Do options contracts get adjusted for dividends?

Do options contracts get adjusted for dividends? Options contracts are financial instruments that give investors the right, but not the obligation, to …

Read Article

The forward premium for USD INR, or United States Dollar - Indian Rupee, is an important concept in the field of finance and international trade. It refers to the difference between the spot exchange rate and the forward exchange rate for these two currencies. Understanding the forward premium is crucial for investors, businesses, and individuals who engage in foreign exchange transactions involving these currencies.

When the forward premium for USD INR is positive, it indicates that the forward rate is higher than the spot rate. This suggests that the market expects the Indian Rupee to weaken against the US Dollar in the future. On the other hand, a negative forward premium implies that the market anticipates the Indian Rupee to appreciate against the US Dollar.

Investors and businesses closely monitor the forward premium for USD INR as it can have significant implications for their investment and trade decisions. A positive forward premium may lead investors to hedge against currency risk by entering into forward contracts to lock in the exchange rate. It can also influence cross-border transactions, as businesses may decide to delay or accelerate their foreign currency payments based on their expectations of exchange rate movements.

Factors such as interest rate differentials, inflation rates, political stability, and economic indicators of both countries can affect the forward premium for USD INR. Changes in these factors can lead to fluctuations in the forward premium, providing opportunities for investors to profit from currency trading.

It is important to note that predicting exchange rate movements and accurately forecasting the forward premium is a challenging task. Exchange rates are influenced by a multitude of factors, and even highly experienced traders and economists often struggle to consistently predict them.

In conclusion, the forward premium for USD INR is a key indicator of market expectations regarding the future movements of these currencies. It plays a vital role in investment and trade decisions, and understanding its implications can help individuals and businesses navigate the complexities of the foreign exchange market.

The forward premium for USD INR refers to the difference between the spot exchange rate and the forward exchange rate for the USD to INR currency pair. In simple terms, it is the amount by which the forward exchange rate exceeds the spot exchange rate.

The forward exchange rate is a rate at which two parties agree to exchange currencies in the future, typically for settlement within three days to one year. It is determined by factors such as interest rates, inflation rates, market expectations, and supply and demand dynamics.

If the forward exchange rate for USD INR is higher than the spot exchange rate, it implies that the USD is trading at a premium against the INR in the forward market. This indicates market expectations of the INR weakening against the USD in the future.

The forward premium for USD INR can be interpreted as a measure of market sentiment towards the future value of the INR relative to the USD. A higher forward premium suggests that market participants anticipate a larger depreciation of the INR in the future, while a lower or negative forward premium indicates expectations of INR appreciation.

Market participants, such as importers and exporters, use the forward premium to hedge against foreign exchange rate risk. By locking in a forward exchange rate, they can protect themselves from potential losses due to adverse currency movements. Speculators and investors also consider the forward premium when making decisions about currency investments or trades.

Read Also: Understanding equity derivatives trading: A comprehensive guide

It is important to note that the forward premium is not always an accurate predictor of future exchange rate movements and can be influenced by various factors. Economic indicators, political events, central bank policies, and global market conditions can all impact currency exchange rates and the forward premium.

Key Takeaways:

The forward premium for USD INR is a concept that is of great significance for traders and investors in the foreign exchange market. It refers to the difference between the spot exchange rate and the forward exchange rate for the USD and INR currencies. The spot exchange rate is the rate at which currencies are traded for immediate delivery, while the forward exchange rate is the rate at which currencies are traded for delivery at a future date.

Traders and investors closely monitor the forward premium for USD INR as it provides valuable insights into the market expectations and future direction of the exchange rate. A positive forward premium indicates that the market expects the USD to appreciate against the INR in the future, while a negative forward premium suggests the expectation of depreciation.

Read Also: Top Brokerage Options for UK Traders: Who to Use

This information is crucial for traders and investors as it helps them in making informed decisions regarding their currency holdings and investment strategies. For example, if the forward premium for USD INR is positive, investors may decide to hold more USD as they anticipate a potential appreciation in the future. On the other hand, a negative forward premium may prompt them to reduce their USD holdings and explore other investment opportunities.

Furthermore, the forward premium also plays a significant role in hedging strategies. Companies that engage in international trade often use forward contracts to hedge against future currency movements. By locking in a specific exchange rate through a forward contract, these companies can protect themselves from potential losses due to unfavorable exchange rate movements.

