Is Forex Trading Legal in Lebanon? Find Out the Latest Regulations

Is Forex Trading Legal in Lebanon? Forex trading is a popular investment activity around the world. However, each country has its own regulations and …

Read Article

Technical analysis is an essential tool for traders and investors to predict market trends and make informed decisions. One popular pattern that traders often use is the Wolfe Wave pattern, named after its discoverer, Bill Wolfe. This pattern helps to identify specific price movements that can indicate a trend reversal or continuation.

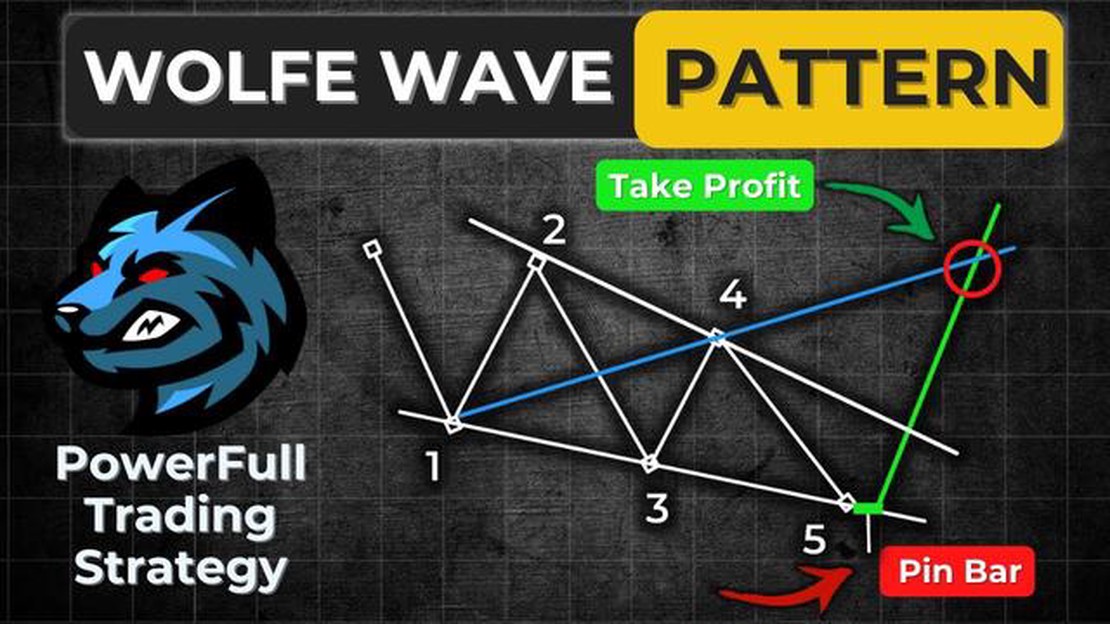

To draw a Wolfe Wave pattern, you need to follow a specific set of rules. Firstly, you need to identify four points on the price chart: two lower lows (labeled point 1 and point 3) and two higher highs (labeled point 2 and point 4). These four points will form a basic pattern of alternating highs and lows.

Next, draw a trendline between points 1 and 3, and extend this line. Then, draw a parallel line from point 2, touching the extended trendline. This line will act as a potential target for the price trend. Once the price reaches this line, it may reverse its direction.

After drawing the first set of lines, you need to draw additional lines to complete the pattern. Draw a trendline between points 2 and 4, and extend it to intersect with the first trendline. This intersection point will be labeled as point 5. Connect point 3 and point 5 with another parallel line, which will act as another target for the price.

The final step is to draw a trendline from point 1 and point 4, connecting the two parallel lines. This line will form the resistance or support line for the pattern. If the price breaks above or below this line, it may indicate a trend reversal or continuation.

Remember, drawing a Wolfe Wave pattern requires practice and experience. It is important to confirm the pattern with other technical indicators or analysis techniques to increase its reliability. By mastering this pattern, traders can have an additional tool in their arsenal to make more accurate predictions in the financial markets.

A Wolfe Wave pattern is a naturally occurring pattern in financial markets that was discovered by a professional trader named Bill Wolfe. It is a graphical pattern that can be used to accurately predict the future price movements of an asset. The pattern consists of five waves, with the first wave being the largest and the fifth wave being the smallest.

