Can Bots Be Illegal? Exploring the Legal Implications of Bot Activity

Are Bots Considered Illegal? Exploring the Legal Implications of Automated Software In an era dominated by the internet and technological …

Read Article

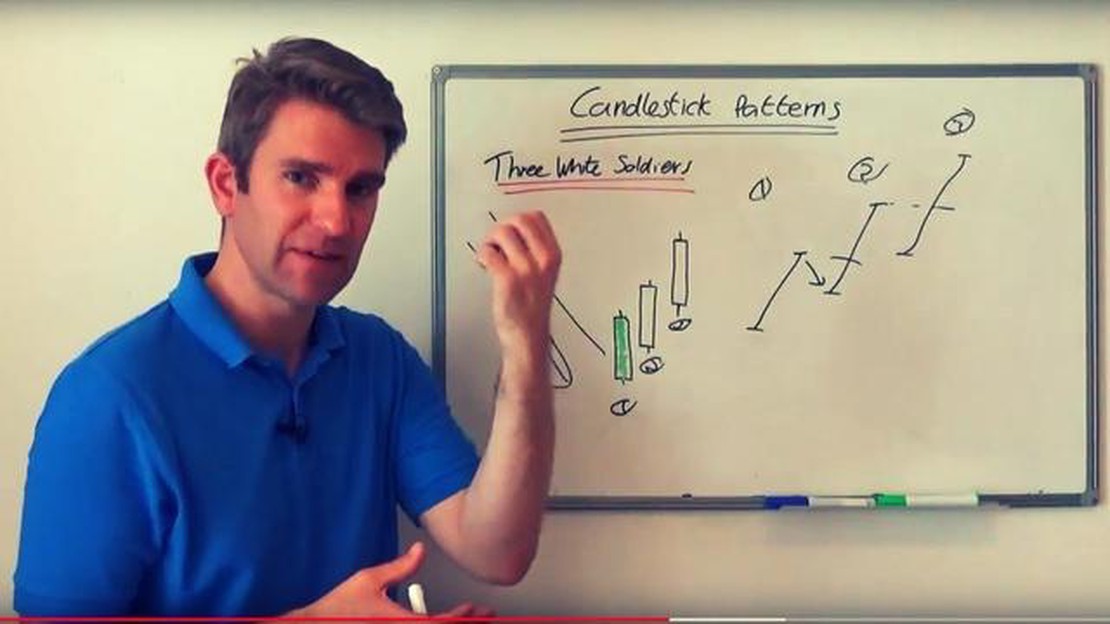

When it comes to analyzing price patterns in trading, Three White Soldiers is a well-known and significant candlestick formation. This pattern typically appears in a downtrend and indicates a potential reversal in the market. Traders who understand the meaning and significance of Three White Soldiers can use it as a powerful tool to make informed trading decisions.

The Three White Soldiers pattern consists of three consecutive bullish candlesticks with increasing prices and small or no shadows. Each candlestick opens higher than the previous one, showing strong buying pressure and a shift in market sentiment. This formation suggests that the buyers have taken control and are pushing the price higher.

The significance of Three White Soldiers lies in its ability to indicate a possible trend reversal. When this pattern appears after a downtrend, it suggests that the selling pressure is weakening and buyers are stepping in. Traders often interpret this formation as a sign of a bullish trend reversal, signaling the start of an uptrend. However, it is essential to consider other technical indicators and confirm the reversal before taking any trading action.

It is crucial for traders to understand the meaning and significance of Three White Soldiers as part of their technical analysis toolkit. By recognizing this pattern and combining it with other indicators, traders can enhance their ability to identify potential trend reversals and make profitable trading decisions.

Three White Soldiers is a bullish candlestick pattern that typically forms at the end of a downtrend. It consists of three consecutive long green (or white) candles with small or non-existent shadows.

1. Formation at the end of a downtrend: Three White Soldiers pattern typically appears after a prolonged downward movement in the price of a security. It indicates a potential reversal of the downtrend and the beginning of an uptrend.

2. Three consecutive long green candles: Each candle in the pattern should have a long real body, indicating strong buying pressure. The open price of each subsequent candle should be higher than the close price of the previous candle, showing a continuation of buying momentum.

3. Small or non-existent shadows: The candles in the Three White Soldiers pattern should ideally have small or non-existent upper and lower shadows. This indicates that the buying pressure remained strong throughout the trading session, with little to no retracement.

