How much do prop firm traders make: Exploring earnings potential

Prop Firm Trader Salary: How Much Do They Make? In the world of finance, prop trading firms play a vital role in the trading ecosystem. These firms …

Read Article

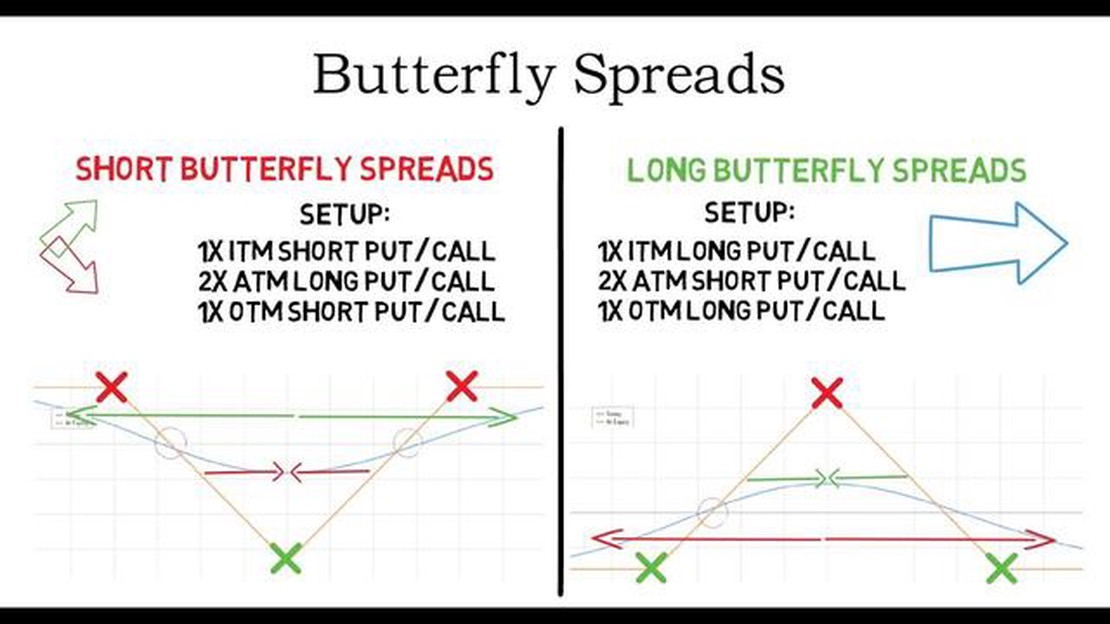

The butterfly payoff function is a common concept in options trading and is used to understand the potential profits and losses associated with certain options strategies. It is a non-linear function that exhibits a distinct “butterfly” shape when graphed, hence the name. This function is particularly useful for traders who employ advanced options strategies and need to assess the risks and rewards of their positions.

The butterfly payoff function takes into account the strike price, the premium, and the expiration date of the options involved in the strategy. By plotting this function, traders can visually analyze the potential outcomes of their trades at different price levels of the underlying asset. This allows them to make informed decisions based on their risk tolerance and market expectations.

When graphed, the butterfly payoff function typically shows a limited profit potential in a narrow price range centered around the strike price. This means that while the strategy has the potential to generate substantial profits within this range, its profitability diminishes as the price of the underlying asset moves further away from the strike price. Traders must carefully consider this when implementing butterfly strategies in their trading portfolios to ensure they align with their risk management goals.

In conclusion, understanding the butterfly payoff function is crucial for options traders looking to execute advanced strategies. By analyzing this function, traders can gain insights into the profit potential and risk exposure of their trades, allowing them to make informed decisions in the volatile options market. It is important for traders to study and practice utilizing this function in order to best utilize its insights and to protect themselves against potential losses.

The butterfly payoff function is a commonly used option strategy in options trading. It is a combination of multiple options contracts that provides traders with a potential profit in the event of a specific price movement in the underlying asset.

The concept of the butterfly strategy is based on the belief that the underlying asset’s price will remain relatively stable within a certain range. This strategy is most commonly used when traders anticipate minimal price movement in the underlying asset.

The butterfly payoff function is structured using three options contracts with the same expiration date. These contracts consist of two long options contracts and two short options contracts. The strike price of the long contracts is typically lower than the strike price of the short contracts.

The butterfly payoff diagram shows the potential profit or loss at expiration for each level of the underlying asset’s price. The diagram is shaped like a butterfly, hence the name. The profit is maximized when the price of the underlying asset is equal to the strike price of the short options contracts, and it decreases as the price moves away from this point.