To identify a Wolfe Wave pattern, you need to look for specific price points and ratios. The pattern starts with a wave that moves in the opposite direction of the overall trend, followed by a smaller wave that retraces a portion of the first wave. This is followed by a larger corrective wave that moves in the direction of the initial trend, and finally, a smaller wave that completes the pattern.

The Wolfe Wave pattern is considered to be a reliable pattern because it is based on the principles of Fibonacci ratios and Elliott Wave theory. These concepts suggest that market movements follow fractal patterns and that price swings exhibit specific Fibonacci ratios.

Read Also: Discover the Best Volume Indicator for Accurate Market Analysis

Traders often use the Wolfe Wave pattern to identify potential reversal points in the market. By correctly identifying the pattern, traders can anticipate when an asset is likely to change direction and take advantage of the resulting price movement.

The Wolfe Wave pattern is a powerful chart pattern that was discovered by American trader and analyst Bill Wolfe. It is a natural pattern that occurs in all financial markets, including stocks, currencies, commodities, and cryptocurrencies.

The Wolfe Wave pattern consists of five waves – two bullish waves (1 and 3) and three bearish waves (2, 4, and 5). These waves follow specific criteria and form a structural pattern that can be used to predict future price movements.

The main idea behind the Wolfe Wave pattern is that it represents a balance between supply and demand. The pattern forms when price makes four distinct swings, with each swing connecting specific points on the chart. These points create converging trendlines that form a channel. The channel helps to identify the potential reversal points and targets for price movement.

The Wolfe Wave pattern has several key characteristics that traders can use to identify and trade the pattern. These include:

By understanding the basics of Wolfe Wave patterns and how to identify and interpret them, traders can gain a valuable tool for predicting potential price movements and making informed trading decisions.

Read Also: Understanding the Difference Between SMA and EMA: A Comprehensive Comparison

Drawing a Wolfe Wave pattern is a popular charting technique used in technical analysis to identify potential reversal points in the market. The pattern is composed of five waves, with specific rules for their formation and measurement. Here is a step-by-step guide to drawing a Wolfe Wave pattern:

Remember, drawing a Wolfe Wave pattern requires practice and careful observation of price movements. It’s important to combine this pattern with other technical analysis tools for a comprehensive analysis of the market.

A Wolfe Wave pattern is a naturally occurring pattern in financial markets that is used to predict price reversals. It consists of five waves, with the first two being smaller waves and the last three being larger waves.

To draw a Wolfe Wave pattern, you need to first identify the two smaller waves (waves 1 and 2) and then draw a trendline connecting the end points of these waves. Next, you need to identify the larger waves (waves 3, 4, and 5) and draw a parallel trendline to the first one, connecting the end points of waves 2 and 3. Finally, you can use the intersection of these two trendlines as the starting point for a potential price reversal.

A Wolfe Wave pattern has several key characteristics. The first two waves are typically smaller and in the same direction, while the last three waves are larger and in the opposite direction. The second wave usually retraces 61.8% of the first wave, and the fourth wave retraces 38.2% of the third wave. The fifth wave extends beyond the trendline connecting waves 1 and 3.

The Wolfe Wave pattern is primarily used to identify potential reversal points in price movements. While it can provide a basis for making predictions, it is important to note that it is just one tool among many and should be used in conjunction with other technical analysis methods.

One potential challenge when using the Wolfe Wave pattern is the subjectivity involved in identifying the correct waves and drawing the trendlines. Different traders may interpret the pattern differently, leading to potential variations in predictions. Additionally, like any technical analysis method, the Wolfe Wave pattern is not foolproof and can produce false signals.

A Wolfe Wave pattern is a natural pattern that appears in financial markets and is used for technical analysis. It is characterized by a series of waves, with specific ratios and relationships between them.

Is Forex Trading Legal in Lebanon? Forex trading is a popular investment activity around the world. However, each country has its own regulations and …

Read ArticleIs Apple a Good Choice for Options Trading? Options trading is a popular form of investment that allows traders to speculate on the price movement of …

Read ArticleTrading Gold in Binary Options: A Comprehensive Guide Trading gold in binary options can be a lucrative venture, especially for those who are …

Read ArticleInvertibility of the Ma matrix Ma is a concept that has puzzled scholars and philosophers for centuries. It is a term that originates from Chinese …

Read ArticleExploring the Distinction between Options and Gambling When it comes to investing, there is often a fine line between options trading and gambling. …

Read ArticleUnderstanding the Role of a Trading System In today’s fast-paced and interconnected financial markets, a trading system plays a crucial role in …

Read Article