4. Volume confirmation: An increase in trading volume is often observed in conjunction with the Three White Soldiers pattern. Rising volume suggests a strong conviction among traders and adds credibility to the bullish signal.

5. Trend confirmation: The Three White Soldiers pattern is most reliable when it occurs within the context of an overall uptrend. This indicates that the pattern is a continuation of the prevailing bullish trend rather than a reversal signal.

Understanding the key characteristics of Three White Soldiers can help traders identify potential buying opportunities and make informed trading decisions. However, it is important to consider other technical indicators and analyze the overall market conditions before placing trades based solely on this pattern.

The Three White Soldiers pattern is a bullish candlestick pattern that often signals a trend reversal or continuation of an upward trend in trading. It is formed by three consecutive upward candlesticks with increasing closing prices, indicating a strong buying pressure in the market.

Read Also: Understanding the HH HL Trading Strategy: A Powerful Approach to Trading

Interpreting this pattern involves looking at the context in which it appears and considering other technical indicators to confirm its significance. Here are some key factors to consider when interpreting the Three White Soldiers pattern:

1. Trend Reversal:

A Three White Soldiers pattern appearing at the end of a downtrend often indicates a potential reversal in the market sentiment. It suggests that the selling pressure has subsided, and bullish momentum may take over. Traders can interpret this as a signal to enter long positions or close their short positions.

2. Continuation of an Upward Trend:

Read Also: How to Become a F&: Step-by-Step Guide and Tips

When the Three White Soldiers pattern appears during an already established upward trend, it can be seen as a confirmation of the trend’s strength and a signal to stay in the market. It suggests that the bullish momentum is continuing, and traders may consider adding to their positions or maintaining their existing positions.

3. Volume Confirmation:

Volume plays a crucial role in confirming the significance of the Three White Soldiers pattern. Higher trading volume accompanying the pattern indicates strong buying pressure and reinforces the bullish signal. Traders should look for an increase in volume as a confirmation of the pattern’s reliability.

4. Overbought Conditions:

While the Three White Soldiers pattern is generally seen as a bullish signal, it is essential to consider other technical indicators, such as the relative strength index (RSI) or moving averages, to assess overbought conditions. If these indicators suggest the market is overbought, it may indicate a potential correction or slowdown in the upward trend.

In conclusion, the Three White Soldiers pattern is a powerful bullish signal that can provide traders with valuable insights into market dynamics. However, it is crucial to interpret this pattern within the larger context of the market and consider other technical indicators for confirmation.

The Three White Soldiers pattern is a bullish reversal pattern that occurs in candlestick charts. It consists of three consecutive long green (or white) candles with small or no wicks. This pattern is interpreted as a strong sign that the market sentiment has shifted from bearish to bullish, as it suggests a strong upward momentum in the price.

The significance of the Three White Soldiers pattern is that it indicates a potential reversal of a downtrend and the start of an uptrend. Traders often look for this pattern as it can be a good entry signal to buy stocks or other financial instruments. It suggests that buyers are taking control of the market and are willing to push the price higher, which can lead to further price appreciation.

To identify the Three White Soldiers pattern, you need to look for three consecutive long green (or white) candles with small or no wicks. These candles should open within the previous candle’s real body and close near their highs. It is important to consider the context in which the pattern appears, such as the overall trend and volume, to confirm its validity.

Yes, the Three White Soldiers pattern can appear in various markets, including stocks, forex, commodities, and more. It is a widely recognized candlestick pattern that traders use to analyze price charts and make trading decisions. However, it is important to remember that no pattern can guarantee future price movements, and other technical analysis tools should be used in conjunction with the Three White Soldiers pattern.

Are Bots Considered Illegal? Exploring the Legal Implications of Automated Software In an era dominated by the internet and technological …

Read ArticleUnderstanding Bollinger Band Breakouts When it comes to technical analysis in the financial markets, Bollinger Bands are a popular tool used by …

Read ArticleUnderstanding Graded Vesting for Stock Options Stock options are a popular form of compensation for employees, giving them the opportunity to purchase …

Read ArticleTypes of Options in Trading: A Comprehensive Guide Options trading can be an exciting and lucrative venture for investors looking to diversify their …

Read ArticleIs Olymp trade halal in Islam? Islamic finance is guided by the principles of Shariah law, which prohibits certain activities such as usury and …

Read ArticleWho is the owner of TS Imagine? TS Imagine is a highly popular and widely-used platform in the financial industry. It is known for its advanced …

Read Article