How much is $1 USD in PHP? Current exchange rate

What is the current exchange rate for $1 USD to PHP? The exchange rate between the United States Dollar (USD) and the Philippine Peso (PHP) is an …

Read Article

Options trading can be a complex and sometimes daunting endeavor, with its own set of formulas and calculations to understand. One of the key formulas used in options trading is the Black-Scholes model, which provides a way to calculate the theoretical price of an option.

The Black-Scholes model takes into account a variety of factors, including the current price of the underlying asset, the strike price of the option, the time to expiration, the volatility of the underlying asset, and the risk-free interest rate. By plugging these variables into the formula, traders can determine the fair value of an option.

However, understanding the Black-Scholes formula is just the beginning. Traders must also consider other important concepts, such as the Greeks, which measure the sensitivity of the option price to changes in the underlying variables. These include delta, gamma, theta, vega, and rho, each providing valuable insights into the potential risks and rewards of an options position.

By gaining a thorough understanding of the formula for options and the various factors that can influence option prices, traders can make more informed decisions and increase their chances of success in the dynamic world of options trading.

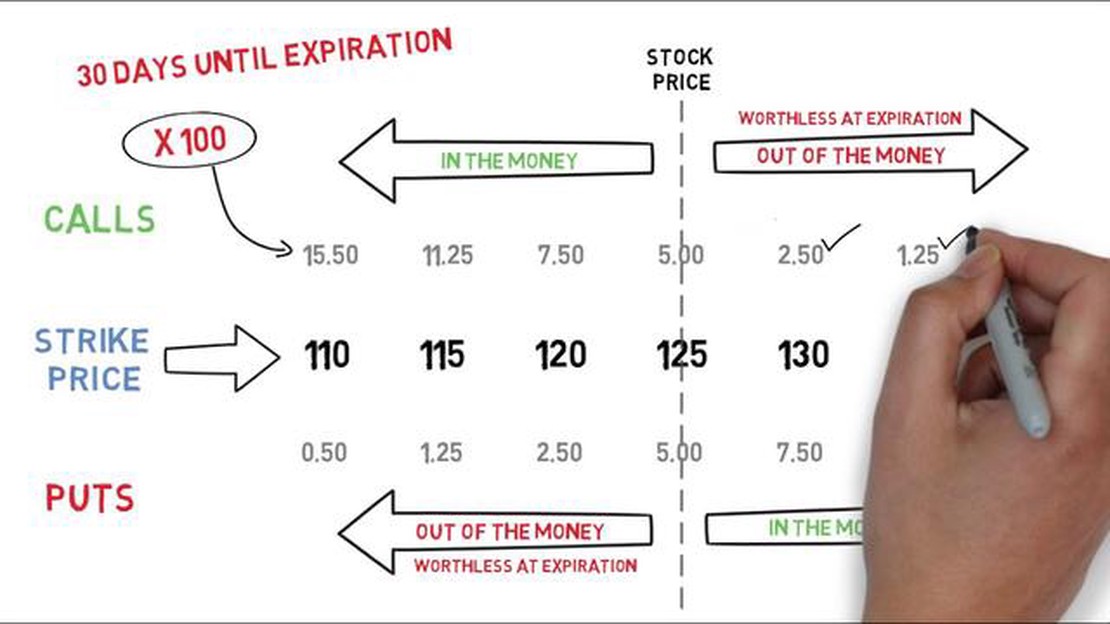

Before diving into the complexities of options trading, it is important to understand some basic concepts. Options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. This predetermined price is known as the strike price.

There are two types of options:

| Call Option | Put Option |

|---|---|

| A call option gives the holder the right to buy the underlying asset at the strike price. | A put option gives the holder the right to sell the underlying asset at the strike price. |

Options also have an expiration date, which is the last day on which the option can be exercised. It is important to note that options are not free - the buyer of the option pays a premium to the seller for the right to buy or sell the underlying asset.

The price of an option is influenced by various factors, including the current price of the underlying asset, volatility in the market, time until expiration, and interest rates. These factors can impact the premium of an option and its overall value.

Options can be used for various purposes, such as speculation, hedging, and generating income. Traders use different strategies to take advantage of the unique characteristics of options, including buying and selling options, as well as combining multiple options to create more complex positions.