Overall, understanding the forward premium for USD INR is essential for traders and investors who are involved in the foreign exchange market. It provides valuable insights into market expectations and helps in making informed decisions regarding currency holdings and investment strategies. Moreover, the forward premium also plays a crucial role in hedging strategies, allowing companies to manage their currency risk effectively.

The forward premium for USD INR is the difference between the forward exchange rate and the spot exchange rate for the USD INR currency pair.

The forward premium for USD INR can vary due to changes in interest rates, inflation, market expectations, and other factors that affect the demand and supply of the USD INR currency pair.

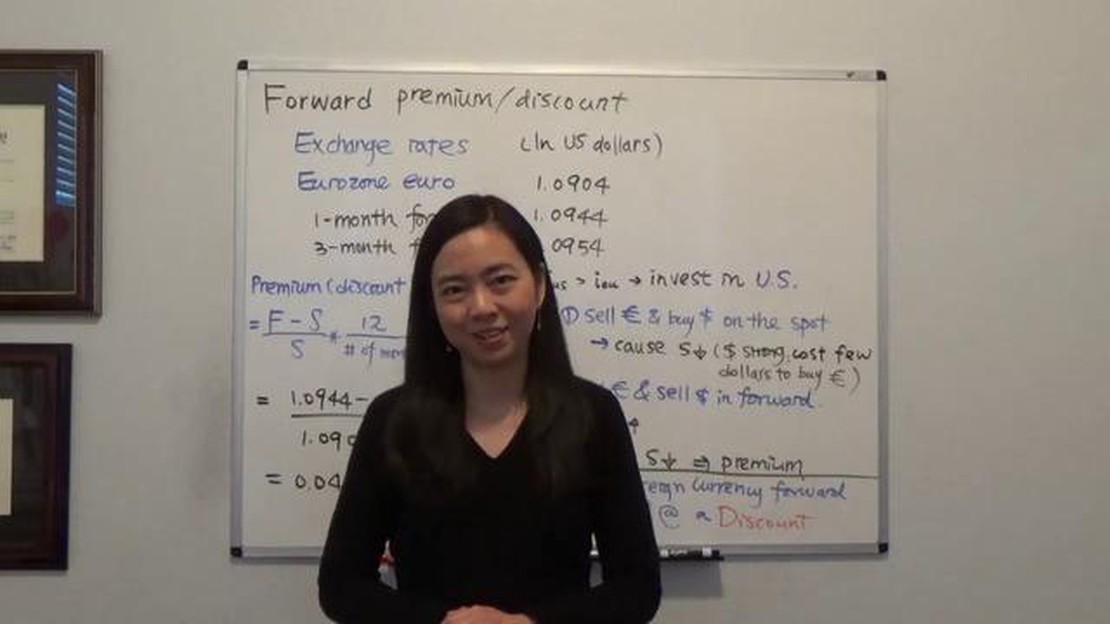

The forward premium for USD INR can be calculated using the formula: forward premium = (forward exchange rate - spot exchange rate) / spot exchange rate * 100.

A positive forward premium for USD INR indicates that the forward exchange rate is higher than the spot exchange rate, suggesting that the USD might appreciate against the INR in the future.

The forward premium for USD INR can affect importers and exporters as it determines the cost of future exchange rate transactions. If the forward premium is high, importers might prefer to hedge their currency risk by locking in a forward exchange rate, while exporters might prefer not to hedge if they expect the USD to depreciate.

The forward premium for USD INR refers to the difference between the forward exchange rate and the spot exchange rate for the US dollar and the Indian rupee. It is a measure of the market expectation for the future exchange rate between the two currencies.

The forward premium is calculated by subtracting the spot exchange rate from the forward exchange rate and then dividing that difference by the spot exchange rate. The resulting value is then multiplied by 100 to express it as a percentage.

Do options contracts get adjusted for dividends? Options contracts are financial instruments that give investors the right, but not the obligation, to …

Read ArticleFAQ: Can I deduct foreign exchange losses? Foreign exchange losses can have a significant impact on businesses and individuals engaged in …

Read ArticleTrading NIFTY Options for Intraday Gain: Tips and Strategies Options trading in the NIFTY index can be a highly profitable venture for intraday …

Read ArticleWhen can you trade US options? Trading options can be an exciting and potentially profitable venture, but it’s important to know the rules and …

Read ArticleUnderstanding TPO in Trading: Basics and Benefits In the world of trading, there are various tools and indicators that traders use to analyze the …

Read ArticleAvaTrade demo: Is there a demo account offered by AvaTrade? Are you considering trading with AvaTrade but want to test the waters first? Look no …

Read Article