The butterfly strategy can be implemented using call options or put options, depending on the trader’s expectations of the underlying asset’s price movement. It is a limited risk strategy with a potential limited profit.

| Strike Price | Long Options Contracts | Short Options Contracts | Profit/Loss |

|---|---|---|---|

| Lower Strike Price | 1 | 1 | Profit |

| Higher Strike Price | 1 | 1 | Profit |

| Short Options Contracts Strike Price | 2 | 2 | Highest Profit |

| Higher Strike Price | 1 | 1 | Profit |

| Lower Strike Price | 1 | 1 | Profit |

The butterfly payoff function allows traders to potentially profit from a narrow range of price movement in the underlying asset. It can be a useful strategy for traders who expect the price of the underlying asset to remain relatively stable in the short term.

However, it is important to note that options trading involves risks and may not be suitable for all investors. Traders should understand the risks associated with the butterfly strategy and manage their positions accordingly.

Read Also: Understanding Non-Vesting Conditions in IFRS 2: A Comprehensive Guide

The butterfly payoff function is a popular option strategy in finance that offers investors a unique way to potentially profit from both bullish and bearish market moves. It combines the benefits of a long straddle and a short strangle, allowing investors to potentially benefit from a wide range of market scenarios.

The mechanism of the butterfly payoff function involves the purchase of two options contracts with different strike prices, typically both higher and lower than the current market price. These options are typically purchased at a lower premium compared to other option strategies, making it an attractive choice for investors looking for a cost-effective strategy.

Read Also: Step-by-Step Guide on Adding 200 DMA in TradingView

The butterfly payoff function derives its name from the shape of the potential profit graph, which resembles a butterfly spread with wings. When the market price is close to the strike prices of the options contracts, the butterfly strategy generates maximum profits. However, as the market price moves further away from the strike prices, the potential profits decrease, leading to a maximum loss if the market price exceeds the strike prices of the options contracts.

| Market Scenario | Potential Payoff |

|---|---|

| Market price near strike prices | Maximum profit |

| Market price further from strike prices | Reduced profit |

| Market price exceeds strike prices | Maximum loss |

One of the main benefits of the butterfly payoff function is its versatility. It allows investors to potentially profit in a variety of market scenarios, including when the market is stagnant or experiencing moderate price fluctuations. This strategy can be particularly useful for investors who expect the market to trade within a specific range.

In addition, the butterfly payoff function offers a limited downside risk compared to other option strategies. Since the maximum loss occurs when the market price exceeds the strike prices of the options contracts, investors have a predefined risk level and can mitigate their losses by closely managing their positions.

Overall, the butterfly payoff function is a powerful and flexible option strategy that can help investors capitalize on a wide range of market conditions. By understanding its mechanism and potential benefits, investors can make informed decisions and incorporate this strategy into their overall investment approach.

The Butterfly Strategy is an options trading strategy that involves simultaneously buying and selling options with different strike prices but the same expiration date and underlying asset. It is called the Butterfly Strategy because the profit and loss diagram resembles the shape of a butterfly.

The Butterfly Payoff Function is a mathematical representation of the potential profit or loss from a Butterfly Strategy. It takes into account the price of the underlying asset, the strike prices of the options, and the premium paid or received. The payoff function shows how the profit or loss changes at different price levels of the underlying asset at expiration.

The breakeven point for a Butterfly Strategy is the price level of the underlying asset at expiration, at which the strategy neither makes a profit nor incurs a loss. It can be calculated by adding or subtracting the net premium paid or received from the highest or lowest strike price of the options involved in the strategy.

One advantage of using a Butterfly Strategy is that it allows traders to profit from a neutral outlook on the underlying asset. It can be used when a trader expects the price of the underlying asset to remain within a certain range until expiration. Another advantage is that the risk and potential loss of the strategy are limited and predetermined, making it a more conservative strategy compared to some other options trading strategies.

One limitation of the Butterfly Strategy is that it requires precise timing and accurate prediction of the price movement of the underlying asset. If the price does not remain within the expected range, the strategy may result in a loss. Furthermore, the potential profit from the strategy is also limited, as the maximum profit is reached when the price of the underlying asset is at the middle strike price at expiration. Additionally, the premium paid or received for the options can also affect the profitability of the strategy, as higher premiums decrease the potential profit.

Prop Firm Trader Salary: How Much Do They Make? In the world of finance, prop trading firms play a vital role in the trading ecosystem. These firms …

Read ArticleDoes GameStop check consoles when you trade them in? Do you often find yourself struggling to complete tasks or achieve your goals? Are you constantly …

Read Article2023 Day Trading Rules: Everything You Need to Know Day trading has become increasingly popular in recent years, thanks to advancements in technology …

Read ArticleCan You Get a 7% Interest Savings Account? When it comes to saving money, finding the right savings account can make a big difference. But with so …

Read ArticleIs Having High Forex Reserves Beneficial? Foreign exchange reserves play a crucial role in shaping the economic stability and growth of a country. …

Read ArticleIs OctaFX Legit in the Philippines? OctaFX is a renowned online broker that has gained popularity among traders in the Philippines. As a trader, it is …

Read Article