Understanding the basics of options is crucial before diving into more advanced topics. It is important to have a clear understanding of how options work and the risks associated with them. With this knowledge, traders can make more informed decisions and potentially profit from the opportunities presented by options trading.

Understanding the formula for options is incredibly important for anyone involved in the options market. The formula, often referred to as the Black-Scholes model, is a mathematical tool that helps investors and traders determine the value of an option.

By understanding the formula, traders can make more informed decisions about which options to buy or sell. The formula takes into account various factors, including the current price of the underlying asset, the strike price, the time to expiration, and the volatility of the underlying asset.

Read Also: Exploring the Benefits and Strategies of the 2 Hour Trading Timeframe

Without a solid understanding of the formula, traders may be relying on guesswork or intuition when making options trades. This can lead to costly mistakes and missed opportunities. By understanding the formula, traders can have a more systematic approach to evaluating options and can better assess the risk/reward profile of each trade.

Furthermore, understanding the formula allows traders to adjust their strategies based on changing market conditions. The formula provides insight into how different factors impact the value of an option and can help traders anticipate how changes in these factors will affect the price of the option.

Overall, a thorough understanding of the formula for options is crucial for anyone looking to succeed in the options market. It provides a solid foundation for making informed decisions and managing risk. Traders who take the time to learn and understand the formula will be better equipped to navigate the complexities of the options market and maximize their potential for profits.

Developing a comprehensive strategy is crucial for successful options trading. It involves careful consideration of various factors, such as market conditions, risk tolerance, and investment goals. A well-thought-out strategy can help minimize risks and maximize returns.

Read Also: NZD to USD Forecast for 2023 - Expert Predictions and Analysis

One important aspect of developing a comprehensive strategy is analyzing market conditions. Traders need to stay updated on market trends, news, and events that may impact the prices of the underlying assets. This information can be used to identify potential trading opportunities.

Risk tolerance is another crucial factor to consider when developing a strategy. Traders should assess their comfort level with different levels of risk and tailor their approach accordingly. This may involve adjusting the size of trades, setting stop-loss orders, or using hedging strategies to protect against potential losses.

Investment goals should also be taken into account. Traders need to define their financial objectives and timeframes for achieving them. This will help guide their decision-making process and ensure that their trading activities align with their goals.

Once market conditions, risk tolerance, and investment goals have been assessed, traders can begin developing specific trading strategies. These may include various options strategies, such as buying or selling call or put options, spread strategies, or combinations of different options positions.

A comprehensive strategy should also include a risk management plan. It is essential to determine the maximum amount of capital that can be allocated to options trading and to establish risk-reward ratios for different trades. Traders should regularly assess the performance of their strategy and adjust their approach if needed.

Developing a comprehensive strategy takes time and effort, but it is crucial for long-term success in options trading. By carefully considering market conditions, risk tolerance, and investment goals, traders can create a strategy that is tailored to their individual needs and maximizes their chances of achieving their financial objectives.

| Related Articles: |

| * Understanding Options Trading |

An option is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific period of time.

The pricing of options is determined by various factors such as the current price of the underlying asset, the strike price, the time remaining until expiration, the volatility of the underlying asset, and the prevailing interest rates.

A call option is a type of option that gives the holder the right, but not the obligation, to buy the underlying asset at a predetermined price within a specific period of time.

A put option is a type of option that gives the holder the right, but not the obligation, to sell the underlying asset at a predetermined price within a specific period of time.

Some common strategies for trading options include buying call options, buying put options, selling call options, selling put options, and using combinations of these strategies such as the straddle and the strangle.

What is the current exchange rate for $1 USD to PHP? The exchange rate between the United States Dollar (USD) and the Philippine Peso (PHP) is an …

Read ArticleUnderstanding the Difference between Unvested and Vested Stock Options When it comes to stock options, there are two key terms that investors and …

Read ArticleUnderstanding CMTA in Options Trading In options trading, the Clearing Member Trade Assignment (CMTA) process plays a crucial role in ensuring the …

Read ArticleBest Calendar App for Exchange: Find the Perfect Fit Exchange is one of the most popular email and calendaring solutions for businesses, offering …

Read ArticleUnderstanding the Weighted Average Method of Forecasting Forecasting is an essential tool for businesses to plan for the future and make informed …

Read ArticleLearn How to Trade Binary Options Trading binary options can be a lucrative way to earn money in the financial markets. Whether you are a beginner or …

Read Article