Currency Charges: Find out the Fees for BA Amex

BA Amex Currency Charges: How Much do they Cost? If you’re a frequent traveler or someone who frequently makes purchases in foreign currency, it’s …

Read Article

When it comes to stock options, one term that often comes up is the lock-up period. But what exactly does this term mean, and why is it important for investors? In this article, we will explore the lock-up period in detail, explaining what it is, how it works, and why it matters.

In simple terms, the lock-up period refers to a predetermined time period during which employees or insiders of a company are restricted from selling their stock options. This period typically begins after an initial public offering (IPO) or when a company goes through a significant event such as a merger or acquisition. The purpose of the lock-up period is to prevent insiders from flooding the market with shares, which could lead to a decrease in the stock price.

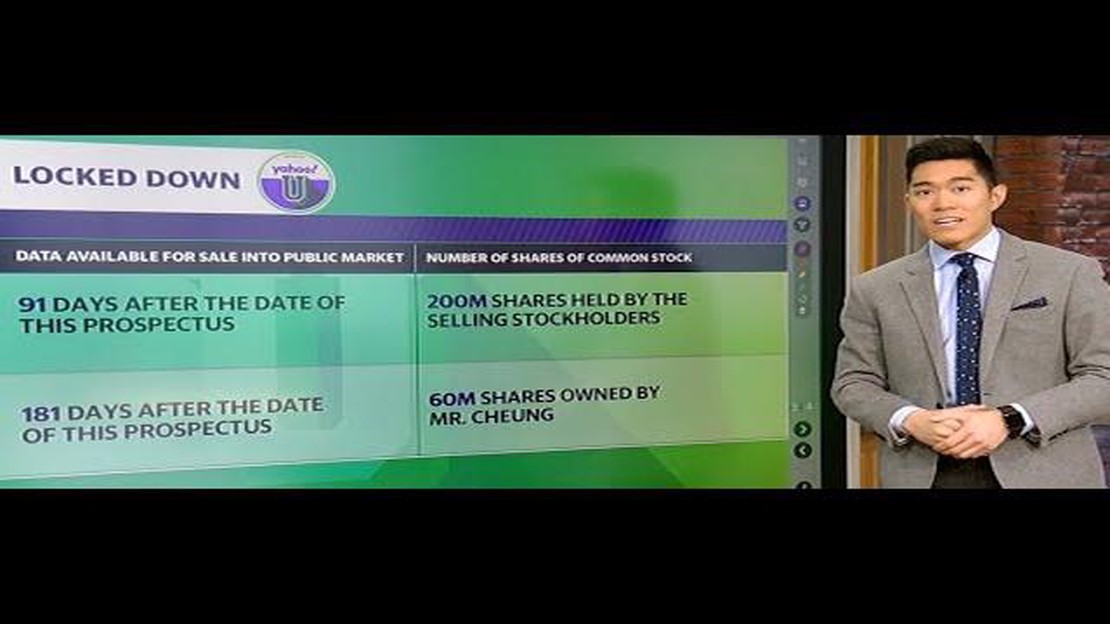

During the lock-up period, employees or insiders are essentially “locked out” from selling their stock options. This means that they are unable to capitalize on any potential gains until the lock-up period expires. The duration of the lock-up period can vary, but it is often set for a period of several months, typically between 90 to 180 days. Once the lock-up period is over, insiders are free to sell their stock options on the open market.

Understanding the lock-up period is crucial for investors because it can have a significant impact on the stock price. When the lock-up period expires, insiders can sell their shares, which can increase the supply of stock in the market. This increase in supply can potentially lead to a decrease in the stock price, as more shares are available for trading. Therefore, investors need to be aware of upcoming lock-up expirations and consider the potential impact on the stock’s performance.

A lock-up period is a predetermined time period during which an investor cannot sell or trade their stock options, typically following an initial public offering (IPO) or other significant event. This restriction is put in place to prevent insiders, such as company founders, executives, and early investors, from flooding the market with their shares immediately after the company goes public.

The lock-up period is typically set by the underwriters of the IPO and can range from a few months to several years, depending on the specific circumstances. During this time, insiders are not allowed to sell their shares, which helps to stabilize the stock price and prevent volatility in the market.

Lock-up periods also provide a sense of security for potential investors, as they demonstrate a commitment from insiders to holding onto their shares and growing the company. This can be seen as a sign of confidence in the company’s future prospects, which may attract more investors to buy the stock.

Once the lock-up period expires, insiders are free to sell their shares, which may lead to increased selling pressure and potential price fluctuations. However, the impact of the lock-up period expiration on the stock price can vary depending on market conditions, company performance, and investor sentiment.

It’s important for investors to be aware of lock-up periods when considering investing in a company, as they can have a significant impact on the stock’s liquidity and potential price movements. It’s also worth noting that lock-up periods only apply to insiders and certain shareholders, while other public shareholders can buy or sell the stock freely.

