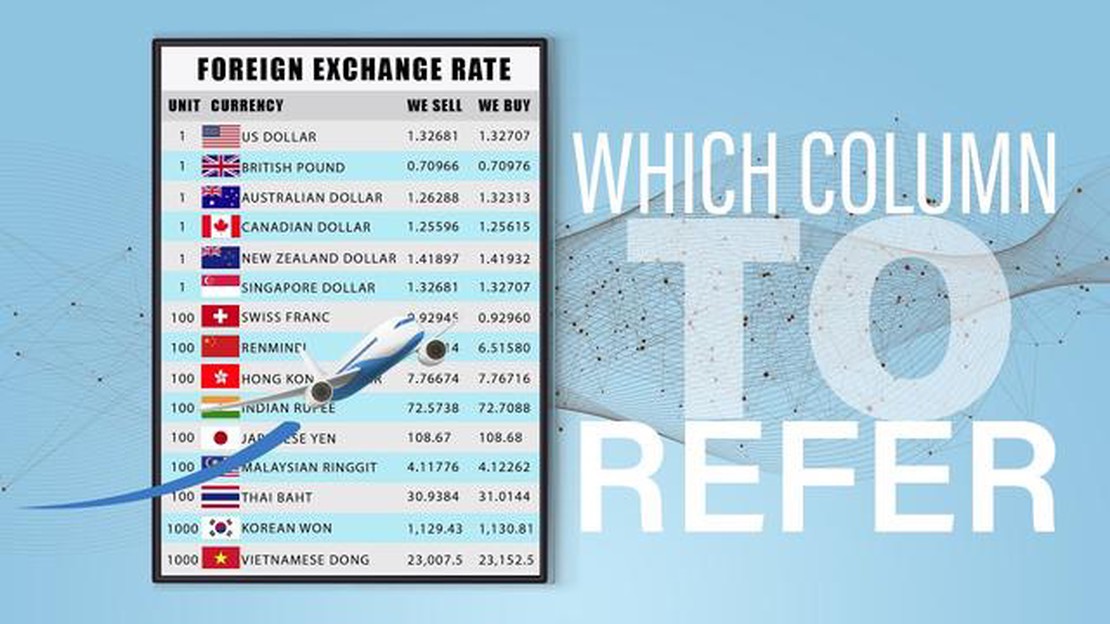

When it comes to exchanging currencies, understanding the buying and selling rates is crucial. This guide will provide you with all the information you need to know about the USD buying and selling rate. The USD, or United States dollar, is one of the most widely traded currencies in the world. Its buying and selling rates are influenced by various factors, including the supply and demand dynamics of the global foreign exchange market.

The buying rate refers to the rate at which you can purchase USD in exchange for another currency. This rate is typically lower than the selling rate and is set by the financial institution or money changers. The buying rate takes into account their costs, such as overhead expenses and profit margins. It’s important to note that the buying rate may vary between different institutions, so it’s advisable to compare rates before making a currency exchange.

The selling rate, on the other hand, refers to the rate at which you can sell USD in exchange for another currency. This rate is typically higher than the buying rate and is also determined by financial institutions or money changers. The selling rate includes their costs and profit margins, just like the buying rate. Just like with the buying rate, it’s wise to compare selling rates to get the best deal possible.

It’s important to understand that the USD buying and selling rates are not fixed and can fluctuate throughout the day due to various economic factors. These factors include interest rates, inflation, economic stability, geopolitical events, and market sentiment. As a result, the buying and selling rates may differ from one day to the next or even within the same day.

To keep up with the latest USD buying and selling rates, you can check financial news websites, consult exchange rate charts, or use currency converter applications. By staying informed about the rates, you can make more informed decisions in your currency exchanges and potentially save money.

In conclusion, understanding the USD buying and selling rates is crucial when it comes to exchanging currencies. By knowing how these rates work, you can make more informed decisions and potentially get a better deal. Keep in mind that these rates are not fixed and can fluctuate due to various economic factors. Stay updated and compare rates to ensure you get the best possible exchange rate when buying or selling USD.

There are several factors that can affect the buying and selling rate of the USD. These factors play a crucial role in determining the value of the US dollar in the foreign exchange market. Understanding these factors is essential for individuals and businesses involved in international trade and investment. Here are some of the key factors that influence the USD buying and selling rate:

Read Also: Is Ameritrade good for beginners? - Everything you need to know

4. Political Stability: Political stability is another critical factor that can influence the USD buying and selling rate. A stable political environment is generally considered favorable for economic growth and investment. Countries with stable political systems and institutions are more likely to attract foreign investors, leading to an increase in the demand for their currency, including the USD. On the other hand, political uncertainty or instability can lead to a decrease in the demand for the USD and a potential devaluation. 5. Trade Balance: The trade balance between the United States and other countries can impact the USD buying and selling rate. If the US has a trade deficit (imports exceed exports), it means that there is a higher demand for foreign currencies to pay for imports. This increased demand for foreign currencies can lead to a depreciation of the USD. Conversely, if the US has a trade surplus (exports exceed imports), it means that there is a higher demand for the USD, which can appreciate its value.

It is important to note that these factors do not act independently but are interconnected and can influence each other. Additionally, currency exchange rates are also influenced by other external factors such as geopolitical events, market speculation, and central bank interventions.

Read Also: Discover the Optimal Strategies for Trading Gold in Forex - Expert Tips and Tricks

The USD buying rate is the rate at which a bank buys US Dollars from individuals or other banks, while the USD selling rate is the rate at which a bank sells US Dollars to individuals or other banks.

USD buying and selling rates are determined by various factors, such as supply and demand for the currency, interest rates, inflation rates, and the overall health of the economy.

USD buying and selling rates are different because banks typically add a margin to the interbank exchange rate to cover their costs and make a profit. This margin is often higher for selling US Dollars than buying them.

Yes, it is always a good idea to shop around and compare USD exchange rates offered by different banks and currency exchange providers. Small differences in the exchange rate can add up, especially for larger transactions.

Yes, banks and currency exchange providers may charge fees or commissions for USD buying and selling transactions. It is important to check the fees and commissions upfront to understand the total cost of the transaction.

Is ESOP beneficial or detrimental to shareholders? Employee Stock Ownership Plans (ESOPs) have become increasingly popular among businesses as a means …

Read ArticleImpact of Stock Options on Taxes Stock options are commonly used as a form of compensation in many companies, particularly in the tech industry. They …

Read ArticleUnderstanding SP 100 Options Options trading can be a complex and intimidating endeavor for beginners. However, gaining a deep understanding of the …

Read ArticleTrading Options on Futures with TD Ameritrade TD Ameritrade is a leading brokerage firm that offers a wide range of investment products and services …

Read ArticleUnderstanding Fair Value: An Example and Explanation When it comes to assessing the worth of an asset or liability, fair value is a key concept in …

Read ArticleUnderstanding the NBP Exchange Rate The NBP (National Bank of Poland) exchange rate is an essential aspect of the Polish economy. Understanding how it …

Read Article