Lock-up periods are imposed by companies for a variety of reasons. They are often used to maintain stability in the stock market and protect the value of the company’s stock. For example, when a company goes public, there is typically a significant amount of excitement and anticipation among investors. The lock-up period allows the company to control the release of its stock into the market, preventing a sudden influx that could cause the stock price to plummet.

Additionally, lock-up periods can be used to prevent insider trading and illegal practices. By restricting the ability of employees, executives, and other insiders from selling their stock immediately after an initial public offering (IPO), companies can discourage unethical behavior and protect the integrity of the market.

Read Also: Is AvaTrade a Legit Broker? Expert Analysis and Review

Lock-up periods have also been shown to benefit the company and its stakeholders in the long run. By requiring stakeholders to hold onto their stock for a certain period of time, it demonstrates their commitment and confidence in the company’s future prospects. This can be seen as a positive signal to potential investors, leading to increased trust and investment in the company.

Furthermore, lock-up periods can reduce the volatility of a company’s stock price. By limiting the supply of available shares in the market, the natural fluctuations caused by supply and demand dynamics can be mitigated. This can help stabilize the stock price, making it more attractive to potential investors.

In summary, companies impose lock-up periods to maintain stability in the stock market, prevent insider trading, demonstrate commitment and confidence, and reduce stock price volatility. Ultimately, these periods serve as a mechanism for protecting the interests of the company, its stakeholders, and the market as a whole.

When it comes to stock options, a lock-up period can have a significant impact on investors. During this period, which is typically set by the company and can range from a few months to several years, investors are not able to sell or transfer their shares.

This restriction can have both positive and negative effects on investors. On the one hand, it demonstrates the company’s commitment to its long-term growth and stability. By restricting the sale of shares, the company is conveying a message that it has confidence in its future prospects and wants to prevent any potential negative impact from short-term selling pressures.

On the other hand, the lock-up period can also limit an investor’s ability to realize gains on their investment. If the stock price were to increase significantly during the lock-up period, the investor would not be able to take advantage of the price appreciation by selling their shares. This can be frustrating for investors who are looking to generate profits from their investments in a relatively short period of time.

Read Also: Understanding Lot Sizes: Exploring the Meaning of 0.01 Lot Size

Additionally, the lock-up period can also create a sense of uncertainty among investors. They may have concerns about the company’s ability to meet its long-term objectives and may feel trapped by their inability to sell their shares. This can lead to increased volatility in the stock price once the lock-up period ends, as investors may rush to sell their shares in order to mitigate potential losses.

Overall, the lock-up period is a tool that companies use to balance the interests of their shareholders and their long-term goals. While it can be frustrating for investors in the short term, it can also be a sign of confidence in the company’s future prospects. It is important for investors to carefully consider the implications of a lock-up period before making investment decisions.

A lock-up period for stock options is a predetermined period during which employees or investors are not allowed to sell or transfer their stock options. This period typically follows an initial public offering (IPO) or a merger and acquisition (M&A) transaction.

Companies have lock-up periods for stock options to ensure stability in the stock price and prevent insiders from flooding the market with shares immediately after an IPO or M&A transaction. It gives investors and employees confidence that the company’s management team is committed to the long-term success of the company.

The length of lock-up periods can vary, but they typically last for 90 to 180 days after an IPO or M&A transaction. Some lock-up periods may be shorter or longer depending on the specific circumstances of the company and the transaction.

After the lock-up period expires, employees and investors are free to sell or transfer their stock options. This can lead to increased volatility in the stock price as insiders and early investors may choose to sell their shares.

Lock-up periods can sometimes be waived or shortened if there is an agreement between the company and the underwriters or if there is a specific exemption under securities laws. This is usually done to accommodate certain circumstances, such as the need for liquidity or an unforeseen event.

A lock-up period for stock options is a specific timeframe during which employees or insiders of a company are restricted from selling their stock options. It is typically put in place to prevent excessive selling pressure on the stock price immediately after an initial public offering (IPO) or another significant event.

The duration of a lock-up period can vary, but it commonly lasts for 90 to 180 days after an IPO. However, lock-up periods can also be longer or shorter depending on the company and the terms of the stock option agreement.

BA Amex Currency Charges: How Much do they Cost? If you’re a frequent traveler or someone who frequently makes purchases in foreign currency, it’s …

Read ArticleWhat is a Moderately Bearish Option Strategy? When it comes to investing in the stock market, there are a variety of strategies that traders can …

Read ArticleStep-by-Step Guide on Drawing a Wolfe Wave Pattern Technical analysis is an essential tool for traders and investors to predict market trends and make …

Read ArticleHow to Check My ESOP As an employee, it is important to stay informed about your Employee Stock Ownership Plan (ESOP), a beneficial retirement plan …

Read ArticleStock price prediction for Cheesecake Factory The Cheesecake Factory is a well-known restaurant chain that has gained popularity for its delicious …

Read ArticleTransfer Fee for iRemit: Cost and Details When sending money internationally, it’s important to consider the transfer fees involved. If you’re using …

Read Article